Posted on 10/14/2014 12:59:40 PM PDT by Starman417

The United States is in the midst of an economic malaise. 92 million Americans are out of work. 35% of the population is on welfare. The economy is barely growing. While incomes for the richest have been skyrocketing, the middle class has seen their incomes decline by 5% in the last 5 years. The federal debt stands at $17 trillion, up $6 trillion since Barack Obama became president. All of this while the Fed has been pumping tens of billions of dollars a month into the economy for years…

Although Barack Obama has made much of this worse, the truth is, things have been going the wrong way for half a century and rather dramatically for a quarter century. Of all of the problems that exist today – and their numbers are legion – there are two that are most troublesome: regulations and taxes. These two things have hammered the fount of American prosperity, the middle class.

First is the regulatory state – particularly federal regulations. Being an entrepreneur, running a successful small business (from whence 2/3 of all new jobs emerge) takes a great deal of work, tenacity and effort. Unfortunately however, the cost of complying with regulations has skyrocketed over the last 40 years. From the EPA to OSHA to the NLRB to HHS and a seemingly endless array of acronymmed bureaucracies come regulations that strangle job creation, and in the process, prosperity. According to the US Chamber of Commerce – no friend to small business – the cost of complying with government regulations at all levels has almost quadrupled since 2000… and all of those increasing costs contribute to the growing death rate among small businesses, which in turn take jobs with them.

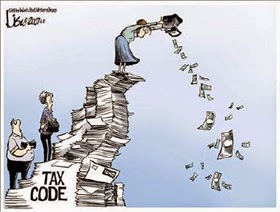

Then there are taxes, again, particularly federal taxes and the insane complexity of the IRS tax code. This can be summed up in one measure: According to the Tax Foundation’s 2014 International Tax Competitiveness Index the United States ranks 32 out of 34 developed countries in terms of the competitiveness of our tax system – and if it weren’t for our relatively low consumption taxes, ranked 5 out of 34, we’d be dead last. That means, for companies seeking to invest their money, of the 34 OECD nations, only 2 of them have tax structures that are less inviting than the United States, Portugal and France. Imagine that, that the United States tax system is less attractive to investors – and prospective employers – than Turkey, Estonia, Chile… and even the dysfunctional Greece! While the United States does have advantages… for investors, tax consequences are an extraordinary driver of their choices. And unfortunately for American workers, the government is making the choice to invest in the United States less and less appealing every year.

Despite what you might hear on the Sunday morning news programs or read in the NY Times, this new American malaise is not an intractable problem, is not an unsolvable problem, in fact, the solution is rather simple. Fix those two problems. “How?” you say.

First, sunset every federal regulation on the books. If necessary, pass a Constitutional Amendment that states that every federal law has an implicit sunset provision of 10 years unless it passes each house of Congress by at least 60%. It would also stipulate that all federal regulations sunset after 10 years, regardless of the margin of passage of the underlying law. If such regulations demonstrate themselves to be effective and necessary, they can be renewed. If a regulation were deemed or proven to be sufficiently important to be granted permanent status it should then be passed as a law rather than remaining a regulation.

Second, implement the Fair Tax – although a 10% flat tax might be a distant second suggestion. In 2014 investors have the world at their fingertips. Choices abound from Estonia to Singapore to Switzerland to Canada. If the United States were to implement the Fair Tax, not only would the economy be jolted by an immediate influx of an estimated $2 trillion from the offshore holdings of American companies, it would likely experience an additional annual influx of hundreds of billions of dollars of direct investment from foreign companies seeking to set up shop in the United States. Those additional trillions of dollars would result in the creation of millions of jobs – and these would be real jobs in the real economy, unlike the boondoggles inflicted on the country by President Obama’s “Stimulus”. In addition, the resulting savings of the hundreds of billions of dollars wasted each year simply trying to comply with the incomprehensible IRS tax code could be spent on useful things – or just fun – and the hundreds of millions of hours saved could be spent on work or leisure.

Of course it’s one thing to point these things out and another to actually get them done. So, as in an effort to demonstrate the potential effectiveness of the above I’d like to suggest using Wayne County, Michigan – where the disaster area known as Detroit is located – as an “Enterprise Zone” proving ground. This demonstration would turn Wayne County into a federal tax and regulation free zone. Eliminate all federal regulations within the county and eliminate all federal taxes save a 23% embedded tax.

(Excerpt) Read more at floppingaces.net...

Here’s the problem:

The D’s and R’s are arms of the same party. One side supports “big business” and the other supports “big government”. Taxes and regulations are nothing to big business. They have entire departments that deal with that sort of stuff. And they pass the cost on to the customer.

No, what taxes and regulation destroy is their common enemy: Small business.

The reason is simple: Everyone who works for government or a large company really does not have constitutional rights. You lose your first amendment rights if you want to keep your job, anyway.

Their perfect world is one run by a brotherhood of big business and big government. The occupants of such a world are easily controlled - to the very top of the income ladder. If you doubt that, just remember what happened to a certain football team owner when an illegally recorded phone call was made public.

Oh, and they have another common enemy: The TEA party.

Lease Wayne County to the Red Chinese in return for a paydown of some of their debt and let them turn it into a Special Administrative Region like Hong Kong for the next 50 years. They can implement this suggestion and deal with the criminal class already there.

> First, sunset every federal regulation on the books. If necessary, pass a Constitutional Amendment that states that every federal law has an implicit sunset provision of 10 years unless it passes each house of Congress by at least 60%.

Can anyone say “continuing resolution”?

Nailed it.

The premise of this experiment is flawed. If federal taxes and regulations were the main cause of decline then it would have happened everywhere, not just in Detroit. The federal problems listed are real but removing them would not create a thriving Detroit unless the unique problems of Detroit were also removed. High business taxes, local regulation, corruption, crime, high workman’s comp are a few issues. The current 50% literacy rate and what it says about the school system must also be considered. California is proof that state and local regulations can be just as damaging to business as the federal behemoth.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.