Posted on 2/22/2009, 8:15:56 PM by An Old Man

B I G - - - - - C L I P - - - - - - -

Unsustainable Policies & Practices

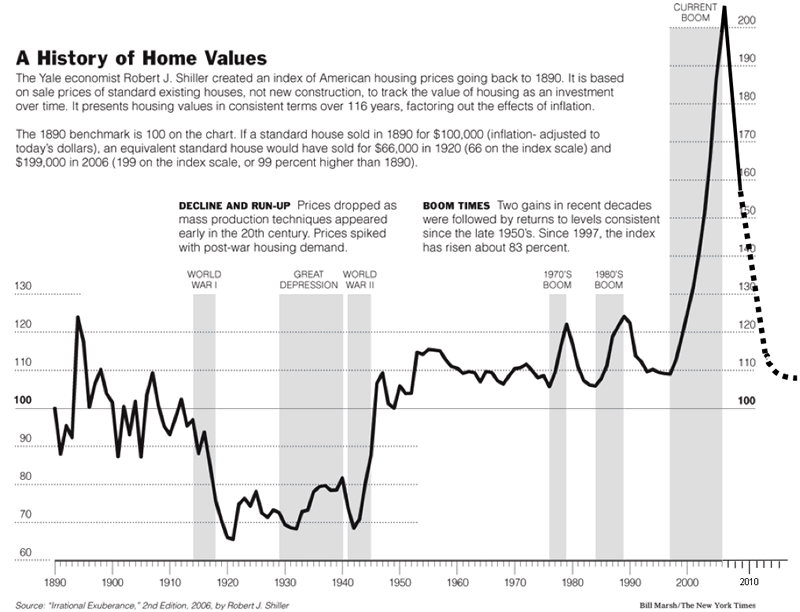

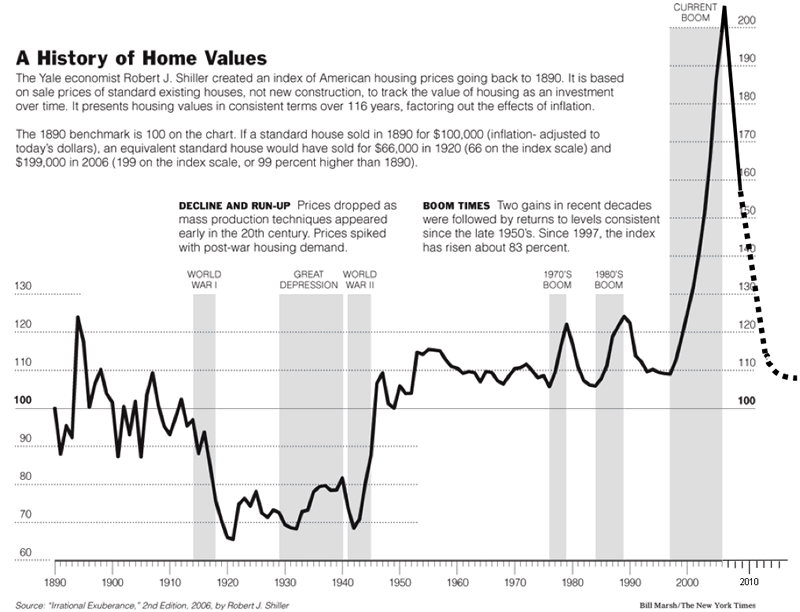

The definition of unsustainable is, not able to be maintained or supported in the future. To me, a picture is worth a thousand words.

Source: Robert Shiller

As Congressional moron after Congressional moron goes on the usual Sunday talk show circuit and says we must stop home prices from falling, I wonder whether these people took basic math in high school. Are they capable of looking at a chart and understanding a long-term average? The median value of a U.S. home in 2000 was $119,600. It peaked at $221,900 in 2006. Historically, home prices have risen annually in line with CPI. If they had followed the long-term trend, they would have increased by 17% to $140,000. Instead, they skyrocketed by 86% due to Alan Greenspan's irrational lowering of interest rates to 1%, the criminal pushing of loans by lowlife mortgage brokers, the greed and hubris of investment bankers and the foolishness and stupidity of home buyers. It is now 2009 and the median value should be $150,000 based on historical precedent. The median value at the end of 2008 was $180,100. Therefore, home prices are still 20% overvalued. Long-term averages are created by periods of overvaluation followed by periods of undervaluation. Prices need to fall 20% and could fall 30%. You will know we are at the bottom when the top shows on cable are Foreclose That House and Homeless Housewives of Orange County .

Instead of allowing the housing market to correct to its fair value, President Obama and Barney Frank will attempt to “mitigate” foreclosures. Mr. Frank has big plans for your tax dollars , "We may need more than $50 billion for foreclosure [mitigation]". What this means is that you will be making your monthly mortgage payment and in addition you will be making a $100 payment per month for a deadbeat who bought more house than they could afford, is still watching a 52 inch HDTV, still eating in their perfect kitchens with granite countertops and stainless steel appliances. Barney thinks he can reverse the law of supply and demand by throwing your money at the problem. He will succeed in wasting billions of tax dollars and home prices will still fall 20% to 30%. Unsustainably high home prices can not be sustained. I would normally say that even a 3rd grader could understand this concept. But, instead I'll say that even a U.S. Congressman should understand this.

A N O T H E R - - - - - B I G - - - - - C L I P - - - - -

“All tyranny needs to gain a foothold is for people of good conscience to remain silent.” Thomas Jefferson

When I was a kid and I'd read something fascinating in a book, I'd breathlessly tell my Dad what I'd learned. He'd look up from his newspaper and say, “Don't believe everything you read”. I'd be so mad, but his advice produced a world class skeptic. Don't believe anything or anyone until you've verified their facts and figured out their motives. If you are tired of remaining silent and have ideas you want to discuss, join me at TheBurningPlatform.com to have a forum for ideas that can put our country back on track.

By James Quinn

The article is quite long but considering the state of the economy, a worthwhile read.

Brace yourselves for the market opening, considering the $ocialist tax increases and new spending announced through the weekend. Gold to keep soaring.

But who would warn us in 2006?

bump for later

Yep.

If mortgage money is available around the country, good banking practices are in place, and rates go to 4 to 4.5%, I believe the real estate market will self adjust. But not to where is was, but to where it should be.

In some spots built up specifically to be almost plausibly “commutable” to Silicon Valley, drops of 75% from the 2005 peak to present REO sale price are not out of the question.

I won’t mention the specific place I have in mind because I’ve been aced out of two of them in the past month.

From what I’ve seen in our Philadelphia suburb, values are holding reasonably well too. Sales are slow, and there are more sheriff’s sales than usual, but it doesn’t appear catastrophic. Values didn’t skyrocket here during the boom years like they did in a lot of other areas. They climbed, but more gradually. Going forward, a lot depends on employment, of course. I’m glad we bought in 1993, so at least we didn’t come in at a grossly inflated price.

if anything...the housing market in Nevada, California, Virginia, Florida, etc were the obscene outliers....the rest of the country had steady and slow growth....

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.