Skip to comments.

Is Fed Sowing Seeds Of Next Recession?

IDB ^

| March 21, 2014

Posted on 03/21/2014 3:43:15 AM PDT by upchuck

Monetary Policy: Now that Janet Yellen says the countdown to a Fed interest-rate hike has begun in earnest, maybe we should ask a follow-up question: Is this also a countdown to the next recession?

In her first remarks as new Fed chairwoman, Yellen this week seemed to back off the central bank's earlier vow to start raising interest rates only when unemployment falls to 6.5% or lower.

Instead, she said, the Fed will rely on a "wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments."

We're not sure what she means by that, but she did make a prediction of sorts: The Fed will wait a "considerable time" after its $85 billion-a-month bond-buying program ends before starting to raise interest rates.

[snip]

The bottom line is, we've basically had zero interest rates for almost five and a half years now, so a fairly big rise is on the way.

If you go back in history, you can see that substantial rises in interest rates have always preceded recessions. Always. But even after half a decade of interest rates near zero, the economy is still basically just crawling.

GDP growth remains less than half the normal pace for a recovery. We still have 2 million fewer jobs than we did at the peak in late 2007. While unemployment has indeed fallen to almost 6.5%, it's mainly due to frustrated jobseekers leaving the workforce entirely.

"There has never been a recovery worse than this, (and) there is no reason to think doing nothing would have turned out worse," said University of Georgia economist George Selfin, speaking at an American Enterprise Institute conference on the Fed this week.

The Fed, in short, has painted itself into a corner.

(Excerpt) Read more at news.investors.com ...

TOPICS: Business/Economy; Crime/Corruption; Government

KEYWORDS:

Navigation: use the links below to view more comments.

first previous 1-20, 21-23 last

To: upchuck

Next recession? Did the last recession ever end?

To: upchuck

Gee I didn’t know we got out of the first recession. Silly me. :-)

22

posted on

03/21/2014 8:20:12 AM PDT

by

Georgia Girl 2

(The only purpose o f a pistol is to fight your way back to the rifle you should never have dropped.)

To: tom paine 2

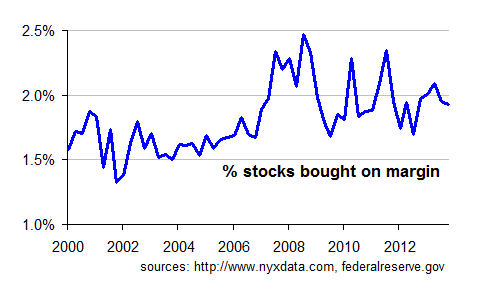

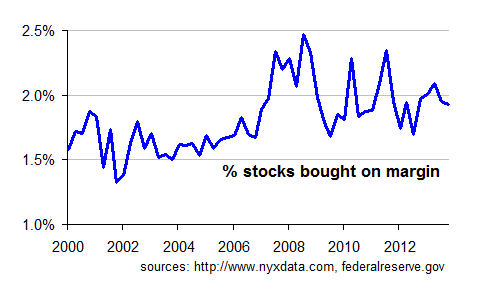

People are borrowing money to hedge the stock market like they did back in 2001.Maybe you were thinking of 2000 with the dot.com bust because back in 2001 the amount of stocks 'hedged' on margin was at a low point --only just over a percent of all stocks owned. Now it's up closer to two percent:

Of course with the low interest rates that percent's been way over 2% a lot but of late it's been fading back down to the average level we seen for the past decade.

23

posted on

03/21/2014 8:48:19 AM PDT

by

expat_panama

(Arguing with those who have renounced reason is like giving medicine to the dead. --Thomas Paine)

Navigation: use the links below to view more comments.

first previous 1-20, 21-23 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson