Last month, in "Cities, States Shun Moody's For Blowing The Whistle On Pension Liabilities," we highlighted a rift between Moody’s and some local governments over the return assumptions for public pension plans.

To recap, when it comes to underfunded pension liabilities, one major concern is that in a world characterized by ZIRP and NIRP, it’s not entirely clear that public pension funds are using realistic investment return assumptions. The lower the return assumption, the larger the unfunded liability. After 2008, Moody’s stopped relying on the investment return assumptions of cities and states opting instead to use its own models. Unsurprisingly, this led the ratings agency to adopt a much less favorable view of state and local government finances and as WSJ reported, rather than admit that their return assumptions are indeed unrealistic, local governments have opted to drop Moody’s instead.

The debate underscores a larger problem in America. Almost half of the states in the union are facing budget deficits.

Underfunded pension liabilities are one factor, but the reasons for the pervasive shortfall vary from plunging oil revenues to plain old fiscal mismanagement. The pension issue gained national attention after an Illinois Supreme Court decision threw the future of pension reform into question and effectively set a precedent for other states, sending state and local officials back to the drawing board in terms of figuring out how to plug budget gaps. One option is what we have called the "pension ponzi" which involves the issuance of pension obligation bonds. Here is all you need to know about that option:

'Solving' this problem by issuing bonds is an enticing option but at heart, it amounts to what one might call a "pension liability-bond arbitrage." The idea is to borrow the money to plug the pension gap and invest it at a rate of return that's higher than the coupon on the bonds, thus saving money over the long-haul. Of course, much like transferring a balance on a high interest credit card onto a new card with a teaser rate (or refinancing a high interest credit card via a P2P loan) this gimmick only works if you do not max out the original card again, because if you do, all you've done is doubled your debt burden. As it relates to pension liabilities, this means that what you absolutely cannot do is use the cash infusion as an excuse to get lax when it comes to pension funding because after all, that's what caused the problem in the first place.

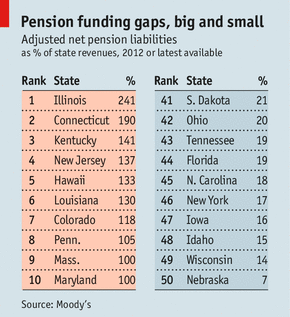

And here's a look at how pervasive the problem has become:

Make no mistake, America’s pension problem isn’t likely to be resolved anytime soon and in fact, with risk-free rates likely to remain subdued even as equity returns face the possibility that the beginning of a Fed rate hike cycle could trigger a 1937-style equity meltdown (bad news for return assumptions), and with investors set to demand higher yields on muni issuance thanks to deteriorating fiscal circumstances, the financial screws may be set to tighten further on the country’s struggling state and local governments. Bloomberg has more:

The cost to American cities for their cash-strapped pension funds is starting to look a lot worse, and it’s not because the stock-market rally may be losing steam.

Houston was warned by Moody’s Investors Service this month that it may be downgraded because of mounting retirement bills, the latest municipality put on notice as the company ignores bookkeeping gimmicks that let cities mask the size of their debt for years. The approach foreshadows accounting rules for even top-rated issuers that are poised to cause pension shortfalls to swell as new financial reports are released.

"If you’re AAA or AA rated and you’ve got significant and visible unfunded pension obligations, you’ve only got one direction to go in terms of rating, and that’s potentially down," said Jeff Lipton, head of municipal research in New York at Oppenheimer & Co. "It’s the presentation on the balance sheet that is now going to drive urgency."

Cities that shortchanged pensions for years are under growing pressure to boost their contributions, even after windfalls from a stock market that’s tripled since early 2009. Janney Montgomery Scott has said growing retirement costs are "the largest cloud overhanging" the $3.6 trillion municipal-bond market, where investors are demanding higher yields from borrowers under the greatest strain.

That was on display this week for Chicago, whose credit rating was cut to junk by Moody’s in May because of a $20 billion pension shortfall. The city was forced to pay yields of almost 8 percent on taxable bonds maturing in 2042, about twice what some homeowners can get on a 30-year mortgage.

Estimates of the pension-fund deficits facing states and cities vary, depending on the assumptions used to calculate the cost of bills due over the next several decades. According to Federal Reserve figures, they have $1.4 trillion less than needed to cover promised benefits.

Officials have been able to lower the size of the liability by counting on investment earnings of more than 7 percent a year, even after they expect to run out of cash. New rules from the Governmental Accounting Standards Board require a lower rate to be used after retirement plans go broke. Many reported shortfalls will grow as a result.

Moody’s, which in 2013 began using a lower rate than governments do to calculate future liabilities, has estimated that the 25 largest U.S. public pensions alone have $2 trillion less than they need. Cincinnati and Minneapolis are among cities Moody’s has since downgraded.

The California Public Employees’ Retirement System, the largest U.S. pension, this week said it earned just 2.4 percent last fiscal year, one-third of the annual return it projects. The California State Teachers’ Retirement System, the second-biggest fund,gained 4.5 percent, compared with its 7.5 percent goal.

In short: America is facing a fiscal crisis at the state and local government level and it appears as though at least one ratings agency is no longer willing to suspend disbelief by allowing officials to utilize profoundly unrealistic return assumptions in the calculation of liabilities. This means downgrades and as for what comes next, we'll leave you with a recap of Citi's vicious "feedback loop".

From Citi

How does a downgrade create a feedback loop?

Payment induced liquidity shock

For many issuers’ credit contracts, a drop to a speculative grade rating acts as a payments trigger. For instance, the issuer may have commercial paper programs and line of credit agreements as a part of its short term borrowing program and a rating downgrade could qualify as an event of default for these borrowing arrangements. This enables the banks to declare all outstanding obligations as immediately due and payable.

A rating downgrade could also force accelerated repayment schedules and penalty bank bond rates on swap contracts and variable-rate debt agreements.

Thus, as a result of the rating action, an issuer could face increased liquidity risk at an unfortunate time

when it is working to navigate its way out of a fiscal crisis.

Knock-on rating downgrade risk

In some instances, rating agencies may disagree on an issuer’s creditworthiness which could result in a split level rating for a prolonged period. But a drastic rating action by one main rating agency (either Moody’s or S&P) which knocks the issuer’s debt to below investment grade could force the other rating agencies to follow with a similar downgrade. While the other rating agencies might feel that underlying credit fundamentals of the issuer do not merit a sub-investment grade rating, their rating action could be dictated by negative implications due to the liquidity pressures posed by the first downgrade to junk status. Recently, S&P downgraded a credit as a result of Moody’s rating action that stated that its rating action reflected its view that the issuer’s efforts “are challenged by short-term interference” that prevents a solid and credible approach to resolving their fiscal problems.

Shrinking buyer base

Many investors have mandates to buy investment grade debt only and a fall to speculative grade status could cause existing investors to liquidate the holdings of the fallen credit and shrink the universe of buyers.

Rising issuance costs

In many cases the issuer may have been working diligently to reduce its exposure to bank credit risks in the event of a ratings deterioration (for e.g. shifting its variable-rate GOs and sales tax paper to a fixed rate by tapping its short-term paper program then converting it into long-term debt) but the unfortunate timing of the downgrade will make this task much more challenging as a shrunken buyer base for an entity’s debt, quite naturally, translates into a higher cost of debt.

A higher cost of debt exacerbates liquidity problems and thus the feedback loop could continue to gain traction.