Posted on 06/29/2010 9:57:07 PM PDT by blam

Plunging Consumer Confidence and Treasury Yields, Economic Depression Is Here

Economics / Great Depression II

Jun 29, 2010 - 01:46 PM

By: Mike Shedlock

Is that a 3-handle I see on the long bond and a 2-handle of the 10-year treasury? Why yes it is.

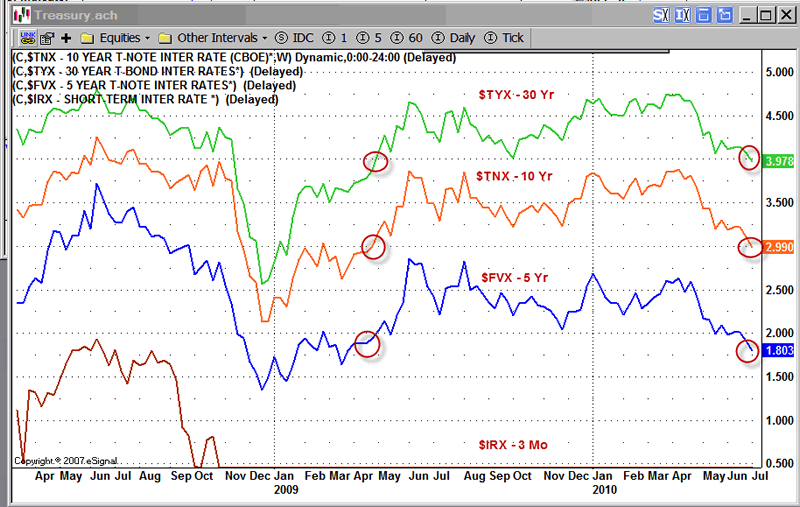

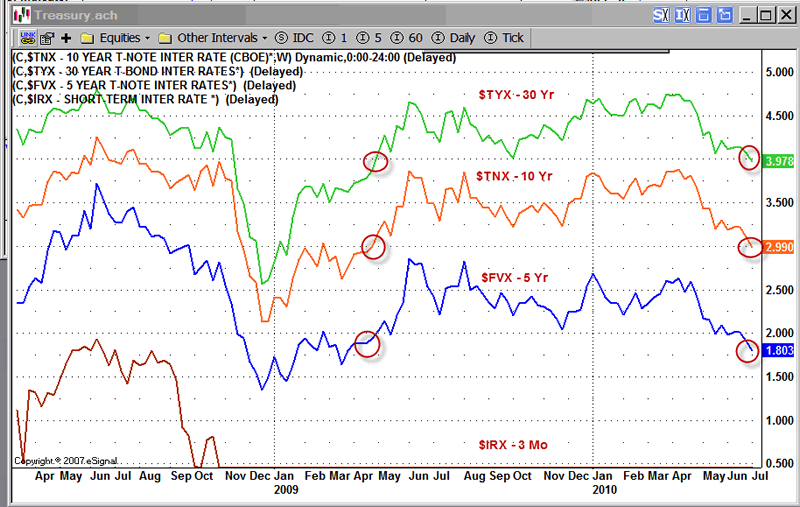

Treasury Yields - Weekly Close

The week is not over yet but this looks rather ominous. Treasury yields are back where they were in April of 2009 at the start of the so-called "recovery".

I am not quite sure why the 3-month treasury displays as a flatline at .5. The flatline is closer to 0.

Consumer Sentiment Plunges

Inquiring minds note that the Consumer Conference Board Confidence Index Drops Sharply.

The Conference Board Consumer Confidence Index® which had been on the rise for three consecutive months, declined sharply in June. The Index now stands at 52.9 (1985=100), down from 62.7 in May. The Present Situation Index decreased to 25.5 from 29.8. The Expectations Index declined to 71.2 from 84.6 last month.

Those saying conditions are “good” decreased to 8.0 percent from 9.7 percent, while those saying business conditions are “bad” increased to 42.4 percent from 39.5 percent. Consumers’ assessment of the labor market was also less favorable. Those claiming jobs are “hard to get” increased to 44.8 percent from 43.9 percent, while those saying jobs are “plentiful” decreased to 4.3 percent from 4.6 percent.

Consumers’ short-term outlook, which had improved significantly last month, turned more pessimistic in June. Those anticipating an improvement in business conditions over the next six months decreased to 17.2 percent from 22.8 percent, while those expecting conditions will worsen rose to 14.9 percent from 11.9 percent.

An Economic Depression is Here

Either the present conditions are about to move back up or the expectations index is about to plunge as well. I expect the latter. Expectations for improvement are way too optimistic, not that a reading of 71 is optimistic at all. It isn't.

