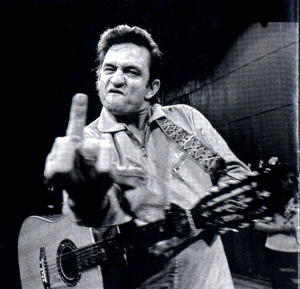

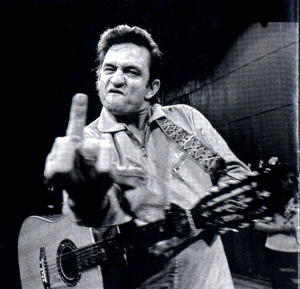

You know, this would be my response if I was not ever intending on going to America, etcetera.

I would mail them this picture with their requested response:

Posted on 09/22/2011 8:10:12 AM PDT by danielmryan

When Julie Veilleux discovered she was American, she went to the nearest U.S. embassy to renounce her citizenship. Having lived in Canada since she was a young child, the 48-year-old had no idea she carried the burden of dual citizenship. But the renunciation will not clear away the past 10 years of penalties with the Internal Revenue Service (IRS).

Born to American parents living in Canada, Kerry Knoll’s two teenaged daughters had no clue they became dual citizens at birth. (An American parent confers such status on Canadian-born children.) Now the IRS wants to grab at money they earned in Canada from summer jobs; the girls had hoped to use their RESPs (registered education savings plans) for college.

The IRS is making a worldwide push to squeeze money from Americans living abroad and from anyone who holds dual citizenship, whether they know it or not. It doesn’t matter if the “duals” want U.S. status, have never set foot on U.S. soil or never conducted business with an American. It doesn’t matter if those targeted owe a single cent to the IRS. Unlike almost every other nation in the world, the United States requires citizens living abroad to file tax forms on the money they do not owe as well as to report foreign bank accounts or holdings such as stocks or RSSPs. The possible penalty for not reporting is $10,000 per “disclosed asset” per year.

Thus, Americans and dual citizens living in Canada (or elsewhere) who do not disclose their local checking account — now labeled by the IRS as “an illegal offshore account” — are liable for fines that stretch back 10 years and might amount to $100,000. A family, like the Knolls, in which there are two American parents and two dual-citizen children, might be collectively liable for $400,000.

Approximately 7 million Americans live abroad. According to the IRS, they received upward of 400,000 tax returns from expatriates last year — a compliance rate of approximately 6%. Presumably, the compliance of dual-citizen children is far lower. Customs and Immigration is now sharing information with the IRS and, should any of 94% expats or their accidentally American offspring set foot on U.S. soil, they are vulnerable to arrest.

Why Now?

As of 8:30 a.m. EST, Sept. 20, the US National debt was $14,744,278,404,668. That is over $47,000 per American citizen, over $131,000 per taxpayer. America is bankrupt and desperate to grab at any loose dollar within its reach. Having reaped the easy pickings within its own borders, America is extending its reach.

So far, the IRS push into foreign territory has been a rousing success by their own standards. In 2009, the IRS offered “amnesty” — that is, lessened but still hefty penalties — to whoever stepped forward to disclose foreign bank accounts. According to Fox Business News, the 2009 program netted

“the government $2.2 billion in tax revenues…and $500 million in interest from the 2011 program, for a total of $2.7 billion…Moreover, the IRS says it has yet to reap penalties from these evaders, which could rake in hundreds of millions more.”

IRS Commissioner Doug Shulman stated:

“we are in the middle of an unprecedented period for our global international tax enforcement efforts. We have pierced international bank secrecy laws, and we are making a serious dent in offshore tax evasion.”

Going after the college money earned by children born and raised in Canada (or elsewhere) is just one part of the international enforcement effort. The entire package is called the Foreign Account Tax Compliance Act, or FATCA; it was a revenue-raising provision that was slipped into one of Obama’s disastrous stimulus bills. Starting in 2013 — or 2014 if an exemption is granted — every bank in the world will be required to report to the IRS all accounts held by current and former U.S. citizens. If account holders refuse to provide verification of their non-U.S. citizenship, the banks will be required to impose a 30% tax of all payments or transfers to the account on behalf of the IRS. Banks that do not comply will “face withholding on U.S.-source interest and dividends, gross proceeds from the disposition of U.S. securities and pass-through payments.”

