Skip to comments.

Market Uptrend, Sound Trading, and How to Buy Stocks; --Thread April 26, 2015

Investors Busniness Daily ^

| April 26, 2015

| Freeper Investors

Posted on 04/26/2015 11:45:54 AM PDT by expat_panama

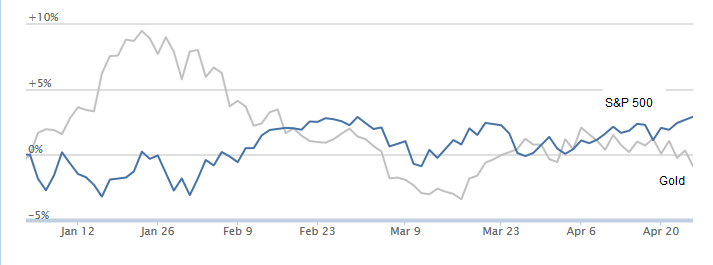

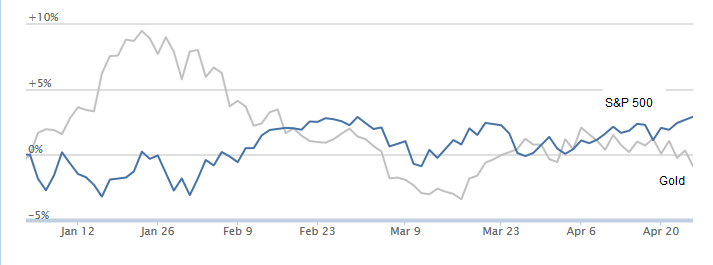

| Supposedly the top finance news stories this week have been the Greek Bailout, the Trade Fast Track Vote, but with NASDAQ's all time high we're getting even more buzz on our new stock rally.  This past week's seen the S&P500 leap almost 2% and gold fall more than 2%. A couple percent may not seem like much but having it happen in just five trading days means we got annualized returns of a 2/3 loss on gold and 50% gain on stocks. This past week's seen the S&P500 leap almost 2% and gold fall more than 2%. A couple percent may not seem like much but having it happen in just five trading days means we got annualized returns of a 2/3 loss on gold and 50% gain on stocks.

Weird how it is though that with stocks it means that we're now officially in a "confirmed uptrend", but for metals nobody says we're in some kind of downtrend. No matter. What does matter is what we got right now and what we're doing about it. This market trend for stocks means something beyond "aw if only...", namely that a lot of folks are happy with 'em and Investor's Business Daily has a "how to" page with these topics.

|

| So what this weeks stock rally means is in this page [from IBD: ...Market Direction, Key To Sound Trading... ]: |

| ...the last element to remember is the M in CAN SLIM. It stands for market direction. Invest only when the market is in a confirmed uptrend. The M also reminds investors not to fall into the bad habit of trying to forecast the market — not to get caught up in worrying over where the market is headed next week, next month, next year. IBD takes a more here-and-now approach. The rules here are simple: Keep your investments to a manageable few. Pay close attention to each chart. Manage your investments according to the behavior of each individual stock. And the M reminds you to pin the backdrop — the overall stock market. The tighter you dial in your attention to this type of stock tending, the more fascinating the lessons become. The fastest, simplest way to follow the market is to read IBD's daily Big Picture articles. These provide an overview of each day's market action, including a quick-glance status indicator, the Market Pulse. The Big Picture doesn't try to tell you where the market will be six or 12 months from now. It counsels investors as to how aggressive or cautious they might want to be, given the market's current behavior. A confirmed uptrend with institutional money moving into the market gives a risk-on signal. This frees investors to buy leading stocks breaking out past buy points, or to add to current holdings when stock charts provide follow-on opportunities. |

|

The Big Picture and Market Pulse keep a tally of distribution days on the major indexes. A distribution day occurs when an index falls at least 0.2% in higher trade. This indicates unusually strong selling by institutional investors such as... [snip] * * * * * * * * * *

|

TOPICS: Business/Economy; Culture/Society; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-51 next last

To: expat_panama

2

posted on

04/26/2015 11:48:50 AM PDT

by

M Kehoe

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

The adventure continues...

To: expat_panama

Stocks always go up...until they go down. Why not just let the casinos have your money? At least they have show girls.

4

posted on

04/26/2015 11:59:09 AM PDT

by

txrefugee

To: txrefugee

And waitresses and free drinks. :-)

5

posted on

04/26/2015 12:01:27 PM PDT

by

NormsRevenge

(Semper Fi - Revolution is a'brewin!!!)

To: txrefugee

Stocks always go up...until they go down. Why not just let the casinos have your money? At least they have show girls.But mostly up.

If you invest in proven, solid companies and use the "buy and hold" strategy over the long term, you can't go run.

Love the casinos and show girls too. But I go there to blow money and have some fun.

To: NormsRevenge

and free drinks They ain't free. You've paid for them many times over. Just add up all the nickels, dimes and quarters you feed into the slot machines and divide the total by the number of "free" drinks.

7

posted on

04/26/2015 1:03:31 PM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: SamAdams76; txrefugee

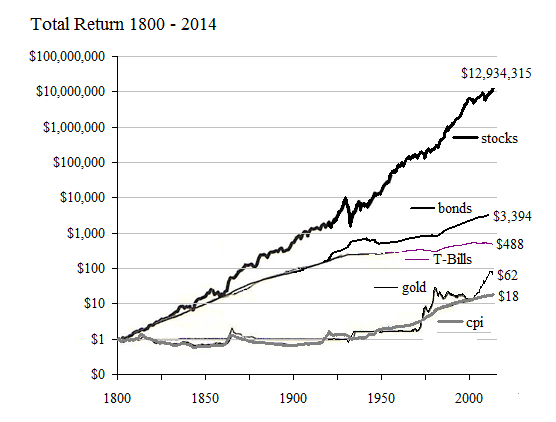

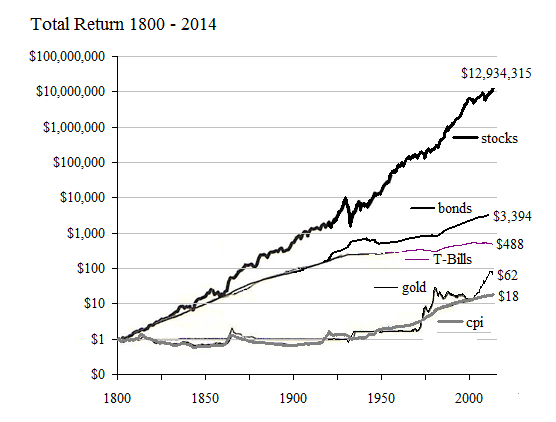

Stocks always go up...until they go down. Why not just let the casinos have your money? At least they have show girls.But mostly up.

--and that 'mostly' is pretty much all of it.

OK, so there is a bunch of short term static caused by daily surprises and it's completely unpredictable, but the big part is easy enough to bank on: the population will grow, more people will buy more stuff and companies selling stuff will grow. Add to that the fact that Americans will continue to work smarter and come up with even better ideas --it all means that it's a lot easier to believe that what we've had for hundreds of years will be there next year.

Casinos aren't so bad though, I mean there are plenty of folks who've made a lot of money in casinos --as owners: Best Casino Stocks For 2015

To: SamAdams76; All

I have Walmart, Proctor and Gamble, GE and Pfizer.

Any advice?

I read that Pfizer has a drug recently approved by the FDA that will prolong the life of those with advanced CA, and it is due to collect billions in years to come.

Anyone heard that?

I’ve also read that Pfizer, the largest drug company in the world) is dedicated to find drugs to treat cancer.

9

posted on

04/26/2015 1:47:48 PM PDT

by

patriot08

(NATIVE TEXAN (girl type))

To: patriot08

I have two of those, PG and WMT. Any pronounced market downturn will be an opportunity to buy more, IMO.

10

posted on

04/26/2015 1:51:56 PM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: patriot08

Investors.com likes Pfizer but not the others. Here are the ratings:

WAL-MART STORES RANK WITHIN THE RETAIL-MAJOR DISC CHAINS GROUP (9 STOCKS)

- Composite Rating 32 Rank within Group: 6th 44%

- EPS Rating 56 Rank within Group: 6th 44%

- Relative Strength Rating 32 Rank within Group: 7th 33%

- SMR Rating (sales, margins and return on equity) C Rank within Group: 4th 66%

- Acc/Dist. Rating C- Rank within Group: 7th 33%

PROCTER & GAMBLE RANK WITHIN THE COSMETICS/PERSONAL CARE GROUP (31 STOCKS)

- Composite Rating 34 Rank within Group: 20th 38%

- EPS Rating 45 Rank within Group: 17th 48%

- Relative Strength Rating 25 Rank within Group: 22nd 32%

- SMR Rating C Rank within Group: 13th 61%

- Acc/Dist. Rating D+ Rank within Group: 26th 19%

GENERAL ELECTRIC CO RANK WITHIN THE DIVERSIFIED OPERATIONS GROUP (30 STOCKS)

- Composite Rating 32 Rank within Group: 19th 40%

- EPS Rating 56 Rank within Group: 20th 36%

- Relative Strength Rating 60 Rank within Group: 8th 76%

- SMR Rating C Rank within Group: 18th 43%

- Acc/Dist. Rating D- Rank within Group: 25th 20%

PFIZER INC RANK WITHIN THE MEDICAL-ETHICAL DRUGS GROUP (38 STOCKS)

- Composite Rating 77 Rank within Group: 16th 60%

- EPS Rating 46 Rank within Group: 19th 52%

- Relative Strength Rating 77 Rank within Group: 19th 52%

- SMR Rating B Rank within Group: 12th 71%

- Acc/Dist. Rating B Rank within Group: 11th 73%

To: expat_panama

Just read elsewhere on FR that India is buying three more C17 Globemasters due to the earthquake.

Many billions. Maybe Boeing is a buy? Or too late based on this news?

12

posted on

04/26/2015 5:39:55 PM PDT

by

MichaelCorleone

(Jesus Christ is not a religion. He's the Truth.)

To: expat_panama

Don’t like to let the emotions cloud the thinking, but that is one heck of a lot of unanticipated money.

13

posted on

04/26/2015 5:50:42 PM PDT

by

MichaelCorleone

(Jesus Christ is not a religion. He's the Truth.)

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Monday's upon us and futures traders see price uptrends for both stock indexes (+0.22%) and metals (+0.67%)! The only econ stat I know of is the Chicago Fed national activity index coming up an a half hour. Stuff to browse before opening:

To: MichaelCorleone

too late based on this news?News hasn't seemed to change BA's price any yet, this morning's offered price is only $148.61 compared to last Feb's high of $158.83. IBD seems happy enough w/ it tho...

BOEING CO RANK WITHIN THE AEROSPACE/DEFENSE GROUP (56 STOCKS)

Composite Rating 80 Rank within Group: 11th 82%

EPS Rating 82 Rank within Group: 11th 82%

Relative Strength Rating 79 Rank within Group: 19th 67%

SMR Rating B Rank within Group: 11th 82%

Acc/Dist. Rating D- Rank within Group: 51st 10%

... and their ratings may not yet have factored in the order. Some traders might to well there but for my strategies I go for consistant growth and BA's been pretty erratic.

To: expat_panama

Book value is the current vale of your stock. (at best — considering that the book vale of companies are usually overstated)

But what about PE you ask. True, it is the most common measure of value used. Everyone is speculating on their investments.

Sky high PEs can only spell trouble. Think tulips.

But I am not a financial expert and I did not stay at a Holiday Inn Express last night.

16

posted on

04/27/2015 7:20:09 AM PDT

by

BenLurkin

(The above is not a statement of fact. It is either satire or opinion. Or both.)

To: BenLurkin; Wyatt's Torch

Sky high PEs can only spell troubleNot if we're talking about the current price divided by last year's earnings. Sometimes we can get a 'forward PE' based on this year's expected earnings but then the problem becomes one of how much we want to trust the analyst...

To: expat_panama

http://finance.yahoo.com/news/economy-uncertain-no-fed-rate-153058237.html

With economy uncertain, no Fed rate hike is seen before fall

Associated Press By Martin Crutsinger, AP Economics Writer

4/27/2015

WASHINGTON (AP) — For 6½ years, the Federal Reserve has held its key interest rate near zero, and for nearly that long the financial world has speculated about when the Fed will start raising it.

Don’t look for it soon.

That’s the view of most economists, who say a still-subpar economy and still-low inflation will keep rates at record lows at least until September.

On Wednesday, the Fed could clarify its plans after ending its latest policy meeting. Analysts caution, though, against expecting any specific guidance on the Fed’s timetable for a rate hike. Too many uncertainties still surround the U.S. economy. The Fed’s policymakers may want to leave themselves maneuvering room until their view of the economy’s health becomes clearer.

18

posted on

04/27/2015 11:11:48 AM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

What my thinking had been before was that the Fed would never raise rates if there was no inflation. Now I'm thinking that the fed may still be concerned about deflation and wish it still had the capacity to lower rates --thus they wish they could set them higher now --just in case-- so long as the rate hike didn't hurt anything.

This talk about the 'soft' economy means any rate hike would probably be a disaster --both to production and to prices.

To: expat_panama

IIRC, Mark Haines, late of CNBC, often used the term “Don’t fight the Fed.”

20

posted on

04/27/2015 12:06:50 PM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-51 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

This past week's seen the S&P500 leap almost 2% and gold fall more than 2%. A couple percent may not seem like much but having it happen in just five trading days means we got annualized returns of a 2/3 loss on gold and 50% gain on stocks.

This past week's seen the S&P500 leap almost 2% and gold fall more than 2%. A couple percent may not seem like much but having it happen in just five trading days means we got annualized returns of a 2/3 loss on gold and 50% gain on stocks.