Skip to comments.

Saving the New Year (Why you are not saving enough for retirement)

The Atlantic ^

| 12/29/2011

| Megan McArdle

Posted on 12/29/2011 5:44:15 AM PST by SeekAndFind

In between the happiness of Christmas and the promise of the New Year, permit me to introduce a sour note, a hint of a scold. If you're like, well, almost everybody, you're not saving enough. 15% of each paycheck into the 401(k) is the bare minimum you can get away with, not some aspirational level you can maybe hope to hit someday when you don't have all these problems.

I mean, obviously if one out of two workers in your household just lost their job, or has been stricken with some horrid cancer requiring all sorts of ancillary expenses, then it's okay to cut back on the retirement savings for a bit. But let's be honest: that doesn't describe most of us in those years when we don't save enough.

What describes most of those years when we aren't saving is normal life. We moved. We got married or had kids. The kids required entirely expected things like food, clothes, and schooling. Work was hard and we felt we wanted a really nice vacation. Friends and family went through the same normal life stages that we were, requesting that we travel and bring gifts to the happy events.

These things are not an excuse to stop saving, for all that I have used these excuses myself from time (and regretted it later, at length). The recession should have driven home some hard facts, but the nation's 3.5% personal savings rate indicates that these lessons haven't quite sunk in, so let me elaborate some of them.

1. You cannot count on high asset growth rates to bail out a low savings rate. In the 1990s, we believed that we could guarantee something like an 8% (average) annual return by pumping our money into the stock market and leaving it there.

(Excerpt) Read more at theatlantic.com ...

TOPICS: Business/Economy; Society

KEYWORDS: 401k; saving

To: SeekAndFind

Sure people should save more but the rising cost of living is eating wages wholesale. A family of five has seen $50-$60 per week added to their grocery bill over the past year.

The middle class is taking a beating and when someone is trying to decide whether to run out of gas or groceries by this time of the week they really don’t want to be berated for not saving more.

2

posted on

12/29/2011 6:25:28 AM PST

by

count-your-change

(You don't have to be brilliant, not being stupid is enough.)

To: count-your-change

... the rising cost of living is eating wages wholesale.

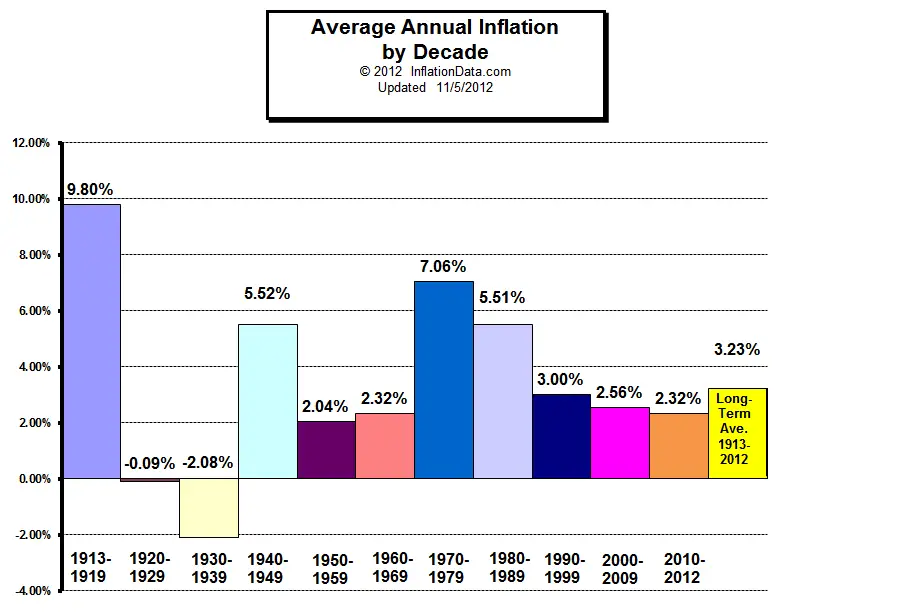

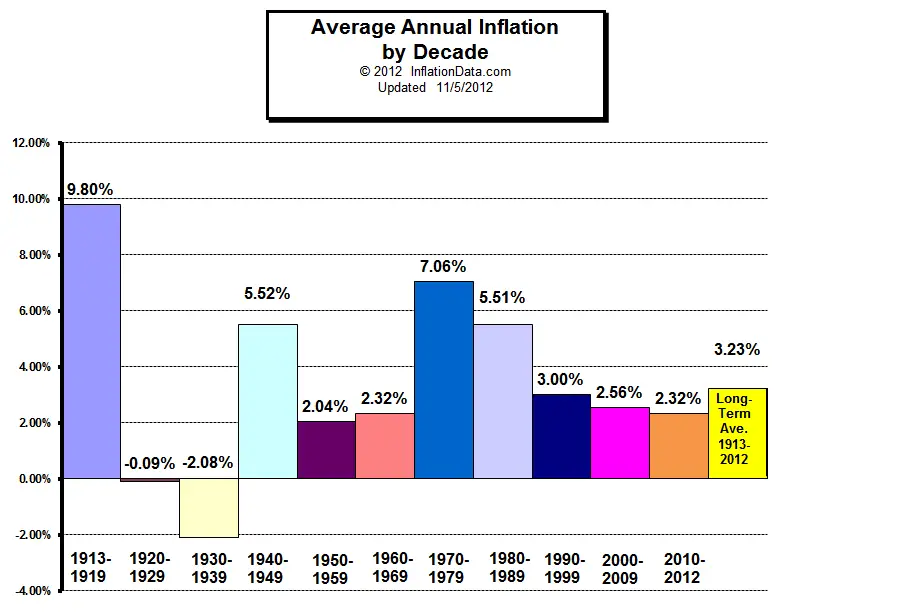

Can't argue the point, however, the Jimmy Carter years were a hell of a lot worse ... and we survived.

3

posted on

12/29/2011 6:32:53 AM PST

by

oh8eleven

(RVN '67-'68)

To: oh8eleven

Inflation is killing us. The cost of living and doing business in this country is skyrocketing.

4

posted on

12/29/2011 6:43:41 AM PST

by

GlockThe Vote

(The Obama Adminstration: 2nd wave of attacks on America after 9/11)

To: GlockThe Vote

Better to pay down debt and buy preps than dump money into a system that is going to collapse from its own weight.

5

posted on

12/29/2011 7:15:03 AM PST

by

IGOTMINE

(1911s FOREVER!)

To: count-your-change

I don’t think this holds true as a generalization. I have two parents who never saved 15%, but who ended up with plenty of assets and lived off their income and SS. My mother is 97 and my mother-in-law just passed on at 98 leaving a small estate. Both never spent their income.

The secret is, like in government, spending less. Once the kids are gone, the house is sold, what do you really need?

It helped that both were frugal, coming from a generation that survived the depression, and in reasonably good health all their lives. But then that was due to maintaining a healthy life style.

They are not alone either as I regularly see when visiting the retirement place where they both lived.

6

posted on

12/29/2011 7:23:13 AM PST

by

JeanLM

(Obama proves melanin is not enough)

To: GlockThe Vote

Inflation is killing us.C'mon, stop whining. It may be a little painful, but it's a long way from killing you.

It was so bad in the 70s, Nixon enacted price controls.

Mortgage rates under Carter were up around 16% - 18%.

In contrast, during the last two years, inflation has been so low seniors on SS got no COLA raises.

7

posted on

12/29/2011 7:51:12 AM PST

by

oh8eleven

(RVN '67-'68)

To: JeanLM

You've explained an important point, perhaps without intending to: Savings can be assets like a piece of property paid off.

“The secret is, like in government, spending less”

Quite true and when the kids are gone most couples are able to live on less and do. But telling someone to save when they are losing their home or facing a layoff that wipes out savings is silly.

8

posted on

12/29/2011 7:57:57 AM PST

by

count-your-change

(You don't have to be brilliant, not being stupid is enough.)

To: count-your-change

But telling someone to save when they are losing their home or facing a layoff that wipes out savings is silly. I doubt someone in that situation will be reading the Atlantic..

9

posted on

12/29/2011 8:10:33 AM PST

by

EVO X

To: oh8eleven

I would say that “core” inflation is a bogus number. The Fed is using the decline in housing prices to obscure the actual rise in food and energy. Food costs have risen significantly. Check how much coffee is in your “two-pound” can at the store and how much more it costs than it did a year ago.

10

posted on

12/29/2011 8:12:43 AM PST

by

old3030

(I lost some time once. It's always in the last place you look.)

To: SeekAndFind

Obama is using the printing presses at Treasury to suck the value out of our retirement savings and redistributing it to his “homies”.

11

posted on

12/29/2011 8:15:47 AM PST

by

tacticalogic

("Oh, bother!" said Pooh, as he chambered his last round.)

To: old3030

The Fed is using the decline in housing prices to obscure the actual rise in food and energy The BLS uses rent instead of home sales to calculate that portion of the cpi. If they would have included home sales in the earlier part of the last decade, inflation would have been higher. The FED would have had to raise rate to knock it down and we probably wouldn't be in the mess we are in today..

12

posted on

12/29/2011 8:24:38 AM PST

by

EVO X

To: EVO X

13

posted on

12/29/2011 9:58:53 AM PST

by

count-your-change

(You don't have to be brilliant, not being stupid is enough.)

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson