Skip to comments.

Investment & Finance Thread (May 10 edition)

Investment & Finance Thread ^

| 05/10/2014

| Freeper Investors

Posted on 05/10/2014 10:39:26 AM PDT by expat_panama

|

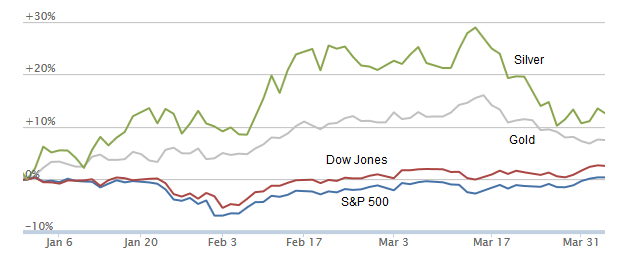

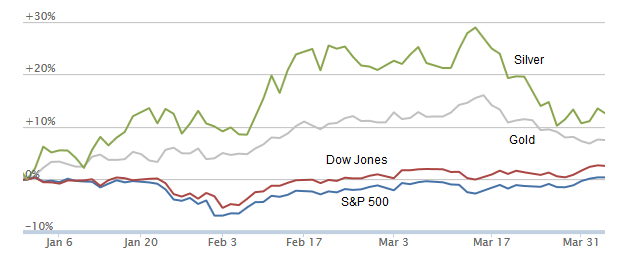

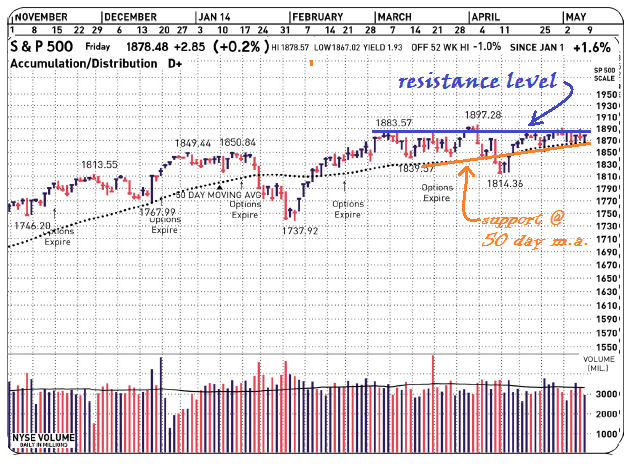

imho this past week is what I'd call a 'head-scratcher', but here are some other people's ho's:  (click on pic to enlarge) (click on pic to enlarge)

Gold Seeker Weekly Wrap-Up Gold climbed $5.04 to $1294.24 by a little before 8AM EST before it dropped back to $1285.54 in the next four and a half hours of trade, but it then bounced back higher into the close and ended with a loss of just 0.04%. Silver slipped to as low as $19.052 and ended with loss of 0.1%. Next week’s economic highlights include the Treasury Budget on Monday, Retail Sales, Export and Import Prices, and Business Inventories on Tuesday, PPI on Wednesday, Initial Jobless Claims, CPI, Empire Manufacturing, Net Long-Term TIC Flows, Industrial Production, Capacity Utilization, the Philadelphia Fed, and the NAHB Housing Market Index on Thursday, and Housing Starts, Building Permits, and Michigan Sentiment on Friday... Investing.com Weekly Wrap-Up 09 May 2014 U.S. stocks rose on Friday as bottom fishers snapped up nicely priced technology shares and looked past escalating tensions in Ukraine, sending the Dow Jones Industrial Average to an all-time high. At the close of U.S. trading, the Dow 30 rose 0.20% to close at a record-high 16,583.34, the S&P 500 index rose 0.15%, while the NASDAQ Composite index rose 0.50%. Follow up: Technology and biotech shares have taken a beating in recent sessions, as investors have viewed the sector as too frothy... Newscast: Stocks edge higher 4:25 p.m. May 9, 2014 - By MarketWatch Newscast: Stocks edge higher. Steve Orr reports on the closing numbers, including a new record high for the Dow.. Last Update: 4:25 PM May 9, 2014 Wall Street had hired wrap up the week the Dow industrials also closed at a fresh record high then...

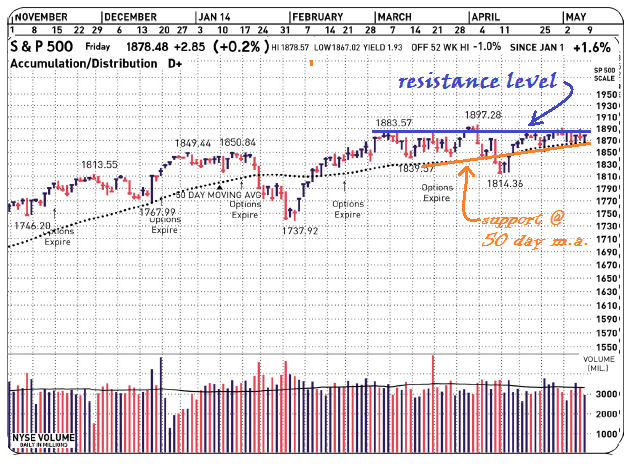

(click on pic to enlarge) Honestly, this still isn't anything we could call 'market direction'. OK, so the Dow hit a record. Sort of. More likely what the large caps are hitting is a tightening range between solid resistance and firm support. Then again, while what we've been seeing is flat/nowhere, this kind of pattern is usually what gurus refer to as 'bullish' because it bespeaks consolidation and presents a solid base to build on. |

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-46 next last

To: expat_panama

Nouriel Roubini Just Presented A New List Of Risks To The Global Economy

REUTERS/Mike Segar

Nouriel Roubini

In financial circles, academic Nouriel Robin is known as “Dr. Doom.” On Wednesday morning at the SALT Las Vegas hedge fund conference, he tried to give a crowd full of journalists and financial professionals some sugar with their medicine.

Roubini presented a list of six receding global risks, and six new rising global risks.

Lets start with the good news. Here are the risks that are fading out of sight.

- It looks like the Euro Zone is going to stay together — the Grexit isn’t going to happen and austerity is almost over.

- The United States is out of the woods in terms of a potential fiscal crisis, and it seems like Democrats and Republicans have come to a truce on the fiscal cliff.

- The risk of deflation in Japan has fallen thanks to Abenomics, at least for now.

- The risk of deflation in all advanced economies, in fact, is low thanks to quantitative easing. “Of course inflation is still too low,” he added.

- The Middle East — Pakistan, Afghanistan, Syria etc. — is still a mess, but investors just don’t care as long as it’s not messing with oil and gas supply.

So that’s the good news, now for the bad news.

- China! “Some people believe in a hard landing... some people believe in a softer landing,” said Roubini. “I worry about a bumpy, tougher landing.”

- What does that mean? Growth of 6% or less by 2016 and the continuation of bad investment policies. Roubini does not believe the market is pricing this in yet.

- A policy mistake by the Fed. For example, lets say the Fed decides to set the Fed Funds Rate at 3% rather than too, and that turns out to be too high. Maybe the Fed exits QE too soon.

Roubini sees a “secular stagnation in advanced economies,” thanks in part to income inequality. Right now companies are rich but they’re not spending any of that money on capital expenditures. They don’t see the demand.

Why? Because of income equality. “High debt and inequality are slowing down consumption.” In consumption based, advanced economies, “that’s a problem,” said Roubini.

There are six new countries that are fragile for political and economic reasons — Argentina, Venezuela, Thailand, Ukraine, Russia, and Hungary.

An expansionist Russia. “Putin is not just after Ukraine, he wants to create a Eurasian union,” said Roubini. It’s a 20 year process that would join a bunch of countries in Eastern Europe politically and economically.

Japan and China are really getting angry at each other.”I was quite disturbed at the World Economic Forum... senior officials were talking about relations between China and Japan being like Britain and Germany before WWI.” You’ve got nationalist governments in both countries, and xenophobic elements that could be exacerbated if either country’s economy goes sour. This conflict would spill out to the rest of Asia too — to Korea and India at the very least.

Sweet dreams everyone.

To: Wyatt's Torch

wtf —there’s no fiscal crisis but we’ve got a big problem w/ China and income inequality?

Seriously?

To: expat_panama

No fiscal cliff type of crisis looming. China is a potential drag if they have a hard landing. Their government fueled multi-bubbles are going to burst and it will drag on the global economy.

I wouldn’t define the “growth” issue as inequality. But you’ve pointed out that real median incomes have declined. But if you look at the top 10% they have increased and the bottom 90% have fallen faster. The top 10% can’t drive consumer spending for long. But the problem is a lack of growth. Not “inequality.”

To: Wyatt's Torch

Roubini sees a “secular stagnation in advanced economies,” thanks in part to income inequality. Right now companies are rich but they’re not spending any of that money on capital expenditures. They don’t see the demand. Why? Because of income equality. We agree that's wrong, that income inequality is good, and that we want people to be different.

No fiscal cliff type of crisis looming.

It may not be looming in the ultra left press we're subjected to, but lack of perception will do nothing to let the nation avoid getting stuck with $trillions in interest outlays brought about by years of excessive and profligate federal spending.

To: expat_panama

I think your definition of “income inequality” is simplified. There will always be differences. The issue is when a small portion of those earners have income increasing significantly and the largest portion are seeing incomes decline, it’s going to cause problems in the economy. The top 10% cannot sustain the growth of the economy.

Now many leftists think the so,union is to raise taxes. That’s just stupid. The problem is growth. As we’ve discussed numerous times growth is decidedly insufficient due to the regulatory and fiscal environment.

As a nice byproduct, growth solves the long term fiscal issues as well. We absolutely cannot cut spending enough to solve them.

To: Wyatt's Torch

To: Wyatt's Torch

....your definition of “income inequality” is simplified. There will always be differences. The issue is when a small portion of those earners have income increasing significantly and the largest portion are seeing incomes decline, it’s going to cause problems...Nobody's offered a new definition here so the words "income inequality" have to mean what they mean. We want it and we don't want income equality.

The study of fixed exclusive income strata however raises other issues. You raised the question of whether America's worse off if average incomes increase while "the largest portion are seeing incomes decline". We do not know if this is the case --what we know is that the Census Br says real median incomes are less than they were 8 years ago. Even if they're correct it may not be the result of declining incomes for most people but rather the result of new entrants to the labor force from say, demographics or immigration. We don't know, and we can't say something we don't know is bad enough to require raising taxes.

Income castes are bad where lower castes are not allowed upward mobility. That's not the case in the US as most Americans are able to rise up through quintiles and one out of eight Americans are eventually able to make it to the infamous "one percent" that the occupy folks want to murder. What we do want is (like you sad) is economic growth --an expanding economy and rising productivity-- and we're together on the idea that "growth is decidedly insufficient due to the regulatory and fiscal environment". mho is that at its core the main obstacle we face is a class warfare borne of envy.

To: expat_panama

Americans are allowed to fall out of the upper income brackets as well. That’s critical, too. The other part of this is single entry accounting. Incomes can fall in an increasing productivity economy and the cost of goods also makes a lower income not lose any purchasing power. It can actually gain purchasing power in that case.

28

posted on

05/14/2014 7:28:48 PM PDT

by

1010RD

(First, Do No Harm)

To: All

To: expat_panama

To: expat_panama

Consumer prices +0.3% vs. FactSet Consensus 0.3%

Initial Claims +298K vs. FactSet Consensus +320K

To: 1010RD

--and it goes on and on. My income's a great fer'instance here as even though my 'earned' income's fallen to zero my spending has soared with my 'unearned' income.

Census Br. numbers really do have to be handled with tongs while wearing a gas mask...

To: Wyatt's Torch

To: expat_panama

FReepers agree with Robert Reich:

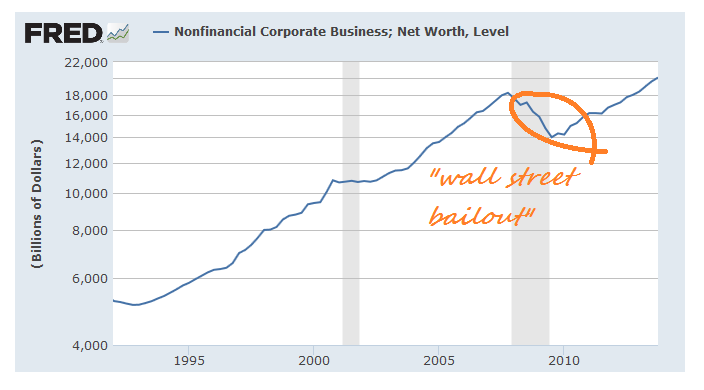

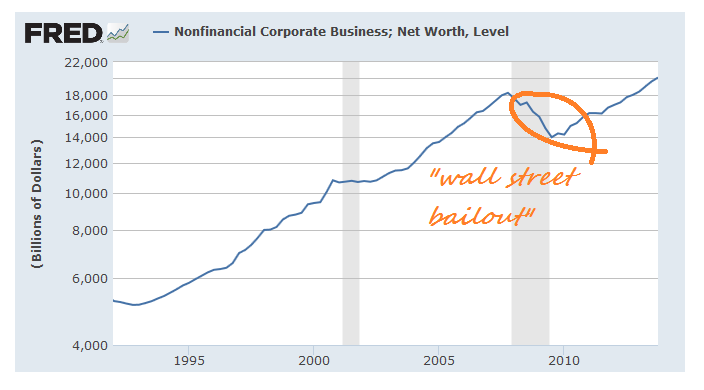

3 Reasons Why The Wall Street Bailout Was A Failure

Eduardo Munoz/Reuters

Timothy Geithner’s new book about the financial crisis, “Stress Test,” is basically an argument that the Wall Street bailout succeeded.

That’s hardly surprising, given that Geithner was in charge of the bailout when Treasury Secretary (as was his predecessor at Treasury, Hank Paulson), and so has an inherit interest in telling the public it succeeded.

Even so, the bailout clearly did succeed, if success means avoiding another Great Depression.

But another Great Depression might have been avoided if the crisis had been handled differently — for example, by allowing the bankruptcy laws to do what they were intended to do, and forcing the big Wall Street banks to reorganize under them.

In fact, the bailout was a colossal failure in several respects Geithner barely mentions in his book, or avoids completely:

1. Bigger Than Ever ...

... and no sane person on or off the Street now believes Washington will ever allow them to fail – which means they’ll continue to make big, risky bets because they know they can’t fail. And they’ll get even bigger because big depositors and lenders know they’ll never fail and therefore demand lower interest rates than demanded from smaller banks.

2. No Wall Street executives have ever been prosecuted for what they did to the country ...

... which means even more rampant irresponsibility in executive suites as well as even deeper cynicism in the public about the political power of Wall Street.

3. The bailout helped the banks but did little or nothing for the tens of millions of Americans ....

... who lost billions of dollars in home equity and savings, and the millions more who lost their jobs. The toll was greatest on the poor and the middle class, who still haven’t recovered their losses, even though Wall Street has fully recovered (and then some). Nor have reforms been enacted that will help the middle class and the poor the next time Wall Street implodes.

So pardon me if I take issue with Tim Geithner. The bailout was a success in the narrowest terms. Seen more broadly it was a terrible failure.

We’d have done better had we forced the biggest Wall Street banks, including the giant insurer AIG, to reorganize under bankruptcy rather than bail them out.

This article originally appeared at RobertReich.org. Copyright 2014. Follow RobertReich.org on Twitter.

To: expat_panama

GUNDLACH: We Could Be On The Verge Of ‘One Of The Biggest Short-Covering Scrambles Of All Time’

REUTERS/Eduardo Munoz

Jeffrey Gundlach, chief executive and chief investment officer of DoubleLine Capital

DoubleLine Funds’ Jeffrey Gundlach warns that we may be on the edge of a big bond market rally that could see yields tanking.

“If we go down [more] on Treasury yields, we will see one of the biggest short-covering scrambles of all time,” said Gundlach on Wednesday in San Diego. This quote is being reported by FA Mag’s Dan Jamieson from the Altegris Investments strategic investment conference.

Coming into 2014, almost no one predicted the 10-year Treasury yield would tumble to the levels we’re seeing today.

But bond fund manager Jeff Gundlach did.

During a public webcast on January 14 when the 10-year yield was at around 3.0% and when Wall Street said it would climb to 3.4%, Gundlach predicted that it could fall as low as 2.5% in the near-term.

Today, the 10-year yield fell through 2.5% and got as low as 2.4716%.

Gundlach isn’t the only one warning of a short squeeze in the bond market.

“10y short interest futures (CFTC) data showing a very crowded short,” said Stifel Nicolaus’ Dave Lutz. “The crowd is rarely right, and now the squeeze is on.”

Should things intensify, Gundlach’s already contrarian prediction may not have been contrarian enough.

“If for some reason someone has to cover these shorts, you could actually see the low yields of 2012 get taken out,” said Gundlach.

To: expat_panama

Now an economic report on....... bees....

New Report Warns That Bees Are Still Collapsing At An Economically Unsustainable Rate

REUTERS/Heinz-Peter Bader

Fewer honeybees died over the winter that just ended than in previous ones, although bees are still dying at a rate that is not economically sustainable, according to a new federal report published Thursday.

The new survey, issued by the U.S Department of Agriculture and the Bee Informed Partnership, found that nationwide losses of managed honeybee populations from all causes was down to 23.2%, a close to 7% drop from the winter before when death rates were at 30.5%. Over the past eight years, beekepers have reported average winter losses of 29.6%

That’s still no reason to celebrate. Beekeepers say that they lose money each year that losses exceed 18.9%, according to the USDA.

Honeybee die-offs have been blamed on a combination of factors, including pesticides, disease, parasites, poor nutrition, bad weather, and the stress of being trucked from orchard-to-orchard to pollinate different crops. Colony collapse disorder, a mysterious phenomenon in which bees vanish from their hives, may be triggered by one or a number of these pressures.

“Yearly fluctuations in the rate of losses like these only demonstrate how complicated the whole issue of honey bee heath has become,” Jeff Pettis, co-author of the survey and leader of the government’s bee research laboratory in Maryland.

The report comes on the heels of a Harvard study that found a strong link between the most widely used class of pesticides, neonicotinoids, and colony collapse disorder. Some scientists have dismissed the report, taking issue with the small sample size (only 18 colonies were tested) and noting that the pesticides used to treat the colonies were not administered to the bees in a way that would be found in nature.

Rather than targeting pesticides, the government report said one of the leading contributors to colony loss is the varroa mite, an Asian bee parasite that first arrived in United States in 1987.

“What is clear from all of our efforts is that varroa is a persistent and often unexpected problem,”Dennis vanEngelsdorp, director of the Bee Informed Partnership and an entomologist at the University of Maryland. “Every beekeeper needs to have an aggressive varroa management plan in place. Without one, they should not be surprised if they suffer large losses every other year or so.”

As ;Reuters notes, pesticide companies like Monsanto and Bayer pin the blame on mites, too, adding that “Monsanto-owned BeeLogics, a bee health company, is one of the collaborators in the partnership with USDA.”

The survey results are based on self-reported information from 7,200 beekeepers, who represent 21.7% of the country’s 2.6 million colonies.

To: Wyatt's Torch

To: Wyatt's Torch

The Wall Street Bailout...We're constantly hearing this party line about how tax dollars went to help wall street rich people get rich and skip off from having to atone for their sins. Somehow, the TARP, the Quantitive Easings, and the Taper were all pork fed to bloated pin-stripers. Here's the 'proof':

say what?

To: abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; Aquamarine; Archie Bunker on steroids; ...

To: expat_panama

Claims vs SPX...

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-46 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson