Posted on 07/12/2014 2:24:15 PM PDT by Kaslin

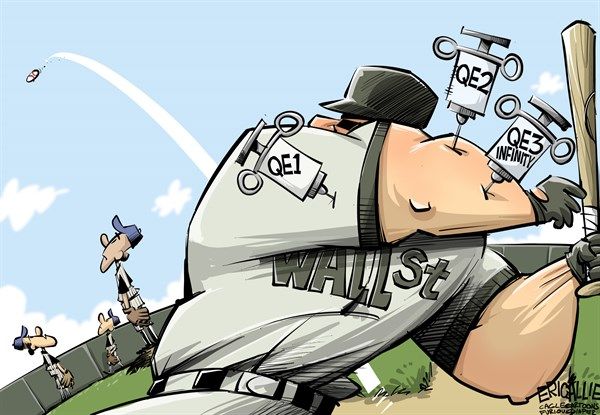

In response to BIS Slams the Fed; Ridiculous Question of the Day: "Is The Fed Going To Attempt A Controlled Collapse?" a number of people commented the Fed cannot be so stupid as to think there is no asset bubble. Here are some examples:

As a huge fan of Occam's Razor, I disagree with all of them. Occam's Razor says the simplest explanation (the one with the fewest assumptions) is likely the best.

Alternatives

Door number 2 is overwhelming likely to be correct.

In general, when sheer stupidity is one of the choices, then stupidity is likely the best answer or part of the best answer.

The Fed is just like the rest of us — they don’t believe a word of it.

The FED was never set up for America’s best interest but for the manipulation by big world banks.

So, will it be collapse + inflation OR collapse + deflation?

Why should they?

So, will it be collapse + inflation OR collapse + deflation?

I don’t know. I heard something about “reset” what ever that is and a new currency of reserve notes.

Ping

Sponsoring FReepers are contributing

$10 Each time a New Monthly Donor signs up!

Get more bang for your FR buck!

Click Here To Sign Up Now!

a new currency of reserve notes.

Could have been Treasury notes.

The Fed is required to break down their loan pool into risk sets in their portfolio of investments (the Fed's investments used to be LOANS) and it was their target to achieve a $12 return one dollar a year if possible. For example, Credit Card loans were regulated so that only a very small percentage could be at the maximum loan rate of 36% while the bulk was at the lowest - this allowed both profits and speculation within a tight band to ensure money supply growth. Growing the money supply was how the Fed served America when operating properly.

Today, the Fed was instructed by the congress to PRINT money to grown the money supply due to the loss of opportunity to make safe loans. In addition, laws enacted by congress to further minority and other other "programs" were passed into law by idiots elected that could not understand a household budget. Making laws to transfer money printed to Green Energy which in turn is passed into DNC coffers as the companies go bankrupt should be collected from the DNC if loans were not repaid - how can a political party pass money to donors and then bankrupt it except for owner profits and political donations?

The Fed is no longer increasing the money supply by economic activity but has replaced economic activity with printed money. Inflation will follow; a new currency for the America's too will follow. All the World's Banks and Governments have together printed a like amount of money so that inflation would be hidden from the people, but at some point with so money in the economies and not jobs or personal wealth, it will become impossible due to the Fed in American to live the American Dream. We are broken as a nation, and broke as an economy. We are morally bankrupted by Liberals like Obama and the DNC.

The unaccountable (socialist) creature should be destroyed.

Only God knows.

But for sure - it will radically one or the other.

The only reason there is no collapse now is that the forces of both are counter-acting each other. But that will not last.

Things will tip one way or the other.

But all at the Fed know deflation would be the worst. They can do nothing to affect that. They can only influence inflation to a point - once hyperinflation sets in, they cannot influence it either......both are facts proven by history.

The part-time nation and extremely low worker participation rate tell me it’s a depression. So, I’m thinking there’s a strong likelihood of collapse + deflation.

But the Fed wants inflation so badly. It’s talked about it for years. I don’t get it, because it will just cause increased interest payments on the debt. By some calculus, I guess they’ll hope to pay off debt with dollars worth far less?

Explain the relationship between money supply and money demand and how changes in monetary policy impact price levels given that supply and demand. Now look at the actions of the Fed and give a conclusion on their actions.

Occam’s Razor says the simplest explanation is that the author doesn’t understand the monetary system and how inflation and deflation work.

That sounds like a test question. LOL.

Do you teach this stuff someplace?

The idiots at the Fed - and many others - are convinced that they can control inflation - and they know they cannot control delflation - that’s why they want it.

They believe they can keep things where inflation may go up, but remain under their control.

Fools.

I too think it will be deflation most likely. But I’ve been wrong so many times......

:-) no I don’t. I’m a corporate finance type but have done a lot of reading and studying monetary policy over the last 15 years. Learned a ton from Jude Wanniski and particularly his book “The Way a The World Works” and his Polyconomics site he had before he passed away.

Great book. A classic that every conservative should read. It’s really a roadmap to victory for us.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.