Disclosure: I am long BOND. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

A tipping point is when the happening of a previously rare occurrence becomes rapidly and dramatically more common...

Will 2012 mark the beginning of the end for traditional mutual funds?

ETFs are baskets of securities that allow you to track hundreds of domestic and international indexes. Numerous un-managed ETFs mirror well-known indexes like the S&P 500 or the NASDAQ 100, and some track securities specific to a particular industry or country. With the rising popularity of ETF investing, many managed ETFs have appeared. But none was as highly anticipated in 2012 or as highly covered as PIMCO's Total Return ETF (BOND).

On March 1st, 2012, trading of the exchange traded fund version of PIMCO's Total Return Fund began. The traditional PIMCO Total Return Fund, managed by the respected bond manager, Bill Gross, is the world's largest mutual fund with over $280 Billion in assets. The launch of the ETF version now allows any investor with a brokerage account to purchase a low cost alternative to the traditional fund without having to pay a sales load and offers lower operating expenses to boot.

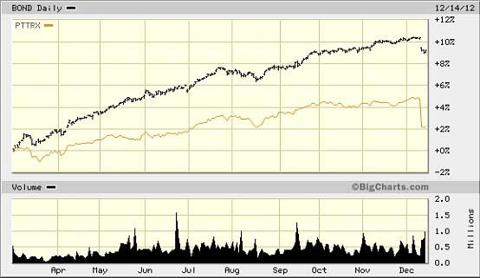

The annual .55% internal operating expense ratio of the ETF compares favorably to those investors lacking the necessary $1,000,000.00 to qualify for the institutional class share and its .46% expense ratio. To investors who pay 0.85% for the PIMCO Total Return retail-class A shares, the ETF expense cost offers substantial savings, especially when every basis point counts in this continuing challenging interest rate environment. Relative performance has been interesting as well. Since its March inception, BOND has significantly outperformed its behemoth parent, including the institutional class shares (PTTRX):

(RE: Dip on 12/12/12. BOND went ex-date on a $.8826 dividend.)

Dividends on BOND have been consistent as well:

|

Ex/Eff Date |

Type |

Cash Amount |

Declaration Date |

Record Date |

Payment Date |

|

12/12/2012 |

Cash |

0.8826 |

-- |

12/14/2012 |

12/18/2012 |

|

11/30/2012 |

Cash |

0.2 |

-- |

12/4/2012 |

12/6/2012 |

|

10/31/2012 |

Cash |

0.2 |

-- |

11/2/2012 |

11/6/2012 |

|

9/28/2012 |

Cash |

0.195 |

9/27/2012 |

10/2/2012 |

10/4/2012 |

|

8/31/2012 |

Cash |

0.2 |

-- |

9/5/2012 |

9/7/2012 |

|

7/31/2012 |

Cash |

0.18 |

-- |

8/2/2012 |

8/6/2012 |

|

6/29/2012 |

Cash |

0.21 |

-- |

7/3/2012 |

7/6/2012 |

|

5/31/2012 |

Cash |

0.2 |

-- |

6/4/2012 |

6/6/2012 |

|

4/30/2012 |

Cash |

0.18 |

-- |

5/2/2012 |

5/4/2012 |

|

3/30/2012 |

Cash |

0.12 |

-- |

4/3/2012 |

4/5/201 |

The ETF version of the Total Return Fund has created big waves for Wall Street and the investment-management business, currently dominated by traditional mutual funds. Mutual Fund companies with large actively managed funds have begun to follow PIMCO into the managed ETF business. The principle benefit to investors is that ETFs offer a more investor-friendly "package" due to their low expense ratios, tax efficiency, transparency and ability to buy and sell during the trading day.

Many no-load investors and fee-only advisors had anxiously looked forward to the rollout of PIMCO's Total Return ETF for some time. Having the clout, performance and recognition of the fund available to clients in a low cost ETF version was a coup, not only for PIMCO but for millions of smaller investors around the world. Having the power and reputation of a big firm like PIMCO and a superstar manager like Bill Gross embrace the investor-focused structure that ETFs have over the higher cost structure of traditional mutual funds truly validates the thoughts of many forward looking investment professionals about which direction the industry is going.

Scott Burns, director of ETF analysis at Morningstar, says "Ultimately, investors want and deserve all of the advantages the ETF structure and stock exchanges can provide whether the underlying strategy is active or passive. For their part, fund companies and the broader asset management community need to open their eyes and start asking the right questions to the right people. In the end, the investor is going to get what he or she wants - one way or another."

In a January 24, 2012 Fortune Magazine piece titled "The end of mutual funds is coming," Joshua Morgan Brown covered the then upcoming launch of the PIMCO Total Return ETF, but from the perspective of a decade in the future.

"PIMCO saw an inevitability that the other mutual funds were slow to accept," Brown wrote. "They saw that as brokers morphed into advisers, broker-sold products like mutual funds would eventually lose assets by attrition (there once was an old saying that "mutual funds are sold, ETFs are bought"). PIMCO recognized that what people hated most about their mutual funds were their high expense ratios, the 12-b1 marketing fees and the inflexibility of a product that could not be purchased or liquidated until after the market close each day."

He concludes: "The mutual fund industry died from a thousand cuts - but it was PIMCO who drew the first blade in 2012."

Tipping point indeed.

For the fixed income portion of your portfolio, The PIMCO Total Return ETF makes a great core holding. And if you're still holding a more expensive version of its parent... why?