Skip to comments.

In Stock Market, The Price - Not Speed - Is Right [MARKETS CRASH, DEAL WITH IT]

Investors Busniness Daily ^

| 08/26/2015

| STEPHEN PORPORA

Posted on 08/27/2015 4:06:11 AM PDT by expat_panama

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-36 last

To: expat_panama

The markets are up on some new & revised economic data. That’s good and much needed.

Tho since the econ collapse I have pretty much no confidence that the posted data isn’t largely to wholly adjusted to favor those in power.

21

posted on

08/27/2015 7:32:58 AM PDT

by

citizen

(America is-or was-The Great Melting Pot. JEB won't even speak American in his own home. NO Bush!!)

To: 1010RD

...the folly in having 12 people determine an entire country’s monetary policy. Free markets for a free people...how we can privatize monetary policy. Would we like, take bids or something on how many dollars to be printed and award say, a 6-month contract to whoever can print the most dollars for the lowest bid?

Here’s the velocity of the US dollar going forward and that’s it.

Wait a second, the FedReserve doesn't do velocity, it does 2 or 3 particular interest rates and leaves the other thousands of rates to the market --but never velocity. I mean, it's completely impossible for any private contractor change U.S. dollar velocity.

Honestly, all I'm getting here is that you don't like the Federal Reserve and at the same time you can't find a better way. I'm sure you'd never intend to be a complainer w/o options so maybe you'd either want to rethink your complaints or restate your options..

fiscal policy is at the heart of what ails the US economy. Regulation costs $2 trillion a year

That's absolutely true but let's please not change the subject to fiscal policy until we decide how we want monetary policy done.

To: proxy_user

...just put in a limit order on good blue chips stocks....There are a lot of happy traders who do just that. Personally I guess I get to fidgety and want results right away so I just stare and wait till the price is met and then I buy. I bot a bunch of etf's today; we'll see....

To: citizen

...markets are up on some new & revised economic data...Yeah, gdp just went from 2.3% to 3.7%, claims is staying low, and home sales went to +0.5% after last months -1.8%

...no confidence that the posted data isn’t largely to wholly adjusted to favor those in power...

Sure are a lot of freepers saying all they things they don't like, but I've yet to hear any of the complainers say what they do like. I mean if the claims numbers, home sales, gdp, and all the publically available numbers these stats come from are all bogus, then please tell us what stats and supporting data are there that you do like? OK, I'll admit there've been a few numbers that are patently false and when that happens the vast majority of traders see right through 'em. Wish I could say the same for all the mindless voters that seem to lap it up but that's another thread...

To: expat_panama

Don't misunderstand. Just because I'm skeptical of some of the people controlling the data doesn't mean I'm not fine with the good-sounding numbers.

DOW +358 is much better than DOW -358.

If they can keep the financial world going by whatever means necessary for another 15-20 years, that will be as long as I'll likely need.

25

posted on

08/27/2015 10:20:38 AM PDT

by

citizen

(America is-or was-The Great Melting Pot. JEB won't even speak American in his own home. NO Bush!!)

To: citizen

ah, that's clean. Go with what is --ya can't beat it!

To: expat_panama

Check this bounce over the last 30 minutes. Stout!

27

posted on

08/27/2015 12:48:44 PM PDT

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

yeah, with the new highs it sure is looking like we’re off on a new upward direction now.

To: expat_panama

Federal Funds Rate. My apology for not being specific. Fed Chair Yellen thinks they are creating jobs keeping the Fed’s fund rate low. In reality she is only covering for failed economic policies that promised improvement. Also for savers who have low risk tolerance there is poor return.

To guess at a specific level— How about 3 and 1/2% ? Then let government do their part and pass legislation that actually is going to help the private sector grow.

29

posted on

08/27/2015 3:55:48 PM PDT

by

Son House

(The American Recovery and Reinvestment Act of 2009; the Original Legislative Fraud.)

To: Son House

Federal Funds Rate.... ....for savers who have low risk tolerance there is poor return.

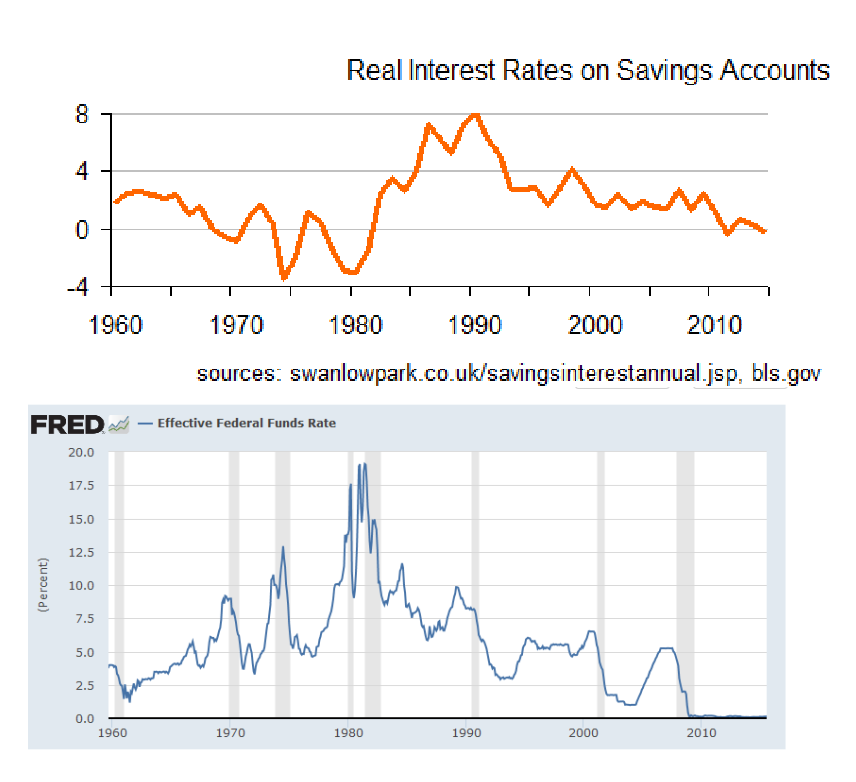

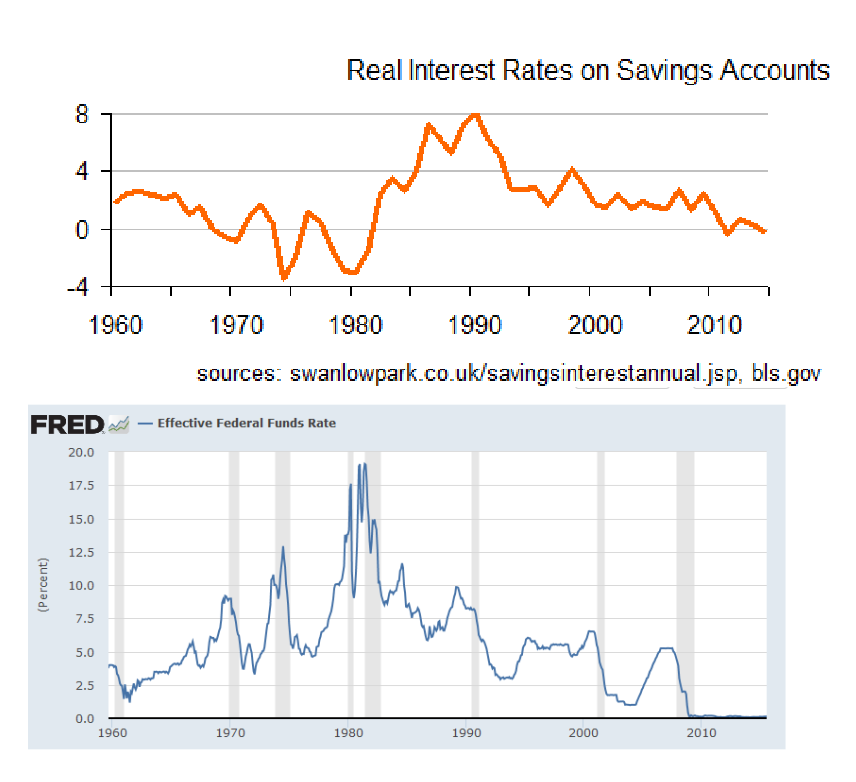

It's true that many (most?) people say that the fed's low rates are hurting savers, but when I personally look at the fed funds rate along w/ the real savings interest (savings acct interest less inflation) I can see years when real savings rates were much lower while the fed funds rate was double digit.

There really has not been that much of a connection. My take is that low risk tolerance is the real cause of poor returns, it's always been that way and it always will be.

To: expat_panama

The Fed does too do velocity of money. They study it all the time and it's a critical factor in their decision making. I espouse the long held and data supported position of Monetarists on the Fed. Milton Friedman being the most prominent. You're arguing against him, not me. He's right, though. Characteristics of Monetarism Monetarism is a mixture of theoretical ideas, philosophical beliefs, and policy prescriptions. Here we list the most important ideas and policy implications and explain them below. 1.The theoretical foundation is the Quantity Theory of Money. 2.The economy is inherently stable. Markets work well when left to themselves. Government intervention can often times destabilize things more than they help. Laissez faire is often the best advice. 3.The Fed should be bound to fixed rules in conducting monetary policy. They should not have discretion in conducting policy because they could make the economy worse off. 4.Fiscal Policy is often bad policy. A small role for government is good. http://www.econweb.com/MacroWelcome/monetarism/notes.html Application: Friedman�s Money Growth Rule Mainstream view: monetary policy should be used to fine tune the economy, to help smooth the recurrent ups and down of the business cycle. Milton Friedman view: the Fed should follow a policy consistent with a constant rate of growth of the money supply. Arguments for Friedman�s view: 1. This policy would have good long run effects (low inflation). 2. It would be better than actual fine-tuning policies since it would avoid some big mistakes (the high inflation rates of the 1970s). 3. Discretionary short-run policy management leads to shortsightedness and bad long-run policy decisions. 4. You can use monetary policy to start a recession, but not stop one. Today, Greenspan and the Fed do not follow a policy of targeting a rigid money growth rule. The Fed tries instead to target a short term interest rate (the Federal Funds rate).Actual US monetary policy is more flexible and discretionary than advocated by Friedman. http://people.stern.nyu.edu/nroubini/NOTES/HAND6.HTM By privatizing the monetary policy you take it out of the hands of 12 'smart' people, all of whom are political appointees deeply attached to the financial community and put it to the market. This is done by applying an objective rate and setting it forever. This allows private individuals (the privatize part) to make decisions understanding the economic lay of the land. I reject central planners and central planning. I hope some day you'll join me and get consistent because free markets make a free people. That's how I want monetary policy done. Capisce?

31

posted on

08/28/2015 5:08:04 AM PDT

by

1010RD

(First, Do No Harm)

To: expat_panama

The Fed does too do velocity of money. They study it all the time and it's the critical factor in their decision making. I espouse the long held and data supported position of Monetarists on the Fed. Milton Friedman being the most prominent. You're arguing against him, not me. He's right, though.

Characteristics of Monetarism

Monetarism is a mixture of theoretical ideas, philosophical beliefs, and policy prescriptions. Here we list the most important ideas and policy implications and explain them below.

1.The theoretical foundation is the Quantity Theory of Money.

2.The economy is inherently stable. Markets work well when left to themselves. Government intervention can often times destabilize things more than they help. Laissez faire is often the best advice.

3.The Fed should be bound to fixed rules in conducting monetary policy. They should not have discretion in conducting policy because they could make the economy worse off.

4.Fiscal Policy is often bad policy. A small role for government is good.

Characteristics of Monetarism

Application: Friedman�s Money Growth Rule

Mainstream view: monetary policy should be used to fine tune the economy, to help smooth the recurrent ups and down of the business cycle.

Milton Friedman view: the Fed should follow a policy consistent with a constant rate of growth of the money supply.

Arguments for Friedman's view:

1. This policy would have good long run effects (low inflation).

2. It would be better than actual fine-tuning policies since it would avoid some big mistakes (the high inflation rates of the 1970s).

3. Discretionary short-run policy management leads to shortsightedness and bad long-run policy decisions.

4. You can use monetary policy to start a recession, but not stop one.

Today, Greenspan and the Fed do not follow a policy of targeting a rigid money growth rule. The Fed tries instead to target a short term interest rate (the Federal Funds rate).Actual US monetary policy is more flexible and discretionary than advocated by Friedman.

Application: Friedman's Money Growth Rule

By privatizing the monetary policy you take it out of the hands of 12 'smart' people, all of whom are political appointees deeply attached to the financial community and put it to the market. This is done by applying an objective rate and setting it forever. This allows private individuals (the privatize part) to make decisions understanding the economic lay of the land going forward. That way the whimsical monetary policy of the Fed can be ignored leaving only the whim of the marketplace as the enemy of entrepreneurship and growth.

I reject central planners and central planning. I hope some day you'll join me and get consistent because free markets make a free people.

That's how I want monetary policy done. Capisce?

Now that monetary policy has been stabilized do you want to move to fiscal policy?

32

posted on

08/28/2015 5:14:41 AM PDT

by

1010RD

(First, Do No Harm)

To: 1010RD

The Fed does too do velocity of money. They study it all the time...Lot's of things on the web that I study but my wife is very clear w/ me that I'll never ever be actually doing any of them. As to how much the fed likes to "study" the subject, let's go back down memory lane to this:

To: expat_panama

Just had a discussion with a Senior Economist at the Boston Fed... I asked him about how/when to unwind the balance sheet. His answer was pretty much let the securities expire... 😳 he did mention reverse repos and open market selling but. Also asked him about monetary velocity and he said "I haven't looked at that one." That discussion did not instill confidence in me. It was Fed 101. Weak.

To: expat_panama

I miss Wyatt’s Torch. Did you ever find him?

You’ll note that he calls the velocity of money “Fed 101”. It was “weak” that he didn’t know about or think on or look at velocity of money.

I am not a Fed basher or conspiracy theorist. I believe in small government and free markets wherever possible.

34

posted on

08/28/2015 6:42:59 AM PDT

by

1010RD

(First, Do No Harm)

To: 1010RD

Did you ever find him?He seems to have dropped off suddenly after his last post in March, I think I can google/facebook his real name but I guess I'm afraid to find out bad news that may be lurking there. Meanwhile I'll be 'patient' (read: procrastinating).

small government and free markets wherever possible

Agreed. My understanding is that in this case it's not possible given the fact that the constitution requires Congress to set monetary policy, and they've decided to do it though the Fed. I'm personally at a loss as to how it could be physically possible for the free market to "coin money and set the value thereof" without any control by government.

To: expat_panama

Set money growth at a certain rate and leave it. They’ve fulfilled their Constitutional authority. Done.

36

posted on

09/04/2015 3:53:32 AM PDT

by

1010RD

(First, Do No Harm)

Navigation: use the links below to view more comments.

first previous 1-20, 21-36 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson