Skip to comments.

Has Fed Money Creation Fueled Artificial Stock Gains?

Investor Alert ^

| JUNE 28, 2013

| Richard M. Salsman

Posted on 06/16/2015 6:25:52 AM PDT by expat_panama

...profit-seeking marketmakers are much too smart to be so easily fooled by the Fed’s monetary machinations; they can look through (and past) the Fed’s artificial policies and unearth the real state of things. The opposite view, from “behavioral finance,” holds that policymakers are omniscient and omnipotent preventers and fixers of “market failure”.

In our judgment, U.S. nominal bond yields have declined in recent years not due to Fed money printing but due to three main factors: 1) steady disinflation,2 2) a persistent decline in market expectations of the long-term real return on capital,3 and 3) the Fed’s seemingly interminable zero interest-rate policy (ZIRP).4 Likewise, we believe equity prices have increased due not to Fed money printing but to three fundamental factors, none of which depend on market-makers being deceived: 1) decent postrecession growth,5 2) robust gains in earnings,6 and 3) a steady decline in corporate bond yields (the appropriate proxy for the rate at which analysts capitalize earnings).7

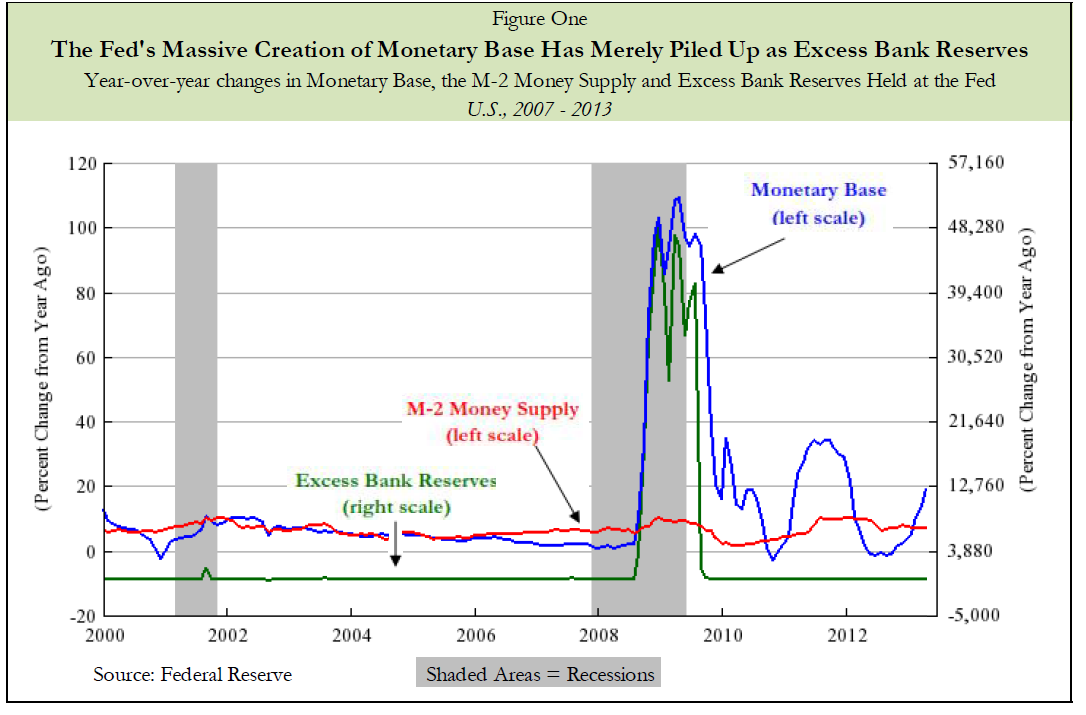

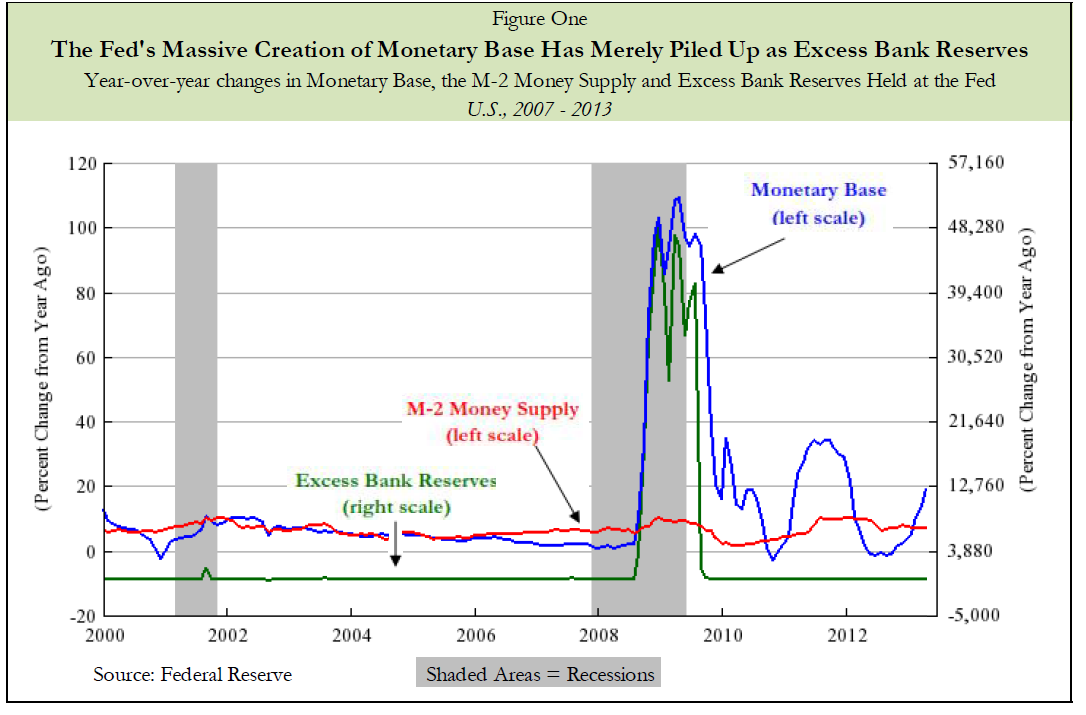

It’s true, of course that since 2008 the Fed has monetized huge sums of U.S. federal debt and agency MBS, and in doing so it has enormously expanded the monetary base, to the point where its balance sheet has ballooned to $3 trillion, more than triple its size in the pre-crisis year of 2007. As we’ve also recently documented, the Fed’s policy has flooded the U.S. banking system with excess liquidity. 8 Yet it doesn’t necessarily follow that such liquidity creation somehow “spills over into the stock market,” as we so commonly hear, or that the extra liquidity artificially boosts equity prices,” such that ending QE would necessarily trigger a stock-price collapse. Below we consult cold, hard facts to see what’s really going on.

[snip]

Money doesn’t go “in” or “out” of the market. First, the stock market is a system primarily for the secondary trading of shares that were already issued, years before, in return for newly invested cash; in a secondary market every buyer of shares on one side faces a seller of shares on the other side, each of whom are brought together by brokers and specialists. Technically, no money “goes in” or “out” of any stock market, certainly not in the way we’d say water might go into or out of a bathtub. The stock market isn’t even analogous to a lockbox, and is not a repository of cash, nor a set of ships that rise or fall with the ocean’s tides. Equity share prices rise or fall due not to shifts in “liquidity” but to shifts in fundamentals – in earnings, economic growth, interest rates.

