Skip to comments.

U.S. towns, cities fear taxpayer revolt if Republicans kill deduction

Reuters via Yahoo ^

| November 17th, 2017

| By Richard Cowan

Posted on 11/17/2017 6:56:41 AM PST by Mariner

WASHINGTON (Reuters) - From Pataskala, Ohio, to Conroe, Texas, local government leaders worry that if Republican tax-overhaul plans moving through the U.S. Congress become law, it will be harder for them to pave streets, put out fires, fight crime and pay teachers.

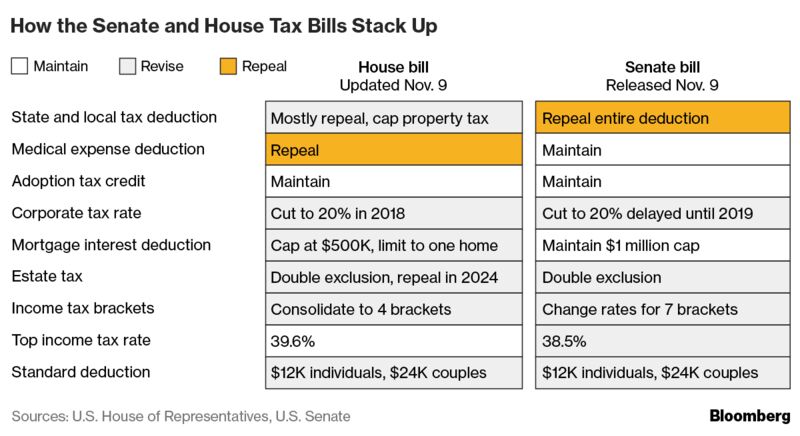

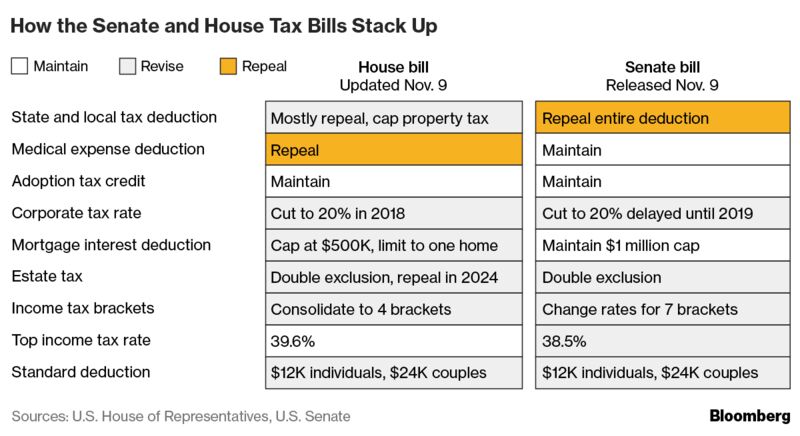

A tax plan approved by the House of Representatives on Thursday would sharply curtail a federal deduction that millions of Americans can now claim for tax payments to state, county, city and town governments.

Ending that deduction, the local leaders say, could make their taxpayers, especially in high-tax communities, less likely to support future local tax increases or even tolerate local taxes at present levels.

The proposed repeal of the state and local tax (SALT) deduction is part of an "assault on local governments" by Republicans in Washington, said Elizabeth Kautz, the Republican mayor of Burnsville, Minnesota, near Minneapolis.

"My hope is that we look at being thoughtful about what we're doing and not ram something through just to get something done before the year is out," Kautz said of the plan being rushed through Congress by her own party.

In the United States, local governments run schools, operate police and fire departments and maintain streets, parks and libraries, among other essential services. The federal government's role at that level is limited.

Cities, towns, counties and states collect their own property, sales and income taxes. Under existing law, payments of those taxes can be deducted, or subtracted from federal taxable income, lowering the amount of federal tax due.

-----snip-----

A bill being debated in the Senate, with Republican President Donald Trump's support, would kill the SALT deduction entirely for individuals and families, although businesses would keep it. The fate of that bill is uncertain.

(Excerpt) Read more at ca.news.yahoo.com ...

TOPICS: Business/Economy; Government; News/Current Events; Politics/Elections

KEYWORDS:

Navigation: use the links below to view more comments.

first previous 1-20 ... 81-100, 101-120, 121-140, 141-160 last

To: SkyPilot

Itsahoot cannot even answer the basic question as to why the corporations need a tax rate cut from 35% to 20%.You completely avoid the issue of where the money comes from that the corporation pays in taxes, just like you avoided answering who paid for the car.

I am not arguing whether they need a tax cut, I am saying that the consumer is the one paying the taxes period. That seems to complicated for you.

Why don't we just tax them at 90% they can afford it.

141

posted on

11/18/2017 4:06:56 PM PST

by

itsahoot

(As long as there is money to be divided, there will be division.)

To: SkyPilot

You are “irrational”. Business taxes wind up as price increases to you; which is why everyday things are so expensive in countries with high taxes. So who do you think pays for them?

You act like lower business taxes just mean companies get to “keep more in their pocket”. Companies have little interest in keeping a amounts of lower costs or higher revenue in their pockets - it earns little for them. Lower costs mean they can be more competitive, invest more, expand more, ect.

Lower business taxes are an economic boost for the economy, for jobs and in time for wages.

142

posted on

11/18/2017 4:07:28 PM PST

by

Wuli

To: Mariner

I assure you the local plumber or landscaper pays taxes. And those taxes are figured into the cost of their services. So their customers actually at those taxes.

143

posted on

11/18/2017 4:27:16 PM PST

by

MileHi

(Liberalism is an ideology of parasites, hypocrites, grievance mongers, victims, and control freaks.)

To: Wuli

I am not the irrational one pal. You are - and you are trying to "Spin" things here, and I won't let you get away with it.

It is amazing to me that you will not even acknowledge THIS:

https://www.nytimes.com/2017/11/16/us/politics/republican-tax-plans-corporations.html

The entire structure of this tax bill is to give a massive (35% to 20%) rate cut to corporations, AND let them keep deductions that are being taken away from individuals, AND to tax the hell out of the middle class and upper middle class to "pay for" the corporate cuts.

You want to feed me some BS that because A pays B in a business, all the reality currently taking place in this crappy bill does not exist.

It must be Hell inside your head. Either that, or you are psychotic.

144

posted on

11/18/2017 5:30:50 PM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: itsahoot

You completely avoid the issue of where the money comes from that the corporation pays in taxes So tell me this: because a business has customers and a revenue source, it doesn't pay taxes?

Really?

House Republicans pass tax plan that would cut corporate rate, add $1.4 trillion to deficit

So the corporate rate is not being cut, and they need middle class tax increases to pay for it?

Come on - admit that this is reality. That is the core of the political debate on this bill! If you can't admit reality, you are just as much of a nut case as the rest of these spinners.

145

posted on

11/18/2017 5:34:19 PM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

Cut to what? Ohhhh......20%.

I guess I imagined that.

146

posted on

11/18/2017 5:37:34 PM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: SkyPilot

You are not reading the bill. All kinds of business deductions are being cut and revised as well.

147

posted on

11/18/2017 5:44:09 PM PST

by

Wuli

To: Wuli

You are not reading the bill. All kinds of business deductions are being cut and revised as well. State, Local, and Property tax deductions are retained for corporations, and taken away from individuals.

https://nypost.com/2017/10/19/senate-votes-to-eliminate-state-and-local-tax-deductions/

Backers of the SALT deduction pledged to keep up the fight as the tax reform legislation is devised in the House and Senate committees. They argue Trump’s tax plan is unfair because it allows corporations to deduct state and local taxes but eliminates the breaks from average tax filers. “Did you hear that?” Sen. Chuck Schumer (D-N.Y.) marveled on the Senate floor Thursday. “Corporations can claim it, individuals can’t. Isn’t that backward? It shouldn’t be taken away from either one.” But the White House defended its plan saying if employers couldn’t deduct their local and states taxes they’d go “out of business.”

Oh, but it's OK to ruin middle class families? I guess it's all right if they "go out of business." Huh?

Do you still want to give me the lie that corporations don't pay taxes, even though the heart of this bill is to give them a massive tax cut, and have the middle class make up for that lost revenue by eliminating or capping their deductions?

148

posted on

11/18/2017 6:36:39 PM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: palmer

No, we need to do what is right for all of America. what's right for all of America is a drastic reduction in the Size, scope, power, and cost of government ... and a corresponding drastic reduction in the amount of tax revenues extracted at gunpoint from We the People.

149

posted on

11/18/2017 6:42:36 PM PST

by

NorthMountain

(... the right of the people to keep and bear arms shall not be infringed)

To: NorthMountain

So you are supporting killing the current tax cut because you want them to reduce the budget first? Well, sorry to break the news to you, but Congress is not going to shrink government. Maybe in some hypothetical world, but not in the real world, not in the current political landscape. RINOs and even conservatives team up with dems to support higher spending on everything except a few token items.

Thus our choices are the current imperfect tax bill to help grow the economy, or nothing. Economic growth is inevitable after Obama's economic strangulation but it will be much higher with the corporate rate cut. At that point we might get enough republicans elected to make something more than token cuts.

150

posted on

11/18/2017 9:23:54 PM PST

by

palmer

(...if we do not have strong families and strong values, then we will be weak and we will not survive)

To: SkyPilot; Mariner

Until you or your parent is denied a Social Security check, medical treatment, or the fire department in your town shuts down. How about if California starts "denying" a few million illegals? Or their thousands of 'homeless' benefits? Or some of their wacky environmental excesses? Or even their bloated union arrangement? Illinois could do the same...

151

posted on

11/18/2017 9:32:32 PM PST

by

GOPJ

(https://www.reddit.com/r/StumpSheet/comments/6ec3z1/fake_hate_crimes_official/)

To: Mariner

Bribes to the GOP Exempt Ones put into action in the form of Selective tax favors.

Understand this and you’ll get it.

Corporations “don’t” pay taxes???

Businesses C or otherwise “don’t??

Married couples “don’t??

Individuals “don’t”??

Purchasers/buyers “don’t”??

it’s ALL passed on

Both FAKED sides of the Exempt Ones will love this, tagged “bipartisan” as usual, after the Exempt Ones attach another free program or compromise say the wall elimination or say easing of illegals rules.

152

posted on

11/18/2017 10:26:44 PM PST

by

Varsity Flight

(Extortion-Care is is the Government Work-Camp)

To: GOPJ

How about if California starts "denying" a few million illegals? Or their thousands of 'homeless' benefits? Works for me.

153

posted on

11/19/2017 4:33:25 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: SkyPilot

“State, Local, and Property tax deductions are retained for corporations, and taken away from individuals.”

They are business expenses. Are you a business?

154

posted on

11/19/2017 4:56:43 AM PST

by

Wuli

To: Wuli

So now you are admitting the truth, that corporations get to keep their SALT deductions that are being taken away from individuals, and your retort to me is why are not individuals businesses? I was right - you are insane.

155

posted on

11/19/2017 6:36:35 AM PST

by

SkyPilot

("I am the way and the truth and the life. No one comes to the Father except through me." John 14:6)

To: SkyPilot

“I was right - you are insane.”

You have no mirrors in your house do you.

156

posted on

11/19/2017 6:48:05 AM PST

by

Wuli

To: palmer

So I am telling you what America actually needs. This tax bill is smoke and mirrors. The Swamp wants people to be nattering mindlessly about the meaningless details of how it gives with the left hand and takes away with the right.

Meanwhile, NOBODY, not even St. Donald the Wonderworker, is talking about the real problem:

1) Government is too big. It must be reduced in size.

2) Government attempts to control and to engage in too much activity. It must be reduced in scope to that which is specified in the constitution.

3) Government is too powerful. It presumes to exercise far more control over the activities of We the People than the Constitution authorizes.

and because of these things

4) Government is too expensive. The amount of money spent by government must be reduced. Government does not make America great. Government is the problem, not the solution.

Thus our choices are the current imperfect tax bill to help grow the economy, or nothing.

And that is a meaningless choice, the only kind The Swamp wants you to have.

157

posted on

11/19/2017 11:22:30 AM PST

by

NorthMountain

(... the right of the people to keep and bear arms shall not be infringed)

To: NorthMountain

I can predict this much: if the tax bill fails, then any chance of smaller government fails with it, because the Republicans (RINOs and conservatives alike) have staked their future on it. In the current situation the only alternative to them is Democrats who are mainly socialists. They will grow the government.

158

posted on

11/19/2017 8:22:30 PM PST

by

palmer

(...if we do not have strong families and strong values, then we will be weak and we will not survive)

To: NorthMountain

I can predict this much: if the tax bill fails, then any chance of smaller government fails with it, because the Republicans (RINOs and conservatives alike) have staked their future on it. In the current situation the only alternative to them is Democrats who are mainly socialists. They will grow the government.

159

posted on

11/19/2017 8:22:31 PM PST

by

palmer

(...if we do not have strong families and strong values, then we will be weak and we will not survive)

Navigation: use the links below to view more comments.

first previous 1-20 ... 81-100, 101-120, 121-140, 141-160 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson