Skip to comments.

The Fiscal Times

U.S. Manufacturing Tumbles Toward Recession — and It Doesn't Matter Much

The Fiscal Times ^

| 12/1/2015

| Yuval Rosenberg

Posted on 12/06/2015 7:41:12 AM PST by cp124

But here’s the good news: Manufacturing now represents a relatively small segment of the U.S. economy — just 12 percent, and less than 10 percent of total employment — and the other 88 percent of the economy is doing much better. Witness today’s data showing construction spending near an eight-year high and car sales, forecast to have had the best November on record, still on pace for a record year.

(Excerpt) Read more at thefiscaltimes.com ...

TOPICS: Business/Economy

KEYWORDS:

Who is going to buy the car and pay the taxes for the construction? The minimum wage, part time workers retail and hospitality? Who is going to pay the taxes for these people to be on government assistance. If this a great economy, we are in big, big trouble. I guess just printing more money is the answer.

1

posted on

12/06/2015 7:41:12 AM PST

by

cp124

To: cp124

car sales, forecast to have had the best November on record, still on pace for a record year.Per Zero Hedge:

Way back in June, we noted that auto sales had reached 10-year highs on record credit, record loan terms, and record ignorance. We based that assessment on the following set of Q1 data from Experian:

Average loan term for new cars is now 67 months - a record.

Average loan term for used cars is now 62 months - a record.

Loans with terms from 74 to 84 months made up 30% of all new vehicle financing - a record.

Loans with terms from 74 to 84 months made up 16% of all used vehicle financing - a record.

The average amount financed for a new vehicle was $28,711 - a record.

The average payment for new vehicles was $488 - a record.

The percentage of all new vehicles financed accounted for by leases was 31.46% - a record.

In short, the "renaissance" in US auto sales is being driven (no pun intended) by increasingly risky underwriting practices and this is leading directly to the securitization of shoddier and shoddier collateral pools in a return to the "originate to sell" model that drove the housing bubble over a cliff in 2008.

As Comptroller of the Currency Thomas Curry recently put it, "what's happening in the auto loan market reminds me of what happened in mortgage-backed securities in the run-up to the crisis."

2

posted on

12/06/2015 7:51:39 AM PST

by

ChildOfThe60s

(If you can remember the 60s, you weren't really there....)

To: cp124

“But here’s the good news: Manufacturing now represents a relatively small segment of the U.S. economy”

Yeah, real good news. Idiot.

To: cp124

Yep. Washers, dryers, refrigerators and toaster sales don’t matter. With the electricity Obama is keeping from being produced via coal, these conveniences are just superfluous.

4

posted on

12/06/2015 8:03:56 AM PST

by

Gaffer

To: cp124

When there comes a war it is going to matter a lot.

When the USA can no longer borrow more money or pay the interest on the debt then it is going to matter.

When the “Free Money” spicket is therefore turned off then it is going to matter a whole lot.

5

posted on

12/06/2015 8:28:58 AM PST

by

Revel

To: cp124

What no one talks about:

To create wealth you must make something. Whether it is a bushel of potatoes or an airplane, one has created something others want.

That is why short term., the news sounds good. Long term, it means a much much lower standard of living.

To: ChildOfThe60s

Your post is excellent, but it is even more ridiculous than you suggest.

My dealer has pestering me to purchase a $65,000 truck on no down, trade in only, 6 year loan.

I am soon to be 88 years old.

