Posted on 11/17/2016 5:35:17 AM PST by blam

Jeff Berwick

November 17, 2016

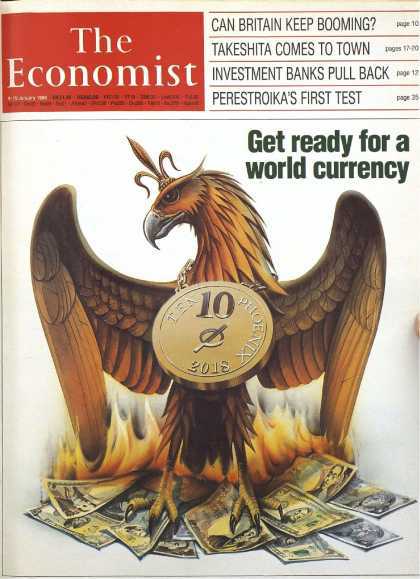

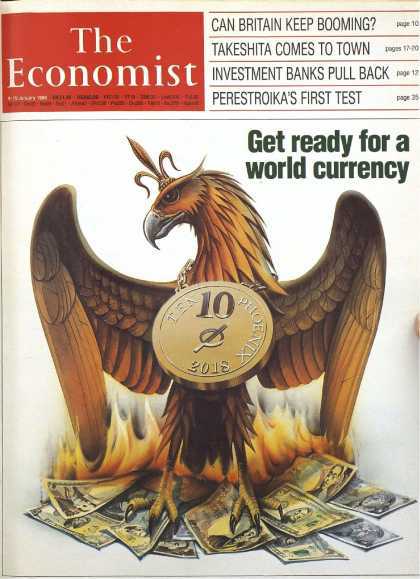

We are living in a world where paper fiat money is becoming a novelty.

In Australia, Citibank has just become the first to declare that it no longer will accept notes or coins. Only digital transactions. This follows on the heels of India banning large cash denominations.

The cash-oriented changes of these two countries are especially troubling in light of the eventual plans to phase out large denomination euro notes and the US 100 dollar bill by 2018. Just as the Economist predicted nearly 30 years ago, the world is going cashless.

A few days ago we wrote (here) about how the Reserve Bank of India eliminated 500 and 1000 rupee banknotes from the money supply. These notes represent 20% of the cash value in circulation and 80% of cash outstanding in the country.

The main reason India has been combating cash in conjunction with selling off gold, is because people in the “black” or “free” Indian marketplace were supposedly circumventing the financial system by conducting business and then slowly buying physical gold with large denomination bills.

Since the transactions were not being tracked or monitored, it was much easier to hide earnings from the government trying to extort them. So naturally, being a greedy crime syndicate that operates parasitically on extorted funds, the government is putting a stop to something that it views as an ongoing, expanding threat.

Of course, there’s a reason why Indian women wear their wealth – gold and silver – on their bodies. Indians have been through this before. Indian societies are very old, perhaps the oldest in the world, and they’ve gone through numerous metals confiscations in the past.

(snip)

(Excerpt) Read more at marketoracle.co.uk ...

The big advocates of globalism seemingly never had a course in classical economics, and rely entirely on Keynesian theories, that have utterly failed over time. And much like socialism, they cannot accept failure in their pseudo-religion, no matter how many times it fails. It just needs more *faith* to make it work. They are malevolent imbeciles without pattern recognition.

The very first, number one rule of money, is that anything desirable, that exists in abundance and can be transferred for anything else that is desirable, or even a token of it, is money.

This cardinal rule means that socialism will never work. And they hate this rule because of it. But it is still a rule. And because of this rule, socialists know that there will never be socialism until the government controls *everything* desirable that can be transferred, and all tokens of it. And anything *naturally* in abundance must either be ruined, driven into shortage, or the public convinced it is in shortage when it is not.

In old East Germany, they took this to an extreme, rationing everything they could ration. And things they couldn’t ration they tried to taint and destroy or at least make illegal. They seriously tried to ration even music and color, which was “for the exclusive use of honoring the state.” The place sucked and was a horrifically polluted, painful death. And the socialists didn’t care as long as they stayed in power.

The second iron rule of economics is “Gresham’s Law”, if not the elaborate, over-defined rule found in textbooks, but the simpler version: “Bad money pushes out good money.”

If you have paper money, and its equivalent value in gold, which one will you spend, and which will you save?

Even more so, if you have *virtual* money, that exists only on computer, and an equal amount of gold, which one will you spend, and which will you save? Which one do you trust more?

Once you know the answer to that, what if you knew you had to pay high taxes on your virtual money, but not on your gold? Suddenly there is a big motivation to spend your virtual money, but even less motivation to spend your gold.

But gold is almost an unfair comparison, because it has been desired in all times and places, and is really good at keeping its value. So what about other stuff?

Not just valuable long term goods, but stuff you use all the time? Like gasoline for your car, food for your table, a doctor for your ouchy places, etc. You would prefer to spend up your taxable virtual money on them, but what if the other person wanted gold instead of virtual money?

That is, Gresham’s law is about *competing* forms of money. When such a competition exists, the weaker of the two forms experiences inflation, and the stronger form becomes more valuable. So taxed virtual money is worth less and less, and gold and other things that can be used as money is worth more and more.

The governments of the world really, really, really want to keep track of you and how you spend your hard-earned dough.

Big Brother is definitely watching..... and drooling.

“I never use my debit card anymore - too risky so I am turning to using cash.”

I’m curious, what are your concerns with using a debit card?

Thanks for the link. My sister just told me about the Story in the Stars. https://storyinthestars.com/

“It is called legal tender for a reason. I suggest a class action lawsuit. As legal tender banks should have to accept it or close down any unit not accepting coin or bills.”

You are correct. I used to work for one of the largest Home Mortgage Lenders, think horse and carriage. At their main mortgage campus headquarters they had a sign at the main entrance, “we do not accept cash payments at this location for your mortgage payment.”

One day, three men walked in and one attempted to pay their mortgage with cash. The bank representative refused to accept the cash payment. The man then sued, stating that the mortgagor had failed to accept legitimate and timely payment. The other two men were his witnesses.

The judge, when rendering their decision, made the statement, “This note is legal tender for all debts public and private.”

The judge then nullified the remainder of the mortgage and the man owned his property free and clear.

The sign refusing cash payments was removed the following day. This was in the mid 90’s.

There’s no way to impose negative interest rates if people have the choice of keeping their cash out of banks.

I’m curious, what are your concerns with using a debit card?”””

I never have had one, either. Depending on the amount & the place of business, they don’t require any pin number or ID. IF stolen, you could have your entire bank balance at risk.

But- there are many things I wish to buy ONLY with cash. IT is none of the governments business what I buy or where.

Those grocery store discount cards can bite you, also.

A man was in a trial over a bad car accident. The lawyer for the other party was trying to say that he was drunk. He testified over & over that he didn’t drink. The other lawyer had obtained ALL his purchases for the prior 3 years which were made at the local grocery store with the discount card. IT showed regular purchases of wine & bourbon. The man testified that his mother was house bound due to her age, and that he did all of HER shopping, and she drank wine & bourbon,,,,but HE did NOT drink. Even his close friends testified that he did NOT drink & didn’t have any spirits at his house.

The jury convicted him of causing the accident because he was alcohol impaired.....

Sooo—There is NO PRIVACY with your grocery card OR your credit cards. CASH is king.

The only phone I have is a 35 y/o Princess house phone & a land line. I am not the only one who doesn’t have a mobile electronic device that I can do financial transactions on.

This country has cash & needs to retain that cash. IF my bank doesn’t wish to handle cash-—then I will switch banks.

HOW much money do the banks make on ATM fees????

Fair enough. However, if your debit/credit card is stolen, you are only liable for the first $50.00 in fraudulent transactions, as long as you notify the bank of the theft in a timely manner.

Sounds like the man in the bad accident had a bad attorney, if you ask me.

It doesn’t need to happen here.

There are going to be 300 Million pissed off Indians pretty soon. Where do you think they are going to lash out against?

I don’t think we want three hundred million angry, hungry Indians with nukes.

Silver and gold has been “money” for over 5,000 years. I seriously doubt that is going to change any time soon.

The Citibank Australia announcement reflects the distinction between a bank and a commercial bank. Transactions between companies are already cashless. Transactions at the manufacturing and wholesale level don’t need cash, merely ledger entries.

What Citi is saying is that they don’t engage in retail level banking.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.