Second, even if it were true that the Fed’s vast creation of liquidity somehow gets “poured into” the stock market, recent evidence makes clear that since 2007 most of the increase in what liquidity the Fed directly creates and controls, namely the monetary base – currency plus bank reserves at the Fed – has simply accumulated inside the vaults (both physical and electronic) of the banks. This additional monetary base hasn’t been delivered to Broad Street in armored vehicles and then ceremoniously dumped into the NYSE as a fuel for stock purchases.

Second, even if it were true that the Fed’s vast creation of liquidity somehow gets “poured into” the stock market, recent evidence makes clear that since 2007 most of the increase in what liquidity the Fed directly creates and controls, namely the monetary base – currency plus bank reserves at the Fed – has simply accumulated inside the vaults (both physical and electronic) of the banks. This additional monetary base hasn’t been delivered to Broad Street in armored vehicles and then ceremoniously dumped into the NYSE as a fuel for stock purchases.

Figure One (above) illustrates the huge percentage increase in the monetary base in 2009-2010 and the simultaneous huge increase in excess reserves at U.S. banks – which means reserves have been retained “in-house” and not lent out through additions to borrowers’ checking balances. How do we know? Because most of the money supply is comprised of checkable deposits, and it hasn’t increased nearly as much as the monetary base.

[snip]

We’ve published many reports since 2007 on the link between Fed liquidity policy and equities, and have found good reasons to question the conventional wisdom, by consulting the historical facts.10 We believe our approach has proved more prescient than the monetarist (quantity-of-money) approach, as well as the Keynesian approach, which presumes that a ZIRP can be bullish in a sustainable and costless way. Here we reject the conventional claim that U.S. stock prices have advanced since 2009 due to “the Fed printing money and fueling artificial gains.” If this consensus comes to observe a slowdown in money supply growth, it may falsely predict a collapse in stock prices; alternatively, this same consensus may fail to predict a collapse in stock prices if it sees the money supply rising at a normal pace, as occurred during the plunges of 2000-2002 and 2007-2009.

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: business; economy; investing

Navigation: use the links below to view more comments.

first 1-20, 21-31 next last

Originally published a couple years ago but the facts have not been able to beat the cherished meme. It's timely now w/ the Fed mtg today so it showed up in http://www.realclearmarkets.com/ .

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Double yikes --after yesterday's distributions (albiet w/ recovery) futures now are -0.2% stocks & -0.3% metals.

Triple yikes: opening bell!!!

To: expat_panama

Has Fed Money Creation Fueled Artificial Stock Gains?, Yes. Not only that, but the list of "blue chip" stocks that make up the Dow Jones changes from time to time so it's a double-artificial indicator of how well the economy is humming along.

3

posted on

06/16/2015 6:30:39 AM PDT

by

Texas Eagle

(If it wasn't for double-standards, Liberals would have no standards at all -- Texas Eagle)

To: expat_panama

To: All

dow -2.12%

NASDAQ -1.57%

S&P -1.91%

-—OUCH TIME!

To: expat_panama

As a retiree, near-term interest rates are hurting me. I was better off in the Bush years.

6

posted on

06/16/2015 6:33:25 AM PDT

by

Ciexyz

To: Ciexyz

Near-zero interest rates I meant.

7

posted on

06/16/2015 6:34:34 AM PDT

by

Ciexyz

To: expat_panama

Good morning.

Imho, market P/E ratios don't support a 18,000 index.

5.56mm

8

posted on

06/16/2015 6:39:15 AM PDT

by

M Kehoe

To: expat_panama

Has Fed Money Creation Fueled Artificial Stock Gains? Duh.

To: expat_panama

10

posted on

06/16/2015 6:44:24 AM PDT

by

stockpirate

(A corrupt government is the real enemy of the people.)

To: Ciexyz

In the old Bush days, I would get approximately $1000 per month in interest from my account. My most recent payment was $7.29.

11

posted on

06/16/2015 6:44:46 AM PDT

by

Blennos

To: Ciexyz

Get used to it - sadly. The Fed is locked into low interest rates for many years. Even a small bump in interest pushes the Government into an untenable situation due to interest payments on the national debt.

To: Ciexyz

FWIW, the interest rate on savings was a respectable 5% or so during Clinton's years. The declines began just about as soon as GWB got in office, with the Enron bubble and "fixes" that started the lower interest rates. Then, as with many issues, Obama got in office and took everything bad GWB did and made it worse.

People forget. Responsible financial planning used to be that FDIC insured savings would earn at least 4% interest and by the "Rule of 72" would double every 18 years. Thus, if I saved $4000 when I was 20 it would be at least $8000 when I was 38 and $16,000 when I was 56. That would be a healthy supplement to Social Security.

Without that, people are dependent on what's now a rigged Casino game, Wall Street. Don't like that? Pay a financial planner or mutual fund to handle your money, so they can take their skim. And there are no guarantees they'll do right for you.

I don't understand how there can be a self-sufficient middle class that prepares for retirement without there being incentives for those who try to be responsible about their financial destiny.

13

posted on

06/16/2015 6:55:17 AM PDT

by

grania

To: stockpirate

Is the Pope a Catholic? That used to be a given. Not so sure about that recently.

To: Texas Eagle; DiogenesLamp; stockpirate

Fueled Artificial Stock Gains? Yes.

Is the Pope a Catholic?

Duh.

Y'all say that, but have any of you ever actually believed it enough to go so far as to put your own money into stocks when the did a QE?

To: expat_panama

Bears do THAT in the woods???

16

posted on

06/16/2015 7:02:47 AM PDT

by

arthurus

(It's true!)

To: expat_panama

Of course it has. We know the Fed bought a ton of bonds and the PPT was set up to keep the stock market from tanking. Of course they put money into the market, too.

17

posted on

06/16/2015 7:03:03 AM PDT

by

expat2

To: expat_panama

Y'all say that, but have any of you ever actually believed it enough to go so far as to put your own money into stocks when the did a QE? I would not touch the stock market right now. It is one massive overinflated bubble created by a combination of computers outbidding each other and the inflationary policies of the FedGov.

To: stockpirate

Not at all sure about that.

19

posted on

06/16/2015 7:04:59 AM PDT

by

expat2

To: VideoDoctor

He probably poops in the forest.

20

posted on

06/16/2015 7:07:15 AM PDT

by

MrB

(The difference between a Humanist and a Satanist - the latter admits whom he's working for)

Navigation: use the links below to view more comments.

first 1-20, 21-31 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

Second, even if it were true that the Fed’s vast creation of liquidity somehow gets “poured into” the stock market, recent evidence makes clear that since 2007 most of the increase in what liquidity the Fed directly creates and controls, namely the monetary base – currency plus bank reserves at the Fed – has simply accumulated inside the vaults (both physical and electronic) of the banks. This additional monetary base hasn’t been delivered to Broad Street in armored vehicles and then ceremoniously dumped into the NYSE as a fuel for stock purchases.

Second, even if it were true that the Fed’s vast creation of liquidity somehow gets “poured into” the stock market, recent evidence makes clear that since 2007 most of the increase in what liquidity the Fed directly creates and controls, namely the monetary base – currency plus bank reserves at the Fed – has simply accumulated inside the vaults (both physical and electronic) of the banks. This additional monetary base hasn’t been delivered to Broad Street in armored vehicles and then ceremoniously dumped into the NYSE as a fuel for stock purchases.