Posted on 05/09/2022 1:31:42 PM PDT by blam

More than a month ago, we wrote why with the yen at risk of an “Explosive” downward spiral – which has since been confirmed – we explained why China may soon devalue the yuan, and a few weeks later when this latest prediction was again promptly confirmed, we wrote “Whispers Of Yuan Devaluation After Biggest Weekly Plunge Since 2015.”

Fast forward to Monday, when China’s Onshore yuan’s selloff has accelerated to levels which until recently most “experts” FX strategists (with a few exceptions) said were impossible, and after breaking 6.7 per dollar for the first time since 2020 the yuan tumbled as low as 6.7766, as Chinese exports grew at their slowest pace in nearly two years and amid the absence of support from state banks. In the onshore market, the USDCNY rose as much as 1% to 6.7321, the highest since November 2020.

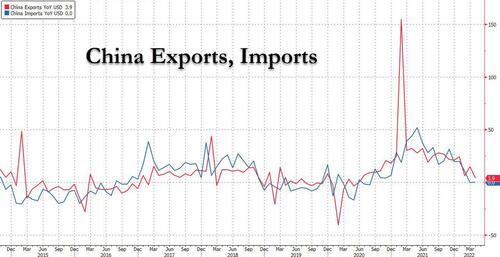

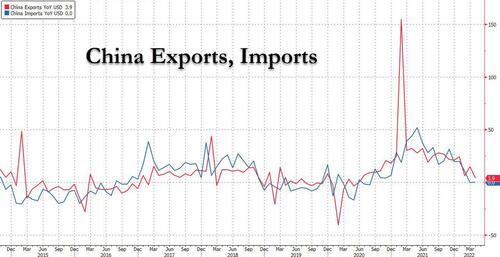

Export growth in April slowed to 3.9% in dollar terms from a year earlier, compared to an increase in March of 14.7%, while imports were flat Y/Y. That’s the weakest pace since June 2020 but faster than the median estimate of a 2.7% gain in a Bloomberg survey of economists.

Despite demand from some exporters, it was not enough to stop yuan from weakening, according to three traders who spoke to Bloomberg; they also added that the lack of notable dollar selling from state-owned banks also weighed on sentiment.

That said, Beijing appears to be a bit unhappy with the latest sprint lower in the yuan, and on Monday the PBOC set the yuan’s reference rate at 6.6899 per dollar, stronger versus the median estimate of 6.6938 in a Bloomberg survey with traders and analysts. This marked the fifth straight session that the yuan fixing was set at stronger-than-expected levels.

“Investors continue to re-appraise the prospects for China’s economy and asset markets,” strategists including Chris Turner at ING Bank wrote in a note. “With industrial metals taking another leg lower, it still seems too early to call the low in the yuan.”

,/A>

,/A>

Meanwhile, the CFETS RMB Index, the official index of yuan versus trading partner currencies, fell 0.8% to 102.39 last week, lowest since January 14: “Considering the recent sharp decline in the CFETS RMB Index, China’s central bank is expected to step up efforts to further stabilize market expectations if necessary in the foreseeable future, including verbal guidance, state-owned banks’ dollar selloff and a few consecutive lower-than-expected USD/CNY fixings,” Qi Gao, strategist at Scotiabank, wrote in a note.

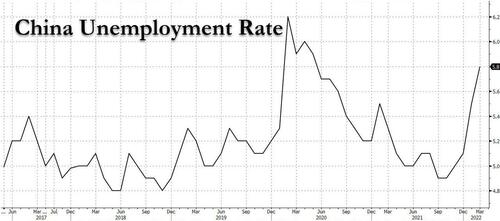

Finally, adding to the weakness, over the weekend, China’s outgoing Premier Li Keqiang warned of a “complicated and grave” employment situation as Beijing and Shanghai tightened curbs on residents in a bid to contain Covid outbreaks in the country’s most important cities, sparking renewed fears of a Chinese hard landing, one which is self-induced.

Li instructed all government departments and regions to prioritize measures aimed at helping businesses retain jobs and weather the current difficulties, according to a late Saturday statement, which cited the premier’s comments in a nationwide teleconference on employment.

“Stabilizing employment matters to people’s livelihoods, it is also a key support for the economy to operate within a reasonable range,” Li said, urging businesses to resume production with Covid-fighting measures in place, while reiterating the government’s policy to promote the healthy development of internet platform companies to support employment.

The premier’s warning on employment came after the nation’s surveyed jobless rate climbed to 5.8% in March, the highest since May 2020.

Bloomberg adds that high-frequency indicators tracking jobs suggest a further deterioration in the labor market in April.

The growing Chinese gloom follows last week’s warning by top leaders against attempts to question the country’s Covid Zero strategy as newly released data for April showed the lockdown-dependent approach taking a heavy toll on the economy. The rolling out of even more intense restrictions over the weekend in Shanghai and Beijing adds further to the challenges facing policymakers seeking to shore up growth.

And since it is sticking with Covid Zero, China reported a new 4,384 Covid-19 cases for May 7. Shanghai, which has been under some form of lockdown for weeks, recorded 3,975 new infections, down from 4,000-plus daily infections earlier. Beijing logged 62 new cases as authorities in the capital scramble to contain a wider spread. Both Shanghai and Beijing increased restrictions on their residents Sunday to achieve the Covid Zero goal, with authorities in the financial hub stepping up efforts to quarantine close contacts of people testing positive for the virus.

People living in the same building of confirmed cases now also risk being transported to designated quarantine facilities, according to local residents and widely circulated social media posts about the subject. Previously, only people living in the same apartment or the same floor of positive cases would likely be considered close contacts and put under central quarantine.

Both Shanghai and Beijing increased restrictions on their residents Sunday to achieve the Covid Zero goal, with authorities in the financial hub stepping up efforts to quarantine close contacts of people testing positive for the virus.

People living in the same building of confirmed cases now also risk being transported to designated quarantine facilities, according to local residents and widely circulated social media posts about the subject. Previously, only people living in the same apartment or the same floor of positive cases would likely be considered close contacts and put under central quarantine.

Top Shanghai officials including party secretary Li Qiang have vowed repeatedly to “win the war” against the outbreak and hit the goal of achieving zero community spread in the city of 25 million residents as soon as possible. Of the nearly 4,000 cases reported for Shanghai Saturday, 11 were still found outside quarantine areas.

In Beijing, authorities on Sunday required all residents in its eastern district of Chaoyang — home to embassies and offices of multinationals including Apple Inc. and Alibaba Group Holding Ltd. — to start working from home. This followed an order to shut down some businesses providing non-essential services such as gyms and movie theaters in the district to minimize infections.

And while China’s economy is set to continue slowing further, its monetary policy diverging from the US for the foreseeable future, the question everyone should be asking – as Albert Edwards first correctly hinted two weeks ago – is how long can US and Chinese policies diverge before something breaks?

They need to totally lock down a few more cities like they did to Shanghai.

That will fix it.

The Chicom mafia will do whatever it takes to see America destroyed. The party members will remain fat and happy and couldn’t care less about the welfare of the average Chinese citizen.

Can one person here tell me, apart from the break up of the Soviet Union, has there ever been one instance of Communist leadership acting outside their own self interest to further their long term goals? And remember, long term to the Chinese isn’t measured the same way in the Western world.

Is this really our problem? It’s not like we do much trading with a murderous communist nation and we would not have essential manufacturing in America.

China’s economic house of cards is collapsing- their ascension to reserve currency will not happen.

This is what happens when governments “invest”.

</chuckle>

I thank God for China’s misfortune.

They’re wretched people.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.