To: old curmudgeon; cp124

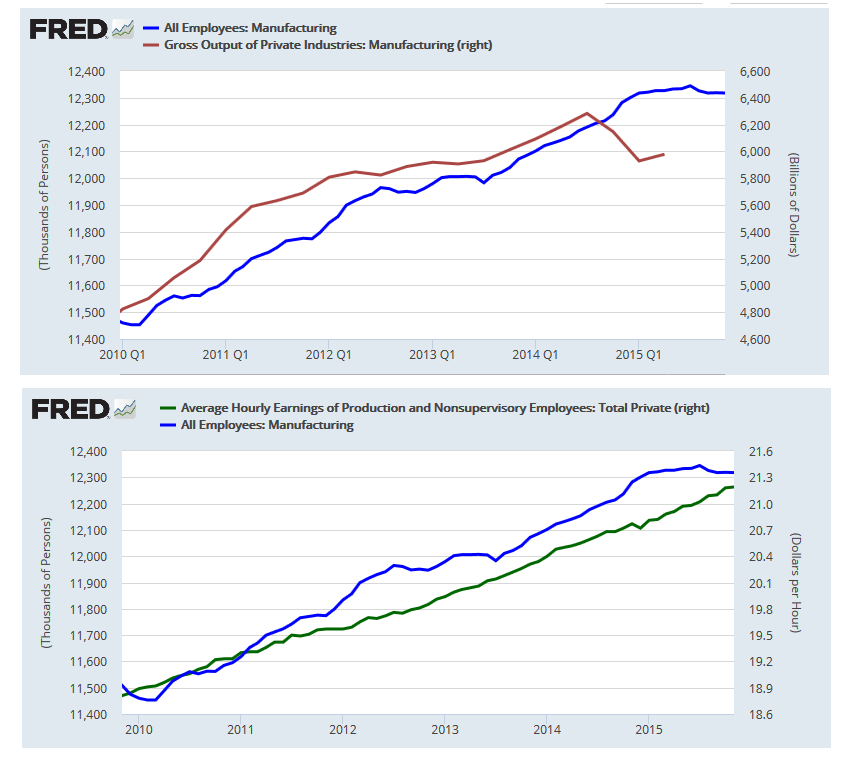

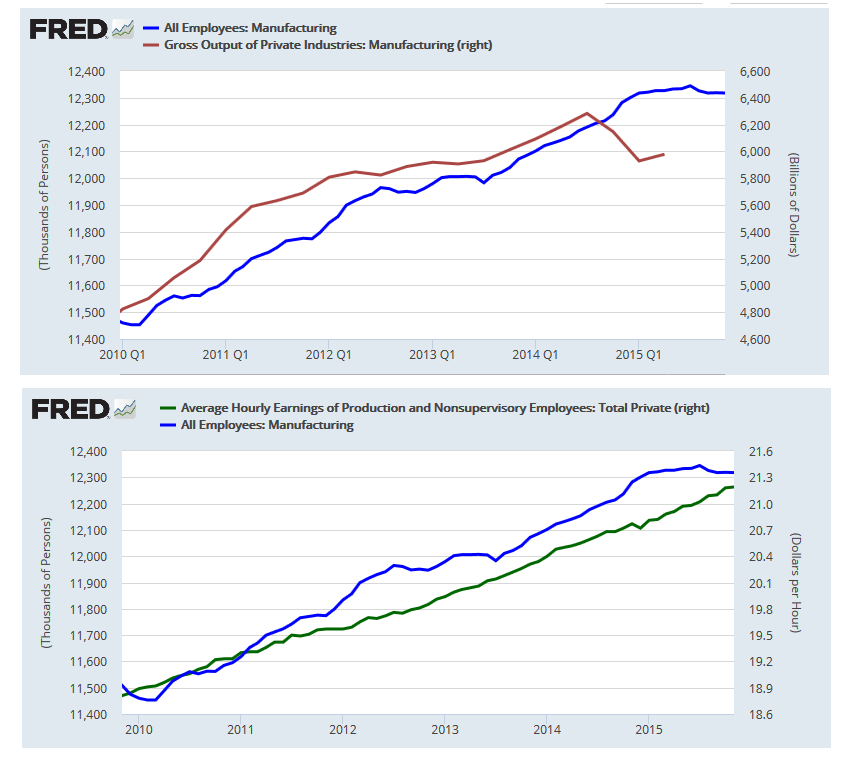

To create wealth you must make something. Whether it is a bushel of potatoes or an airplane, one has created something others want.OK, so right now the stuff U.S. factories make is worth $twelve billion more than it did in 2010 --that's a 25% increase.

Those are hard clear numbers but for some reason the article's just full of mushy fuzz words like "activity" that's some how "grim" even though it's "..solidly above the level that would indicate another recession..."). Even more weird is how they say that their index of manufacturing employment's down when the actual number of manufacturing employees is at an all time high --it's at an 800 million increase since 2010. On top of that they totally leave out factory wages which are also at an all time high --$21.20 compared to $18.60 back in 2010.

Yeah, I know that everyone on the FR seems to really want to hear just bad things for the US, but eventually we've got to accept reality on its own terms and be willing to take the good with the bad.

To: expat_panama

That is interesting, but it would be more interesting if you compared our 200 7working age population to that of today; actually 2001 might be better.

Then compare the percentage of working age people with a job to that of today.

Thenn factor in goods produced, wages and inflation.

I don't think it would look so rosy.

As for total cost of goods manufactured, it takes many fewer people to manufacture a billion dollar jet fighter, even considering all of the vendors that supply electronics, etc. than it does to make a billion dollars worth of furniture, socks, T-shirts, etc.

So yes, a smaller percent of the population is doing OK. The larger part is not.

To: old curmudgeon

...more interesting if you compared our 2007 working age population to that of today...Yeah, I agree 100% that I'm more interesting than the article, but that would be a different thread. The article only cares about 2010 to now and they seem to be using bogus info besides the fact that they ignore factory output going back to 2001. If you're curious about how things added up earlier, you're welcome to check out the Fed's data set for mfg employees, industry output, and production wages.

Neither of us has to say that the Fed's numbers are right, but we do have to know that they don't match w/ article's theme of "grim" manufacturing.

To: expat_panama

I don't plan to discuss who is more interesting or who is smarter, so this will be my last comment.

Your figures do not prove the point you intend because your figures compare recent numbers with 2010, which was probably one of if not the worst year of this recession...two years after the housing market crash when the unemployment numbers where terrible and when as I recall a huge number of people were drawing their two year long unemployment checks.

To see where we really are, the comparison would have to be with one of our better years when almost everyone who wanted a job had a job.

And that is my final word on the topic as it says all I need to say.

To: old curmudgeon

Sounds good. tx for coming back to me.

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson