Posted on 02/23/2011 4:14:22 PM PST by STARWISE

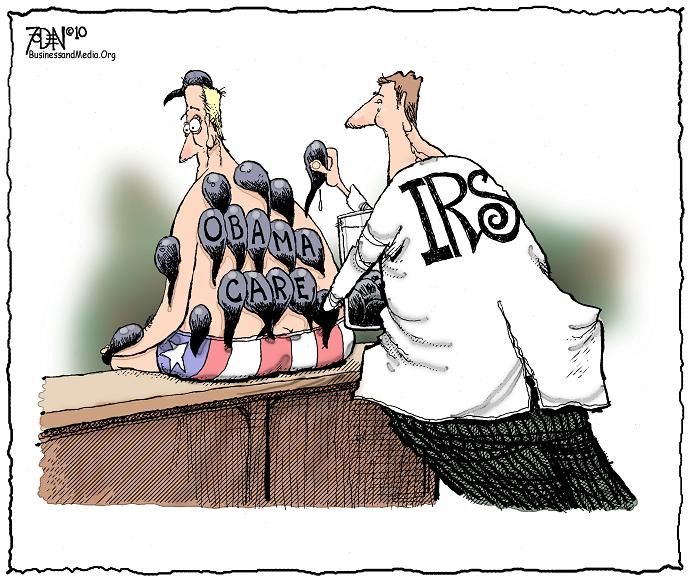

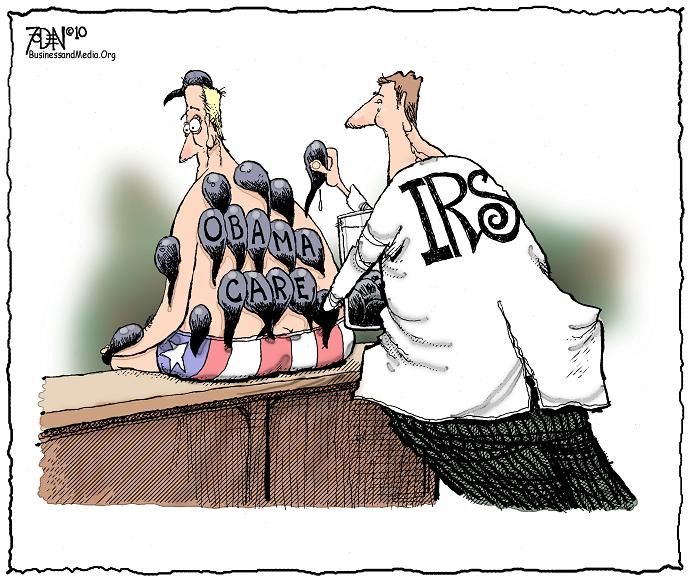

The Tatler has learned that Obamacare government auditing of American society has begun at the Internal Revenue Service.

New details about the IRS budget were released this afternoon by Senator John Barrasso (who also is an MD).

Quoting from the IRS budget document, he reveals that for the IRS, ObamaCare “represents the largest set of tax law changes in more than 20 years, with more than 40 provisions that amend the tax laws.”

More than $93 million has been budgeted by the IRS to assure that the public complies with the new tax rules.

Among other new IRS activities, the agency will spend $11.5 million to promote compliance by tanning salon owners who will be asked to impose a new 10% excise tax on their customers.

Originally the tax was supposed to be on those who offered cosmetic surgery, but their upscale customers defeated the tax and shifted it to those who own storefront tanning beds.

The IRS will not only audit Americans, they intend to be helpful too. They are requesting more than $34 million for something called “information reporting,” $15 million for a call center to help confused citizens to deal with the new Obamacare tax laws, and $22 million to “assist taxpayers in understanding new provisions.”

In a Tatler interview with Senator Barrasso, he called the IRS budget “irresponsible” and that it “empowers the IRS to begin to audit Americans’ health care.”

He also told the Tatler, “Adding hundreds of new jobs and millions of dollars to the IRS isn’t going to make care better or more available for anyone. I will continue to fight to repeal and replace Obamacare with patient centered reforms that help the private sector – not the IRS – create more jobs.”

This is all the more reason people demand Congress pass The Fair Tax Act(HR25/S13)! The Fair Tax will replace all federal income taxes with a national sales tax and abolish the IRS!

No tax sounds fair to me.

The IRS is helpful at one thing!STEALING!

Perfect excuse for the IRS to intrude on every dang area of our lives .. it MUST be defeated !@#$

Sorry,you mean the 16th amendment that never passed.

The 16th amendment had been sent out in 1909 to the state governors for ratification by the state legislatures after having been passed by Congress. There were 48 states at that time, and three-fourths, or 36, of them were required to give their approval in order for it to be ratified. The process took almost the whole term of the Taft administration, from 1909 to 1913.

Knox had received responses from 42 states when he declared the 16th amendment ratified on February 25, 1913, just a few days before leaving office to make way for the administration of Woodrow Wilson. Knox acknowledged that four of those states (Utah, Conn, R.I. and N.H.) had rejected it, and he counted 38 states as having approved it. We will now examine some of the key evidence Bill Benson found regarding the approval of the amendment in many of those states.

In Kentucky, the legislature acted on the amendment without even having received it from the governor (the governor of each state was to transmit the proposed amendment to the state legislature). The version of the amendment that the Kentucky legislature made up and acted upon omitted the words “on income” from the text, so they weren't even voting on an income tax! When they straightened that out (with the help of the governor), the Kentucky senate rejected the amendment. Yet Philander Knox counted Kentucky as approving it!

In Oklahoma, the legislature changed the wording of the amendment so that its meaning was virtually the opposite of what was intended by Congress, and this was the version they sent back to Knox. Yet Knox counted Oklahoma as approving it, despite a memo from his chief legal counsel, Reuben Clark, that states were not allowed to change it in any way.

Attorneys who have studied the subject have agreed that Kentucky and Oklahoma should not have been counted as approvals by Philander Knox, and, moreover, if any state could be shown to have violated its own state constitution or laws in its approval process, then that state's approval would have to be thrown out. That gets us past the “presumptive conclusion” argument, which says that the actions of an executive official cannot be judged by a court, and admits that Knox could be wrong.

If we subtract Kentucky and Oklahoma from the 38 approvals above, the count of valid approvals falls to 36, the exact number needed for ratification. If any more states can be shown to have had invalid approvals, the 16th amendment must be regarded as null and void.

The state constitution of Tennessee prohibited the state legislature from acting on any proposed amendment to the U.S. Constitution sent by Congress until after the next election of state legislators. The intent, of course, is to give the proposed amendment a chance to become an issue in the state legislative elections so that the people can have a voice in determining the outcome. It also provides a cooling off period to reduce the tendency to approve an idea just because it happens to be the moment's trend. You've probably already guessed that the Tennessee legislature did not hold off on voting for the amendment until after the next election, and you'd be right - they didn't; hence, they acted upon it illegally before they were authorized to do so. They also violated their own state constitution by failing to read the resolution on three different days as prescribed by Article II, Section 18. These state constitutional violations make their approval of the amendment null and void. Their approval is and was invalid, and it brings the number of approving states down to 35, one less than required for ratification.

Texas and Louisiana violated provisions in their state constitutions prohibiting the legislatures from empowering the federal government with any additional taxing authority. Now the number is down to 33.

Twelve other states, besides Tennessee, violated provisions in their constitutions requiring that a bill be read on three different days before voting on it. This is not a trivial requirement. It allows for a cooling off period; it enables members who may be absent one day to be present on another; it allows for a better familiarity with, and understanding of, the measure under consideration, since some members may not always read a bill or resolution before voting on it (believe it or not!). States violating this procedure were: Mississippi, Ohio, Arkansas, Minnesota, New Mexico, West Virginia, Indiana, Nevada, North Carolina, North Dakota, Colorado, and Illinois. Now the number is reduced to 21 states legally ratifying the amendment.

When Secretary Knox transmitted the proposed amendment to the states, official certified and sealed copies were sent. Likewise, when state results were returned to Knox, it was required that the documents, including the resolution that was actually approved, be properly certified, signed, and sealed by the appropriate official(s). This is no more than any ordinary citizen has to do in filing any legal document, so that it's authenticity is assured; otherwise it is not acceptable and is meaningless. How much more important it is to authenticate a constitutional amendment! Yet a number of states did not do this, returning uncertified, unsigned, and/or unsealed copies, and did not rectify their negligence even after being reminded and warned by Knox. The most egregious offenders were Ohio, California, Arkansas, Mississippi, and Minnesota - which did not send any copy at all, so Knox could not have known what they even voted on! Since four of these states were already disqualified above, California is now subtracted from the list of valid approvals, reducing it to 20.

These last five states, along with Kentucky and Oklahoma, have particularly strong implications with regard to the fraud charge against Knox, in that he cannot be excused for not knowing they shouldn't have been counted. Why was he in such a hurry? Why did he not demand that they send proper documentation? They never did.

Further review would make the list dwindle down much more, but with the number down to 20, sixteen fewer than required, this is a suitable place to rest, without getting into the matter of several states whose constitutions limited the taxing authority of their legislatures, which could not give to the federal govern authority they did not have.

The results from the six states Knox had not heard from at the time he made his proclamation do not affect the conclusion that the amendment was not legally ratified. Of those six: two (Virginia and Pennsylvania) he never did hear from, because they ignored the proposed amendment; Florida rejected it; two others (Vermont and Massachusetts) had rejected it much earlier by recorded votes, but, strangely, submitted to the Secretary within a few days of his ratification proclamation that they had passed it (without recorded votes); West Virginia had purportedly approved it at the end of January 1913, but its notification had not yet been received (remember that West Virginia had violated its own constitution, as noted above).

More government/employee lies we live with in America and face the consequences for not holding our employees accountable.

They are always wanting more!

Unless Obama gave you a waiver.

Unequal ruling by decree.....

.....Unconstitutional.

Good,what type of taxes???DUH???

I don't see anywhere where the government has a right to steal from Peter to pay Paul under,duties,imposts and excises!Do you???

If you have ever used their existing "help line" Re: income tax, there is a very good chance that they gave you advice which was either misleading or just plane wrong. Their employees don't know the tax code, how are they going to handle questions on the 2000+ pages of Obamacare?

Regards,

GtG

Sickeningly true.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.