On a trend projection basis we might get there around 2024.

Posted on 12/24/2017 3:41:06 PM PST by mywholebodyisaweapon

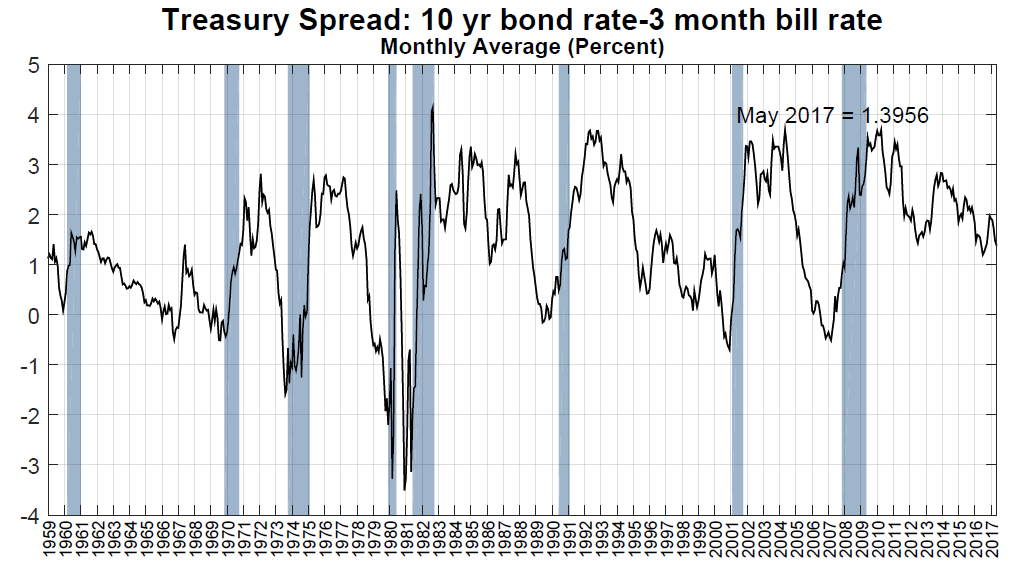

Some economists are worried about the bond curve "inverting," so that short-term yields are higher than long-term yields. The economists cited are using 2 year yields as short-term and 10 year yields as long-term yields.

(Excerpt) Read more at yahoo.com ...

On a trend projection basis we might get there around 2024.

Got it: fake news.

Would appreciate if someone could speculate about upcoming changes to the money velocity...

Waiting in the wings: fear of the economy over-heating because it is being over-stimulated.

Too much of a good thing.

:)

The strange thing is that the two year vs. ten year spread can bounce around all it likes, but doesn’t correlate at all to a coming recession.

I think it may be because the Fed parks so many funds in the one year treasuries, but am not sure. In 1991, I did an exhaustive study using daily data since WWII. NONE of the other yield spreads had the perfect record of the one-year vs. ten-year CMT yields. Of course, it COULD some day go south, but hasn’t yet. I’ve been able to predict three of the last three recessions without false signals using that particular spread. My students think I know something special. Not really, most good economists know about the spread and its predictive power. Besides, I left my portfolios unchanged from 2006 to 2008 even though I knew were going into a recession. When I tell them that, they realize that I am an idiot, not a genius, after all.

But it’s always a little amusing, and little bit annoying, when some analyst with any kind of name recognition suddenly discovers yield curves.

Yeah, but the three-month rate doesn’t have the record of accuracy of the one-year. I’m not sure why.

Many years ago, Stock and Watson incorporated the spread into the Index of Leading Economic Indicators. It seems that the other indicators have so much noise that they swamp the signal of the yield curve spread.

You’ve got me there. Financial markets were more in my line back when I was in banking.

I would be interested in your take on velocity.

:)

That’s the Keynesian orthodoxy, isn’t it? Die from unemployment or die from inflation. Reminds me of the Weimar Republic and the “Goldilocks” policy which doesn’t really exist.

Supply-side works. And Trump is our supply-sider. And we should be getting much more of that good thing now.

Excuse me while I guffaw, and wish everyone a Merry Christmas , and a Prosperous New Year!

These Keynesian economists are trying so hard to follow the tax cuts with some kind of bad news to worry about instead of the tremendous overall effect. These guys are like the blind leading the blind.

Here’s what to look for. Usually significant tax cut initially could have a recessionary effect like a drunk coming off alcohol cold turkey, like what happened initially with the Reagan tax cuts. Watch heads of the Left and these confused Keynesian economists’ spin with delight as they did with Reagan. But in a while, as with Reagan, so here, the economy will blast off, even from the very small cuts made. Watch how the Left and these confused Keynesian economists ignore the economic boom as they did with Reagan. They are so predictable. Forget about these idiots and enjoy the ride.

This should only be the first shot over the bow. What would happen if they REALLY SUBSTANTIALLY cut taxes - NO “corporate tax” (a hidden individual tax) and individual flat tax at 10%-15%. Our economy would explode as never has been seen before. It pray it will happen.

Yeah, Keynes wasn’t that much of a “Keynesian” was he?

Harry Hopkins and his crew (Alvin Hanson, J.K. Galbraith, etc.) kind of co-opted Keynes, seems to me.

!

I personally am wary of these highs and have hedged with WMT and a few other devices. I am impressed with WMT management and recession-benefitting behavior. I moved a LOT to WMT, cash, other instruments at 24,000.

Well, to be fair, there are economists, and then there are Economists.

Merry Christmas and Happy New Year to you! Feel free to guffaw a little louder :)

Usually An inverted yield curve means the Fed is tightening by selling low yield bonds. But the main reason we have an inverted yield curve now is not so much that they are tightening as it is that they bought so many long term bonds during the recession because we were in a liquidity trap.

Yes. This is an attempt at psyops, to slow the growth of the economy. They know that if things have been going great for Americans by 2020, that Trump will be elected again.

My brother, a finance industry professional, has been worried that Obama’s loyalists at the Fed will ratchet up interest rates too fast and too far in order to sabotage Trump.

I’m concerned about inflation. No reason ‘cause I’m sure not an expert.

Wal-Mart sales performance is a much better and more accurate predictor of where the econ is going. I don’t even look at bond curves anymore.

Yes, that’s a possibility. Seems like the short end of the curve gets racheted up faster than the long end and it inverts, even if for a short time.

Rates are so low now that I think there has been virtually no capital formation. Borrowers might want to lend, but institutions are scared of getting DoddFranked and savers look for any alternative investment they can find.

We should get from a year to two-and-a-half years warning if the curve inverts, so it pays to watch it. But the one to ten year CMT spread seems to be the most consistent. It may now be institutionalized in program-trading algorithms, so it could be a self-fulfilling prophecy.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.