Posted on 05/21/2014 1:00:14 PM PDT by Cheerio

The way Charles Plosser sees it, the Federal Reserve is sitting on a ticking time bomb that could severely damage the economy unless the central bank reacts quickly to defuse the looming threat.

The Philadelphia Fed president, viewed as one of the bank’s leading hawks, is worried about some $2.5 trillion in “excess” reserves. That is, loanable funds available to individual or corporate borrowers through the nation’s banks.

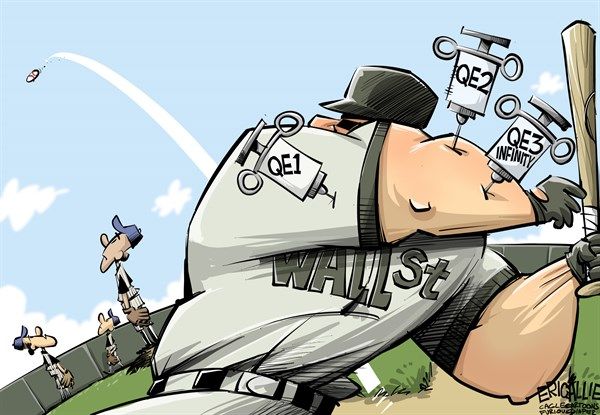

The Fed has created these reserves through unpredented purchases of U.S. Treasurys and mortgage-backed securities, a strategy known as quantatative easing.

These reserves are just sitting in the bank system, basically doing nothing. That’s because demand for loans has been unusually weak amid an economic recovery that’s the slowest on record since the Great Depression.

(Excerpt) Read more at blogs.marketwatch.com ...

Well ironically what the article is saying is that there is no demand for money, so really the opposite of being hooked, there is an excess supply that no one really needs so it’s sitting in the banking system as “excess reserves”.

The controversy will come when the Fed starts paying interest on those reserves, effectively paying banks not to lend, because they will need to do that as they try to tighten policy.

“WHEN YOUR OUTGO EXCEEDS YOUR INCOME, YOUR UPKEEP WILL BE YOUR DOWNFALL,” (Radio Announcer Paul Harvey).

Gomer is asking...”Do the mortgage backed securities bought by the Fed Deserve from Fannie and Freddie that they in turn bought from the issuing securities creating banks have a US Land Title System chain of title associated with them, or are they “non-property” related with no actual chain of title associated with them? Did rating agencies rate the securities triple A with no chain of title associated with them? Golleee...I hope not!”

(Obama Seizes 500,000 Acres of New Mexico Land for Drug Cartels and Goats)

Basicall a huge internal carry trade.

Meanwhile, the banks make 70% of their profits from financial speculation in the stock market.

They're not really banks anymore: they're financial trading companies with a bottomless line of credit from the Fed consisting of money borrowed in your name for which you will be forced to pay and will receive none of the profits.

Enormous profits with no risk: who would say no?

The bomb will explode when a Republican or Conservative takes office — then the Liberals will say that only under Obama was the economy stable and “growing”.

“economic recovery that’s the slowest on record since the Great Depression”

That’s where I stopped reading.

Duh!!!

There are several sources (via Google) predicting a dramatic - and negative - effect on the dollar.

Imagine how much the banks would collect if they still had those bonds paying 2%-4.5%, instead of the 0.25% reserves.

They're not really banks anymore: they're financial trading companies with a bottomless line of credit from the Fed

They're lending trillions to the Fed, why do they need a line of credit?

consisting of money borrowed in your name for which you will be forced to pay and will receive none of the profits.

Money the Fed lends is not "borrowed in your name". Fed earnings go back to the Treasury, so you do kinda benefit from the Fed profit.

Enormous profits with no risk

Huh? Where are you imagining that happens?

Sponsoring FReepers are contributing

$10 Each time a New Monthly Donor signs up!

Get more bang for your FR buck!

Click Here To Sign Up Now!

This gives the Fed enormous "assets" that can be "lent" or "deposited" in US banks to shore up their reserves if they lose money.

JP Morgan's Balance sheet in December, 2011 showed assets of $145 billion cash, $696 billion loans and $1.43 trillion of trading assets (stocks, bonds, etc.). In brief, it's principal market activity is now trading, not banking.

If JP Morgan or any other large bank loses too much money, the Fed "deposits" money leveraged off its T-Bill "assets": remember the Federal Reserve is itself a bank that can treat it's T-Bill holdings as assets to be lent or deposited in other banks. The Fed holds almost $2.4 trillion in T-Bills, applying the 10% reserve requirement to itself, the Fed can loan out over $18 trillion dollars.

If JP Morgan loses big in the casino, err, I mean stock market, the Fed steps in and deposits money borrowed in our name to make up the losses.

You and I are on the hook for the enormous debt taken on by the Fed, but all of the profits go to the bank's shareholders and management.

Like I said, having your losses backed by a third party while getting to keep all of the profits is a nice business if you can get it.

The Fed doesn't deposit money in other banks.

If JP Morgan loses big in the casino, err, I mean stock market, the Fed steps in and deposits money borrowed in our name to make up the losses.

Why would the Fed have to borrow money? Why would it be in our name?

You and I are on the hook for the enormous debt taken on by the Fed

What debt is taken on by the Fed? How are we on the hook for it?

but all of the profits go to the bank's shareholders and management.

Bank expenses last year were about $4 billion. Shareholder dividends were $1.6 billion. Where did the rest of their almost $80 billion in net profits go?

Like I said, having your losses backed by a third party

Not sure what you mean here. Banks lost tens of billions during the crisis. The Fed didn't hand them money to zero out those losses.

No it won't. This scam got really intense under George 2, and it's tough to end it without some pain, the longer it goes on, the worse it gets. If anything, I would've thought a democratic president would've taken a lot of control from the globalist elitist bankers.

The Federal Reserve is the problem. Banking needs to get more local, and borrowers need to pay interest and savers need to collect interest. Ron Paul understood this, lots of people actually do. I wonder if there are any politicians in DC who would end the scam.

It's harder to pay savers when borrowers keep defaulting.

Banks are making healthy enough quarterly profits so that their executives are getting excellent salaries and benefits and stockholders get interest. Banks don't hold the mortgages, either the ones that default or those that don't. They bundle them and sell them for profit. Credit cards and fees on accounts and transactions bring in lots of revenue.

The reason savers don't get interest is that banks don't need our deposits to profit. The feds just keep printing money and calling it loans that the US taxpayer owes to the Federal Reserve. It's a scam with the fed, other national banks, and global domination, and when it all collapses, us little folk might be better off.

Profits are improving. Of course they have to rebuild their capital.....and more, to meet the new requirements.

The reason savers don't get interest is that banks don't need our deposits to profit.

Demand for loans is low. People have been de-leveraging. Along with the shadow banking system. People want to hold risk free cash.

The feds just keep printing money and calling it loans that the US taxpayer owes to the Federal Reserve.

That's not how it works at all.

The US taxpayer owes for money Congress borrows. Doesn't matter if you own the T-Bond, China, your mutual fund or the Fed owns it.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.