Skip to comments.

Investment & Finance Thread 2014 New Year(Jan. 6 - Jan. 13 edition)

Freeper Investors ^

| Jan. 6, 2014

| Freeper Investors

Posted on 01/06/2014 2:28:44 AM PST by expat_panama

Investment & Finance Thread 2014 New Year(Jan. 6 - Jan. 13 edition)

Anyone want more stuff or less stuff posted here please let me know.

Ping list -- on or off let me know here or via freep-mail. If I missed you then Freep-mail me. The list of everyone's links is here. Open invitation continues always for input on ideas for the thread, this being a joint effort works well. Keywords: financial, WallStreet, stockmarket.

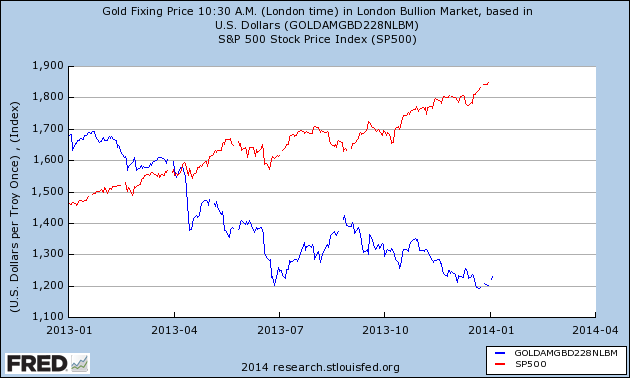

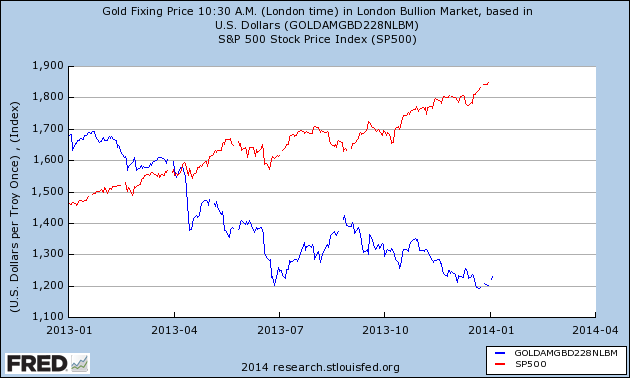

2013 was an amazing year-- stocks up 30%+ w/ metals tanking like 40%. Don't know about you but I spent most of it ready to bail out of stocks finding I never had a good reason. OK, so we made money but I'll be the first confess of being too cautious & missing out on some of the gains I should have gotten. New Year's Resolution #1: No more wimping. Sure, lots of folks are complaining about this past year's stock gains saying it can't last. The thing is that though we've been having a great run on stocks we can't expect it to last forever--- |

|

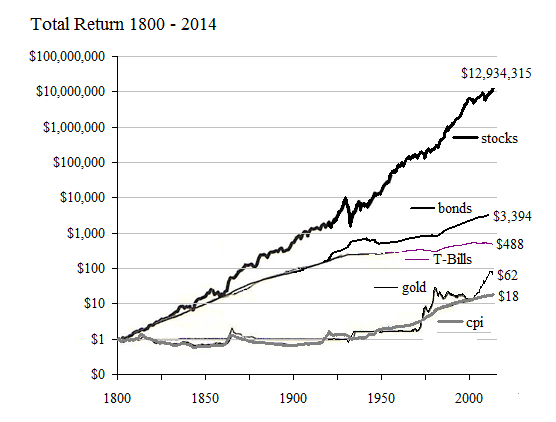

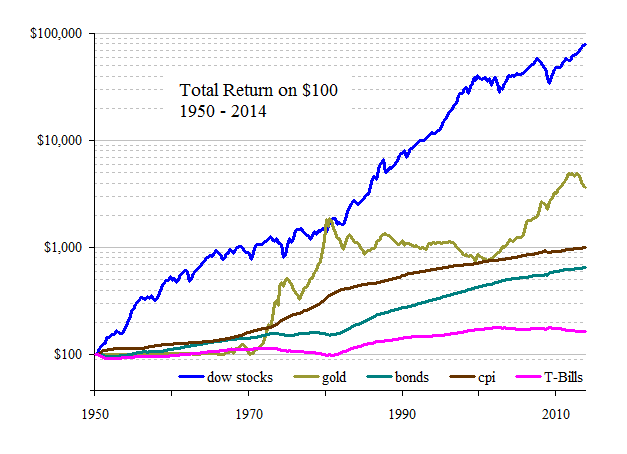

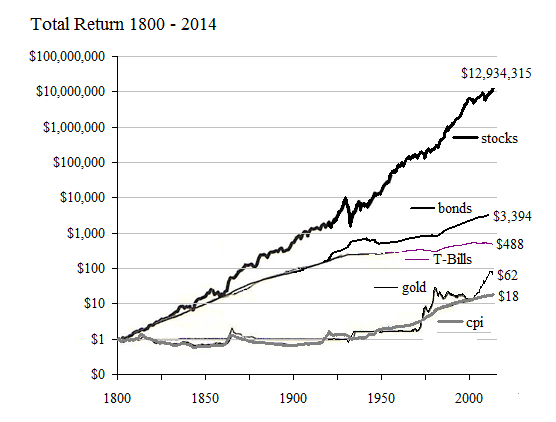

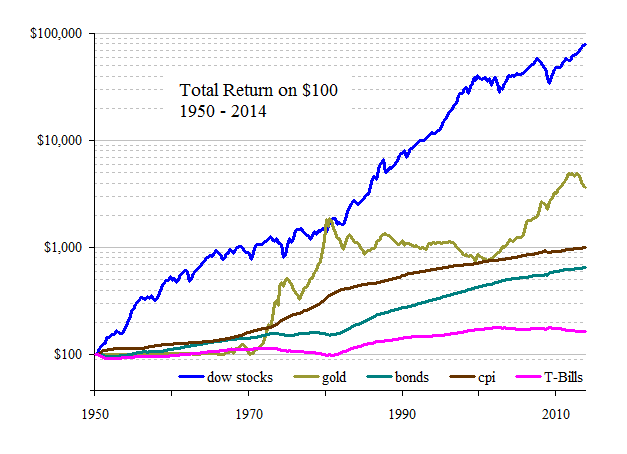

--because the fact that it's been going on for hundreds of years means that stocks are sure to revert to where they were in 1799 any second now. Actually, no. Stock returns are a function of the value of American commerce. America grows. We need to get used to it. The long term pattern is total return on stocks since 1800 has been 8%/year-- that comes out to doubling our money in just over a dozen years. On average. |

|

Looking more closely at the past few decades what I'm seeing is the fact that we're apparently leaving the stock perch we've been on for the past decade and a half, and we're seem to be emerging into what a lot of people call a 'secular bull market'. OK, I'm still ready to dump if what I got drops 9%, but I'll put more effort into really checking before I post my sell order... |

TOPICS: Business/Economy; Culture/Society; Government

KEYWORDS: financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-52 next last

Someone please proof read this while I get my morning coffee...

To: abb; Abigail Adams; abigail2; Aliska; Aquamarine; B.O. Plenty; BenLurkin; bert; BipolarBob; ...

Good morning campers and a happy Mother-of-all-Mondays to all!!!

Last Thurs & Fri were off a bit and while this mornings futures are slightly upbeat in general and tepid for stocks (@ 5.15AM EST) that's how it's been lately. Even the news is mixed:

Europe Faces Specter of Deflation Wall Street Journal - 5:02am Relatively few people alive today in the West have experienced deflation, but for Europeans, that may be changing...

To: expat_panama

The fact that many U. S. business can actually survive, and in some cases thrive, with the political climate we have today, speaks volumes about the ingenuity, creativity, and work ethic of its people.

Never sell the American people short when it comes to commerce.

3

posted on

01/06/2014 2:39:21 AM PST

by

abb

To: expat_panama

I remember 1999 with renewed interest.... Once the tax receipts are counted for the old year, the market tanked. We could all feel it coming since the May-June 1999 but the bozo's in the medial and Bill in the WH continued to smile; then Bill went to the December 1999 meeting where he and Saudi Arabia rescinded the original Gulf War deal that kept Oil prices at $22-24 a gallon and sure enough Bush had his Dot-Com Market Bust.

For myself, I remain unconvinced this market is not due an immediate correction. I believe this correction will be due to War Drums thus absolving the Fed & WH of their ruinous economic policy, and said crash will cull about 40% out of the Fed Stimulus out of Stocks.

4

posted on

01/06/2014 3:37:22 AM PST

by

Jumper

To: abb

The fact that many U. S. business can actually survive, and in some cases thrive, with the political climate we have today, speaks volumes about the ingenuity, creativity, and work ethic of its people. Never sell the American people short when it comes to commerce.Someone posted a retort to one of my comments a couple of weeks ago that is in line with this. And that is, every-time Obama didn't get all he wanted or lost with a piece of legislation the markets rallied. I don't have the data to support it, but it may ring true. So their is an underlying desire to engage in commerce, we have no choice w/ him or without him it will go on.

In terms of the ingenuity, I have been a bit sour on this "3D Printing" revolution, I know enough about metallurgy to be dangerous and couldn't see it for a host of reasons. However, a post here in FR this week on a breakthrough on Titanium production, seeing the CEO of DDD on TV, and that fact that this Titanium can be printed, ( and an application of "powdered aluminum" that has me stunned ) and printing in the Jet Turbine arena makes me wonder if more is going on than can be talked about.

Tangent to this I have been doing some reading on a DOE funding project to make Auto Fuel Tanks that carry CNG and not be the cylindrical space gobblers they are with the 2 enabling technologies being a low cost lower pressure pump and an absorbent medium in the tank to increase capacity by 30%. This would allow the current CNG infrastructure, i.e. the natural gas coming to your home to be the fueling delivery system so that you could fill up at home!

Obama can't stop these paradigm changing technologies ( including the Fracking Revolution ), let us hope his administration doesn't become so onerous that they decide to go off shore.....

5

posted on

01/06/2014 3:38:09 AM PST

by

taildragger

(The E-GOP won't know what hit them, The Party of Reagan is almost here, hang tight folks....)

To: All

I’m starting to get concerned about my Proctor & Gamble stock. I don’t know what’s going on with it. It’s not low but it’s down more than it seems like it should be. My 401K pension is in a separate account that is low risk and it’s doing fine but my P&G stock pension is not doing well and I can’t see why. I’m not a financial expert though. I retired early and draw a small income from my 401K but I don’t bother my P&G stock account. I retired early at 58 last July. I plan to find one of those barely above minimum wage for retiree part time jobs this spring or summer. :-)

To: Tennessee Conservative

Looks good to me for a long-term investment.

7

posted on

01/06/2014 4:11:31 AM PST

by

abb

To: abb

“The fact that many U. S. business can actually survive, and in some cases thrive, with the political climate we have today, speaks volumes about the ingenuity, creativity, and work ethic of its people.”

It is hard to classify many of the listed companies as “American” anymore; their overseas relationships (including their labor pools) have increasingly made them “multi-national”. I’ve posted on other threads: the best way for a company to drive up stock price is to lay off American workers (otherwise we’d have 0% unemployment as these companies “thrived”). The work ethic of the American people is waiting to show itself (when Americans work again).

8

posted on

01/06/2014 4:13:36 AM PST

by

kearnyirish2

(Affirmative action is economic war against white males (and therefore white families).)

To: abb

"...U. S. business can actually survive, and in some cases thrive, with the political climate we have today, speaks volumes about the ingenuity, creativity, and work ethic of its people..."O'neal at Investor's Daily was saying that about how he made money in 1979. Historically peoples who've underestimated America have regretted it.

To: abb

The stock market rises and falls according to the political expediency of the DemocRat party.

10

posted on

01/06/2014 4:36:04 AM PST

by

Excellence

(All your database are belong to us.)

To: abb

It is my belief that a self governing device has been installed on the American economy by busineses that prevents for the time being over revving and maintains a level of thriving or barely thriving.

They long to remove the governor and let ‘er rip.

11

posted on

01/06/2014 4:41:52 AM PST

by

bert

((K.E. N.P. N.C. +12 ..... Travon... Felony assault and battery hate crime)

To: Jumper

...unconvinced this market is not due an immediate correction...Greenspan made his "irrational exuberance" comment back in '96, and the market continued to soar for years. Counting dividends the Dow Jones stocks are worth more than five times what they were in '96.

OK, mere action is all well and good, but real life words is a different and serious matter. Many investors (like myself) prefer a strategy of being fully invested and telling everyone the market's going to crash. That way when it goes up we get rich and if it goes down we say 'I told you so'.

Win win.

To: abb

Everything I read says to buy it and keep it because it’s pretty stable and pays good dividends, which it does, but I guess after it hit over $85 and started going back down I have been panicked. I haven’t lost any of my original stock, just the amount I made last month. It performed good the last couple of months until the last couple of weeks. Since I’m retired I don’t hear as much as I used to from work and I don’t see what is causing it to slow down. I keep it for the long term since I have the other account to draw from and I plan to work at something in the future so that I can stop drawing from the 401K. When I turn 59 1/2 in April I will move the 401K (maybe) to a place that can manage it for me. Being an employer sponsored plan, I am limited to what I can do as long as it is in the company plan with JP Morgan but if I move it now I have to pay the penalty to withdraw any. As long as it’s in the company plan and I retired after 55, I don’t have the tax penalty on monthly withdrawals.

To: Tennessee Conservative

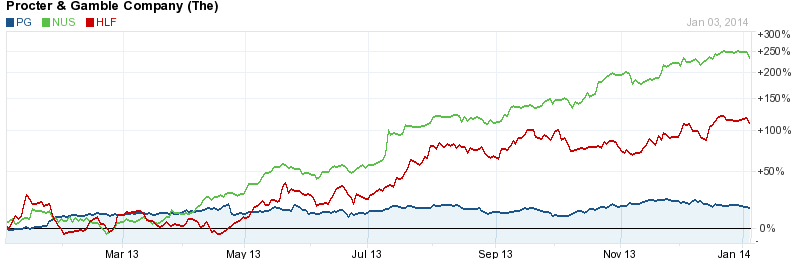

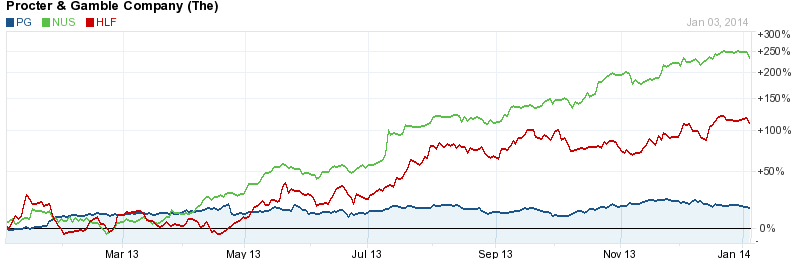

concerned about my Proctor & Gamble stock. I don’t know what’s going on with it.IBD reports that PG ranks poorly compared to other companies in terms of earnings, price performance and the way institutions are not not buying but are selling it. High performing group leaders HLF and NUS have been kind to me recently, and here's how PG compares to them:

To: Tennessee Conservative

That’s what I’m talking about. Except for the big jump recently, it’s not doing much. It’s kind of flat. The good thing is I guess is that it’s not taking a huge tumble. There is so much diversity in P&G products that when one product is not performing, another product is, so while it might not go up, it doesn’t crash either. If you want stock that is growing and making money though, P&G isn’t right now. If you stand back and look at it from several years ago, it is doing fine.

To: Tennessee Conservative

P & G is a core keeper. It pays a good dividend. Its safe money. YOur not going to get 25% on it. Do you buy and use their products? If the answer is yes then keep it. Safe money and growth.

16

posted on

01/06/2014 8:18:08 AM PST

by

ncfool

(Obama's aMeriKa 2012 The land of entitlement for the 51% crowd.)

To: expat_panama

17

posted on

01/06/2014 8:31:59 AM PST

by

ncfool

(Obama's aMeriKa 2012 The land of entitlement for the 51% crowd.)

To: ncfool

Thanks! That makes me feel better. Since I retired I’m more nervous about my savings since I’m not currently contributing. I’ll keep it for sure. I do buy most of their products, mostly to support the business.

The only reason I retired early was 36 years of long hours (80+ hours some weeks before time off), rotating shifts, and back pain. I was a Team Leader, or supervisor, and spent all of my time on my feet on the manufacturing floor with small amounts of time in the office. Since I retired all of my pain is gone and I’m getting back in shape so I want to work at something until my true retirement age at least and save the rest of my savings. I enjoy working but I’m ready to work and have a life. :-)

To: Tennessee Conservative

When I turn 59 1/2 in April I will move the 401K (maybe) to a place that can manage it for me.

~~~~~~~~~~~~~~~~~~~~~~~

A word of advice. Check out Bogleheads. (http://www.bogleheads.org/forum/index.php) They are a group of investors dedicated to the idea of managing your own investments, and primarily investing in index funds.

While it is tempting to just hand over your money to a firm like Edward Jones, to them you are just one of thousands of clients. At the end of a day, no one gives a second thought about your investment balance. To you, though, your investment portfolio is what allows you to sleep at night, to live a good retirement. Managing it does not have to be time consuming. At least learn about Bogleheads and their philosophy before you turn your money over to someone else. Besides a very informative forum, they have a great wiki. In our area, there are also quarterly meetings to which we get about two dozen or more participants.

19

posted on

01/06/2014 10:35:24 AM PST

by

ConstantSkeptic

(Be careful about preconceptions)

To: ConstantSkeptic

Thanks SO much for the link! I will check them for sure.

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41-52 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson