By Erik-Jan van Harn, economist at Rabobank

Summary

-

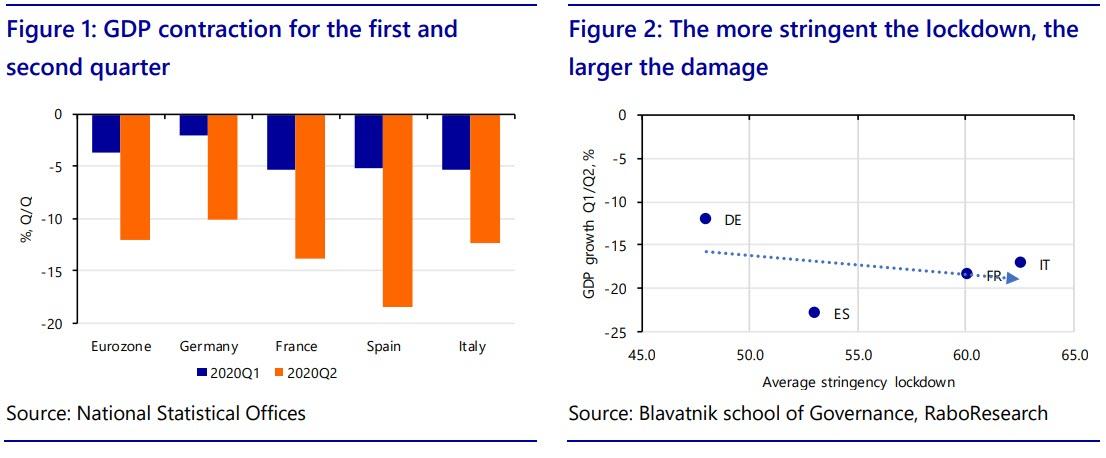

The Eurozone economy contracted by 12.1% in the second quarter. The German, French, Spanish and Italian economy contracted by 10.1%, 13.8%, 18.5% and 12.4% respectively

-

Sentiment indicators point towards a pickup in economic activity, but do not towards a Vshaped recovery

-

As long as there is no vaccine the probability of a second wave is real. Moreover, a vaccine does not necessarily mean that the economy can return to its pre-COVID mode of operation

-

Permanent changes to the economy requires a different skillset from employees. The government should actively guide people to new sectors

Record breaking

The Eurozone economy contracted by 12.1% in the second quarter of 2020. COVID-19 has swept through European economies and left them devastate0. Where the economic contraction for the first quarter of 2020 was unprecedented in the post-war history, the contraction is much worse in the second quarter since the lockdowns lasted for most of the quarter. Now that economies are opening up again we can assess the overall (initial) damage and count our losses. From the figures in the first and second quarter it is clear that the crisis is pushing the Eurozone towards further divergence. The German economy contracted by 10.1% whereas the French, Spanish and Italian economy contracted by 13.8%, 18.5%, 12.4% respectively. These figures are well aligned with our forecast.

In a previous piece we argued that the differences between countries can be explained from a couple of factors. We briefly want to reiterate these arguments. First, the structure of an economy. Economies with a large hospitality sector for example, are more vulnerable. Second, the strictness of the lockdown (figure 2). It generally holds that the economic damage has been larger for countries that have had stricter lockdowns. Third, government finances. Countries such as Germany and the Netherlands are financially better-positioned to support the economy than countries such as Italy and Spain.

Recovery?

Now that we have (hopefully) left the worst behind us, all eyes are now focussed on the recovery phase. Lately, there has been much debate regarding the shape of the recovery, e.g. an L- or Vshaped recovery. But that discussion could easily turn into semantics. The key question, we would argue, is whether and when broad economic activity has reached its pre-covid-19 level.

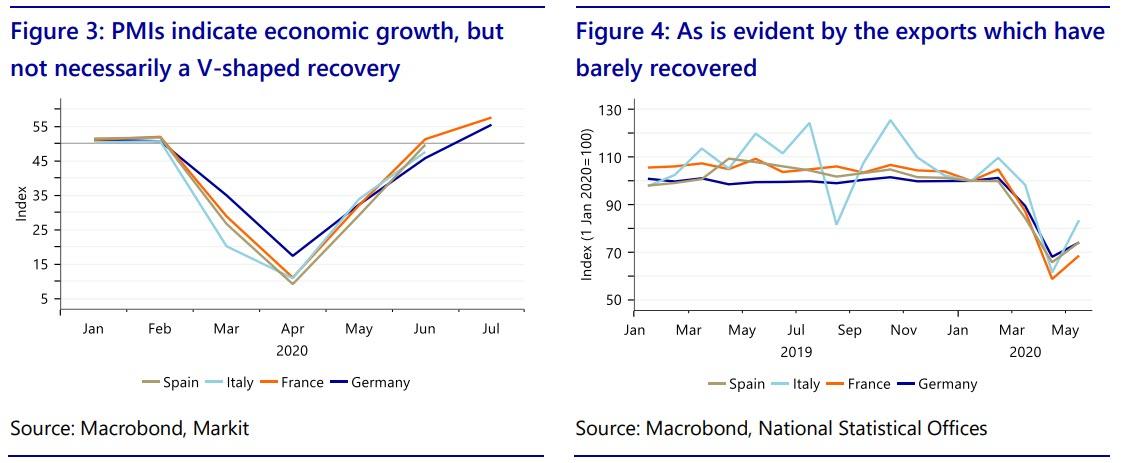

Economic sentiment has seen a sharp rebound recently (figure 4,5). But all that glitters is not gold. First, even though PMI readings above 50 indicate growth, the values are nowhere near the levels that indicate a (complete) V-shaped recovery. The index is based on a questionnaire that asks respondents to compare their expectations for the coming month with the previous month. Given the much lower activity during the lockdown, it is no wonder that expectations for post-lockdown economic activity are better.

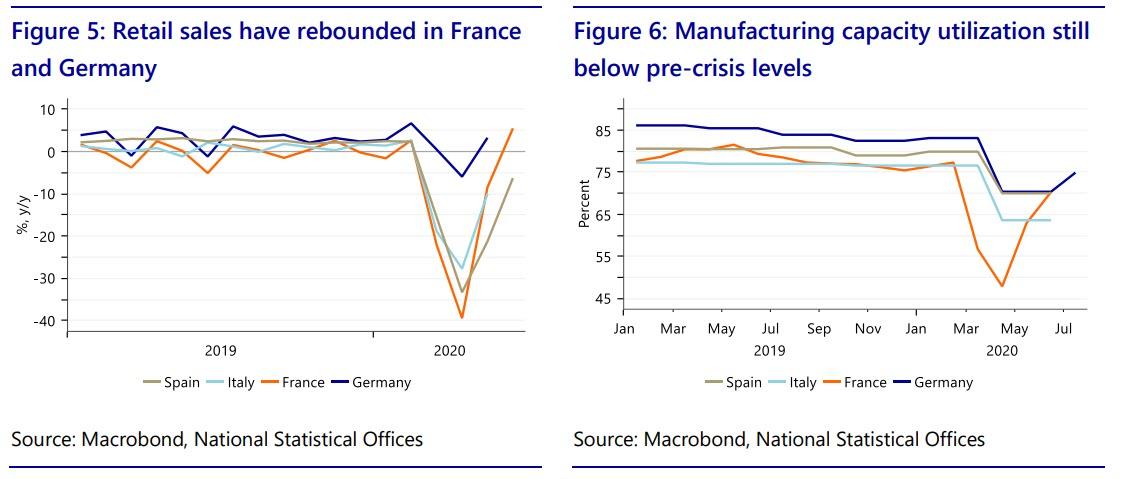

Second, even though we have seen a strong rebound in retail sales and capacity utilization (figure 5,6), the current levels are far from pre-crisis levels. Moreover, the differences between Northern and Southern Europe are large. So even though the figures show a significant improvement from the lockdown period, to say that the economy will be out of the woods in the near term would be presumptuous.

At face value, labor markets have surprised positively

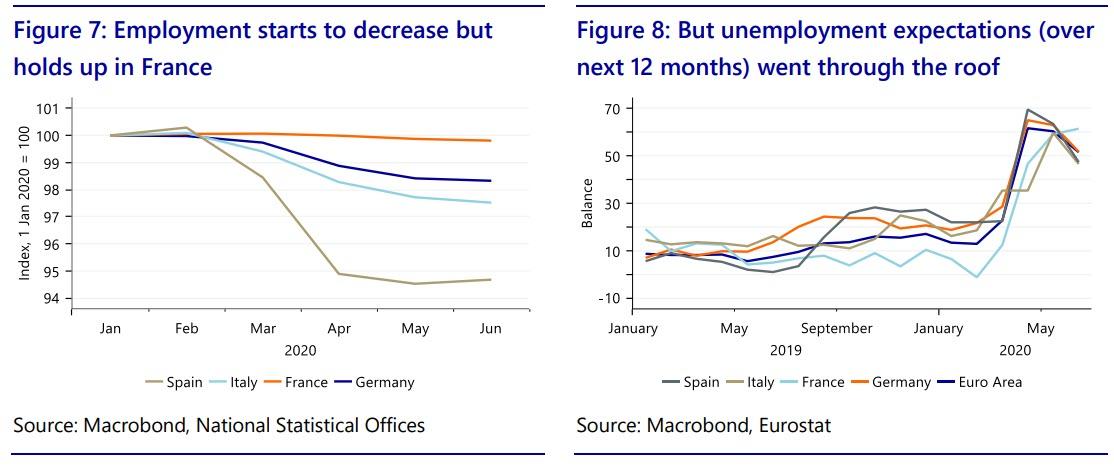

So far, most European governments have been able to hold off large spikes in unemployment rates (unlike the US) through enacting large-scale furlough schemes. But the fact that unemployment rates did not increase as much as feared does not necessarily mean that employment has not decreased (figure 7) or will not decrease at a later stage. For starters, it seems that in quite a number of cases people have left the labor force because their prospects of finding a new job, once fired, are bleak. This effect is especially visible in Spain, where the unemployment rate rose by 1.5ppt whilst employment dropped by 5ppt.

Moreover, it goes without saying that it is impossible (perhaps even undesirable) to keep people on government support for too long. For now, the furlough schemes are planned to be kept in place until the end of 2020 for Germany, but France has already announced that it will extend its scheme to a maximum of two years

It is inevitable that unemployment will spike once the furloughing schemes are removed (and people know it (figure 9)). Even if furlough schemes stay in place for a while longer, employees are not protected from companies going bust or are discouraged to re-enter the labor market once laid off. In other words, the true labor market damage may only show itself in the second half of this year.

Downside risks

Despite the recovery in economic indicators, the better-than-feared performance of labor markets and the recent agreement on the Recovery Fund, we still see various downside risks to the economic recovery. The most obvious is a second wave of infections. Although there have been encouraging reports with regard to a potential vaccine by early 2021 (see below), as long there isn’t any (effective) one, the risk of a second wave remains real. Moreover, we are already witnessing a second wave in the middle east whilst the first wave has not even ended in the United States and Latin America. Export-oriented sectors in the Eurozone may still be in for a tough time.

A second series of (partial) lockdowns could have some serious economic effects. Companies have burned through their reserves in the past months and governments have had to borrow record amounts to keep the economy from collapsing. This has halted a wave of bankruptcies so far, but a second lockdown could prove to be the tipping point if governments are unable (or unwilling) to provide the same generous support to companies and households.

Targeted lockdowns

But haven’t we become better at managing lockdowns? Most European countries have been in a full lockdown from March until May since this was the safest bet for governments, but new lockdowns could be more targeted. But a more targeted approach is certainly not a free pass. Regions with a high population density are fairly often also the regions where a disproportionate share of the economic activity is centred. And these regions are most vulnerable for the spread of the virus. Another lockdown in Lombardy, Catalonia or Paris could still have a significant economic impact.

The holy grail: a vaccine

The path to a vaccine could be bumpy for a number of reasons. First, it might take a while before the vaccine arrives. Even though there are a number of candidates that look promising, it doesn’t mean that a vaccine will be available before there is a second outbreak.

Second, even if there is a working vaccine, this does not mean that we can go back to a preCOVID economy. As long as the vaccine is not a silver bullet and there is still risk of infection, the economy would have to be permanently adjusted to protect the vulnerable. Additionally, the vulnerable (and risk averse) will protect themselves and consumer behaviour will change accordingly.

Third, it will take a while to scale up production and distribute vaccines. With close to eight billion people on the planet, producing a sufficient number of vaccines could take a while.

Only upwards from here?

Where the figures for the second quarter shattered some negative records, it is safe to say that the GDP figures for the third quarter will break some positive records. Although this sounds promising, this is just a technical correction. Compared to the economic activity during the lockdown in the second quarter, economic activity in the partially re-opened economy in the third quarter will be much higher. But as we have argued above, it is very unlikely that the economic expansion will be as large as the economic contraction preceding it. As such, only as from the fourth quarter – assuming no major new lockdowns –can we gauge the more longer-lasting effects on demand.