More evidence the Executive, Legislative, and Judicial Branches of "our" government dance like puppets on a string for their masters on Wall Street.

One has to start wondering how many times THEIR mortgage obligation was used as a vehicle of unjust enrichment.

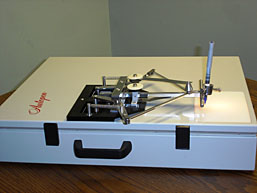

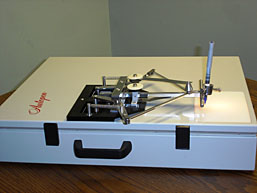

While you may have signed your on your loan docs just once and dutifully remained current with your payments despite the crushing effects of taxes, unemployment, etc., how many times has your "lender" copied your name with an "Autopen" to unjustly enrich themselves?

Speaking of taxes...the biggest tax cheat of them all...MERS...had better watch out. The next CAT 5 finacial hurricane is headed right their way.

KABOOM – Class Action vs MORTGAGE ELECTRONIC REGISTRATION SYSTEMS, GMAC, DEUTSCHE BANK, NATIONSTAR, AURORA, BAC, CITI, US BANK, LPS, et al

The headline should explain it all.

1 posted on

10/04/2010 7:35:18 AM PDT by

Chunga85

To: Chunga85

Community organizing and CRA follwed by illegals aliens - this will destroy FL.

2 posted on

10/04/2010 7:36:42 AM PDT by

Frantzie

(Imam Ob*m* & Democrats support the VICTORY MOSQUE & TV supports Imam)

To: Chunga85

This is nothing more than the government telling the mortgage holders to leave the home owners(?) alone....These home will be given to the occupants free...watch and learn. Those of us that pay our bills are about to get screwed.

3 posted on

10/04/2010 7:39:00 AM PDT by

devane617

(November!)

To: Chunga85

Read Karl Denninger’s analysis at “The Market Ticker.”

While this is a plaintiff’s complaint, and the defense to it isn’t stated, it looks pretty damning. There’s been a lot of rumbles about poor record keeping behind securitization.

Normally, someone who did such a bad job of documentation would get hosed by the courts. But, as seems so often the case these days, this is so huge that it is systemically destabilizing. The whole MBS market rests on sound title tracking, and here we have possibly trillions that have clouded ownership (never mind the underlying soundess of the loans) due to one of the biggest examples of the Peter Principle in action I have ever seen or heard of.

To: Chunga85

So I am seeing Rep. Grayson (D-Nutjob) on record as fighting this thing but no GOP? Is this MSM bias (and there is a Republican on the right side of this — and if so who?) or are the Florida GOPs so clueless that they are not trying to fix this? Hoping it is the former and not the latter. We should be the party of property rights, not yanking homes away from people prematurely.

6 posted on

10/04/2010 7:45:58 AM PDT by

VictoryGal

(Never give up, never surrender! REMEMBER NEDA)

To: Chunga85

Oh, it gets even better than that . . .

There have been a few news stories coming out of Utah in the last year or so about some problems with foreclosures there. These stories don't seem to have gotten a lot of attention, but the implications of the events out there are enormous. The issue at hand involves mortgages that were extended to home buyers over the years and later bundled and sold off by the original banks. It turns out that some of the companies that now hold these mortgages may have to meet some onerous requirements before they can foreclose on them, since in those cases the mortgages were originally cast under Utah state law and are now held by investors or other banks that don't meet Utah's banking standards. There are some people in Utah living in their homes for months after the banks have started foreclosure proceedings, simply because they're trying to figure out how to unravel that convoluted mess.

12 posted on

10/04/2010 7:54:07 AM PDT by

Alberta's Child

("Let the Eastern bastards freeze in the dark.")

To: Chunga85

I would imagine some people will stop making monthly payments on their mortgages until the recipients of that money can show they are legally entitled to it.

This mortgage situation could get very muddled. - Tom

To: Chunga85

There was a lawyer in the Tampa area that was handling cases where the debtor was facing foreclosure. His tactic was to demand to see the contract that the debtor signed. Since most mortgages are sold several times and the bookkeeping was so sloppy, most mortgage holders couldn’t produce the original, signed document. At the least it kept the person in the house for several months while the banks searched their files.

23 posted on

10/04/2010 8:09:38 AM PDT by

mbynack

(Retired USAF SMSgt)

To: Chunga85

Its called rule of law - aka produce the documents that

you actually own the property in question....

Recent tactic is to demand that those demanding foreclosure

produce the documents

If cant judge throws thwe case out

24 posted on

10/04/2010 8:17:38 AM PDT by

njslim

To: Chunga85

“how many times has your “lender” copied your name with an “Autopen” to unjustly enrich themselves? “

Never.

This looks to be a huge mess. The old ideas of people paying their bills and being accountable for their decisions seem to be fading.

Maybe the government will end up owning all the housing in our nation, and we can apply to live in in a home.

All of our comrades will cheer this development.

36 posted on

10/04/2010 8:49:33 AM PDT by

HereInTheHeartland

(Add some short, faux intellectual phrase here:)

To: Chunga85

The Florida Supreme Court ENDORSED the rocket docket system which allows such steam roller litigation.

The next step is easy, the banks will calculate how many employees are needed to avoid suspicion and they will hire them and include the number of employees in the stats.

The only way to eliminate blighted titles is for a legal reboot of the titles. The banks were bailed out and have no more money at risk. In fl attorneys are allowed to claim 3% of the loan amount automatically, that must end in order to encourage settlement.

(ps you forgot the FL Bar gets all the interest money from IOLTA accounts)

38 posted on

10/04/2010 9:00:29 AM PDT by

longtermmemmory

(VOTE! http://www.senate.gov and http://www.house.gov)

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson