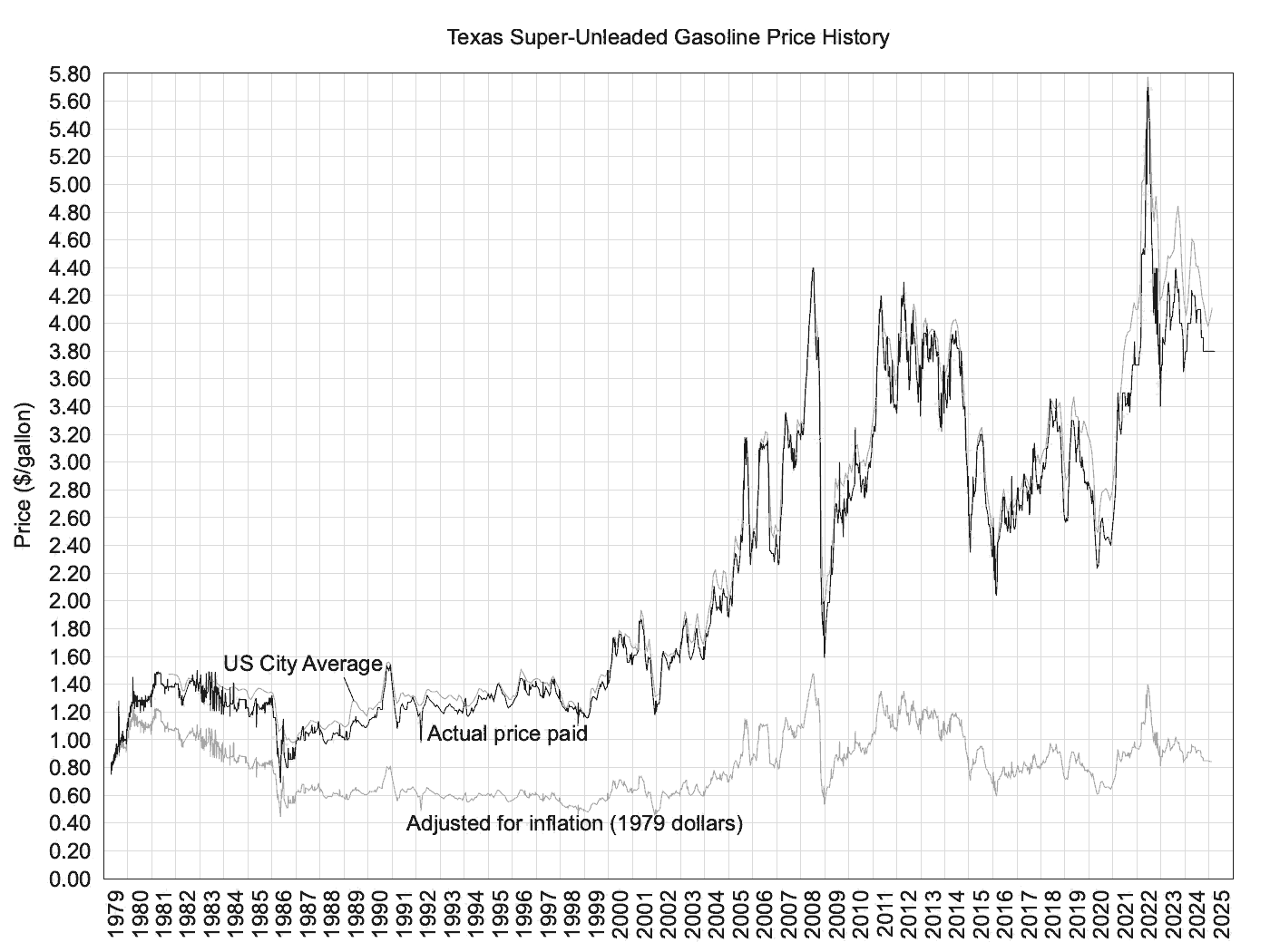

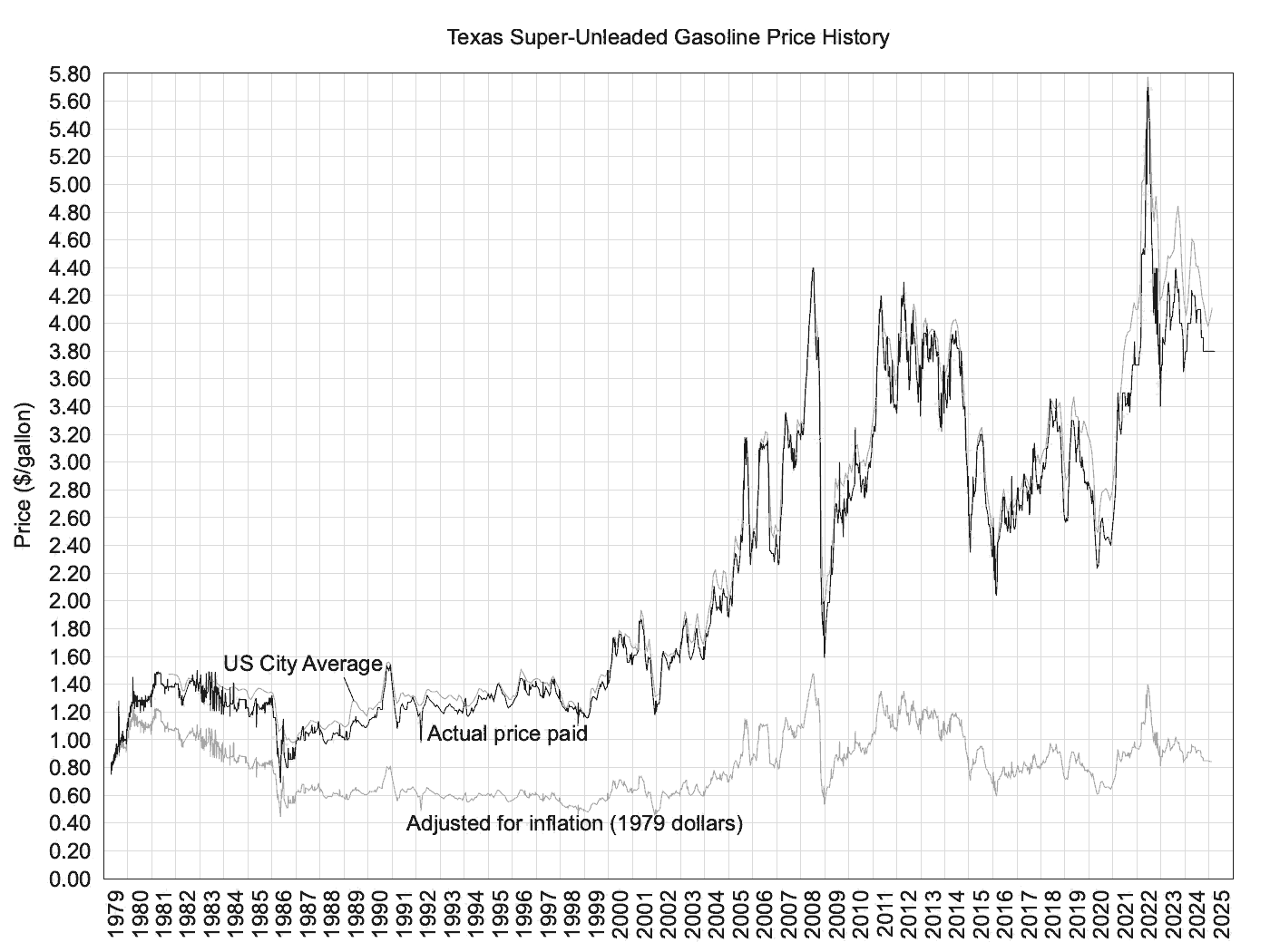

Adjusted for inflation, gas prices are around where they've been for the past 18 years.

Posted on 11/30/2004 7:25:27 AM PST by Toddsterpatriot

November 30, 2004, 8:40 a.m. The Oil Bubble II Listen for the “pop.”

In my column last month (“The Oil Bubble: Set to Burst?”) I discussed the speculative factors that pushed oil prices to all-time highs. I pointed out that despite fear of supply outages stemming from terrorism and a series of odd events, virtually every fear so far has gone unrealized: Terrorism has not removed a single barrel of oil production. Oil output in Saudi Arabia, instead of falling due to terrorism as some have feared, has increased by more than 1 million barrels a day. OPEC has steadily increased production and consistently outpaced analyst estimates of its capacity. Production at Russian oil giant Yukos has not fallen. And, despite a difficult war in Iraq, production in that country has averaged 2 million barrels a day this year — a 68 percent year-over-year increase. The only meaningful supply interruption to hit the oil industry this year was four back-to-back hurricanes in the southeastern U.S.

All of these non-shocks are sucking some of the speculative air out of oil prices. In the past three weeks, despite no significant developments on the macro front, oil prices have fallen by more than $9 a barrel to around $46. There was a similar correction at the end of August when fears of a terrorist attack during the Republican convention went unrealized. The “fear” premium in oil, approximately $15 a barrel currently, fluctuates with events, but I continue to believe that the absence of a significant prolonged supply outage will gradually push speculative money out of oil.

In addition to speculation and fear, improvement in demand earlier this year played a role in the oil-price rise. Growing oil consumption led to concern about the level of spare production capacity and a debate about how much of the upswing in oil prices was due to speculation and how much might be due to fundamentals. Until recently, oil-price appreciation did not seem to affect consumption. However, this is no longer the case.

U.S. oil demand grew 1.6 percent in the third quarter, down from 2.3 percent in the first half, according to the Department of Energy. Gasoline demand in the third quarter was flat with a year ago, after increasing 2.4 percent in the first half. In third-quarter conference calls, every major oil company and independent refiner that provided domestic same-store gasoline-sales information noted deterioration. Conservation and changes in consumer preferences (both in response to high gasoline prices) and perhaps the modest slowdown in economic growth have impacted demand.

Gasoline demand typically falls when the nationwide average retail price exceeds $1.60 a gallon. Currently, the average retail gasoline price is $2.01 a gallon. In a relatively short period of time, consumer preferences have changed. Sales of mid- and large-size sport utility vehicles declined 1 percent in the third quarter despite large discounts and rebates offered by manufacturers. At the same time, sales of fuel-efficient hybrids — such as the Honda Insight and Toyota Prius — grew more than tenfold in the third quarter from a year ago.

The importance of the U.S. gasoline market cannot be overstated given its size. Third-quarter gasoline demand was 9.2 million barrels a day. Demand for this one product matches the consumption of all petroleum products in China, India, and all of Eastern Europe combined. Even a small change in U.S. gasoline consumption has a pronounced impact on world oil demand.

U.S. jet fuel consumption has also slowed. The DOE reports that jet-fuel demand growth slowed from 3.2 percent in the first half of 2004 to 1.7 percent in the third quarter. While the growth rate in available seat miles for commercial flights declined modestly, the slowdown in fuel consumption may be influenced more by cost-cutting measures. As fuel prices rose airlines reduced engine idle time when planes were not in motion, cut wind resistance by polishing aircraft exteriors on more frequent schedules, and reduced flight speeds and the amount of fuel carried.

Chinese oil consumption has also been strong, but estimates show a slowdown from the torrid pace of earlier this year. According to the International Energy Agency (IEA), oil demand increased by 19 percent in the first quarter and 25 percent in the second, but only 7 percent in the third.

More recently, the Chinese government has moved to slow consumption and economic growth by allowing refined product prices to rise (although prices remain below world market levels), tightening credit, and increasing interest rates. Also, coal-fired power generation has reportedly increased, reducing the call on more expensive diesel-powered generators.

Historically, China’s oil demand has grown fast, averaging just under 6 percent annually in the past decade, although growth has been erratic. The International Energy Agency estimates that oil demand grew 19.3 percent in 1993, followed by no growth in 1994. Similarly, demand grew by 7 percent in 2000, only to be followed by 2 percent growth in 2001.

Meanwhile, on the supply end, oil production outside of OPEC has reached a record high at more than 50 million barrels a day in October, according to the IEA. Aside from the hurricane impact, production has been steadier this year than in the past. Production should rise by 600,000 barrels a day in the fourth quarter as shut-in Gulf of Mexico production returns and new fields in West Africa ramp up. In 2005, non-OPEC production should rise by 1.3 million barrels a day compared with world oil-demand growth of 1.4 million barrels a day.

As for OPEC, production has surpassed everyone’s expectations, with production higher than expected for the most unlikely members — Libya, Iran, and Nigeria. Since mid-year 2003, these three nations have increased production by 800,000 barrels a day. In the same time frame, OPEC (excluding Venezuela and Iraq) has increased production by 2.3 million barrels a day. In total, OPEC has increased output by over 4 million barrels a day to 30.3 million barrels a day.

After a pullback in U.S. crude-oil inventories in August, as refined products built, and the hurricane effects of September, oil stocks have resumed their upward course. This confirms industry data showing that supply has exceeded demand all year. Year to date, DOE data show that crude-oil inventories held by industry rose by 19 million barrels. Inventories rose in each of the past six weeks, by a total of 20.2 million barrels, as hurricane recovery began. In addition, the U.S.-government-held Strategic Petroleum Reserve has increased by 33.3 million barrels so far this year, with other reserves worldwide also in well-built positions.

The recent retreat in oil prices reflects only a small pinhole in the oil bubble. Fundamentally, oil prices should be in the high $20-a-barrel range today, based on supply/demand economics and current inventory levels. Eventually, the barrel price should decline to the low $20s as oil inventories continue to build. The oil price still reflects about $15 a barrel of speculation.

The oil bubble will indeed burst. The inventory rise will continue, thereby justifying a lower price fundamentally and reducing the fear premium. Production should grow on schedule without major interruptions. The absence of a supply shock should also reduce speculation. Finally, a weakening price will feed on itself.

— Frederick P. Leuffer, CFA, is senior managing director and senior energy analyst for Bear, Stearns & Co. Inc.

As for OPEC, production has surpassed everyone’s expectations, with production higher than expected for the most unlikely members — Libya, Iran, and Nigeria. Since mid-year 2003, these three nations have increased production by 800,000 barrels a day. In the same time frame, OPEC (excluding Venezuela and Iraq) has increased production by 2.3 million barrels a day. In total, OPEC has increased output by over 4 million barrels a day to 30.3 million barrels a day.

Hey Willie, didn't you say globalism was causing oil production to fall? According to this it keeps rising. Maybe you were mistaken?

Very interesting.

Experiment: Ask ten people on the street why gas prices are higher now than last year, and you'll get "Iraq" as the answer eight times, and "Bush" as the other two.

While I basically agree with this assessment notice that every single fact mentioned buttresses the bearish argument. It's inconceivable that there aren't at least some facts that would support the other side of the argument but these are omitted. Just an observation.

We should hav a government study to find out more about this...

Has anyone noticed that we're (Avg Americans) almost to the point of acceptance when it comes to HIGH gas prices at the pumps? It was the plan all along...

Has everyone forgotten the HUGE spikes in gasoline prices at the pumps which were based on speculation of terror, weather and other falsities which never materialized? Were these "profits" that were extorted from us ever returned to us in the form of lower prices?

LOL Scam after Scam after Scam... Why do we continually tolerate the intolerable!

Today SA announced that they will up oil production again. Likely they want to kill plans to try to drill in ANWR and stiffle efforts to broadly market hybrid cars. They can do this by making oil and gas periodically cheaper. We are headed for a cheaper time.

As a full time RV'er, I get to drive again, just in time for the snow birds.

Unnecessary sarcasm alert!

It sounds reasonable to me.

Has anyone else heard that?

Am I missing something here?? This guy says oil is going to drop another $20 a barrel?? C'mon...

Exactly, the $2.25 price per gallon were all about getting people used to paying around $1.90 or so without a complaint. Now when the local Costco has regular unleaded for $1.85 people go nuts. It was not that long ago, that gas was going for a buck thirty five or so. We have been fleeced, and no one coming on here will convince me that the oil companies did not plan to drive prices high, using the WOT as cover. Thanks GW, for doing nothing about this, we have been fleeced with the permission and blessing of the "Powers that Be" again.

Adjusted for inflation, gas prices are around where they've been for the past 18 years.

See my #13.

"Thanks GW, for doing nothing about this"

Tell me again, how the president can do anything to control the stock market?

These high prices were based on a 'speculative' outcome of (possibly) predicted disasters that didn't occur.

Releasing part of the reserve into the market would have done nothing, especially since the market is 'flooded' with oil as it is.

How is the president supposed to 'control' this?

I have to admit, the plan is brilliant! and it's not just executed in the petroleum arena.

Not so sure it's all GW... However, it would be nice if someone or something stepped in and stopped the extortion.

Forgive my ignorance..., but does that mean the prior to the high prices, we've (Avg Americans) have been ripping off the oil companies?

Wow. I didn't realize that US gasoline consumption was quite this significant.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.