Australia and Japan have already declared their refusal to comply. Canada’s Finance Minister Jim Flaherty has publicly stated that the proposed American legislation “has far-reaching extraterritorial implications. It would turn Canadian banks into extensions of the IRS and would raise significant privacy concerns for Canadians.”

According to the Financial Post:

“Toronto-Dominion Bank is putting up a fight against a new U.S. regulation that would compel foreign banks to sort through billions of dollars of deposits to find U.S. citizens who might be hiding money.… TD has complained that the proposed IRS rule is unreasonable because it would require the bank to make US $100-million investment in new software and staff. Other lenders resisting the effort include Allianz SE of Germany, Aegon NV of the Netherlands and Commonwealth Bank of Australia.… Now the Canadian Bankers association has joined the fray. In an emailed statement the CBA called the requirement ‘highly complex’ and ‘very difficult and costly for Canadian banks to comply with.’”

The Financial Times reports,

“One of Asia’s largest financial groups is quietly mulling a potentially explosive question: Could it organize some of its subsidiaries so that they could stop handling all U.S. Treasury bonds? Their motive has nothing to do with the outlook for the dollar.… Instead, what is worrying this particular Asian financial group is tax. In January 2013, the U.S. will implement a new law called the Foreign Account Tax Compliance Act…The new rules leave some financial officials fuming in places such as Australia, Canada, Germany, Hong Kong and Singapore…Implementing these measures is likely to be costly; in jurisdictions such as Singapore or Hong Kong, the IRS rules appear to contravene local privacy laws…Hence the fact that some non-U.S. asset managers and banking groups are debating whether they could simply ignore FATCA by creating subsidiaries that never touch U.S. assets at all. ‘This is complete madness for the U.S. — America needs global investors to buy its bonds,’ fumes one bank manager. ‘But not holding U.S. assets might turn out to be the easiest thing for us to do.’”

Meanwhile, banking will become more difficult within the United States. FATCA will hold banks liable for any “improper” transfer of money to outside the United States. The Wealth Report, a financial analysis site, states,

“U.S. banks will be desperately trying to cover their liability by checking the exact purpose of the payment, to make sure it doesn’t come within the scope of the legislation. The burden of proof will naturally pass to the account holder who is trying to transfer money, to demonstrate that the transaction is not subject to the new withholding tax. If the sending bank in the USA has any doubt at all about the purpose of the transaction, they will be forced to deduct 30% tax. Net result? It is going to be darned difficult for anyone to transfer money out of the USA. If that isn’t a form of currency control, then I don’t know what is! (emphasis original)”

Returning to the Little Guy and Gal

Expat Americans and children — aka dual citizens — will be caught in the indiscriminate steel net that the IRS wants to throw around the globe. Their innocence or ignorance will not matter. The IRS wants money. If expats and duals do not owe money from their earnings, then the IRS will pursue obscure reporting requirements and apply them to people who did not even know they were American. It will try to yank their college funds and drain their parents’ retirement savings.

They can renounce their American citizenship, but that is an imperfect solution. For one thing, it does not immunize them from the past 10 years of nonreporting. For another, following the United States’ “exit” sign takes many people directly through the Treasury Department, where they may be required to pay a brutal one-time exit tax. Basically, for those with more than $2 million dollars in assets, the tax comes to $600,000.

Moreover, renunciation is a difficult process. The Globe and Mail is one of many Canadian newspapers now explaining to readers how they can renounce American citizenship. G&M states,

“Renouncing your U.S. citizenship starts with a hefty fee — $450 (U.S.), just for the chance to appear in front of a consular official. Need it done in a hurry? Forget about it. It can take about two years to get an appointment.”

The true hope lies in a worldwide refusal to comply. The only power strong enough to rein in the United States is the world itself. There is hope that this will happen.Reuters declared,

“A U.S. law meant to snuff out billions of dollars in offshore tax evasion has drawn the criticism of the world’s banks and business people, who dismiss it as imperialist and ‘the neutron bomb of the global financial system’…A senior American finance executive at the Hong Kong branch of a major investment house [declared] that FATCA was ‘America’s most imperialist act since it invaded the Philippine Islands in 1899.’ The regulation…was ‘engendering a profound and growing anti-American sentiment abroad.’”

How long can America maintain that people “hate us for our freedom”? People fear and hate America for its totalitarianism. And among those people filled with fear are American citizens.

I thought she had one. If not, my bad.

So?....Will this increase unemployment or decrease unemployment here at home? Count on the fascist Obama to make the wrong decision for the little guy.

Not only will less business be done with overseas enterprises but visitors to the U.S. will decrease and that means fewer jobs in many areas of the economy.

Yes and no... The US doesn't recognize any other citizenship for you, but does not prohibit you from gaining other citizenship, either. Getting a second citizenship does not nullify your US citizenship, and most other countries automatically consider your gaining of their citizenship to be an implicit renouncement of US citizenship.

But the US likes to hold on to its people, so you need to pay a bunch of money and spend a few years to actually renounce your citizenship formally.

—Was I wrong?

Yes.—

I knew this day would come. I had no idea how bad it feels to be wrong. No wonder people try to avoid it. ;->

Words fail me. The libs go soft when they should be firm, and they lash out when it’s counterproductive. Do they even know what they’re doing?

Yes, they know full well what they are doing and they celebrate the destruction of America.

Absolutely! Only one other nation taxes based upon citizenship - and that’s the strongarm dictatorship of Eritrea. ALL other nations tax based upon where you earn the money, not where you’re a nominal citizen.

Note that the US also extends this claim to legal residents; if you are a citizen of another nation, but have a green card, you still have to pay US income taxes on monies earned overseas, even if you’re overseas for the entire year.

I confess that I am puzzled as to how the US government even knows about a person born of US parents in another country that has lived there into adulthood. There is no SSN so they should not exist, as far as the US gov is concerned. At least, that is how I would have assumed it worked if it happened to me.

Either you have never been married, or you are female.

Cheers! ;-)

“she went to the nearest U.S. embassy to renounce her citizenship”

Hey, don’ let the door hit you in the *** as you leave.

Hoser.

—Either you have never been married, or you are female.—

Good one! Seriously!

Actually, I just forgot the sarcasm tag. 8-D

I don’t know, either - however, I think it shows the tenacity of the IRS in tracking down anyone they think might be “shirking their responsibility”. The US Government is putting a tremendous amount of resources in identifying citizens and legal residents living abroad all in the name of tax enforcement.

If only they put that same effort into controlling illegal immigration...

Hoover spent massive amounts of money, and it did nothing to stop the onset of the depression. Why the idiots in DC and the public continue to believe that increased theft in the form of "taxes" and increased spending will improve our current lot is beyond me.

We were given a Republic, and we failed to keep it.

—If only they put that same effort into controlling illegal immigration...—

No money in it.

You know, this would be my response if I was not ever intending on going to America, etcetera.

I would mail them this picture with their requested response:

She lived in Canada all her life. She never knew she was considered American whatsoever. I don’t fault her.

US and North Korea are the only countries who tax on worldwide basis.

Time to end it. It is morally wrong and unethical. If you earn money in (say) Canada, and pay local taxes, why the heck you should pay anything to Uncle Sam? No country works this way.

Taxes are evil.

That is a great idea! Then the illegal Mexican’s can purchase the foreclosed US citizenship. If the person being foreclosed on doesn’t hold dual citizenship then they get a letter in the mail like:

“Dear John Doe, We regret to inform you that due to your delinquent taxes owed, The US Dept of Revenue has foreclosed on your US Citizenship. The purchaser was Jose Quervo from Mexico City, Mexico. We have contacted the Mexican embassy on your behalf and completed the citizenship transfer. Your new Mexican passport is available at the nearest Mexican Embassy.

Have a good day, or hasta la vista

“

I question the constitutionality of them going after her. She was born in another country and has never set foot in the USA. What gives the us a claim on her, other than the IRS wants her money? How does this look to the rest of the world?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.