Skip to comments.

Bill Gates calls for higher capital gains taxes

CNBC ^

| 02 MAY 16

| Robert Frank | @robtfrank

Posted on 05/02/2016 8:29:17 AM PDT by DCBryan1

click here to read article

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-76 next last

To: MadIsh32

I am starting to see people in this thread have no idea how cap gain taxes work at all, since 99.9% of FR will never pay cap gain taxes ever.For the liberty minded capitalists:

American Thinker Article : Let's be Fair about Taxation

The Wall Street Journal’s Primer on Capital Gains Taxation

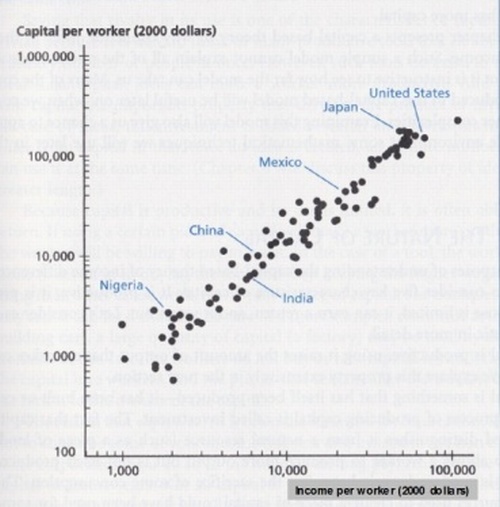

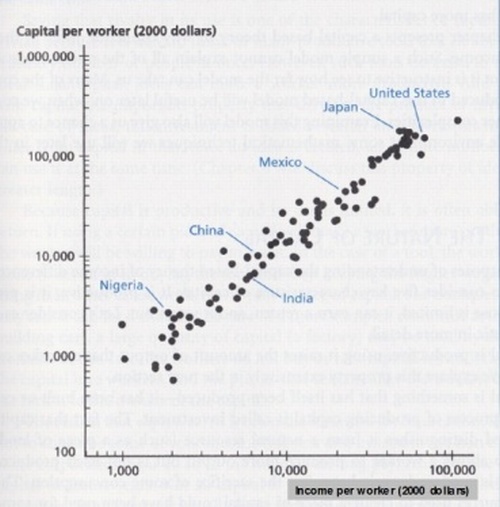

That’s an amazingly powerful relationship. Wages for workers are very much tied to the amount of capital that’s invested. In other words, capitalists are the best friends of workers. Something to think about with the President proposing big increases in the double taxation of capital gains. And something to consider since he wants America to have the highest level of dividend double taxation in the industrialized world.

41

posted on

05/02/2016 9:13:34 AM PDT

by

DCBryan1

(No realli, moose bytes can be quite nasti!)

To: Cecily

Dividends yes but many of us can choose whether to sell stock or not

No sell no taxable gain

42

posted on

05/02/2016 9:14:28 AM PDT

by

silverleaf

(Age takes a toll: Please have exact change)

To: silverleaf

Be surprised by how many people have locked up their wealth in assets such as real estate that they will never choose to sell outright because of the present tax biteHappens in my world too: Client held 1,000 shares of Twitter he bought at 30ish. He was 10 days short of going LONG term. The price was in the 50s when it dropped back to the 30s. The Long term gains tax was significant enough for him to wait according to his CPA, even though I told him to sell......and the stock fell off a cliff. This wasn't a TWTR problem as much as it was a .gov problem. Sad.

43

posted on

05/02/2016 9:17:35 AM PDT

by

DCBryan1

(No realli, moose bytes can be quite nasti!)

To: DCBryan1

He can say that-because I am sure HIS money is nicely tucked away!

44

posted on

05/02/2016 9:22:30 AM PDT

by

SMARTY

("What is freedom? To have the will to be responsible for one's self. "M. Stirner)

To: Cecily

I’ve got a better idea; let’s just confiscate all of the assets of all billionaires who advocate for higher taxes of any kind or the reinstatement of repealed taxes (including estate taxes). Fairer option, that would hit just as hard: Repeal section 501(c). Eliminate the concept of tax-free "non-profits". Have the "Bill and Melinda Gates Foundation", the "Ford Foundation", (and all the rest of the non-profits that the super-rich use to shield their money) pay taxes on the income from their investments. Have Harvard and the rest pay taxes on their endowments income.

45

posted on

05/02/2016 9:26:14 AM PDT

by

PapaBear3625

(Big government is attractive to those who think that THEY will be in control of it.)

To: DCBryan1

Good afternoon.

Why do you think Gates wants to prevent wealth accumulation by the middle class?

Methinks he has his, and doesn’t want the surfs to have theirs?

5.56mm

46

posted on

05/02/2016 9:30:09 AM PDT

by

M Kehoe

To: DCBryan1

This would hurt many lower-middle class families.

Bill Gates is a worthless POS.

To: DCBryan1

Nobody wants a Flat Tax if it means flattening out all taxes, including capital gains.

48

posted on

05/02/2016 9:34:41 AM PDT

by

Wolfie

To: DCBryan1

Master economist, Bill Gates.

What the hell does he or Buffet care, they are already zillionaires.

49

posted on

05/02/2016 9:47:14 AM PDT

by

headstamp 2

(Fear is the mind killer.)

To: DCBryan1

I am sick and tired of these effing Billionaires who tell me that I have to pay more taxes because they THINK they don't.

50

posted on

05/02/2016 9:49:45 AM PDT

by

Chgogal

(Obama "hung the SEALs out to dry, basically exposed them like a set of dog balls..." CMH)

To: jmaroneps37

reminds me of the scene when gates buys out Homer’s computer company. I have always thought that this was the real reason for these guys to want higher taxes. They have theirs already. Kill the competition in the womb.

51

posted on

05/02/2016 9:51:50 AM PDT

by

Bucky14

(And I would have gotten away with it too, if not for you meddling kids!)

To: PapaBear3625

All except the Clinton Global Foundation. They are legit!

52

posted on

05/02/2016 9:52:39 AM PDT

by

Bucky14

(And I would have gotten away with it too, if not for you meddling kids!)

To: Hostage

What happened to the flat tax?

Or is he still “evolving” on that too?

53

posted on

05/02/2016 9:55:46 AM PDT

by

JEDI4S

( It ain't about bathrooms alone...gyms, locker rooms, showers...no pervs means no!)

To: DCBryan1

For how many years did he benefit from low capital gains rates? Just like Buffett, he’s all for higher taxes AFTER he made his billions. If he had any guts, he’d call for a wealth tax that taxed anyone with a billion dollars in the bank at 50%.

54

posted on

05/02/2016 10:00:44 AM PDT

by

Opinionated Blowhard

("When the people find they can vote themselves money, that will herald the end of the republic.")

To: JEDI4S

Your comments were corrected above between taxing the ‘carry trade’ vs. capital gains and now you are attempting to change the subject.

I am not playing your stupid game. Your comments above were false and I corrected them, nothing more.

55

posted on

05/02/2016 10:02:43 AM PDT

by

Hostage

(ARTICLE V)

To: MadIsh32

I am starting to see people in this thread have no idea how cap gain taxes work at allSo true. But it doesn't stand in the way of making some outlandish statements. LOL

56

posted on

05/02/2016 10:05:00 AM PDT

by

ladyjane

To: DCBryan1

INVESTMENT gains taxed as ordinary income?*?! We are already being taxed multiple times for the same money invested and it is taxed again and added to our total income, this pigs want to destroy our ability to save for our future and they want to loot our 401k’s and that is absolutely coming as these pigs get their cheap labor and we are invaded by hordes of such cheap labor as we lose our country, our land, our assets, our savings, our investments looted, debt, debt, debt, loot, loot, loot, voterless elections, double agent delegates, globalists decide, we must be silenced, we must be taken.

Does anyone think this is going to end with the “Syrian refugees” from Africa, Pakistan, Bangladesh, Libya, et all? Can’t do anything to criticize that or it might raise questions about the hordes of illiterates from South of the border. Think it ends with the “refugees”?

What about the next “crisis” that demands us to give up all sovereignty and fork over all of our assets and savings and everything we have? What about the huge “human migrations” coming very soon as a result of the oil collapse? Huge populations from African and South American nations, failed states run by leftist Kleptocrats who live entirely off of oil and steal most of the oil profits for themselves and their nepotistic families, now hordes of their citizens reduced to even more extremes with the collapse of oil, now hordes of “oil refugees” will be heading out, guess where they are heading to? Europe and America. Puerto Rico bankruptcy, where will the “migrants” from Puerto Rico be heading? To Cuba? Or here?

The politicians all set the standard. There will be no end of it. There will be crisis after crisis, they are all coming here. We are being totally displaced and bankrupted. Our children will be harrassed, including victims of violence. America is being balkanized and huge turmoil is coming including civil war. A totally open border with Mexico will not lead to partnership and peace with Mexico. Exactly the opposite. It will surely lead to turmoil and then war with Mexico. It will be war zones. No peace. Turmoil. War. And eventially civil war, Yuguslavia right here. We will be called the Serbians, and told we are guilty of war crimes by the U.N.. We have already been charged as guilty.

57

posted on

05/02/2016 10:05:00 AM PDT

by

ShivaFan

To: Cecily

Then plenty of people should understand the difference between short term and long term cap gains, the real estate exemption on cap gains (500k per couple for the sale of their home) and the difference in how it is applied to those of us who work for living (i.e it barely does) compared to those who trade paper for a living.

Bill Gates should propose a change in how “short term” vs “long term” is defined. Currently “short term” is 1 year, where actual income rates apply.

I would like to see investors keep their money in investments, rather then flip, profit, flip profit, inflating asset bubbles even further.

58

posted on

05/02/2016 10:22:11 AM PDT

by

MadIsh32

(In order to be pro-market, sometimes you must be anti-big business)

To: DCBryan1

The current top tax rate on capital gains is 20 percent (with the highest earners paying an additional 3.8 percent surtax). The top tax rate on ordinary income is 39.6 percent."There's always been the question of whether taxes on capital should be a lot lower than taxes on labor," Gates said. "I tend to think they should be pretty much the same......"

I agree, let's make the top income tax rate 23.8%.

59

posted on

05/02/2016 10:31:21 AM PDT

by

Toddsterpatriot

("Telling the government to lower trade barriers to zero...is government interference" central_va)

To: FlingWingFlyer

Bill Gates, the guy who stuck a lot of his billion$ in tax exempt trusts/charities says we have to pay more taxes?

60

posted on

05/02/2016 11:19:50 AM PDT

by

RicocheT

(Only a few prefer liberty--the majority seek nothing more than fair masters. Sallust, Histories)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-76 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson