Skip to comments.

Study: 401(k) Retirement Plans Failing Most Workers

CBS MoneyWatch ^

| Sep 6, 2013

| Constantine von Hoffman

Posted on 09/07/2013 6:39:30 PM PDT by Toddsterpatriot

According to a new study, the 401(k) savings account isn't adequately providing for people's retirement and is adding to the nation's growing wealth inequality.

The report from the Economic Policy Institute, a liberal-leaning public policy think-tank, illustrates how the shift from pensions to individual savings accounts has affected retirees. The authors find that it is the wealthiest workers who are benefiting the most because they can actually contribute enough to make 401(k) plans work for retirement.

"401(k)s were never designed to replace pensions for most workers. They serve primarily as a tax shelter for high earners," said economist Monique Morrissey, the report's co-author, in a statement. "The 401(k) revolution has been a disaster, yet some policymakers are calling for cuts to Social Security, which will be the only significant source of retirement income for most Americans--if they are able to retire in the first place."

Snip...

According to the report:

Retirement-income inequality has grown in part because most 401(k) participants are required to contribute to these plans in order to participate, whereas workers are automatically enrolled in defined-benefit pensions and, in the private sector, are not required to contribute to these plans. Thus, higher-income workers are much more likely to participate in defined-contribution plans. In addition, higher-income workers have more disposable income and a higher investment-risk tolerance, receive larger tax breaks, and are more likely to work for employers that provide generous matches.

(Excerpt) Read more at finance.yahoo.com ...

TOPICS: Business/Economy; Humor

KEYWORDS: epi

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-65 next last

To: Toddsterpatriot

and so it starts...

..the poor workers who are not on the govt teet and working for a living and paying into their OWN retirement fund are going to be roasted and basted.

until there is a CRISIS and the fed govt and the sob will have to SAVE us and take our money so they can really do better with it...

they'll call it pension "reform"....and they'll steal every single one of our hard earned pennies...

41

posted on

09/07/2013 8:10:20 PM PDT

by

cherry

To: Toddsterpatriot

And add the amount your employer paid in and you would be extremely wealthy.

42

posted on

09/07/2013 8:12:41 PM PDT

by

Lurkina.n.Learnin

(If global warming exists I hope it is strong enough to reverse the Big Government snowball)

To: Toddsterpatriot

I wonder if Monique Morrisey’s job benefits include a 401K...

43

posted on

09/07/2013 8:53:44 PM PDT

by

silverleaf

(Going to war without the French is like going hunting without an accordion.)

To: silverleaf

It sounds like EPI offers an excellent benefit package.

44

posted on

09/07/2013 9:14:39 PM PDT

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: CincyRichieRich

Most workers aren’t putting much into 401Ks. Those who do too often borrow against it or cash it out, instead of letting savings grow.

45

posted on

09/07/2013 10:09:50 PM PDT

by

tbw2

To: qam1

We now are going to start hearing a lot more of these type of stories and “studies” in the coming months Yes we will. The intent of these stories is to take away our IRAs and shore up Social Insecurity with them. In other words, theft by govenment.

46

posted on

09/08/2013 12:18:38 AM PDT

by

sr4402

To: Toddsterpatriot

If a worker’s SS account had been invested in mutual funds for their benefit and not used to buy votes by the government, each worker would have well over a million dollars at their disposal at retirement time.

47

posted on

09/08/2013 4:37:24 AM PDT

by

The_Media_never_lie

(Actually, they lie when it suits them! The crooked MS media must be defeated any way it can be done!)

To: Toddsterpatriot

Solution: Unionize everyone with plush plans and raise the minimum wage to $50/hour. Add price controls and forced manufacturing and services to keep products flowing....Worked great for the Soviet Union and others around the world - no way did only the rich benefit...

48

posted on

09/08/2013 4:38:56 AM PDT

by

trebb

(Where in the the hell has my country gone?)

To: Toddsterpatriot

Here they come. Notice how they mention that those 401Ks are adding to the nation’s wealth inequalities.

They are going to take them soon. Especially if the House falls to democrats in 2014.

49

posted on

09/08/2013 4:41:58 AM PDT

by

dforest

To: tbw2

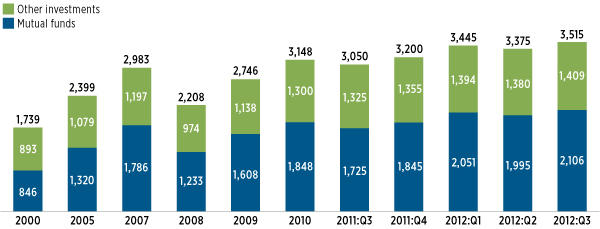

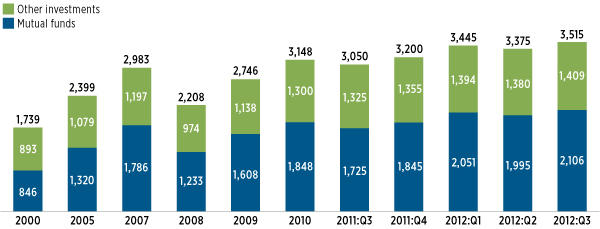

Most workers aren’t putting much into 401Ks.Actually, most people have an IRA or a 401K. We got more 401Ks than IRAs now, they just haven't gotten as big yet--

How many Americans have 401(k)s?

In 2011, 51 million American workers were active 401(k) participants.

401(k) Plan Assets

Billions of dollars, end-of-period, selected periods

Millions of Americans use IRAs to save for retirement. An estimated 48.9 million U.S. households, or 40.4 percent, owned IRAs as of 2012

IRA Assets

Billions of dollars, selected years

--and this means the average worker's got around $100K stashed away. Good enough.

To: Orange1998

To: Toddsterpatriot

52

posted on

09/08/2013 6:28:01 AM PDT

by

silverleaf

(Going to war without the French is like going hunting without an accordion.)

To: Toddsterpatriot

Imagine how much better they'd work if you could put your 12.4% Social Security "contribution" into your 401k.Yes, some would but I would bet that those in the lower classes would not invest that SS money; they would spend it. Those people don't tend to look past next week, much less decades in the future.

To: Toddsterpatriot

The Economic Policy Institute is a bunch of Communists. Nothing they say can be believed. It’s all propaganda aimed at forcing all retirement savings into the hands of the government.

To: Toddsterpatriot

"401(k)s were never designed to replace pensions for most workers." Yes, they were. My employer made the switch early on, and gave everyone a lump sum from the pension funds to start our 401K's with, and ended the pension program.

To: Hoodat

How far are we from hidden in the mattress or whereever being the best retirement plan?

One of the best ways to prepare for the possible loss of retirement funds is to have all long-term purchases and repairs bought and paid for.

56

posted on

09/08/2013 8:03:43 AM PDT

by

grania

To: OldPossum

Yes, some would but I would bet that those in the lower classes would not invest that SS money; they would spend it.Not if the payroll deduction went into the 401k, instead of going into the government maw.

57

posted on

09/08/2013 8:20:38 AM PDT

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: grania

If the rule of law is dead, then also are the protections that come from it. All bets are off. Only the well-connected will be able to protect their assets.

Who is John Galt?

58

posted on

09/08/2013 8:25:54 AM PDT

by

Hoodat

(BENGHAZI - 4 KILLED, 2 MIA)

To: Toddsterpatriot

Yes, but one would then have a political problem with restricting them from taking money out of their 401Ks—yes, I know, we could do that and are doing it with Social Security as currently constituted.

What I would fear is that the politicians would buckle and we could end up with a worse system, i.e., political pressure brought to bear to allow people to foolishly drawing out their retirement savings long before retiring. Then what? Let them starve or institute yet another huge government program?

Yours is a sensible idea. But there could be major problems if the courts rule that it is their money in the 401K accounts.

To: expat_panama

Thank you for the information.

60

posted on

09/08/2013 10:39:55 AM PDT

by

tbw2

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-65 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson