Skip to comments.

What’s with big spread? {Alaska North Slope crude price soars above West Texas Intermediate}

Petroleum News ^

| Week of March 27, 2011

| Wesley Loy

Posted on 03/28/2011 5:00:18 AM PDT by thackney

Recently the price of Alaska North Slope crude oil has topped $117 per barrel — a remarkable development.

We’re also seeing another unusual trend. The price of ANS crude is running far above that of West Texas Intermediate, a high-quality crude that serves as the major benchmark for U.S. oil pricing.

On March 23, the price of ANS stood at $117.55, a $12.35 premium over WTI at $105.20, according to figures available on the Alaska Department of Revenue’s Tax Division website.

Normally, ANS and WTI prices are much closer together, with WTI often commanding a small premium. The last time this happened was on Dec. 23, when WTI held a $1.35 edge.

‘Shallow’ ANS market

So what accounts for the huge gap we’ve been seeing lately? It has much more to do with stresses on WTI crude as a benchmark than it does with any changes in the market for ANS crude.

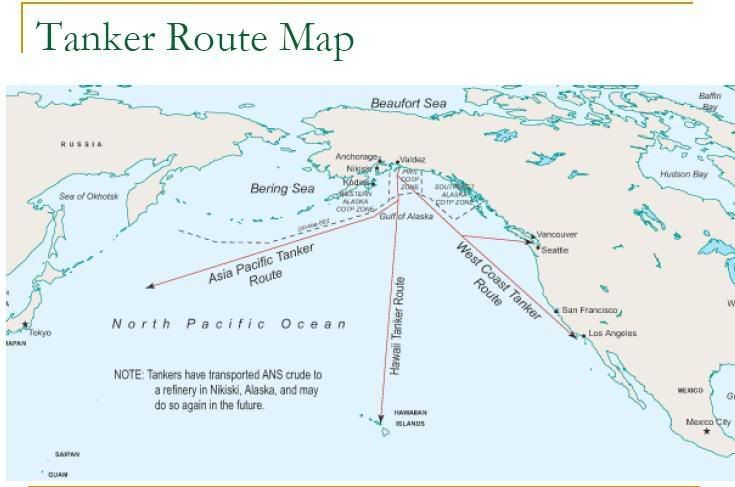

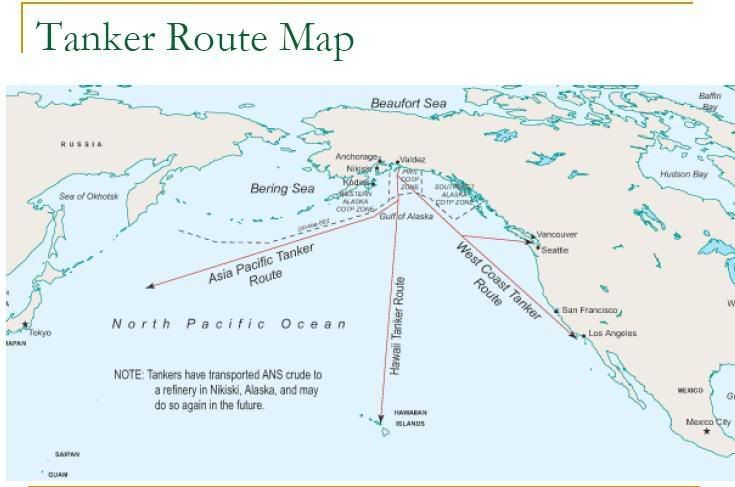

North Slope oil is delivered aboard tankers almost exclusively to West Coast refineries. It competes on the spot market with other crudes that can be hauled in by water from places such as South America, Mexico and Russia.

But the market for ANS crude is very shallow. That is, transactions are infrequent. In fact, most days go by without a spot market deal for ANS crude, said Joyce Lofgren, a petroleum economist with the Department of Revenue.

Of the three major ANS producers, ConocoPhillips is the most apt to sell oil, typically to Tesoro, Lofgren said. Tesoro has refineries at Anacortes, Wash., and in California at Los Angeles and Martinez.

Sales are rare involving the other two North Slope producers, BP and ExxonMobil.

Normally, the light, sweet WTI crude is worth a couple of dollars per barrel more than ANS, which is a little heavier and more sour — that is, it contains more sulfur, Lofgren said. Thus, ANS requires more refining.

Brent also well above WTI

In comparison with ANS crude, WTI is a landlocked crude — it doesn’t move on tankers. WTI crude goes by pipeline to the key oil storage and pricing hub at Cushing, Okla., and then to Midwest refineries making gasoline and other products.

Circumstances surrounding the movement of oil through the country’s midsection appear to have held down the price of WTI compared to U.S. coastal grades as well as North Sea Brent crude, the European benchmark.

Historically, WTI usually traded at a premium to Brent, again due to WTI’s relatively higher quality. But since December, the Brent price has exceeded WTI by as much as $19 per barrel, the U.S. Energy Information Administration reports.

The EIA as well as the financial and trade press have brimmed with analysis over what’s causing the unusually wide and persistent gap between WTI and other crudes.

Among the apparent factors:

• Cushing and Midwest refineries are oversupplied with crude, resulting in lower prices for WTI. One financial writer referred to the situation as the “WTI glut” or “Cushing glut.”

Rising crude imports coming down from Canada on existing and newly opened pipelines, plus the production surge from North Dakota’s Bakken shale, are contributing to the oversupply, the EIA and others write.

A lack of pipelines to carry oil south from Cushing to the Gulf of Mexico coast, rather than north into the Midwest, is seen as part of the problem.

• The market has worried that storage capacity is running out at Cushing, adding pressure to get rid of oil.

• Some see a “political premium” driving up some crudes such as Brent relative to WTI. This is a reference to the unrest in Egypt and neighboring countries.

Other factors driving up Brent prices include North Sea production outages and strong Asian demand for oil. So while WTI prices have remained relatively flat, Brent and other crudes including U.S. coastal grades have climbed, the EIA said.

So how long will the big gap between WTI, ANS, Brent and other crudes last? Everybody seems in agreement it will not become a new normal.

TOPICS: News/Current Events; US: Alaska

KEYWORDS: energy; northslope; oil

Navigation: use the links below to view more comments.

first 1-20, 21-25 next last

1

posted on

03/28/2011 5:00:24 AM PDT

by

thackney

To: SAJ; All

Huh, this is something that our ‘tin-foil’ colleges haven’t gotten around to yet. In the meantime the only factors I can think of are transportation costs and regional political expectations. Anyone else have ideas?

To: thackney

oil is less fungible than previously thought...at least right now

3

posted on

03/28/2011 5:26:51 AM PDT

by

dennisw

( The early bird catches the worm)

To: thackney

Ib4tct (...the conspiracy theorists).

To: dennisw

Key is understanding what each market actually is and where it is produced and supplied.

Cushing and Midwest refineries are oversupplied with crude, resulting in lower prices for WTI. WTI is a landlocked crude — it doesn’t move on tankers. WTI crude goes by pipeline to the key oil storage and pricing hub at Cushing, Okla., and then to Midwest refineries.

5

posted on

03/28/2011 5:34:53 AM PDT

by

thackney

(life is fragile, handle with prayer (biblein90days.org))

To: expat_panama

Pipeline capacity has been a problem for Bakken producers from pretty early on in the play, and still has not been adequately addressed.

I'm not complaining, though, gasoline is a mite cheaper here than on the coast.

6

posted on

03/28/2011 5:42:47 AM PDT

by

Smokin' Joe

(How often God must weep at humans' folly. Stand fast. God knows what He is doing.)

To: expat_panama

Much of the crude oil from the North Slope is exported to Japan and broadly affects the Asian market. The loss of a major nuclear facility in Japan and the improving Asian economies must inevitably cause an increased demand for North Slope crude oil. In addition, the alternative source of crude for Asia — the Mid East — is cast into doubt by the ongoing unrest in the Persian Gulf.

To: Rockingham

Much of the crude oil from the North Slope is exported to Japan Make that NONE, not much. It is far cheaper to send to the closer West Coast refineries.

8

posted on

03/28/2011 6:13:40 AM PDT

by

thackney

(life is fragile, handle with prayer (biblein90days.org))

To: Rockingham

Although Washington has no indigenous crude oil production, it is a principal refining center serving Pacific Northwest markets. Five refineries receive crude oil supply primarily by tanker from Alaska. However, because Alaskan production is in decline, Washington’s refineries are becoming increasingly dependent on crude oil imports from Canada and other countries.

http://www.eia.doe.gov/state/state-energy-profiles-analysis.cfm?sid=WA

- - - -

A network of crude oil pipelines connects production areas to refining centers in the Los Angeles area, the San Francisco Bay area, and the Central Valley. California refiners also process large volumes of Alaskan and foreign crude oil received at ports in Los Angeles, Long Beach, and the Bay Area. Crude oil production in California and Alaska is in decline and California refineries have become increasingly dependent on foreign imports.

http://www.eia.doe.gov/state/state-energy-profiles-analysis.cfm?sid=CA

- - - - - - -

From Valdez, tankers ship the ANS crude oil primarily to refineries along the West Coast. Those refineries are designed to process the intermediate, sour (high-sulfur) crude oil from the ANS. Alaskan crude oil production has been in decline since 1988, when output peaked at over 2 million barrels per day.

http://www.eia.doe.gov/state/state-energy-profiles-analysis.cfm?sid=AK

9

posted on

03/28/2011 6:19:32 AM PDT

by

thackney

(life is fragile, handle with prayer (biblein90days.org))

To: expat_panama; thackney

The spread between WTI and Brent is historically wide, too. As thackney very accurately points out, once crude goes into Cushing, it loses some marginal utility because it cannot be easily put into the int'l mkt from there.

When you see them starting to truck Cushing crude to Tulsa and subsequently barge it to the Gulf, you'll know the spread(s) will be narrowing substantially in short order.

10

posted on

03/28/2011 6:33:20 AM PDT

by

SAJ

(Zerobama -- a phony and a prick, therefore a dildo)

To: expat_panama; SAJ

More info at:

Energy Price Volatility and Forecast Uncertainty

http://www.eia.doe.gov/emeu/steo/pub/uncertainty.html

March 8, 2011 Release

Note this specifically talks about WTI versus Brent and the recent change in pricing spread. The same is applicable for ANS crude. However ANS is a small market and not traded often as much of the oil is long term contracts to West Coast refinery.

11

posted on

03/28/2011 6:38:24 AM PDT

by

thackney

(life is fragile, handle with prayer (biblein90days.org))

To: SAJ; thackney; Rockingham; Smokin' Joe

It’s really a pleasure beginning a beautiful Monday morning with a great cup of coffee, personal income & spending up, and getting input from people who know what their talking about.

Thanks!

To: thackney

“Make that NONE, not much. It is far cheaper to send to the closer West Coast refineries.”

You mean the ones to be built in Baja Mexico? The tree-huggers on the west coast aren’t keen to increase refinery capacity to handle all that crude.

To: RFEngineer

Increase???

Alaskan Crude always went to the West Coast. (except for a few percent that went overseas in 1996-2000 during the West Coast oil glut)

However the production has been declining for years. What increase are you talking about?

14

posted on

03/28/2011 7:19:44 AM PDT

by

thackney

(life is fragile, handle with prayer (biblein90days.org))

To: thackney

I stand corrected. I believe that the larger point remains valid: that the Asian/Pacific crude oil market, of which Alaskan crude oil production is a part, has upward pressures for the reasons stated.

To: Rockingham

Yes I agree. Demand is climbing more than supply in this area.

16

posted on

03/28/2011 7:35:14 AM PDT

by

thackney

(life is fragile, handle with prayer (biblein90days.org))

To: thackney

If you didn’t export crude to Japan, and sent it all to west coast refineries, then that would presumably be an increase.

To: thackney

LA Sweet is selling for 110/barrel. The Texas stuff is, well, crude.

To: RFEngineer

Since it has always went to the West Coast refineries, where is the increase?

The Japan export is basically a false legend. Look at a map.

It is 3,577 miles from Valdez, Alaska to Tokyo, Japan.

It is 1,274 miles from Valdez, Alaska to Anacortes, Washington. (largest Washington refineries)

It is 2,253 miles from Valdez, Alaska to El Segundo, California (major refinery near Los Angeles)

Until 1996 it was illegal to export Alaskan North Slope Crude oil because of the Congressional Approval used to create the pipeline.

In the mid-late 1990's, because of a glut of oil on the West coast, this was relieved and less than 5% of ANS crude was exported. That quit by 2000.

19

posted on

03/28/2011 7:57:58 AM PDT

by

thackney

(life is fragile, handle with prayer (biblein90days.org))

To: sportutegrl

Louisiana Light Sweet crude is both heavier and more sour than West Texas Intermediate. Not much, but still more.

LA Light Sweet is 36.1° API and 0.45% Sulfur.

WTI is 40.4° API and 0.28% Sulfur.

http://www.meglobaloil.com/MARPOL.pdf

20

posted on

03/28/2011 8:08:36 AM PDT

by

thackney

(life is fragile, handle with prayer (biblein90days.org))

Navigation: use the links below to view more comments.

first 1-20, 21-25 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson