Skip to comments.

Social Security Cliff in Sight

Townhall.com ^

| January 18, 2013

| Mike Shedlock

Posted on 01/18/2013 12:57:10 PM PST by Kaslin

In response to my post Making Social Security Actuarially Sound in a Business-Friendly Manner I have been exchanging emails and phone conversations with Jed Graham at Investor's Business Daily.

Jed thinks benefit cuts will happen, and I agree. However, Social Security cuts are considered the "third rail" in politics.

If you are not familiar with the term, it means anyone espousing cuts cannot be elected.

Retirees Will Outlive Trust Fund

Graham's current position on the viability of Social Security can be found in his January 14 article New Social Security Retirees Will Outlive Trust Fund

For the first time since Social Security's cash crisis in 1983, the program can't afford to pay full benefits for its youngest crop of new retirees through life expectancy, government data show.

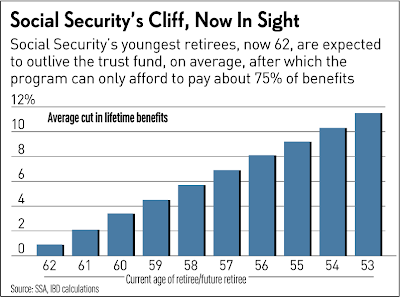

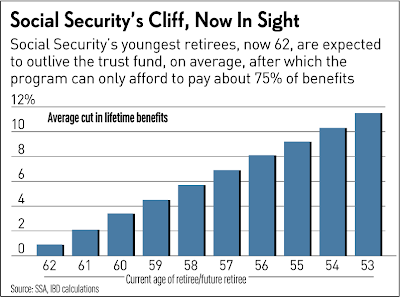

The hastening of the Social Security Trust Fund's demise to 2033 means that workers just becoming eligible for Social Security at age 62 face steep future benefit cuts if they live to the average life expectancy, now about 84.

Those abrupt benefit cuts of about 25% a year for today's 62 year olds and workers nearing the early retirement age would come at an especially bad time — late in life when savings have dwindled and health care bills are on the rise.

Old Contract Invalid

While the trust fund's nonmarketable Treasuries — really IOUs from one branch of government to another — have no value to offset the cost of benefits, they provide Social Security the legal authority to run cash deficits until they're spent.

Under current law, a worker who just turned 62 would face a 25% benefit cut once the trust is spent in early 2033.

Workers now 55 would, on average, lose two full years' worth of benefits, the equivalent of a 9.2% cut in lifetime benefits.

Cliff Now in Sight

Nonmarketable IOUs

Nonmarketable IOUs

Jed and I are 100% in agreement that the alleged "

trust fund" is nothing more than "nonmarketable Treasuries — really IOUs from one branch of government to another" that have no real value.

As Jed states, those IOUs provide the Social Security administration the "

legal authority to run cash deficits until they're spent."

The key points are as follows: There is no lock box, there is no fund, there is a deficit, and IOUs in a pretend piggy bank are not the same as marketable bonds.

Amusingly, I got into an exchange with a reader just a few days ago over the IOU concept. Reader Elliot wrote "You don't seem to understand bonds. They're just an IOU. The Chinese give us $$, we give them an IOU, and then we spend the dollars."

Clearly, one major difference is the trust fund has nonmarketable IOUs, not marketable bonds.

I responded to Elliot that "You cannot owe yourself money and it's even more ridiculous to put an IOU in a piggy bank and pretend to collect interest on it."

Elliott was not convinced. The discussion with Elliott proves that some people will continue to believe whatever nonsense they want, no matter how carefully facts are presented otherwise.

One thing I did not realize before exchanging emails with Jed Graham was that the payroll tax cut did not actually contribute to the current Social Security deficit (SS was not charged for the reductions in payroll taxes). Rather, the cuts simply added to the general deficit, funded as temporary stimulus.

Thus, the current deficit is real, not imagined, no matter how one looks at it. The payroll tax cut did not temporarily overstate the problem.

Simply put, Social Security is already insolvent if one ignores imaginary interest deposited into an imaginary piggy bank. Only on a pretend basis, by counting interest owed to oneself in a piggy bank that does not even exist, is Social Security solvent.

Elliott's of the world aside, Jed points out the IOU pretense is universally understood by the CBO, by the administration, etc. Unfortunately, Congress ignores the problem for political reasons.

Clearly, something needs to be done to shore up the system. And since something has to give, by definition it will. I outlined six possibilities, none of which has universal appeal.

Six Possible Ways to Make Social Security Actuarially Sound

- Raise retirement age

- Raise or eliminate the cap on payroll taxes

- Cut benefits

- Collect Social Security on personal income

- Implement a Tiered Cap structure

- Means Testing

All of the above are likely as noted in Making Social Security Actuarially Sound in a Business-Friendly Manner

For more on Social Security trends please see ...

Jed Graham Reflections

Jed invited me to post a few of his personal thoughts. Those thoughts are not necessarily reflective of the opinions of Investor's Business Daily, nor are they reflective of mine.

However, for the sake of further discussion ...

Jed wrote the 2010 book A Well-Tailored Safety Net. He proposed a new approach to reform called "Old-Age Risk-Sharing".

Under Jed's approach, the maximum benefit cut would come in the first year of retirement; cuts would be progressively smaller for lower earners and the cuts would phase out over 20 years to preserve a robust safety net in very old age.

You can read about his views in his post What I Told Obama’s Fiscal Commission About Social Security.

Mish Reflections

In the above link, Jed writes ... "If we want a Social Security system that maintains the promise of income security late in life, additional benefit cuts that apply in very old age should be off the table"

I have to ask: Is that want we want? My second question is: If so, how do we expect to pay for it?

It's far easier to come up with a want list, than a means to pay for it. People always want things, unless and until they have to accept tax hikes to pay for them.

Personal Belief

The income redistribution philosophy of tax hikes to support Social Security goes against my own Libertarian beliefs of minimalist government.

Cuts Coming, Regardless of Beliefs

However, and regardless of my viewpoint (or yours), cuts of some kind are without a doubt actuarially necessary as fewer workers support more and more retirees.

The only way cuts are remotely possible now would be to combine cuts with tax hikes. Politically speaking however, Democrats won't accept cuts, and Republicans won't accept tax hikes.

Yet, if cuts eventually come (and demographically speaking they must), then perhaps the phased-in approach suggested by Jed is a pragmatic starting point for discussion, whether or not one believes the stated goal of "guaranteed income security" is socialist silliness.

Once again, I am attempting to separate my own personal beliefs from something that may be more politically feasible.

Two Sure Things

- The path we are on is not sustainable

- Burying one's head in the sand because Social Security is the third rail only makes the problem worse

Safety Net Discussion

I have spent an amazing amount of time on this post already, probably 14 hours. I thought I finished yesterday but I didn't.

Yesterday evening I realized I did not fully address the concept of what constitutes a "safety net", and how much it would take for the average worker to accumulate one.

Jed has done quite a bit of research on the subject, so I decided to ask him.

Jed responded...

"I think since we are talking the bare bones safety net w/ SS that people can’t do without, it makes sense to use the risk-free (some might argue with “free”) Treasury rate. Rule of thumb is that to overcome a 10% benefit cut, an average earner (now about $45k a year) has to save 1% of wages (assuming Treasury returns and a lifetime annuity). For new workforce entrants facing a ballpark 25% benefit cut, as in the Romney plan, that means roughly 2.5% of annual wages. "

The key words are "average earner". In a phone conversation with Jed, he acknowledged things are not so simple. Someone making minimum wage needs to save far more on a percentage basis. Those making $100,000 a year need to contribute far less on a percentage basis.

The problems do not stop there because we are not starting from scratch. What about the "average earner" who is now age 40?

Jed notes such a person may need to contribute 5% of his wages for a minimal return.

That still does not cover all the bases because it assumes everyone is funding their own plan.

Is self-funding the new idea? Or is the original intent of Social Security (minimum retirement income assistance regardless of how much one contributed) still intact?

Regardless of your answer, those making minimum wage will never be able to meet a reasonable "safety net" goal, on their own accord.

I do not champion the idea that Social Security is a "right". It isn't. Rather, I simply state the pure mathematics of the setup.

Funding Your Own Way

I have a close friend who objected to "Means Testing" which was point six of Six Possible Ways to Make Social Security Actuarially Sound, as listed above.

She proposed that what she puts into SS should be hers or her heirs, and no one else's.

Ideally, I agree.

However, if her money is hers (and your money is yours) let me ask a simple question: Does government belong in the "income guarantee" business at all (taking your money only to return some portion of it later)?

If so, why? If not, then let's stop Social Security altogether.

It's certainly a debate worth having, and the answer determines whether or not there should be any "safety nets".

Privatizing Social Security

In a follow-up phone call I discussed privatization of Social Security with Jed. He was once in favor of partial privatization, but that was when Social Security was running a surplus. He is not in favor of it now.

Let's discuss this from the point of view of my friend who states "What I put into SS should be mine, no one else's".

Privatization Ramifications

To create a real "lock box", not an imaginary lock box, with imaginary interest, we need to privatize Social Security, not send money to Washington to be confiscated for whims of the moment.

Assuming that is politically feasible, and ignoring all the people already fully committed to the current system (those retired), as well as those half-way in (those in their 40's), what are the ramifications of privatization?

Before answering, please note that Social Security revenues are in practice used for general expenditures. Simply put, if payroll taxes were diverted to funding private plans, the deficit would soar.

Such a step would require massive tax hikes or massive cuts across the board somewhere (I would vote for massive cuts across the board, especially cuts in military spending).

Then we would still need to do something about partial funding and those already retired. Finally we would need to discuss limitations on those who want to tap their SS funds before retirement.

For a discussion on tapping retirement money, please consider Over 25% of 401Ks Tapped to Pay Current Bills; Dead-Fish Housing Assets; Walking Away Yet Again.

Quickly you can see we are back to the basic question "Whose money is it anyway, and why should government dictate what I do with it?"

Frank Discussion of the Issues is Needed

Regardless of your point of view on what should or should not be done (Jed has his ideas, I have mine, my friend has hers, and you have yours), it's long overdue for a frank discussion of the issues.

Solutions can only happen following admission of the problems. The starting point for discussion is simple admission that Social Security and Medicare are both insolvent, that promises have been made that cannot possibly be kept.

Without a doubt the country needs a frank discussion of "safety nets" and how they should be funded, as well as frank discussions on Medicare and healthcare rationing.

Unfortunately, few if any politicians are willing to admit the truth or to have those discussions, for fear of losing votes.

TOPICS: Business/Economy; Culture/Society; Editorial

KEYWORDS:

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-54 last

To: kabar

You are naive.

Every bond sold by the Treasury, to the public or to the SS “Trust Fund” moves money to the GENERAL FUND!

EVERY DIME in the “Trust Fund” has, therefore, been SPEND by the government, through the General Fund.

41

posted on

01/18/2013 9:26:53 PM PST

by

Kansas58

To: kabar

You are still not understanding my point, you are talking past me but not really refuting me.

I state, clearly, that Social Security is TAXED as a benefit even for those who see little or no Social Security Check, in my line of work.

This is due to the fact that high income retired people OFTEN now pay a great deal for their Medicare benefits.

I predict that this will only get worse.

Social Security is turning into PHANTOM ICOME, income on which people are taxed but they do not ever see that income!

42

posted on

01/18/2013 9:34:50 PM PST

by

Kansas58

To: Kansas58

You are naive. You are ill-informed and don't understand how SS and the trust funds work.

Every bond sold by the Treasury, to the public or to the SS “Trust Fund” moves money to the GENERAL FUND!

Yes, they incur a debt by borrowing the money. Interest must be paid on the debt and the bonds can be redeemed by the holder for dollars. When a T-bill is sold to the Chinese, we must pay them interest on the bond and they can cash them in for dollars any time they want. The more bonds we sell, the larger our debt becomes. The only reason people buy our debt is because it is guaranteed by the good faith and credit of the US to honor that obligation.

EVERY DIME in the “Trust Fund” has, therefore, been SPEND by the government, through the General Fund.

And EVERY DIME of the T-bills held by the Chinese has been spent by the government through the General Fund. What's the difference?

43

posted on

01/18/2013 9:42:32 PM PST

by

kabar

To: zeestephen

“You and your employer will each pay 3 cents on each dollar you earn, up to $3,000 a year”

that’s what it was when I first paid into it.

By 1978 I had 27 years paid in in full and quit paying into it until I retired at 65 in 2002.

at this point I think I have gotten everything paid in, both halves, plus interest.

44

posted on

01/18/2013 9:47:54 PM PST

by

dalereed

To: Kansas58

You are still not understanding my point, you are talking past me but not really refuting me. I would echo that sentiment. You are missing my point. The premiums paid by Medicare recipients for Parts B and D cover only 25% of the costs of the program. The other 75% must be funded, by law, from the General Fund, which means that we must borrow 42 cents of every federal to pay Medicare benefits for those programs. The taxpayer is subsidizing it directly.

I state, clearly, that Social Security is TAXED as a benefit even for those who see little or no Social Security Check, in my line of work. This is due to the fact that high income retired people OFTEN now pay a great deal for their Medicare benefits.

I understand that quite well. I receive both SS and Medicare. I see the premiums being deducted from my SS check and I know that my SS is also being taxed. Why is that such a major revelation?

I predict that this will only get worse. Social Security is turning into PHANTOM ICOME, income on which people are taxed but they do not ever see that income!

Of course it will get worse. Duh. The taxation of SS benefits started with the 1983 Faustian bargain Reagan struck with Tip O'Neill to save SS. It also raised the age for full benefits from 65 to 67 and forced all federal workers hired from 1983 onwards to contribute to SS.

SUMMARY of P.L. 98-21, (H.R. 1900) Social Security Amendments of 1983-Signed on April 20, 1983

45

posted on

01/18/2013 9:52:54 PM PST

by

kabar

To: kabar

The difference?

China can show the US Treasury bonds THEY hold as EQUITY or Assets, on their books!

NO government agency can honestly show inter-agency debt on its books as a Positive Asset, it makes no sense.

You can not loan yourself money and neither can the government.

46

posted on

01/18/2013 10:22:21 PM PST

by

Kansas58

To: mountainlion

Yet many claim it’s their money because they paid into it, the money is long gone...stolen, and if your insurance won’t cover the theft you will be lucky to get anything at all back.

47

posted on

01/19/2013 7:26:14 AM PST

by

Son House

(Romney Plan: Cap Spending At 20 Percent Of GDP.)

To: Kansas58

NO government agency can honestly show inter-agency debt on its books as a Positive Asset, it makes no sense. It makes sense if you understand how trust funds operate. The $2.7 trillion held in the SSTF are assets for the fund, but they represent debt for the federal government, hence their inclusion in the $16.4 trillion national debt.

The various US trust funds account for about $5 trillion of the total debt. They are held as Intragovernmental Holdings as distinct from the publicly held debt. You can ascribe adverbs like "honestly" to the accounting, but the reality is that it is quite transparent and open. The SSTF has been operating the same way since its inception in 1939, i.e., all receipts of revenue must immediately be deposited into USG securities.

It is a positive asset for the trust fund, which uses them to make up the shortfall in revenue to pay full benefits. The Federal Government honors them by redeeming them for dollars that are then paid out to recipients. When they talk about SS being solvent until 2031/32, it just means that full benefits can be paid out until then because of the T-bills held in the SSTF to make up the shortfall. After that, by law, benefits must be reduced to just revenue available.

You can not loan yourself money and neither can the government.

The government can and does. To deny that, denies reality.

The real problem with SS is not the trust fund or the accounting. The fact is that it is actuarily unsound and unsustainable. There is just not enough revenue (actual and projected) to continue to pay future benefits as promised. It is a huge unfunded liability that must be addressed either through increased taxes or decreased benefits or some combination thereof. In 1950 there were 16 workers for every retiree; today it is 3.3; and by 2030 it will be two.

FYI: The largest holder of T-bills is the SSTF followed by the Federal Reserve, which currently buys about 70% of the T-bills offered for sale. The government can print money., which is something an individual cannot do.

48

posted on

01/19/2013 7:27:01 AM PST

by

kabar

To: kabar

No, to deny that the Emperor is not wearing any Cloths only makes you a useful fool.

THERE IS NO TRUST FUND!

There is NO MONEY in the Trust Fund, since every “credit” is offset by a “debit” -—

You are in fantasy land.

49

posted on

01/19/2013 1:07:09 PM PST

by

Kansas58

To: Kansas58

Denial just ain’t a river in Egypt. Your are the one living in a fantasy land. I tried to educate you, but you prefer to wallow in your own ignorance. If there is no trust fund then why is it included in our $16.4 trillion national debt?

50

posted on

01/19/2013 8:29:37 PM PST

by

kabar

To: kabar

Take out a sheet of paper

Write:

I _________ Owe __________

$1,000,000.00 Dollars

Now?

Now write your name on BOTH lines.

Take this paper to the bank and tell them you are a “Millionaire” and see if you can borrow against it!

____

By the way, you are the ignoramus here.

The Debt we HEAR about does NOT include Social Security. That is called “Agency Debt” or “Intergovernmental Debt” and is not included in thedebt figures unless noted.

Please go to the Heritage Foundation and educate yourself.

“Total National Debt consists of publicly held debt and intergovernmental Debt. —— “Publicly Held Debt is more relevant to the credit markets”

You have very little clue about what you post, and you should be ignored by everyone who wants to actually learn anything.

51

posted on

01/20/2013 1:10:06 AM PST

by

Kansas58

To: Kansas58

Take out a sheet of paper...Take this paper to the bank and tell them you are a “Millionaire” and see if you can borrow against it! How silly. The government can do things an individual can't including printing money and issuing debt instruments like T-bills.

By law, all receipts into the SSTF must be invested immediately into interest bearing T-bills. Right now, the SSTF holds $2.7 trillion of them. They represent the good faith and credit of the USG to honor them. They always have and now that SS has been permanently in the red since 2010 and Medicare Part A (HI trust fund), these T-bills are being redeemed to make up the shortfall.

You may stomp your foot and get red in the face that there is no trust fund and it contains no T-bills. But it exists and it does contain interest bearing T-bills. You either refuse to understand or can't comprehend how the trust funds fit into our national debt and deficit.

The Debt we HEAR about does NOT include Social Security. That is called “Agency Debt” or “Intergovernmental Debt” and is not included in thedebt figures unless noted.

The debt we hear about is $16.4 trillion, which contains about $11.4 trillion in publicly held debt and $5 trillion in "Intragovernmental Holdings." $2.7 trillion of that is in the SSTF.

The $16.4 trillion debt ceiling that you hear so much about contains the SSTF. It is meaningful because unless the ceiling is raised, the government cannot incur any additional debt. Spending comes to an abrupt halt.

Please go to the Heritage Foundation and educate yourself.

I have been a member of the Heritage Foundation for years. I have hired Heritage analysts to speak to various grassroots groups I belong to. I have attended many briefings at Heritage on a variety of subjects.

As far as educating myself on SS, I have. I attended a week long seminar devoted solely to SS--how it works and how we need to address its problems. I have heard from the head of GAO, the CBO, three congressman and two senators, SS Trustees, the Concord Coaltion, CATO experts, a Nobel winning economist--not Krugman, and many others. I discovered that I really didn't know how SS worked until after hearing these speakers. Solutions ran the gamut from privatization (something I advocate along with a small defined benefit program to cover survivor and disabililty payments) to increased taxes, reduced benefits, and lots of other fixes to reduce the long term liability of the USG, now about $18 trillion over a 75 year period.

I would suggest that you educate yourself on the issues involved. The problem with the solvency of SS has nothing to do with the SSTF and the accounting of the funds. Al Gore's lockbox is a joke. The problem is with the demography of an aging population and fewer workers to pay for a fast growing population of recipients. And the fact that SS benefits are not connected to revenue despite over 40 tax increases and an almost annual increase in the SS salary cap. No one stole the SS money. In essence, SS is a Ponzi scheme that allows the people at the top of the pyramid to get more out of the system than they ever put in. The future will not be as bright for those coming afterwards.

“Total National Debt consists of publicly held debt and intergovernmental Debt. —— “Publicly Held Debt is more relevant to the credit markets”

There is a debate about this among economists as to whether debt we owe to ourselves is really important. The Obama folks and the Left would like you to believe that it doesn't. Personally, I disagree. We are now running in the red as far as the entitlement programs are concerned. In order to redeem these trust fund T-bills, we must borrow 42 cents of every federal dollar to honor that obligation. And the total national debt is woefully understated when you consider that we have in essence obligated ourselves to paying for the entitlement programs--an unfunded liability of over $60 trillion (75 year period)--and that does not include the latest huge new entitlement program of Obamacare.

As far as the credit markets are concerned, you grossly mistate their interest in the US solving its entitlement problems. Look at the statements from Moody's, Fitch, and others. They mention entitlement reform.

You have very little clue about what you post, and you should be ignored by everyone who wants to actually learn anything.

LOL. In psychology, this is called projection. The sad fact is that you not only know very little about how SS works, but you refuse to accept the objective facts about the SSTF and the debt issue. You would rather wallow in your own ignorance and ask others to follow you. If we are going to debate and defeat the other side, we need to use facts not groundless assertions.

For starters, take a look at the 2012 Trustees Report

52

posted on

01/20/2013 7:44:08 AM PST

by

kabar

To: kabar

Kabar, are you REALLY this dense?

Legislation can COMMAND rain, but that will not make it rain.

A King can command the tides, but the tides will not listen.

The REASON that governments forbid private industry, or individuals, from certain financial tricks is because those tricks are detrimental to the public good.

The fact that those tricks are detrimental REMAINS even if the government is arrogant enough to allow an “exception” for itself -—

Even if the government breaks the rules of sound actuarial science, even if the government breaks the rules of sound economics, even if the government breaks the rules of sound accounting -—

The RULES of NATURE will prevail.

THERE IS NO TRUST FUND

-— and you are a naive fool to take the LIARS side of this argument.

53

posted on

01/20/2013 12:38:31 PM PST

by

Kansas58

To: Kansas58

THERE IS NO TRUST FUND YES THERE IS AND YOU ARE CERTIFIABLE. Get yourself fitted for one of these:

54

posted on

01/20/2013 2:38:36 PM PST

by

kabar

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-54 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson