Skip to comments.

Social Security Cliff in Sight

Townhall.com ^

| January 18, 2013

| Mike Shedlock

Posted on 01/18/2013 12:57:10 PM PST by Kaslin

In response to my post Making Social Security Actuarially Sound in a Business-Friendly Manner I have been exchanging emails and phone conversations with Jed Graham at Investor's Business Daily.

Jed thinks benefit cuts will happen, and I agree. However, Social Security cuts are considered the "third rail" in politics.

If you are not familiar with the term, it means anyone espousing cuts cannot be elected.

Retirees Will Outlive Trust Fund

Graham's current position on the viability of Social Security can be found in his January 14 article New Social Security Retirees Will Outlive Trust Fund

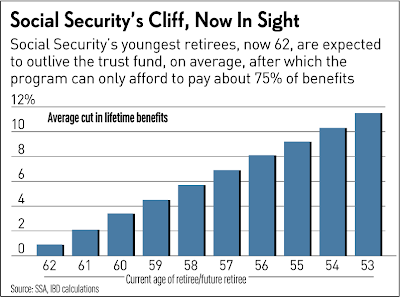

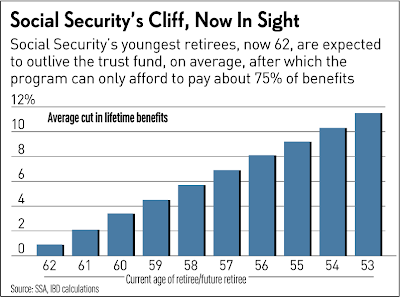

For the first time since Social Security's cash crisis in 1983, the program can't afford to pay full benefits for its youngest crop of new retirees through life expectancy, government data show.

The hastening of the Social Security Trust Fund's demise to 2033 means that workers just becoming eligible for Social Security at age 62 face steep future benefit cuts if they live to the average life expectancy, now about 84.

Those abrupt benefit cuts of about 25% a year for today's 62 year olds and workers nearing the early retirement age would come at an especially bad time — late in life when savings have dwindled and health care bills are on the rise.

Old Contract Invalid

While the trust fund's nonmarketable Treasuries — really IOUs from one branch of government to another — have no value to offset the cost of benefits, they provide Social Security the legal authority to run cash deficits until they're spent.

Under current law, a worker who just turned 62 would face a 25% benefit cut once the trust is spent in early 2033.

Workers now 55 would, on average, lose two full years' worth of benefits, the equivalent of a 9.2% cut in lifetime benefits.

Cliff Now in Sight

Nonmarketable IOUs

Nonmarketable IOUs

Jed and I are 100% in agreement that the alleged "

trust fund" is nothing more than "nonmarketable Treasuries — really IOUs from one branch of government to another" that have no real value.

As Jed states, those IOUs provide the Social Security administration the "

legal authority to run cash deficits until they're spent."

The key points are as follows: There is no lock box, there is no fund, there is a deficit, and IOUs in a pretend piggy bank are not the same as marketable bonds.

Amusingly, I got into an exchange with a reader just a few days ago over the IOU concept. Reader Elliot wrote "You don't seem to understand bonds. They're just an IOU. The Chinese give us $$, we give them an IOU, and then we spend the dollars."

Clearly, one major difference is the trust fund has nonmarketable IOUs, not marketable bonds.

I responded to Elliot that "You cannot owe yourself money and it's even more ridiculous to put an IOU in a piggy bank and pretend to collect interest on it."

Elliott was not convinced. The discussion with Elliott proves that some people will continue to believe whatever nonsense they want, no matter how carefully facts are presented otherwise.

One thing I did not realize before exchanging emails with Jed Graham was that the payroll tax cut did not actually contribute to the current Social Security deficit (SS was not charged for the reductions in payroll taxes). Rather, the cuts simply added to the general deficit, funded as temporary stimulus.

Thus, the current deficit is real, not imagined, no matter how one looks at it. The payroll tax cut did not temporarily overstate the problem.

