Posted on 11/02/2011 8:33:06 PM PDT by blam

Krugman Warns of “Gigantic Bank Run”, “Emergency Bank Closing” and “New Lira”

Commodities / Gold and Silver 2011

Nov 02, 2011 - 07:09 PM

By: GoldCore

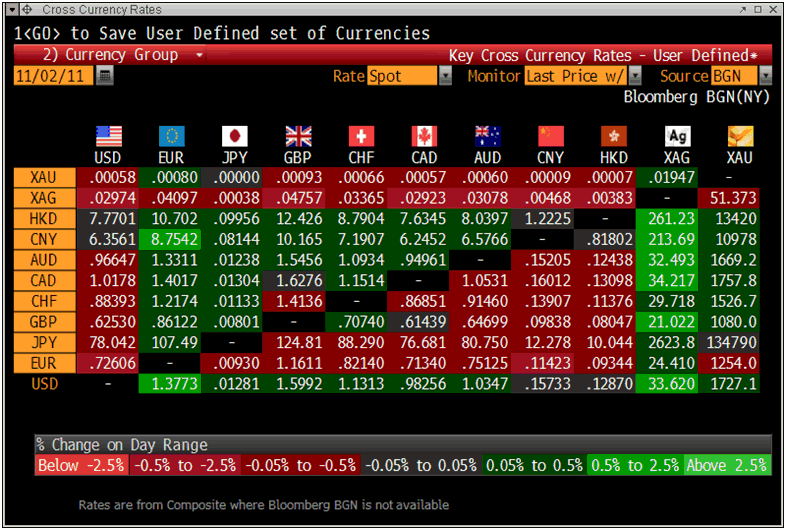

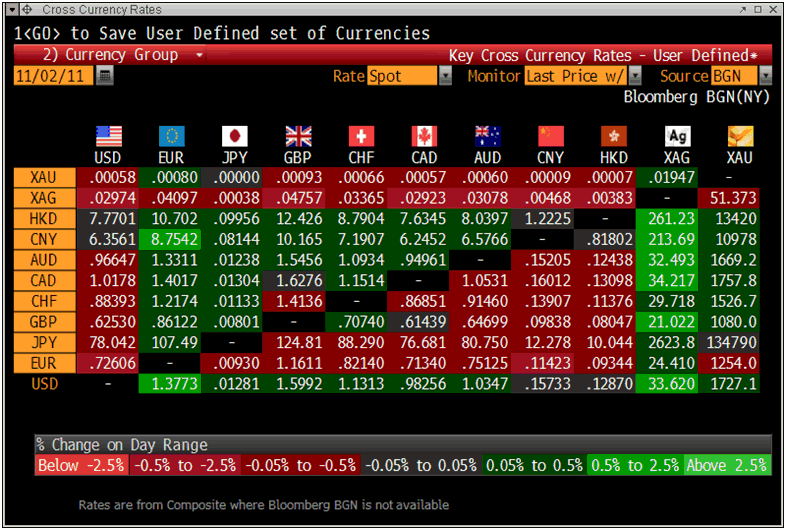

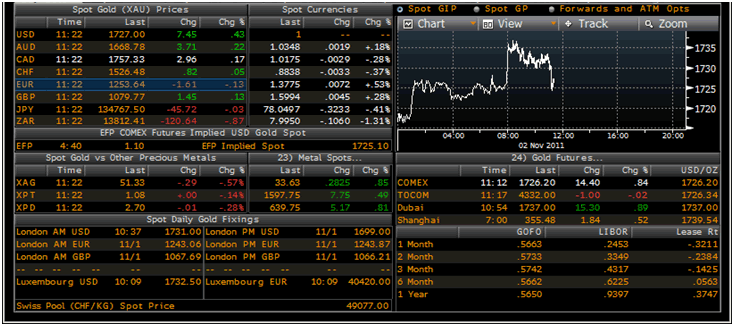

Gold is trading at USD 1,727.10, EUR 1,254, GBP 1,080, JPY 134,790, AUD 1,669.20 and CNY 10,978 per ounce.

Gold’s London AM fix this morning was USD 1,731.00, GBP 1,081.27 and EUR 1,257.35 per ounce.

