Posted on 12/05/2017 7:47:01 AM PST by SeekAndFind

I know what renting means. It seemed to be that “People don’t really need to own their own homes” sounded a lot like “You didn’t build that.”

Since they don’t need to, should they get a big tax benefit?

“Remember when the feds took away the write-off of credit card interest?

That was the end of the world too.”

I’m getting rid of the write off on auto loans was going to destroy the auto industry. I guess people figured out they needed to drive anyway.

Be clear about what any housing related industry folks are actually arguing. It’s less about what some taxpayers, or how many taxpayers, will see as a final, adjusted, income tax bill. It’s about, with the increased standard deduction, how less important the mortgage interest deduction will become, to more people.

What does that mean? It means there is less “tax-benefit”, when the mortgage you are paying off is greater, when itemizing has no gain over the standard deduction. It means there is less “tax benefit”, in spite of greater monthly costs, when acquiring homes that cost more.

It means the housing-related industries selling that more is always better loses its “tax benefits”.

And yes, it means that some folks who in the past bought into the housing, real estate and mortgage industries sales jobs, that “tax wise”, bigger is O.K. or better, may learn their “house-as-an-ever-appreciating-investment” may not appreciate as much in the time frame they expected, and may not now sell for as much as they hoped today.

Let’s all cry! NOT.

I’m not arguing the tax plan. I’m not arguing anything. I wanted a clarification of your post that sounded somewhat like Mao saying people don’t need to wear anything other than a party approved suit. I’m sure that wasn’t your meaning, and that you meant it’s not really beneficial for everyone to purchase a home as opposed to renting. Just know it donded a little...odd.

The GOP tax bill will help drive down the cost of homes in San Francisco. As the prices of these wonderful highly sought after homes fall, it will enable the American dream of home ownership in the land of the sodomites for more low income and disadvantaged Californians.

See #21 and 24 and get back to me

https://www.freerepublic.com/focus/f-news/3610799/posts

The deduction for mortgage interest, like all deductions, is a form of subsidy, where higher taxes for all is absorbed more by those without such deductions than those with them.

As a subsidy and with the implied into of “promoting home ownership” it should have caps, as those needing the subsidy can roughly be equated with those who can’t as well afford a home than those who can. Home price is as good of a marker of that as anything else.

I would not use a fixed dollar amount. I would use the national median sale price of houses. Using it would grant the deduction but at no greater amount than would be provided on a median priced home. A simple calculation would determine what percentage was the purchase price of your home, in the year you bought it, to the national median home price in that year. If your home was at or less than the median, the interest would be fully deductible. If it wasn’t, the IRS would provide tables representing many interest rates and number of years in mortgages of various lengths, identifying how much interest in X year of a mortgage would have been made on a median priced home, and that would be the limit of the interest deduction. At least that would not discriminate based on what interest rate the consumer was able to get a mortgage at.

That is not my ideal, but a workable practical adjustment, in the absence of my ideal - a system with universal flat income taxes with zero deductions, exemptions, exclusions or credits - just a flat tax everyone pays.

P.S. The % of taxpayers that are now renters is nearing 40%; so fewer and fewer are benefiting from the mortgage interest deduction, not even all those paying mortgages take the interest deduction. Also, as the mortgage gets older the amount of interest being paid declines compared to principle, and if income is low enough, with a low mortgage on an “affordable home”, the standard deduction can be greater than the mortgage interest.

But...but...I thought wealthy people WANTED to pay more taxes? Just can’t please some whiners, apparently.

your point?

And it’s relevance to a single person’s home mortgage and taxpayer subsidy of such?

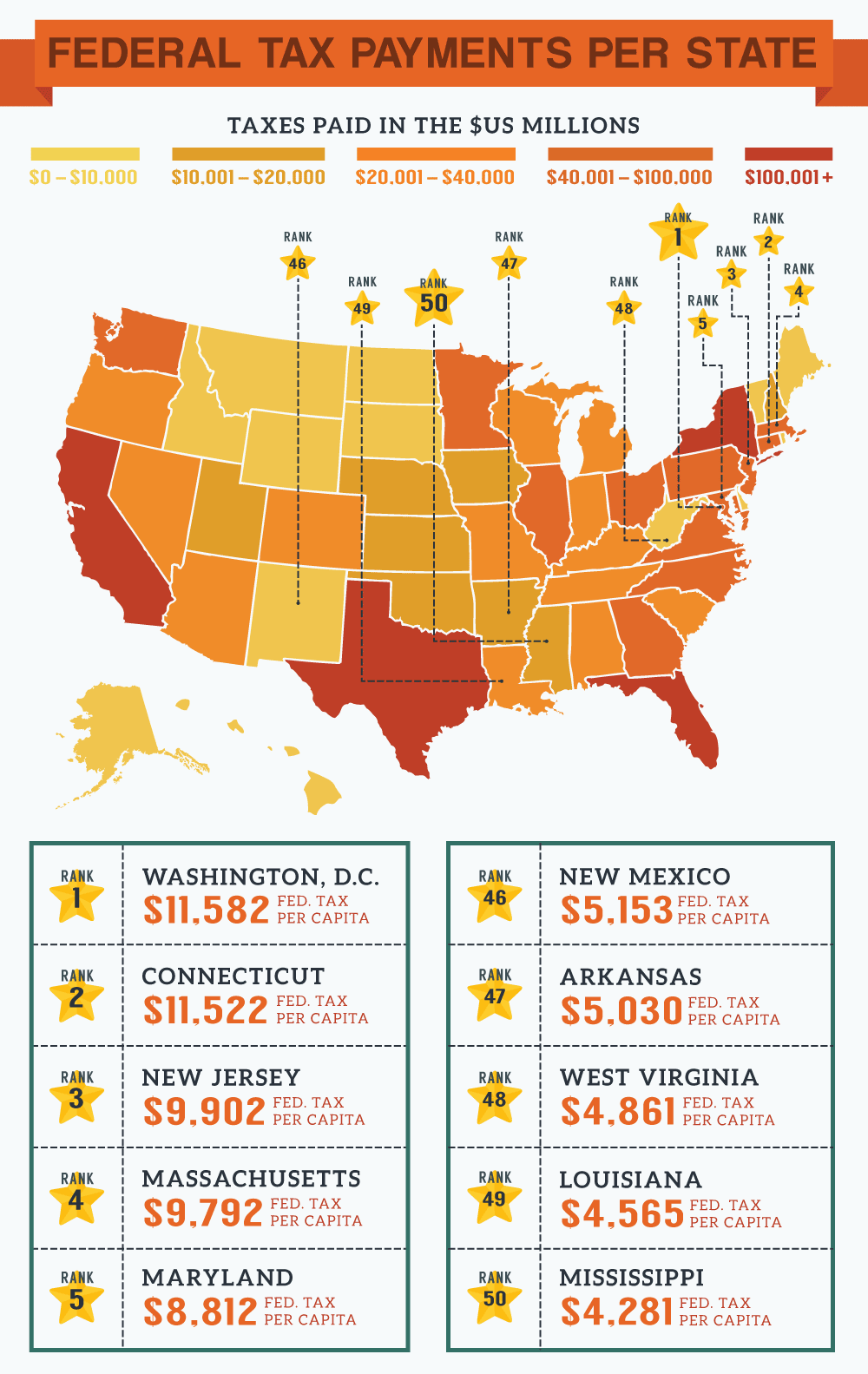

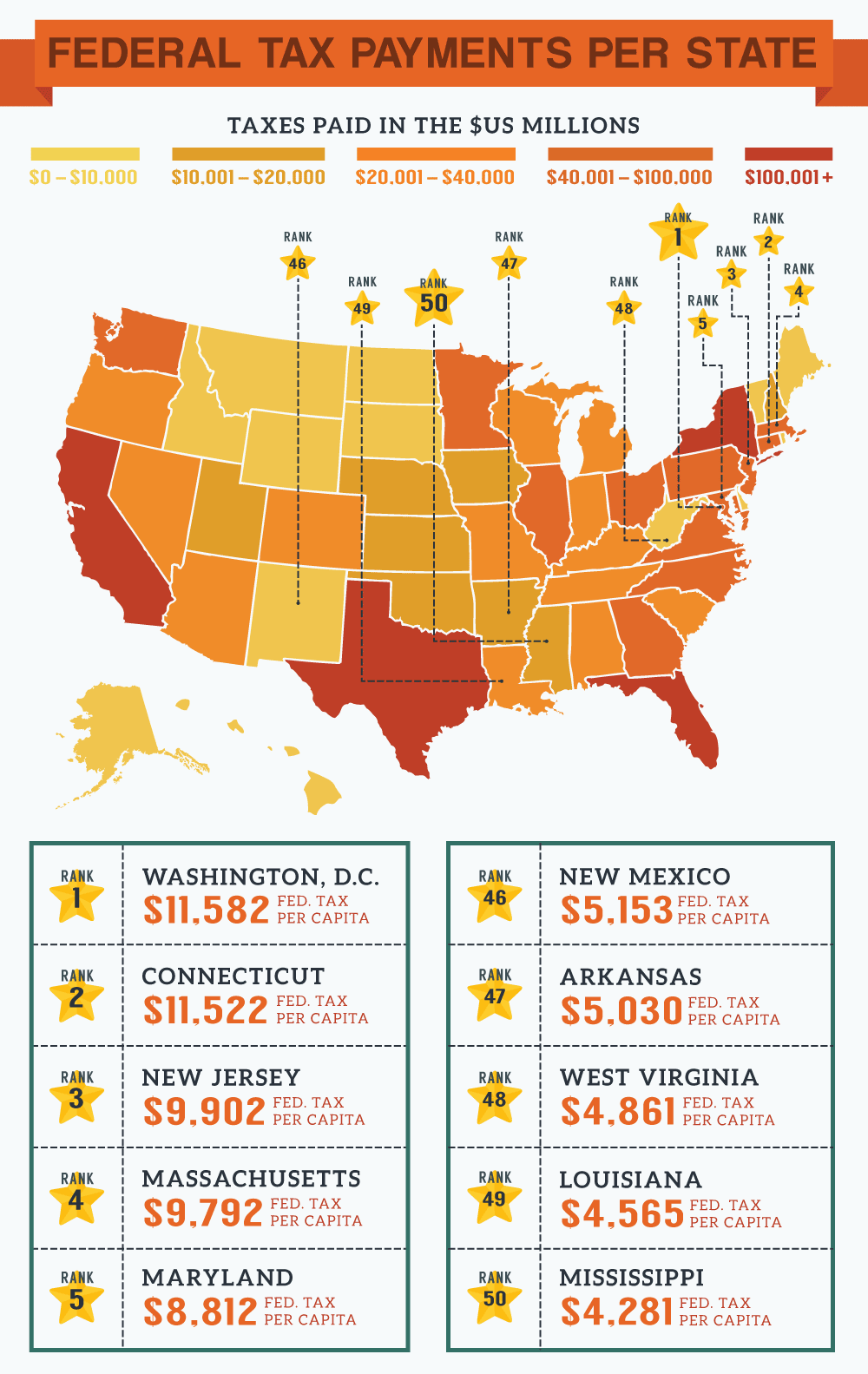

How does something become a “subsidy” when the citizens supposedly taking such subsidy pay more than those in federal income come taxes per capita taking the same “subsidy” and pay less?

This whole “subsidy” term is liberal speak for “we are the government and we demand more of your money because we the federal government know how to spend YOUR money best”

Your math and logic need work.

Meaningless drivel.

That garbage has nothing to do with mortgage subsidies for extravagant housing.

Give it up.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.