Structural problems are immense and the sad fact of the matter is those problems cannot be cured by more deficit spending. Krugman is correct about a depression, just wrong about the cure. Logically the disease and the cure cannot be the same.

By the way, a depression is not coming, we are clearly in one, a deflationary one at that. Once again, those chanting hyperinflation all missed the boat by light-years.

Various safety nets like food stamps, unemployment insurance, and of course people no longer paying their mortgage and living in their houses for free all mask over the depression.

Depression is The Price We Pay For Budgetary Murder and contrary to Krugman's belief, further budgetary murder cannot possibly cure anything.

Understanding The Problem

Before you can fix anything, you have to understand what the problem is and what caused it.

What causes depressions is an unsustainable runup in credit and debt that precedes it, NOT a failure to go deeper in debt.

Anyone who understands 5th grade math should be able to figure that out. Unfortunately, Nobel prize winning economists can't.

Congress, the Fed to Blame

In this case, a spendthrift Congress coupled with loose monetary policy at the Fed, effectively encouraged housing and other speculation. The depression we are in now is a result of massively failed policy. The same policy cannot possibly be the cure.

Give Congress the boot and vote in those against bank bailouts, Fannie Mae bailouts, excessive military spending the US simply cannot afford, and other free-lunch policies.

The inflationistas have been deriding David Rosenberg’s prediction for a “two handle” on the 10 year for months and months now.

Hmmm.

The CPI and PPI prints suggest that we not only have no inflation, we have slight deflation - for the past two months (CPI) and three months (PPI).

And now, the 10 year has a two handle.

Where oh where is the inflation that the bulls were worrying about?

Government debt is deflationary.

Demographics are deflationary when you have 77 million Baby Boomers hitting retirement age from 2007 to 2025 (all of whom desperately want to get out of their mcmansions and into little retirement condos).

The loss of credit availability to the private market is deflationary. The world has 50% less credit availability today compared to 2006.

Rising unemployment is deflationary.

Global overproduction of goods, services, and buildings is deflationary. The world has too many shopping malls, too many cargo ships, too many cars, too many computers, too many aircraft, too many factories, too many office towers...in short, too much of everything.

It’s in the universities — 30% to 40% hikes in rates after many years of 7% to 10% hikes. Of course, we all now who runs higher-ed.

When the SHTF, have a list, people. We need to take care of business.

sarc/

Interesting. BTTT.

If it comes to that, those on the list will have long since fled for greener pastures. Good luck.

And befriend a good herbalist/chemist, for when pharms are unavailable. Food does no good if you die from not having meds.

I agree with you on deflation but when the government has to continually print money to pay interest on those debts we will eventually see inflation as our currency is devalued.

Regardless, either scenario is not good and we are in big trouble!

What is a two handle? What is the significance?

The recovery blueprint is simple: The Consititution.

i have a very long memory, and always need in a good stretch of the legs.

Looks symmetrical, with no upside. No short term or long term upticks, so the market is going negative across the board. The Great Unwinding.

Bump

Amen, but with all the corruption in government, I really don’t see this story ending without a lot of blood-shed, honestly.

Sorry - trader lingo.

A “two handle” means that the first digit of the 10-year Treasury yield is a “2” - as in “2.990%” in yesterday’s market, or “2.95%” in the overnight market.

The significance: If we’re supposed to have inflation, then treasury yields should be going up. Indeed, that’s what the “smart” people on Wall Street and economists were projecting.

Here’s an example of what I speak:

http://online.wsj.com/article/SB10001424052748703523504574604351415337492.html

Here we are, halfway through the year, and we’re going firmly in the wrong direction to these forecasts.

Oh, and the other end of the yield curve? Golly, let’s have a look at those projections for 2+% yields on the 2’s, shall we?

http://online.wsj.com/article/BT-CO-20100629-712036.html

Huh. LOWER than the panic-buying of late 2008. Really? What does that tell us?

Well, it tells us that these clowns couldn’t forecast rain in Seattle, that’s what.

America began with a lot of blood shed. Nobody wanted it then, nobody wants it now, but it’s probably coming.

but we are paying thru the nose for services like airline travel,health insurance,car insurance.....

Money is coming out of corporate bonds and is coming out of stocks. Money is going into credit default swaps (betting on company failures) and into government bonds (flight to safety).

Congress just punted the most recent “bailout” (unemployment extension) and the ECB is telling Spain that it won’t renew its special $400 Billion line of credit this week.

“Everyone” knew that both of the above would get renewed...now, not so much.

If there was a better way to bring on deflation faster, the current world governments haven’t missed it.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.