Yesterday's AM fix was USD 1,702.00, GBP 1,067.69 and EUR 1,243.06 per ounce.

Cross Currency Table

Gold is higher in most major currencies but especially the US dollar this morning. Although gold has lost some of its early gains in Europe as the euro and equity indices have stabilized.

The shock and uncertainty regarding Prime Minister George Papandreou's call for a referendum on a European Union bailout deal continues to reverberate in international markets leading to a renewed safe haven bid.

Greece's cabinet decided early on Wednesday to back Papandreou's proposal for a referendum on the EU deal – according to government spokesman. Papandreou is sticking to plans to hold the vote despite signs his government may collapse.

Greek Referendum to Lead to Return of the Drachma?

The possibility of a return to the drachma has raised its head after Papandreou said a referendum on Europe’s rescue package will confirm Greece’s membership of the euro.

There are increasing calls in Greece for a return to the drachma – polls show 33% in favour of a return to the Greek drachma at this time.

The fact that it is impossible for Greece to regain competitiveness while clinging to the euro is becoming increasingly evident. Prominent economists such as Nouriel Roubini, as well as investor George Soros have said as much and influential voices in Greece are now questioning the wisdom of clinging to the euro.

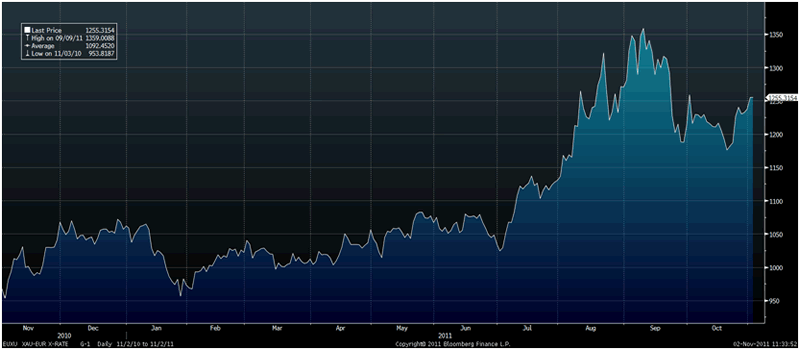

XAU-EUR Exchange Rate (G1-Daily)

Krugman Warns of “Gigantic Bank Run”, “Emergency Bank Closing” and “New Lira”

Paul Krugman’s latest post is extremely bearish and he warns that “things are falling apart in Europe; the center is not holding”

Krugman warns that this could lead to a “gigantic bank run” and “emergency bank closing”.

Not only does Krugman warn of a massive bank run and emergency bank holidays but he warns of the euro breaking up and Italy returning to the Italian lira and even warns of similar problems confronting France.

“The question I’m trying to answer right now is how the final act will be played. At this point I’d guess soaring rates on Italian debt leading to a gigantic bank run, both because of solvency fears about Italian banks given a default and because of fear that Italy will end up leaving the euro. This then leads to emergency bank closing, and once that happens, a decision to drop the euro and install the new lira.”

“Next stop, France.”

Uber Keynesian Krugman, has been one of the most vocal gold bears in recent years and his opinion on gold has been biased and uninformed.

It will be interesting to see if his attitude towards gold has changed given the appalling vista he is now warning of.

An important question we have posed for some time, “What price is gold in drachma, lira, pesetas, escudos and punts?“

What should the ordinary people in European countries do to protect themselves from currency debasement and devaluations?

Unfortunately, we may find out the answer to these questions in the coming months.

Gold Prices, Gold Rates, Gold Fixes

Gold’s Safe Haven Status Being Shown

Gold’s safe haven status has again been clearly shown in recent days despite continuing skepticism from the sadly misinformed.

Gold’s recent sell off led to renewed doubt and a new bout of questioning with regard to gold as a safe haven. While gold was 0.9% lower yesterday in US dollar terms, it was higher in the majority other fiat currencies.

Its 0.9% fall in dollar terms was an impressive performance given the scale of the losses seen in equity and commodity markets.

In euro terms, gold has risen from €1,215/oz on Monday to €1,256/oz or a rise of some 3%. European equity indices have fallen sharply since Monday showing gold’s proven status as a hedging instrument and a safe haven.

October Market Review

Despite the dramatic new flow of recent days it is as always crucial to keep an eye on the long term performance of major assets.

In October, currency markets saw the US dollar fall against major currencies except for the Japanese Yen.

The Euro climbed 3.3% in October against the dollar. GBP was up 3.0%, CAD up 4.91%, and CHF up 3.33%. Hong Kong dollar was 0.23% higher against US dollar, and Chinese Yuan was 0.51% higher. The Japanese Yen lost 1.5%.

Bonds markets had varied performance. US Treasuries ended 1.4% lower in October, the biggest loss since December 2010. German bunds have fallen 1.5%. However, the risky bonds flourished as equities did. The Barclays Capital US high yield index gained 6.2%, while US investment grade bonds climbed 1.1%.

There was a huge rally in global major stock indices in October, making it the best month for equities since 2009.

The benchmark S&P 500 was up 10.77% while the Dow Jones Industrial Average ended the month 9.54% higher.

In Europe, the FTSE 100 ended 8.11% higher, Germany’s Dax up 11.26%, the CAC rose 8.75% and Ireland’s ISEQ was 8.85% higher.

In Asia, the Hang Seng Index was up 12.92%, while NIKKEI 225 had a relatively weaker performance, ending 3.31% higher.

Oil ended the month 17.5% higher.

Precious metals also had strong performance. Gold finished at around 5.7% higher, while silver surged 15.1%. The strong gains suggest that gold and silver’s recent sharp correction and period of consolidation may be coming to a close.

Platinum and palladium gained 6.2% and 5.4%, respectively.

Liquidity continues to slosh around global markets which is supportive of risk assets and saw risk appetite return in October - in what had the hallmarks of an inflationary “crack up boom”.

The shock Greek and MF Global news since Halloween and brutal start to November is already challenging risk appetite and November looks set to be a volatile month.

It's Always Something (IAS)

What, the Lira and Drachma return as national currencies!? THE HORROR! /sarc

Don’t really follow him daily but would love to something he has ever been right on, anyone?

Mamta Badkar

Nov. 2, 2011, 10:04 PM

Italy is fast becoming the next Greece. The country has 120% debt-to-GDP ratio, and its debt now stands at $2.2 trillion.

While a disorderly Greek default looks increasingly likely and has been hurting global markets, the Italian economy is nearly seven times as big as Greece's, and it's fast looking like the next domino that could fall.

(snip)

Krugman = Maureen Dowd with an econ degree

Krugman’s a histrionic.

Even Al Gore has a degree.

He wouldnt have gotten VP pick without one.

This was posted at http://www.tfmetalsreport.com/blog/2840/mfing-global yesterday.

It was about a memo from a broker who wrote a memo, one of which points was this stunner:

“6. And now here is a paragraph that everyone in the financial industry, but most particularly the futures industry, should send viral. Every Introducing Broker and Futures Commission Merchant in the world is being targeted for extinction by the megabanks. They want you GONE. Goldman, Citi, JP Morgan, etc. They are working with and through the financial regulatory bodies and with the Federal Government via such legislation as Dodd-Frank to force out of business every FCM and fold all of that business into the megabanks. IBs like me are also a target, but we IBs are meaningless guppies compared to whale-sized FCMs.”

And this:

“7. This MF Global collapse is a small-scale (yes, that’s right, SMALL-SCALE) foretaste of what is going to happen to the entire system. When I say get your money out of the market, out of paper instruments, and turn it into something real that is physically located on your property, that you can then stand in front of with an assault rifle and physically defend, I’M NOT KIDDING.”

Something evil this way comes.....

It would be poetic justice if the got his ass trampled to death by an OWS throng celebrating it.

He’s never been right on anything yet. But, he got a Nobel prize, dontcha know?

Sounds familiar...

On one hand, I admire Krugman because he never seems to warn against the greatest threat to himself, both to him and to Robert Reichhhhhhhhhhh....which would be the resurgence of dwarf-tossing contests.

On the other hand, he is a flaming moron.

Ann Barnhardt Responds to Death Threat

That is totally correct.

Thank You.

That's "gravitationally challenged stature" for those in Rio Vista.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.