Simply put, Social Security is already insolvent if one ignores imaginary interest deposited into an imaginary piggy bank. Only on a pretend basis, by counting interest owed to oneself in a piggy bank that does not even exist, is Social Security solvent.

Elliott's of the world aside, Jed points out the IOU pretense is universally understood by the CBO, by the administration, etc. Unfortunately, Congress ignores the problem for political reasons.

Clearly, something needs to be done to shore up the system. And since something has to give, by definition it will. I outlined six possibilities, none of which has universal appeal.

Six Possible Ways to Make Social Security Actuarially Sound

- Raise retirement age

- Raise or eliminate the cap on payroll taxes

- Cut benefits

- Collect Social Security on personal income

- Implement a Tiered Cap structure

- Means Testing

All of the above are likely as noted in Making Social Security Actuarially Sound in a Business-Friendly Manner

For more on Social Security trends please see ...

Jed Graham Reflections

Jed invited me to post a few of his personal thoughts. Those thoughts are not necessarily reflective of the opinions of Investor's Business Daily, nor are they reflective of mine.

However, for the sake of further discussion ...

Jed wrote the 2010 book A Well-Tailored Safety Net. He proposed a new approach to reform called "Old-Age Risk-Sharing".

Under Jed's approach, the maximum benefit cut would come in the first year of retirement; cuts would be progressively smaller for lower earners and the cuts would phase out over 20 years to preserve a robust safety net in very old age.

You can read about his views in his post What I Told Obama’s Fiscal Commission About Social Security.

Mish Reflections

In the above link, Jed writes ... "If we want a Social Security system that maintains the promise of income security late in life, additional benefit cuts that apply in very old age should be off the table"

I have to ask: Is that want we want? My second question is: If so, how do we expect to pay for it?

It's far easier to come up with a want list, than a means to pay for it. People always want things, unless and until they have to accept tax hikes to pay for them.

Personal Belief

The income redistribution philosophy of tax hikes to support Social Security goes against my own Libertarian beliefs of minimalist government.

Cuts Coming, Regardless of Beliefs

However, and regardless of my viewpoint (or yours), cuts of some kind are without a doubt actuarially necessary as fewer workers support more and more retirees.

The only way cuts are remotely possible now would be to combine cuts with tax hikes. Politically speaking however, Democrats won't accept cuts, and Republicans won't accept tax hikes.

Yet, if cuts eventually come (and demographically speaking they must), then perhaps the phased-in approach suggested by Jed is a pragmatic starting point for discussion, whether or not one believes the stated goal of "guaranteed income security" is socialist silliness.

Once again, I am attempting to separate my own personal beliefs from something that may be more politically feasible.

Two Sure Things

- The path we are on is not sustainable

- Burying one's head in the sand because Social Security is the third rail only makes the problem worse

Safety Net Discussion

I have spent an amazing amount of time on this post already, probably 14 hours. I thought I finished yesterday but I didn't.

Yesterday evening I realized I did not fully address the concept of what constitutes a "safety net", and how much it would take for the average worker to accumulate one.

Jed has done quite a bit of research on the subject, so I decided to ask him.

Jed responded...

"I think since we are talking the bare bones safety net w/ SS that people can’t do without, it makes sense to use the risk-free (some might argue with “free”) Treasury rate. Rule of thumb is that to overcome a 10% benefit cut, an average earner (now about $45k a year) has to save 1% of wages (assuming Treasury returns and a lifetime annuity). For new workforce entrants facing a ballpark 25% benefit cut, as in the Romney plan, that means roughly 2.5% of annual wages. "

The key words are "average earner". In a phone conversation with Jed, he acknowledged things are not so simple. Someone making minimum wage needs to save far more on a percentage basis. Those making $100,000 a year need to contribute far less on a percentage basis.

The problems do not stop there because we are not starting from scratch. What about the "average earner" who is now age 40?

Jed notes such a person may need to contribute 5% of his wages for a minimal return.

That still does not cover all the bases because it assumes everyone is funding their own plan.

Is self-funding the new idea? Or is the original intent of Social Security (minimum retirement income assistance regardless of how much one contributed) still intact?

Regardless of your answer, those making minimum wage will never be able to meet a reasonable "safety net" goal, on their own accord.

I do not champion the idea that Social Security is a "right". It isn't. Rather, I simply state the pure mathematics of the setup.

Funding Your Own Way

I have a close friend who objected to "Means Testing" which was point six of Six Possible Ways to Make Social Security Actuarially Sound, as listed above.

She proposed that what she puts into SS should be hers or her heirs, and no one else's.

Ideally, I agree.

However, if her money is hers (and your money is yours) let me ask a simple question: Does government belong in the "income guarantee" business at all (taking your money only to return some portion of it later)?

If so, why? If not, then let's stop Social Security altogether.

It's certainly a debate worth having, and the answer determines whether or not there should be any "safety nets".

Privatizing Social Security

In a follow-up phone call I discussed privatization of Social Security with Jed. He was once in favor of partial privatization, but that was when Social Security was running a surplus. He is not in favor of it now.

Let's discuss this from the point of view of my friend who states "What I put into SS should be mine, no one else's".

Privatization Ramifications

To create a real "lock box", not an imaginary lock box, with imaginary interest, we need to privatize Social Security, not send money to Washington to be confiscated for whims of the moment.

Assuming that is politically feasible, and ignoring all the people already fully committed to the current system (those retired), as well as those half-way in (those in their 40's), what are the ramifications of privatization?

Before answering, please note that Social Security revenues are in practice used for general expenditures. Simply put, if payroll taxes were diverted to funding private plans, the deficit would soar.

Such a step would require massive tax hikes or massive cuts across the board somewhere (I would vote for massive cuts across the board, especially cuts in military spending).

Then we would still need to do something about partial funding and those already retired. Finally we would need to discuss limitations on those who want to tap their SS funds before retirement.

For a discussion on tapping retirement money, please consider Over 25% of 401Ks Tapped to Pay Current Bills; Dead-Fish Housing Assets; Walking Away Yet Again.

Quickly you can see we are back to the basic question "Whose money is it anyway, and why should government dictate what I do with it?"

Frank Discussion of the Issues is Needed

Regardless of your point of view on what should or should not be done (Jed has his ideas, I have mine, my friend has hers, and you have yours), it's long overdue for a frank discussion of the issues.

Solutions can only happen following admission of the problems. The starting point for discussion is simple admission that Social Security and Medicare are both insolvent, that promises have been made that cannot possibly be kept.

Without a doubt the country needs a frank discussion of "safety nets" and how they should be funded, as well as frank discussions on Medicare and healthcare rationing.

Unfortunately, few if any politicians are willing to admit the truth or to have those discussions, for fear of losing votes.

TOPICS: Business/Economy; Culture/Society; Editorial

KEYWORDS:

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-54 next last

To: Ruy Dias de Bivar

Don’t you love how they call taxes “contributions”? Kinda like how the Germans told certain guests of the government “Arbeit macht frie.”

To: USFRIENDINVICTORIA

Friend,

The current Social Security full retirement age is 66 and will gradually phase to 67.

From memory, I think we start one month per year phasing to age 67 in 2014.

The idea that 70 year old workers will be generally competitive against younger workers is really foolish, especially for those who work in blue collar jobs.

America is already experiencing an explosion of SS Disability claims - most of that from workers over 60 years of age.

To: zeestephen

Thanks for the info about your retirement ages.

You have a point regarding some blue-collar workers. However, many older blue-collar workers are supervisors, etc. and don't need to compete with younger workers on the purely physical level. In skilled trades, experience still matters.

That said, one size does not fit all. As the article implies, privatized pension plans would probably be better for most people.

My point was really that something needs to change. Raising retirement ages (or pension-eligibility age) is just one alternative. The notion of a "third rail of politics" can't prevent the inevitability of change. It can keep change from happening in time.

To: Tublecane

Second because unfortunate souls like you pretend they’ve “paid into the system” and won’t allow the problem ever to be fixed. It is not a pretense - I have “paid into the system” - I was forced to by the federql government.

And unless you have never held a job or always worked of the books you have paid into the system as well.

I don't support the system that is imposed on us because it is nothing more than a Ponzi scheme.

But I do say that Social Security should not be cut until all the moocher programs, freebies and handouts are cut for people who never contributed a cent to those programs.

As a nation, are we to kick our parents and grandparents out into the street so we can continue paying fpr welfare, housing, food stamps, free medical, Obama Phones, etc., etc. to moochers and illegals?

24

posted on

01/18/2013 2:45:39 PM PST

by

Iron Munro

(I Miss America, don't you?)

To: Kaslin

Six Possible Ways to Make Social Security Actuarially Sound 1. Raise retirement age

2. Raise or eliminate the cap on payroll taxes

3. Cut benefits

4. Collect Social Security on personal income

5. Implement a Tiered Cap structure

6. Means Testing

Or to summarize:

1. Cut benefits

2. Raise taxes

3. Cut benefits

4. Raise taxes

5. Cut benefits

6. Cut benefits

25

posted on

01/18/2013 2:46:20 PM PST

by

KarlInOhio

(Choose one: the yellow and black flag of the Tea Party or the white flag of the Republican Party.)

To: Buckeye McFrog

This is a problem with no solution. The shortfall runs in the tens of trillions of dollars. We can’t tax out way out of it. On second thought, there MAY be a solution after all. Unfortunately, the solution happens to be soylent green.

26

posted on

01/18/2013 2:51:00 PM PST

by

fhayek

To: KarlInOhio

Oops. I looked at the attached article and saw that 5. is "Raise taxes" rather than "Cut benefits".

27

posted on

01/18/2013 2:54:03 PM PST

by

KarlInOhio

(Choose one: the yellow and black flag of the Tea Party or the white flag of the Republican Party.)

To: Tublecane

I don’t even understand what this article is about. No, there was no trust fund. SS is not self-supporting. It’s already in the red. What are we talking about, it being more in the red? Look, they can use allow the funny accounting they want. Why should we pretend it’s meaningful? Here is how SS works. It is a pay as you go system where today's workers pay for today's retirees. The payroll tax is used to raise revenue to pay for benefits.

For many years SS ran a "surplus" where more revenue was collected than benefits paid out. The "surplus" was deposited into the General Fund and Treasury issued non-market, interest bearing T-bills in the amount of the surplus and deposited them into the SS Trust Fund. Currently the SSTF has $2.7 trillion in T-bills.

SS has been running in the red since 2010 and will do so permanently from that point onwards. In order to make up the shortfall, T-bills from the SSTF are redeemed by the General fund so benefits can be paid in full. Based on the Trustee's report, SS will exhaust its T-bills in the SSTF around 2031/2. After that point, by law, SS can only pay benefits based on the revenue collected thru the payroll tax. It will require an estimated cut of 20% for all beneficiaries.

Source: CBO “Combined OASDI Trust Funds; January 2011 Baseline” 26 Jan 2011.

Note: See “Primary Surplus” line (which is negative, indicating a deficit)

The $2.7 trillion in the SSTF is part of the national debt and held under "Intragovernmental Holdings" rather than under the publicly held portion of the debt. Here is how SS describes the T-bills in the SSTF:

"Far from being "worthless IOUs," the investments held by the trust funds are backed by the full faith and credit of the U. S. Government. The government has always repaid Social Security, with interest. The special-issue securities are, therefore, just as safe as U.S. Savings Bonds or other financial instruments of the Federal government."

The reason that SS and Medicare are going bankrupt is not what is or is not in the SS or HI trust funds. Rather, it is a matter of the demographics of a aging society, which has been compared to a pig going thru a python. In 1950 there were 16 workers for every retiree; today it is 3.3; and by 2030 it will be just two. And by 2030 one in five in this country will be 65 or older--twice what it is now. SS is a Ponzi scheme where those at the top of the pyramid are receiving much more than they ever contributed to the system. Those at the bottom will not be that lucky.

And for those who say that SS is not contributing to the national debt problem, they are wrong. In order to redeem those T-bills in the SSTF, the General Fund must come up with the money, 42 cents of which are borrowed for every federal dollar spent. This is why Obama is correct that if the debt ceiling is not raised, SS payments could be affected. Unwittingly, he is telling the American public that we must borrow the money to pay SS benefits. I wish some Rep would make that point.

28

posted on

01/18/2013 3:05:41 PM PST

by

kabar

To: kabar

“The payroll tax is used to raise revenue to pay for benefits”

That’s simply untrue. That tax raises revenue to be spent on whatever it is the feds spend money on, along with what they borrow, what they sell, and what they counterfeit.

I see you put quotes around surplus, probably because, like I said, there was no system and therefore is no such thing. The federal gubmint hasn’t been in the black since, what, Andy Jackson? How could there possibly be a surplus, unless SS funds were segregated, which they weren’t.

So this supposed fund of profits off SS money which we supposedly can draw until the 2030s is “the system” which everyone’s always talking about and which supposedly isn’t broke yet. But that’s absurd, because we have a freaking 16 trillion dollar debt and annual trillion-plus dollar deficits. The idea that there’s this seperate thing called SS with its own fund and which, unlike everything else, people are somehow still getting what they pay for, is ridiculous. It insults our intelligence.

To: kabar

Obama is correct, yes. This is so because SS isn’t special and is paid for like everything else. It is also so because I’m sure they’d find a way to spend money leftover after the instant balanced budget of the debt ceiling in the most painful manner possible.

To: Iron Munro

You were forced to pay a tax, yes, just like you presumably paid an income tax and any number of other taxes. What this has to do with SS benefits is almost nothing. Point is, there is no “system.” Payroll taxes end up in a big pile with the rest of federal revenue. The gubmint as a whole is broke, obviously, and therefore so is SS.

It is like a Ponzi scheme, but not exactly. They made it sound like you were paying into a system at first. They even called taxes “contributions,” the program “insurance,” and said you had a right to benefits. They’ve since admitted otherwise. When private ponzi schemers admit it’s a scheme they go to jail. When gubmint does so, it stops being a scheme and becomes simple theft.

To: Iron Munro

“At least social security recipients paid something into the system”

Sorry, but wrong, wrong, wrong, wrong.

Remember when clintoon “ended welfare” back in 1997?

Change the Social Security disability rules back to what they were in 1993 and see how much better the Social Security situating gets.

The bent-on “ended welfare” by hiding it in 80 different government programs. And Social Security took it big time. And no, many of these newly ‘disabled’ workers didn’t pay squat into the system.

To: Iron Munro

“Social Security should not be cut until all the moochers programs, freebies and handouts are cut”

Oh, that’s perfectly rational of you. “My program is the important one; all you other guys are the problem.” This is exactly why government will never, ever shrink. Because everyone defends their goodies. Welfare for me but not for thee.

Democrats checkmate Republicans every time by threatening their babies, like defense. And there’s something to pubbies’ whining, as at least defense is actuallly in the Constitution. But how much moeny spent in its name actually has anything to do with defense? And what does it matter, anyway, when cuts to the other stuff will never, ever happen the way you want it?

There seems to be some credence to what you say about those who worked for it deserving federal goodies more than freeloaders. But dealt it’s an argument for why they should have kept it in the first place. There is no principle whereby he who earned it gets redistributed wealth. That contradicts the entire philosophy of the Welfare State, actually. It’s like the Soviet Union introducing glasnost and perestroika. Good things, but deadly to a regime which lives off secrecy and terror.

To: I cannot think of a name

Sorry, but wrong, wrong, wrong, wrong. You are doing the same thing others do when trying to conflate Social Security retirement with welfare.

Like it or not, there is a difference between Social Security retirement as compared to disability, welfare and other non-contributory government handout programs.

People who receive social security upon retirement, who worked through life were forced to contribute to social security. So you are the one who is "wrong, wrong, wrong, wrong".

Can't you see the difference between social security, that the government forced working people (snd their employers) to contribute to, and programs that are pure handouts?

How can you equate some welfare queen or drug user on disability with men and women who worked all their life and were forced to contriibute some of their weekly pay to a program they did not necessarily choose to belong to?

Certainly social security is a Ponzi scheme, but it was forced on working people and it is wrong to lump social security retirees with pure moochers.

34

posted on

01/18/2013 4:23:54 PM PST

by

Iron Munro

(I Miss America, don't you?)

To: Tublecane

You were forced to pay a tax, yes, just like you presumably paid an income tax and any number of other taxes. What this has to do with SS benefits is almost nothing. have you ever had a job?

You really sound quite daft.

35

posted on

01/18/2013 4:27:06 PM PST

by

Iron Munro

(I Miss America, don't you?)

To: Tublecane

That’s simply untrue. That tax raises revenue to be spent on whatever it is the feds spend money on, along with what they borrow, what they sell, and what they counterfeit. Now you are being silly. According to the laws that set up SS, the payroll taxes raised must be used to pay benefits for SS.

The Social Security Trust Funds are the Old-Age and Survivors Insurance (OASI) and the Disability Insurance (DI) Trust Funds. These funds are accounts managed by the Department of the Treasury. They serve two purposes: (1) they provide an accounting mechanism for tracking all income to and disbursements from the trust funds, and (2) they hold the accumulated assets. These accumulated assets provide automatic spending authority to pay benefits. The Social Security Act limits trust fund expenditures to benefits and administrative costs.

By law, income to the trust funds must be invested, on a daily basis, in securities guaranteed as to both principal and interest by the Federal government. All securities held by the trust funds are "special issues" of the United States Treasury. Such securities are available only to the trust funds.

I see you put quotes around surplus, probably because, like I said, there was no system and therefore is no such thing. The federal gubmint hasn’t been in the black since, what, Andy Jackson? How could there possibly be a surplus, unless SS funds were segregated, which they weren’t.

The Social Security Trust Fund was created in 1939 as part of the Amendments enacted in that year. From its inception, the Trust Fund has always worked the same way. The Social Security Trust Fund has never been "put into the general fund of the government."

Most likely this myth comes from a confusion between the financing of the Social Security program and the way the Social Security Trust Fund is treated in federal budget accounting. Starting in 1969 (due to action by the Johnson Administration in 1968) the transactions to the Trust Fund were included in what is known as the "unified budget." This means that every function of the federal government is included in a single budget. This is sometimes described by saying that the Social Security Trust Funds are "on-budget." This budget treatment of the Social Security Trust Fund continued until 1990 when the Trust Funds were again taken "off-budget." This means only that they are shown as a separate account in the federal budget. But whether the Trust Funds are "on-budget" or "off-budget" is primarily a question of accounting practices--it has no affect on the actual operations of the Trust Fund itself.

So this supposed fund of profits off SS money which we supposedly can draw until the 2030s is “the system” which everyone’s always talking about and which supposedly isn’t broke yet. But that’s absurd, because we have a freaking 16 trillion dollar debt and annual trillion-plus dollar deficits. The idea that there’s this seperate thing called SS with its own fund and which, unlike everything else, people are somehow still getting what they pay for, is ridiculous. It insults our intelligence.

The T-bills held by the SSTF are just as much of an obligation as the T-bills held by the Chinese, which is why they are included as part of the $16.4 trillion national debt and affect the debt ceiling. The payment of this debt is dependent upon the good faith and credit of the USG to honor them. It is as simple as that.

I am not saying that SS does not represent a huge unfunded liability or that the program is solvent. I specifically stated that the USG must borrow money to redeem the SS T-bills so SS can pay full benefits. SS is in the red from now until 2031/32 and will need to continue to redeem the T-bills to make up the growing shortfall. Once the T-bills are exhausted, SS will no longer be able to pay full benefits as promised. It is limited by the revenue it has coming in. Without reform, SS benefits will be reduced for everyone.

Again, I strongly emphasize that SS is contributing to our growing national debt. Pelosi and the Dems have said that is not the case, but as I just demonstrated, they are wrong.

36

posted on

01/18/2013 5:03:05 PM PST

by

kabar

To: I cannot think of a name

The shark attorneys are all over this SSDI gig trolling for clients. TV commercials are pervasive, especially during Maury and Springer. So you know there’s big money at stake.

I got a cold call today here in Indiana from a New Jersey law firm asking if I was interested in applying for SSDI. I asked them how they got my name and they wouldn’t tell me.

37

posted on

01/18/2013 5:14:59 PM PST

by

nascarnation

(Baraq's economic policy: trickle up poverty)

To: Iron Munro

“Can’t you see the difference between social security, that the government forced working people (snd their employers) to contribute to, and programs that are pure handouts?”

Hate to break your heart, but you better check who Social Security has been paying money to since 1997, under the guise of ‘disability.’ Yes sir, “pure handouts” who have some of the most bogus disability claims imaginable. Kick all of those loafers off, and Social Security won’t be in as bad of shape. Of course if you kicked them off of all the 80 programs and put them back into what they actually are - welfare - you’d actually find that welfare payments exceed social security, medicare, and the military. And they darn near exceed any two of them combined.

If you want to find out how many federal programs are polluted with hidden welfare costs, check out:

http://www.heritage.org/search?query=welfare

Do not send me any private e-mails asking me to replace your keyboard or monitor if you check that website out.

The people that had paid into social security and medicare their whole lives are getting screwed!

To: kabar; All

I don't wish to argue with you, but I am in the Social Security and Medicare BUSINESS!

Even if your Part D plan costs the average or middle income client ZERO dollars (yes that is possible with a Medicare Advantage Plan) -— those how make more than $213,000 (Individually) will now pay $66.40 PER MONTH for the same Part D Prescription drug plan.

That same person will pay $349.00 for Part B of Medicare.

This is a total of $415.40 PER MONTH for Medicare services for the top brackets.

I am telling you that there is NO limit on what Congress will charge, for Part D and Part B services, in the future, for the upper income groups.

Again, this is my business, but if you want to check my work go to Medicare.gov, all the tables are there for you.

39

posted on

01/18/2013 8:37:33 PM PST

by

Kansas58

To: Kansas58

I am telling you that there is NO limit on what Congress will charge, for Part D and Part B services, in the future, for the upper income groups.I understand how they are changing the premiums for Medicare Parts B and D. I am on Medicare. But even raising the rates on those who are 65 and older and make more than $213,000 (individual) a year will cover just a small part of the total costs. Here are the 2013 rates. There are very few seniors making that level of income.

What you appear to be missing is that the premiums for these programs only cover 25% of the total costs. The rest of the costs must be funded by the General Fund. From the 2012 Trustees Report:

The Trustees project that Part B of Supplementary Medical Insurance (SMI), which pays doctors’ bills and other outpatient expenses, and Part D, which provides access to prescription drug coverage, will remain adequately financed into the indefinite future because current law automatically provides financing each year to meet the next year’s expected costs. However, the aging population and rising health care costs cause SMI projected costs to grow rapidly from 2.0 percent of GDP in 2011 to approximately 3.4 percent of GDP in 2035, and then more slowly to 4.0 percent of GDP by 2086. General revenues will finance roughly three quarters of these costs, and premiums paid by beneficiaries almost all of the remaining quarter. SMI also receives a small amount of financing from special payments by States and from fees on manufacturers and importers of brand-name prescription drugs.

If you go to the table showing what were the sources of income to the Trust Funds in 2011, you will see that SMI (Medicare Parts B and D) received $222 billion from the General Fund and $65.4 billion from premiums. These costs will continue to rise as 10,000 people a day retire every day for the next 20 years. And Medicare will eventually consume the entire federal budget if not reformed.

Yes, the USG has been gradually changing the premium structure for Medicare Parts B and D since I started on the program five years ago. It is becoming more of a means tested program, but it has been under the radar since very few people are affected by the fee structure. It is worth remembering that one-third of retirees depend on SS as their sole source of income and for two-thirds of retirees, it is more than 50% of their retirement income. The vast majority of people will pay $104.90 for Medicare Part B in 2013.

I would also note that 9 out of every 10 Medicare recipients pay for supplementary insurance or Medigap.

40

posted on

01/18/2013 9:20:22 PM PST

by

kabar

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-54 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson