Posted on 08/29/2021 7:00:36 PM PDT by SeekAndFind

301 AD was a big year for the Roman Empire.

That was the year that, amid spiraling inflation, Emperor Diocletian issued his Edict on Maximum Prices, essentially fixing prices of just about everything across the Roman Empire.

The price of wheat, a day labor’s wages, a quart of olive oil, transportation rates– everything was established by the Emperor’s edict, and enforced under penalty of death.

Diocletian’s edict infamously didn’t work, and the empire plunged into even more severe inflation.

The other big event of 301 AD was the introduction of the solidus gold coin, roughly 4.5 grams of nearly pure gold.

And while the Romans had a history of debasing their other coins, like the silver denarius and sesterce, the government actually did a pretty good job maintaining the value and purity of the gold solidus.

Even hundreds of years later, after the western empire in Rome had fallen to the barbarians, and imperial power was concentrated in Byzantium, the gold solidus was still approximately as pure as it was in the early 300s.

That’s an extraordinary track record for currency stability. Confidence in the gold solidus was so high, in fact, that various tribes and kingdoms around the world used the coin for trade and savings.

This became a source of pride for the Byzantine Empire; Justinian I, who ruled in the mid 500s, stated that the solidus was “accepted everywhere from end to end of the Earth,” and that it was “admired by all men in all kingdoms, because no kingdom has a currency that can be compared to it.”

It wasn’t until the mid 11th century, more than seven centuries after the introduction of the solidus, that an Emperor began to debase the currency.

Just like Hemingway described going bankrupt, the debasement of the solidus was gradual… then sudden.

Emperor Constantine IX, who ruled from 1042 to 1055, reduced the gold purity down to 87.5%. His successor brought it down to 75%. By the end of the century it had been reduced to just 33%.

The rest of the world took notice. The Byzantine Empire’s political, economic, and military power were waning. And with the rapid debasement of the solidus, international traders looked for other options.

Soon the rising Italian city states, particularly Venice and Florence, began minting their own gold coins; Italy was rapidly becoming the dominant economic power in Europe, so their ducats and florins became widely accepted, essentially replacing Byzantine coins for international trade.

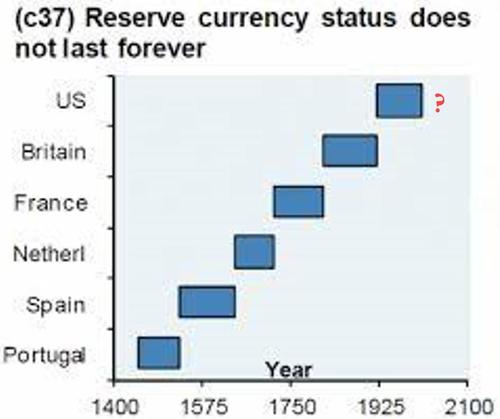

Throughout history, in fact, reserve currencies have routinely changed, just as frequently as power and wealth shift.

For example, the Spanish real de ocho was the dominant reserve currency for hundreds of years, just as the Spanish Empire was the dominant power in the world.

But eventually Spain’s wealth and power waned, and the real de ocho was replaced. The Dutch guilder dominated European trade in the 1600s and 1700s, just as the Netherlands’ wealth and power soared. Yet they were displaced by the British Empire and pound sterling in the 1800s and early 1900s.

Both the United States and the US dollar have held this status for the last 80 years. And at the moment this is still the case.

History, however, is very clear on this point: wealth and power shift. Reserve currencies change. And it would be foolish to assume that this time is different.

Reserve currencies hold their status because the rest of the world has confidence– confidence in the soundness of the currency, confidence in the power and prestige of the country that issues it.

But let’s be honest: the rest of the world is probably not brimming with confidence in the United States right now.

They’re looking at this shameful, disgraceful catastrophe in Afghanistan and wondering, “Is this seriously the world’s dominant superpower?”

But it’s more than Afghanistan. It’s endless deficits. It’s ridiculous spending initiatives that pay people to stay home and NOT work. It’s rising inflation thanks to the continued erosion of the US dollar.

None of these inspires confidence.

It was nearly 1,000 years ago when foreign traders began looking for new options after they lost confidence in the solidus, and in the Byzantine government.

Today there are already international banks, multinational businesses, and foreign governments that are starting to diversify out of the US dollar.

This is a major change. It’s not something that will happen overnight; like the solidus debasement, it will happen gradually… then suddenly.

There will be small milestones and minor events that take place over a period of many years. A lot of it has already happened.

But the end result will be a sharp decline in the US dollar’s market share of global reserves. And for anyone holding US dollars, that’s going to mean a LOT more inflation.

only time will tell

Gradually...then suddenly...

It is an interesting story how Britain debased their coinage like The Roman Empire did.

I understand the political frustration underlying these speculations but there is no good alternative.

The dollar is weaker but still vastly stronger than all other currencies.

We are the final power. China has no shot.

But if you like surprising malicious bio weapons, China is your sovereign.

Probably never,

I’ve been hearing about the imminent loss of the Reserve Currency status of the dollar for 20+ years now.

And yet like Flying cars, electric cars, cures for Baldness and Cancer, Solar + Wind being competitive with fossil fuels it never comes.

Agreed.

I’d give it two more weeks of gradual. Tops.

Yikes!

I continue to wonder how Bitcoin and the various other crypto currencies will fit into the reserve currency situations of the future. At the moment I am clueless about what will happen and how soon it will unfold. Yet there is something going on. I just do not know exactly what it is or what it will be.

I recommend stories of the Civil War, Abraham Lincoln and the greenback.

The real reason JFK was assassinated and how he started the silver certificate which was then revoked by Johnson.

The real reason why Garfield was assassinated.

The real reason why McKinley was assassinated.

Why Trump was really impeached. What Nixon was about to do before he messed up and resigned.

They all have something in common, every single one of them and it starts with the impeachment of Andrew Johnson.

Seek out UK’s debasing of the coinage too because it ties in with those assassinations and impeachments.

“in 1560, under the instructions from the queen, Thomas Gresham withdrew all debased coinage from circulation and had the withdrawn coins melted down and replaced with newly minted coins with high fineness. An estimated £50,000 was gained by the crown in the process. In 1561 milled coinage was introduced into England by French moneyer Eloy Mestrelle replacing the often crude hammer struck coins.”

Gresham’s law:

Gresham’s law is a monetary principle stating that “bad money drives out good.”

It will be fine as long as it is backed by gold. Once it isn’t, look out below!

The above was me back in 1970.

RE: It will be fine as long as it is backed by gold.

Ergo, IT ISN’T FINE.

Correct. You can’t replace something with nothing.

Gold bug types never understand that the dollar is the prettiest dog in an Ugly Dog contest and so wins.

bmp

Bingo!

Three years tops if dems get their way.

My prediction is...not long.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.