Posted on 01/13/2016 9:27:00 AM PST by NRx

You have a better chance of getting hit by lightning in a frog thunderstorm than you do winning the Powerball, but hey, it's always fun to play billionaire. If you were to win (and you won't), there are a few things you should to do to protect and optimize your winnings.

http://lifehacker.com/winning-the-po...

Ah, the age old question all lottery winners (well, big winners) have to contend with: Do you take the annuity or the lump sum amount?

With the annuity, you get your payout over time, and you'll get more money. If you win this Powerball Jackpot, you can opt for 30 annual payments that average to about $37 million, after Federal taxes. That adds up to just over a billion dollars over time. (This varies depending on what state you live in, because you have to consider those pesky state taxes).

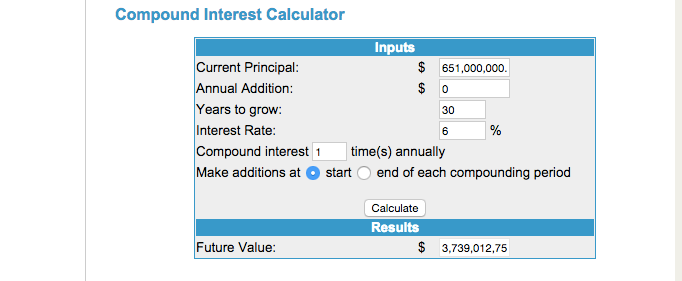

With the lump sum, you get all your money at once, but after Federal taxes, that's about $651 million. Pretty good, I guess, but it's no billion dollars. Here's the thing, though: even though the annuity adds up more over time, lump sum could still be a more lucrative option if you invest it, thanks to a little thing called compound interest. Let's say you invest that $651 million into the broad stock market, which earns about 6-7% each year, on average, after inflation. To keep things simple, we'll assume you don't have state taxes. In five years, you'd earn $871 million. In 30 years--the payout term for the annuity--you'd earn $3.74 billion. That more than makes up for the money you lost by opting for the lump sum amount.

It's not quite that simple, though. For one, you have to pay taxes on the money you earn from investing, and there's a big tax advantage to the annuity option. Tax Lawyer David Hryck explains:

If you take the lump sum, you will be paying taxes twice. You pay on the prize itself and again on your investments. If you go the annuity route you will pay taxes on each installment but you will not pay taxes on your investments of the money while the government essentially holds your winnings for you. Over time, this will add up for you as your winnings grow with no tax stipulations.

With the annuity option, Powerball basically invests the money on your behalf, and, according to Hryck, you earn a pre-tax rate of about 2.8%. That's not much, and you can do better investing on your own, but remember: that money is growing tax-free. As The New York Times points out, "you'll never beat the effective tax rate of zero on the investment income earned inside the Powerball annuity."

http://www.nytimes.com/2016/01/13/ups...

Of course, you can invest your annual annuity payout in the broad market, too, and then you pay taxes on those earnings as well. Like we said, it's complicated.

These scenarios also assume you'll invest your entire winnings, which is unrealistic (that private island isn't gonna pay for itself). They assume you have decades to invest and wait out market slumps. There are so many numbers to crunch and the outcome really depends on how long you have to invest, what kind of yield you can expect, and where you live.

A multimillionaire shouldn't have to do this much math.

Thankfully, Business Insider crunched some numbers with a lottery a few years ago, and here's what they concluded:

if you can score a rate of return somewhere between 3% and 4%, you're still better off with the lump sum...Factoring in investment, though, it only makes sense to take the lump sum if you think you can get an altogether reasonable rate of return.

Even the most basic, set and forget investment portfolio averages 6-7% on average, so those numbers point to lump sum. But it basically comes down to the advantage of investing the lump sum vs. the tax savings of the annuity. And most experts seem to think the tax savings of the annuity outweigh the return of the lump sum. You might also choose the annuity if you have a hard time managing your money.

Before rushing out to claim your ticket, take a moment to soak it all in. You're a multimillionaire, I know! It's time for couch jumping and champagne popping. However, if there's one thing I've learned from sitcoms, it's that acting impulsively when you win the lottery always backfires.

You need time to understand the rules and come up with a reasonable plan. And don't worry about missing the deadline: in most states, you have 180 days to claim your ticket. (Mark your calendar, though, because you'll be kicking yourself if you miss that deadline!)

