You know why you're here.

Posted on 07/14/2010 7:20:33 AM PDT by Errant

Midway through 2010 we are approaching the end of the end-game, the resolution of the monetary imbalances that began in 1971. For more than 2500 years, gold was money: but, in 1971 that changed. After 1971, money was no longer connected to gold. For the first time in history, money had no intrinsic value...

...The enormous amount of government debt—total sovereign debt now totals $34 trillion dollars—can never be repaid. The end of the end-game will come when investors collectively realize this is so. That realization has not yet happened. When it does, for most it will be too late...

...The European debt crisis marks the beginning of the end of the government debt bubble. Only a false sense of confidence is now supporting sovereign bond markets. In the spring of 2010 that confidence was shaken; and, someday, it will disappear entirely.

We live in interesting times. We are in the end-game.

(Excerpt) Read more at marketoracle.co.uk ...

All according to schedule. NWO plans to eliminate cash eventually. Out of chaos comes order.

You know why you're here.

Let me just get this out of the way and say that you can’t eat gold or fill your gas tank with gold.

What film is that picture from? Seems familiar.

America is headed for PEMEX-ification of its currency. This means a sharp devaluation, but not hyperinflation, and not the end of the fiat currency.

Instead the dollar will lose about 80% of its current buying power by 2012.

We won’t be in Mad Max territory. We’ll be in the equivalent of 2001 Argentina. Which means poorly paid police and interrupted power supplies, but not a colossal die-off. We’ll be very glad we brought canned goods and firearms, and self-sufficiency goods, and it ALSO means that we’ll be very glad we brought gold when we had the chance.

The obvious rejoinder is that you can buy food and gas with gold; but you can't carry food and gas around in your pocket.

You fail to understand the problem.

Gold will not be used by the common plebeians to transact business. Gold will be used as it has in relatively modern times to transact sovereign business and trade. When France needs to settle balance of trade differences with the USA or Chad or Qatar, it will ask for gold.

That gold will likely be on deposit in vaults in Paris or New York or Dubai. The keeper will move the gold from the vault of the debtor to the vault of France, an electronic entry will be made on ledgers and all will be well.

That being said, the day to day plebeian transactions will be settled with gold backed paper certificates or more likely, plastic keys to an electronic ledger. The electronic absolute values recorded on that ledger in the national currency will be known with a high degree of certainty.

People here like to boast about brass and lead, but that is all bravado. Bullets are merely brass and lead.

A more valuable metal will be silver. Silver is more abundant but suitably scarce and there could be a transition. But that too would not be acceptable for the simple reason electronic plastic backed by gold is easier, cheaper and universal.

For those who doubt me I would suggest reading “the Power of Gold: the History of an Obsession”. You will learn that the present day situation is but a continuation of king’s and politician’s problems since the beginning. Gold always emerges as the solution to a wrecked economy that is put right.

http://www.amazon.com/Power-Gold-History-Obsession/dp/0471003786

It didn't have any more intrisic value when it was connected to Gold, since Gold has a very small "intrinsic" value.

Most of gold's price is not because of actual uses for gold which give it value, but because people have an irrational desire for gold believing that people will always have an irrational desire for gold.

Money has no value except as a government maintains laws providing an intrinsic value. For most of our lives, government has done a relatively decent job of enforcing laws and enacting policies that only allowed a slow deterioration in the value of money printed by the government (notwithstanding the Carter years).

The current administration has no concept of the importance of government in maintaining the value of money, and seems bent on pretending that it can spend as much as it wants without having it, which is similar to printing money except if they printed the money we wouldn't have a "debt".

But I disagree with the notion of those who think it would be a good thing to go back to when the money supply was artificially enslaved to the inherently unrepresentative "value" of the current supply of gold.

Within the country, a devaluation (which I don’t expect) won’t necessarily be that disruptive. It wipes out existing debt, and wipes out savings, IF the money is literally re-valued. But if it devalues RELATIVE to something else (meaning some other foreign currency), we will still have our same savings, the same debt, and the same earnings. We just won’t have cheap foreign goods at Walmart.

I expect the former is more what people expect; that in order to solve the debt problem, the US would have to “devalue” it’s currency, doing some sort of revaluation in place, such that our salaries would all double, and all prices would double (as an example), leaving our current debts cut in half, and our current savings cut in half.

I don’t expect that by 2012 though.

A nice quote from the article: "Some believe gold is a bubble. It is not. The price of gold, however, tracks a bubble and that is why it is mistaken for one. The real bubble is government debt, not gold."

Mail me to get on or off the Free Republic Goldbug Ping List.

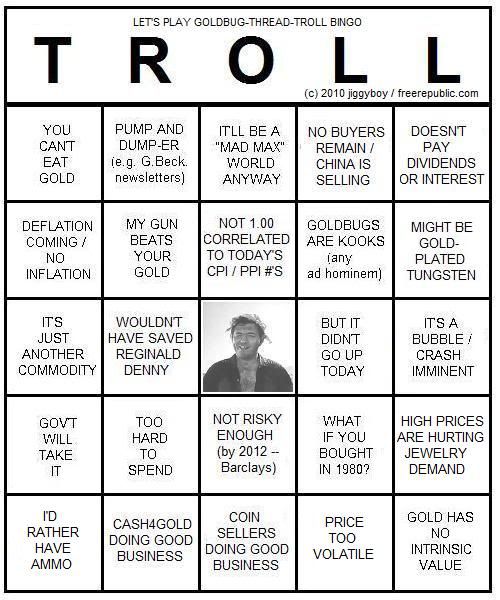

That is the best I’ve seen.

Very funny!

The anti-gold talking points haven’t changed much over the years.

I can imagine in a couple of years, with gold at 2-3 thou, and the world no closer to utopia, that we’ll be hearing them even louder!

Also the end of cheap energy since we import 66% of all the oil we use. These days energy imports are more of our trade deficit than cheap stuff from China/Asia/etc

Such a devaluation would be good if we handled it the right way. Such as producing a lot more of our energy via coal, natural gas, more oil exploration. Such as producing more at home instead of importing it

Excellent. I like Bingo. LOL!

http://www.oftwominds.com/blogjuly10/deflation-hyperinflation-07-10.html

Why (Hyper) Inflation Is Not In the Cards

(July 12, 2010)

The Con of the Decade Part II

(July 9, 2010)

The Con of the Decade Part I

(July 8, 2010)

Well maybe not hyperinflation but certainly regular inflation, and by that I mean inflation so bad that it shows up in official reports. Our current situation of made-up money going straight to zombie banks can (will) last a long time, but I think it’s ultimately just an unstable state that inevitably leads to inflation. Here’s an article I happened to see today that says it’s too early to rule out big time inflation.

http://article.nationalreview.com/438056/the-inflation-canard/stephen-spruiell

That’s really cool, I have to admit.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.