Posted on 01/27/2022 6:07:48 AM PST by millenial4freedom

Bill Ackman disclosed a new, billion-dollar bet on Netflix in a letter to clients on Wednesday.

Ackman's Pershing Square has snapped up more than 3.1 million Netflix shares since Friday, giving it a roughly $1.1 billion position, the billionaire investor revealed. His hedge fund's 0.7% stake makes it one of the video-streaming giant's 20 largest shareholders, he noted.

(Excerpt) Read more at msn.com ...

I wonder how well Ackman will get along with that schmutz Barack Obama.

Buy! He knows something we don’t.

Ackman endorsed Michael Bloomberg as a prospective candidate for President of the United States in the 2016 presidential election. He is a longtime donor to Democratic candidates and organizations, including Richard Blumenthal, Chuck Schumer, Robert Menendez, the Democratic National Committee, and the Democratic Senatorial Campaign Committee.

He’s hoping people like you believe that he knows something. Not all of his endeavors have been successful, and I believe this is another one. Short term perhaps, long term I don’t think so.

Probably he just bothered to read the article and not the headline. There was the big news of Netflix subscriber count being lower than expected. The headlines all said “x million fewer subscribers” but the story was “x million fewer NEW subscribers”. So the stock tanked, but subscriber count is still going up, the company is still strong. That’s pretty much textbook good time to buy.

Agreed. I’m not sure how their stock moves up in a big way.

Netflix’s years of exponential growth are at an end.

They are also too big for an acquisition even from the Big Five.

GOOD! Streaming entertainment is the future. (and present)

Hollywood is DEAD!

Gonna Lose His Ass

Netflix is near dead for the future.

It’s just not necessary anymore.

Big chunk dumping because it’s too woke.

Big chunk see FireStick as a much better deal.

Streaming TV packages don’t really need it

YouTube has all many folks can ever watch.

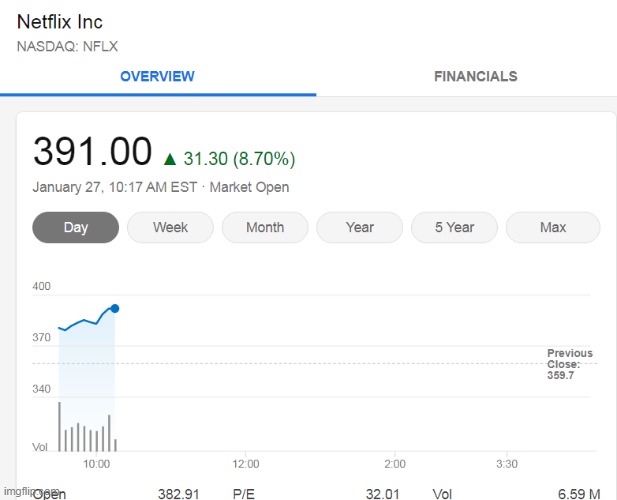

People like me don't move the market, but Ackman with a $billion one time bet on Netflix do. The stock is up more than 8% today, which translates to Ackman making more than $80 million dollars on his bet, and the day is young!

That’s today. This was friday:

https://freerepublic.com/focus/f-news/4031410/posts

45 billion of market cap went away on a crap headline. They were trading at about $520 before that. Buy in the dips.

If you follow your own advice, then you are a participant, even if just a small one perhaps. Buy your involvement encourages others to follow. Not you of you personally investing, but early rises after a big-hitter invests is a positive sign for others who fear they will miss the boat if they fail to act quickly to maximize their potential sure thing gains.

This SOB ought to be in prison...was talking down about the market in Feb and March of 2020 then bought in magically on March 23rd and made billions.

Their content is low quality, woke garbage.

So many free streaming services now as well...more people rediscovering the old antenna, etc.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.