Make a copy of your ticket and put the original in a safe place (like literally, a safe.) When friends, family, and creditors find out you won, they'll start hitting you up nonstop. Forbes recommends the following strategy to avoid this:

...check state rules to see whether you can dodge them all by remaining anonymous...rules on winner publicity vary by state. In New York, for example, winners' names are a public record. Elsewhere it may be possible to maintain your anonymity by setting up a trust or limited liability company to receive the winnings, says Beth C. Gamel, a CPA with Pillar Financial Advisors in Waltham, MA. A client of Gamel's who won a past lottery did that, and had a lawyer claim the prize on behalf of of the trust. In South Carolina, where the Sept. 18 winner bought his or her ticket, it's also possible to remain anonymous.

If you're married, your spouse is entitled to some of the winnings. According to Legal Zoom, spouses' earnings are generally considered marital income, so if you buy something with those earnings--even if it's a lottery ticket--that item becomes marital property. If you're going through a divorce and you won the lottery, your ex might be entitled to some of the winnings, too. It depends on how far along you are in the divorce and where you live (laws vary by state).

Maybe you won the Powerball as part of an office pool. In thie case, things get a little messy. You should've thought about that before asking Noel in accounting to go in with you, but here you are. In most states, there can only be one payee per ticket. So you'll have to create a single entity to represent all of the winners. AmericanBar.org explains how this works:

Thus, in a multiple- beneficiary situation, it is advisable to create an entity because if only one person in the pool claims the prize, when that person distributes shares of the prize to the other members of the group, it could be a taxable gift. In addition, only that individual will receive the W-2G, reporting the lottery winnings as 100 percent taxable to him or her for income tax purposes. Further, the other members of the pool may not be comfortable with just one member claiming the prize as the winner, individually... In these instances a group arrangement should be used for all purposes and should be documented appropriately.

A good lawyer will walk you through these issues, but it helps to know what to expect. Once you do claim your ticket, you'll have another 60 days to decide how you'll receive payment.

http://lifehacker.com/5826959/how-to...

Congratulations--you're in the one percent! This means you'll pay a ton of taxes, but unlike your peers, you won't get a chance to think about how to shelter your millions with tax loopholes. You've gotta pay up.

The Powerball website crunched the numbers for you so you can see what you'll pay in both Federal and state taxes, depending on where you live, and depending on whether you take the lump sum or annuity.

Assuming you quit your job, you'll have to pay estimated quarterly taxes now, too. A good CPA will help you figure this out so you can avoid tax penalties. It's pretty easy, though. When you don't have a full-time job, you don't have an employer to make regular tax payments during the year on your behalf. So you have to make these payments yourself every few months, using IRS Form 1040 ES, if you have any income during the year. You can pay these taxes online, too.

http://lifehacker.com/268406/pay-you...

Keep in mind: you're also in the highest possible tax bracket now, too. For 2016, that means your federal income tax rate is 39.6%. Again, you'll pay all of your taxes at once with the lump sum, so that rate won't change. However, if you opt for the annuity, your rate could very well change over the years. Here's how one tax pro explained it to Business Insider:

"As we know tax rates are always changing. If you take a lump sum you are looking at a 39.6% rate. If you take an annuity over the next 30 years the rates will probably be very different when you receive each payment." So people who expect that the top tax rate will decrease over time -- or that the Flat Tax crowd will win -- should take that annuity.

On the other hand, if you think the tax rate will only get higher over time, you'll want to take the lump sum.

At the very least, you're going to need an attorney, a Certified Financial Planner, and a tax preparer.

An estate attorney will help you figure out how to set up a Will and Trust as well as other complicated legal documents. Here's what estate lawyer Barry Nelson says you'll need:

In preparing a Will and Trust, the lottery ticket winner will have to consider difficult non-tax issues. For example, at what age should the winner's children inherit such large sums of money in the event of the lottery winner's death. Most of my clients believe that it is advantageous to delay large distributions to younger family members until they finish college and have work experience so they obtain a healthy work ethic.

Find a good lawyer by asking a trusted friend or family member or running a search on the American Bar Association website. You might even reach out to past lottery winners, suggests Richard Morrison, who won $165 million back in 2009.

http://business.time.com/2012/11/29/pow...

undefined business.​time.​com

When you meet with your lawyer or interview them over the phone, you should feel comfortable, and they should explain things clearly. And watch out for this big red flag, as lawyer John M. Phillips points out on his website:

Do NOT agree to allow them a percentage of your winnings or anything crazy like that. If they ask... that's the wrong lawyer. Just find someone who you trust and come up with fair retainer and/or hourly compensation to help you make good decisions and protect you from people who will look to separate you from your windfall.

When you look for a financial planner, make sure it's a Certified Financial Planner, who takes a fiduciary oath and is legally required to act in your best interest. Ideally, you want a fee-only financial advisor, too. This CFP should also be able to help you with taxes or refer you to someone who can help.

http://twocents.lifehacker.com/how-to-find-an...

A good lawyer will help protect your money. They'll suggest a series of legal moves and insurance products to help protect you against all the things that might possibly go wrong with your money: lawsuits, creditors, divorce.

Forbes explains how this asset protection plan works in a little more detail.

The best defense is to erect a variety of roadblocks that make it difficult, if not impossible, for creditors to reach your money and property. These asset protection strategies, as they are called, can range from relying on state-law exemptions to creating multiple barriers through the use of trusts and family limited partnerships or limited liability companies. It may be possible to rely on a variety of strategies, either separately or in combination with each other.

For example, Morrison told Time that his lawyers even suggested kidnap and ransom insurance to protect his family. He says he opted out but hired security to protect his home and children. He also suggested claiming your ticket at a lottery office far from your home town.

Of course, it's probably a good idea to pay off old debt and learn a few good financial habits, too. You're rich, I get it, but if it can happen to Wayne Newton, it can happen to you. Plus, when you have debt to pay, that means you're paying interest. Obviously, you want to pay all of that off at once so your debt interest doesn't offset the interest you earn from investing.

In general, though, you'll probably be fine. With some proper planning and a basic understanding of how the system works, you should be in pretty good shape. That is, assuming you actually win.

The amounts are so large and I’m getting old enough that it probably doesn’t matter what I did with the winnings. I probably couldn’t spend that much money in the rest of my life without buying pro sports franchises or tropical islands.

Sounds like a good start. :)

Even if your state doesn’the allow an anonymous collection of lottery winnings, you could still form a trust, llc, or holdings corp. and remain anonymous.

ANY $$$$ THAT’S LEFT OVER WILL BE,

1. THE GRAND CHILDREN’S BIRTHDAY’S OR HOLIDAY’S.

2. A COLLEGE FUNG FOR EACH OF THEM.

3. LOOSE POCKET CHANGE FOR ME.

There is a section on the powerball site about previous winners. One older guy in california won a bunch of money - 100+ million.

“Well - I’ll buy some good cars for my kids for their families - SUV’s for the snow with decent gas mileage. Nothing fancy like a Lexus or such. I like my truck and my house so I’m not getting anything new. I’m an old guy - I don’t need much.”

I’m the only person in the country (the world?) with my name as far as I know. Can one get a name change in 180 days?

That's what our office pool would have to do. Even with a 40+ way split it still would be a nice chunk'a change. I'd leverage about half of my share by putting downpayments on several well-located apartment buildings and taking the writeoffs on the property tax, financing and operating costs. Correctly managed, that would feed my descendants for several generations, if America lasts that long.

Be interesting to know how it’s possible to get 75% coverage on a huge volume of sales last time that boosted the pot by $600 million, but 85% coverage on a relatively puny volume of sales in comparison this time that is only going to boost the pot by $200 million???... Something’s fishy in Denmark.

And if you buy it from a vending machine, you don't get a choice. You can only lump sum.

If I win this powerball draw I could see my self buying some small bank like Mr Drysdale bank in the Beverly Hillsbillies. hehe

Not really. It went from $500 million (Jan 6) to roughly $950M (Jan 9) at the last drawing. With each ticket running $2 (and some costing $3 if they used the Poweplay) that’s no more than 225 million tickets. Some will undoubtedly have been duplicates. The odds of winning are just a tick under 1 in 300 million. It sounds about right to me.

Oops... ERROR. It would have been around 400 million tickets because half the money collected does not go into the pot. Still when considering the extra buck on a lot of tickets plus the inevitable duplicate #s I think it is pretty reasonable. They are certainly selling more tickets this time around.

BKMK for when I Win

**** “The annuity is a certified asset. If you die it would become part of your estate and pass to your heirs” ****

And what is the Death Tax on that? 50%?

40% assuming you do not live in a state with a death tax.

***** “HAHAHAHA.”If you can’t stand in front of it with an AR15, you don’t own it”. For all you “investors” out there, check banking laws, the laws about stock “ownership” and look up “MF Global”.

PS. You never really own your property. Tribute must always be paid to a bunch of retards sitting at a table who threaten you with violence perpetrated by simpletons in silly uniforms.”*****

I wish you and about 500 like you were my neighbors, I’m in Texas but it is still a mixed bag...

I think after Jan 1 even the IRS desk jockeys are now granted Agent Status (Armed and other powers)

You would need VERY deep pockets! LOL!

A VERY funny movie.

.

So let it be written, so let it be done.

Go FL!

5.56mm

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.