Skip to comments.

Is Fed Sowing Seeds Of Next Recession?

IDB ^

| March 21, 2014

Posted on 03/21/2014 3:43:15 AM PDT by upchuck

Monetary Policy: Now that Janet Yellen says the countdown to a Fed interest-rate hike has begun in earnest, maybe we should ask a follow-up question: Is this also a countdown to the next recession?

In her first remarks as new Fed chairwoman, Yellen this week seemed to back off the central bank's earlier vow to start raising interest rates only when unemployment falls to 6.5% or lower.

Instead, she said, the Fed will rely on a "wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments."

We're not sure what she means by that, but she did make a prediction of sorts: The Fed will wait a "considerable time" after its $85 billion-a-month bond-buying program ends before starting to raise interest rates.

[snip]

The bottom line is, we've basically had zero interest rates for almost five and a half years now, so a fairly big rise is on the way.

If you go back in history, you can see that substantial rises in interest rates have always preceded recessions. Always. But even after half a decade of interest rates near zero, the economy is still basically just crawling.

GDP growth remains less than half the normal pace for a recovery. We still have 2 million fewer jobs than we did at the peak in late 2007. While unemployment has indeed fallen to almost 6.5%, it's mainly due to frustrated jobseekers leaving the workforce entirely.

"There has never been a recovery worse than this, (and) there is no reason to think doing nothing would have turned out worse," said University of Georgia economist George Selfin, speaking at an American Enterprise Institute conference on the Fed this week.

The Fed, in short, has painted itself into a corner.

(Excerpt) Read more at news.investors.com ...

TOPICS: Business/Economy; Crime/Corruption; Government

KEYWORDS:

Navigation: use the links below to view more comments.

first 1-20, 21-23 next last

Who didn't see this coming. House of cards indeed.

1

posted on

03/21/2014 3:43:15 AM PDT

by

upchuck

To: upchuck

2

posted on

03/21/2014 3:49:52 AM PDT

by

Drago

To: upchuck

To: upchuck

Bubble, bubble, toil and trouble

4

posted on

03/21/2014 3:56:23 AM PDT

by

Reeses

To: Third Person

Permanent recession.I was thinking about that.

Can we please get out of and fully recover from the current recession before the Fed saddles us with another one? Pretty please?

5

posted on

03/21/2014 3:58:52 AM PDT

by

upchuck

(South Carolina Representative Trey Gowdy for Speaker of the House!!!)

To: upchuck

Next Recession?!? We never got out of the 1st one. 47 million on food stamps, the lowest labor participation rate since WW2, We are in a Great Depression.

6

posted on

03/21/2014 4:07:23 AM PDT

by

2001convSVT

(Going Galt as fast as I can.)

To: Third Person

This is just like Japan's "Lost Decades." The only thing missing is an interest rate structure so low that bank deposits are subject to

negative interest rates.

What's interesting is that it was pretty much inevitable, and there really isn't anything the Fed (or anyone else) can do about it except wait it out and hope for the best.

7

posted on

03/21/2014 4:09:38 AM PDT

by

Alberta's Child

("I've never seen such a conclave of minstrels in my life.")

To: upchuck

Is Fed Sowing Seeds Of Next Recession? I don't think so. I think what people responsible for managing this country are about to create is a complete collapse. Recession? We have been in a recession for years.

We're about to see what happens when our fearless leaders can't stop trying to fix the recession.

8

posted on

03/21/2014 4:15:27 AM PDT

by

stevem

To: upchuck

The NEXT recession? The one that started late in 2008 seems to be running along just fine although infaltion is rampant. don’t recession and inflation go together?

To: 2001convSVT

Agreed. See number 5 above.

10

posted on

03/21/2014 4:16:41 AM PDT

by

upchuck

(South Carolina Representative Trey Gowdy for Speaker of the House!!!)

To: Lion Den Dan

Let’s go back even further than 2008. When you have an economy like ours that is built on piles of debt-financed economic activity, you can make the case that we’ve been in a recession since 2000.

11

posted on

03/21/2014 4:24:39 AM PDT

by

Alberta's Child

("I've never seen such a conclave of minstrels in my life.")

To: upchuck

Next Recession?

That title is based on the premise that we actually left the last one.

With fuzzy math and Obama lies we have just grown weary of talking about it. But the workforce participation level has done nothing but decline since the Won was first elected. There can be no “recovery” until he is gone.

12

posted on

03/21/2014 4:45:05 AM PDT

by

Texas Fossil

(Texas is not where you were born, but a Free State of Heart, Mind & Attitude!)

To: Texas Fossil

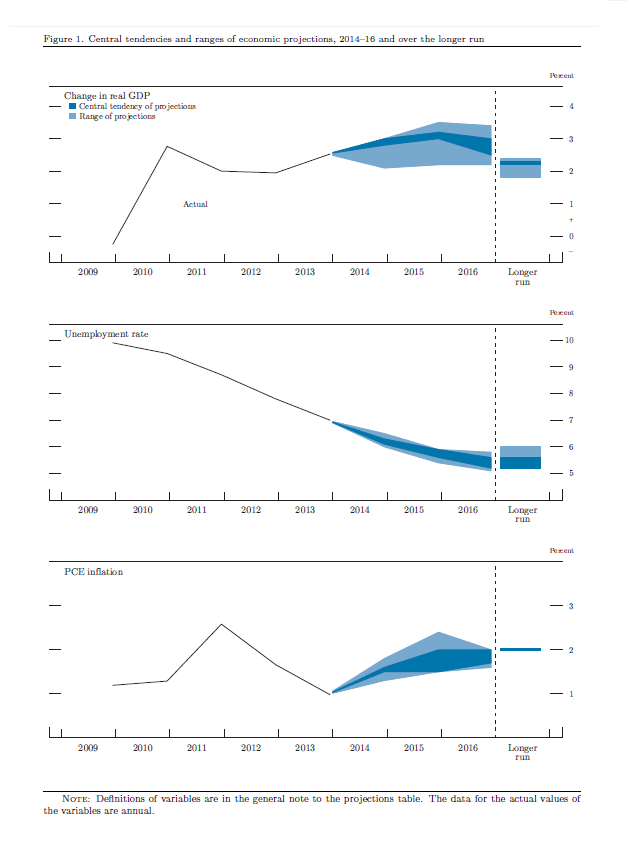

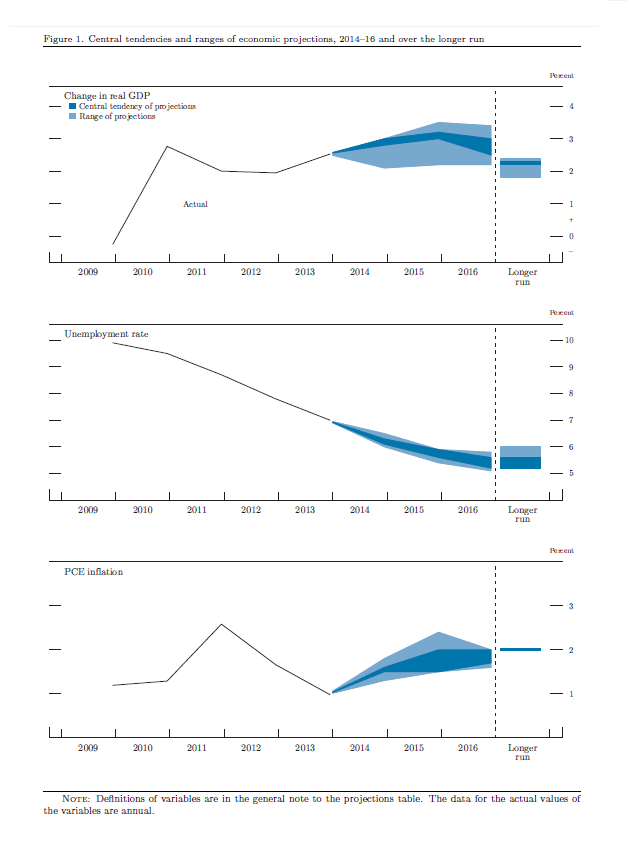

no “recovery” until he is gone--and then we can get back to work. That may be what the FOMC's really thinking; here're their numbers:

They're fully aware that the current economy's in the cr@pper, but they seem to be assuming that somehow the American voter's going to sober up. imho this is where the Fed's delusional.

13

posted on

03/21/2014 5:04:05 AM PDT

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

To: upchuck

Yes, a permanent Depression is where we are. Until we have a countrywide system reset, both economically and politically.

14

posted on

03/21/2014 5:06:36 AM PDT

by

2001convSVT

(Going Galt as fast as I can.)

To: upchuck

Unless a Cruz or a Palin can win in 2016 and right our economic policy.

To: upchuck

Uh, c'mon. Except for the elite and powerful who are benefitting from absurd stock price increases, the US has never gotten out of recession, and everyday a majority of the US population falls further behind.

Higher interest rates would mean responsible "little people" could accumulate some money. It would mean people would stop propping up the market, I'd wager for as little as 2% interest. The market my go down to rational levels, and there'd be less money available to those who know what the best bests will be because of their manipulations.

There has to be an end to how long things can be manipulated. At some point, there's going to be a crisis. The longer it takes to happen, the worse it's going to be. You know what? If it's that the big banks and hedge funds fail, I wouldn't lose any sleep over it. JMHO

16

posted on

03/21/2014 5:17:14 AM PDT

by

grania

To: upchuck

Abolish the Federal Reserve.

To: upchuck

——it’s mainly due to frustrated jobseekers leaving the workforce entirely.-——

I believe that they have not left the workforce but rather joined an underground economy that does not report what it does nor how it functions. Many of those that left have developed income producing work. Since they are in effect self employed or allied in a small group that is self employed they don’t operate with in the confines of reportable economic activity.

18

posted on

03/21/2014 5:33:50 AM PDT

by

bert

((K.E. N.P. N.C. +12 ..... History is a process, not an event)

To: expat_panama

assuming that somehow the American voter's going to sober upI agree that is a bit much. The "low information" Obama supporters are not likely to "wise up". But they have been badly hurt by his policies. And even a "blind squirrel" finds an acorn some times.

The indoctrination of the public school system, the media, the public employees are such that it is truly an uphill battle from here.

19

posted on

03/21/2014 5:45:16 AM PDT

by

Texas Fossil

(Texas is not where you were born, but a Free State of Heart, Mind & Attitude!)

To: Drago

The Fed needs to raise margin rates on stock traders. People are borrowing money to hedge the stock market like they did back in 2001.

Navigation: use the links below to view more comments.

first 1-20, 21-23 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson