Skip to comments.

The Federal Reserve is setting America up for economic disaster

The Hill ^

| September 18, 2017

| Armstrong Williams

Posted on 09/19/2017 7:24:05 PM PDT by Tolerance Sucks Rocks

I recently had the opportunity to read "The Creature from Jekyll Island" by G. Edward Griffin, a prodigious tome dealing with the circumstances surrounding the creation of the U.S. Federal Reserve System. I was taken aback by some of its provocative assertions.

- America joined World War I largely to help a few bankers profit off the war (despite a long-standing Monroe doctrine that prohibited our involvement in European affairs)

- The Bolshevik Revolution of 1917 was supported by international financial interests in order to destabilize Russia and steal the wealth of the Russian people; and

- So-called "foreign aid" is merely a clever means of shifting the bad debt incurred by banks and wealthy financiers to American taxpayers.

The book is narrated in a notably conspiratorial tone and contains some obvious contradictions. For example, it contends that President Lincoln was once a liberator who sought to avoid being goaded into a destructive civil war by European powers jealous of America’s success, and had designs on colonizing Mexico. However, the book still raised some very good points that deserve serious consideration.One that stood out is that over successive generations, people with concentrated wealth have sought to use the American military and the purse power of the taxpayer for personal gain. In fact, Griffin argues, the creation of the current iteration of the Federal Reserve System was a political act designed to hide the fact that a private banking cartel would manage the U.S. currency.

The Federal Reserve, as Griffin explains, is neither "federal" nor a "reserve." It is not owned by the federal government, and it does not hold real assets in reserve. In reality, it is a giant debt factory backed by the "full faith and credit" of the government, or taxpayers.

One thing is clear. In the aftermath of the global recession of 2008, America and the world have been swimming in debt. America’s national debt alone has skyrocketed. While the Fed continues to justify flooding the market with cheap "reserve notes" based on the theory that it must supply these notes in order to support asset prices, the overall effect has been to debase the currency and prolong the pain of the American people.

As an entrepreneur who owns real assets — real estate, spectrum licenses and a publishing library, among others — I was able to benefit, at least on paper, from the Fed’s asset inflation strategy. I have been able to refinance my debt at attractive rates, and I've seen asset prices (but not necessarily values) climb. But others, especially workers (who derive the bulk of their income from salary instead of capital appreciation) and savers (retirees living on a fixed income), have lost under this post-recession scheme.

Workers lost because their spending power diluted drastically over the past 10 years. The costs of housing and energy have continued to rise in areas where the highest concentrations of jobs are located. For example, a young college graduate who wants to earn a high salary in the tech industry has to live in Silicon Valley, where even a base salary of $100,000 won’t enable them to afford to purchase a home there. Home prices are so out of line with average salaries that cities like San Francisco and Los Angeles are seeing an epidemic of homelessness never experienced since the Great Depression of 1929.

Savers have lost because the interest income they were counting on earning from their lifetime of saving has dwindled to less than nothing. These days, in most cases, you actually have to pay the bank to keep your money there. And so many retirees have had to tap into their home mortgages or take on additional consumer debt merely to survive. As America faces the largest retirement boom in its history — the retiring baby boomers — more than two-thirds of them do not have enough savings to retire comfortable. And on top of that, the Social Security system that was to be a back-stop against poverty for older Americans is practically insolvent.

The unwieldy national debt also causes friction for entrepreneurs. Governments have sought to increase taxes, regulations and fees on entrepreneurial activity in order to service the ballooning debt. This has sucked critical capital out of the system that entrepreneurs need in order to grow businesses and drive employment. With consumers still reeling from the great recession, demand for goods and services is lagging employment growth by a significant margin, further constraining opportunities for entrepreneurs.

The great project to rescue the American economy by the Fed has hit an obvious wall. The debt it used to goose the economy is now gumming up the system and constraining real growth. The looming question of what actually happens when the debt bubble finally bursts is one that not even the soberest economists at the Fed have been able to confront effectively. Unless we deal finally with the false notion that "central economic planning" can replace actual capitalism as the driver of American growth, we may be in store for far, far worse.

Armstrong Williams (@ARightSide) is author of the brand new book, "Reawakening Virtues." He served as an adviser and spokesman for Dr. Ben Carson's 2016 presidential campaign, and is on Sirius XM126 Urban View nightly from 6 p.m. to 8 p.m. Eastern.

TOPICS: Business/Economy; Crime/Corruption; Editorial; Government; News/Current Events

KEYWORDS: armstrongwilliams; assets; bankers; collapse; debt; economy; entrepreneurs; fed; federalreserve; gedwardgriffin; greatrecession; inflation; interest; jekyllisland; monetarypolicy; money; qe; recession; savers; spending; taxes; thefed; usdebt; value; wars; workers; yellen

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-76 next last

To: Garth Tater

What is the 'Multiplier Effect' Thanks for the link

The size of the multiplier effect depends on the percentage of deposits that banks are required to hold as reserves.

You may notice that none of the links agrees with your claim that they hold a percentage of loans as a reserve.

They all seem to agree with my claim that they hold a percentage of deposits as a reserve.

To: Garth Tater

To calculate the effect of the multiplier effect on the money supply, start with the amount banks initially take in through deposits, and divide this by the reserve ratio. If, for example, the reserve requirement is 20%, for every $100 a customer deposits into a bank, $20 must be kept in reserve. However, the remaining $80 can be loaned out to other bank customers.Thanks again for the link.

The $80 loan is fully funded by the $100 deposit.

Now if you find a decent source that shows the $100 deposit funds a $1000 loan, I'd love to see it.

Good night.

To: Toddsterpatriot

"Only the loans where 90% of the loan's value is created out thin are subject to the reserve requirement.

Commercial Banks don't create money out of thin air.

Only central banks can do that. "

No, not according to the article I just linked for you at Investorpedia. From the article:

"This cycle [the money multilier effect] continues as more people deposit money and more banks continue lending it until finally the $100 initially deposited creates a total of $500 ($100/0.2) in deposits. This creation of deposits is the multiplier effect."

43

posted on

09/19/2017 9:32:26 PM PDT

by

Garth Tater

(Return to sound money and Constitutional governance.)

To: Toddsterpatriot

You are hopeless Todd. I’m not going to waste any more time on your education. Have a nice day.

44

posted on

09/19/2017 9:36:59 PM PDT

by

Garth Tater

(Return to sound money and Constitutional governance.)

To: Tolerance Sucks Rocks

Has been for doing just that for 100 years.

45

posted on

09/19/2017 9:44:18 PM PDT

by

mulligan

To: Tolerance Sucks Rocks

so in one paragraph since he owns assets he’s done well in this post crash economy. In the next paragraph taxes are gumming up the works and stopping him from making even more money.

Lets see workers can’t afford homes on the west coast even making 100k a year but then we circle back to the assets of this entrepreneur doing well in this economy which means its the value of his asset these impoverished 100k a year slaves can’t afford.

I’ve been in finance for 38 years. Heres what i learned.

As much as the capitalistic system benefits us it takes away. The profit motive guides all. That means the less paid to workers the greater the profit. You can’t have both.

Look at insurance companies. They stand between you and your doctor. They don’t stand there for nothing do they?

No they make a profit. And they’re always looking to increase that profit. All that means is higher costs for everyone on both sides (medical malpractice insurance, right??)

So we can’t have it both ways. We can have unfettered capitalism and eventually employment will go to 25% of the population. Right, 75% not working. Or we can have more people gumming up the works and working.

Its a tough problem that may never be solved.

46

posted on

09/19/2017 10:17:13 PM PDT

by

wiggen

(#JeSuisCharlie)

To: SubMareener

How do you define we?

Is we everyone who lives in the country, with those against abortion and those for abortion indiscriminately lumped together, with all being subjected to the same judgment?

To: Toddsterpatriot

low rates encourage speculation in housing so yes the fed is very much part of the problem. Somewhat higher rates, nothing to discourage a true buyer but enough to make a speculator think twice would slow down price growth.

48

posted on

09/19/2017 10:19:32 PM PDT

by

wiggen

(#JeSuisCharlie)

To: Architect of Paradise

As in the time of Lot....

Lot, his wife, and his two randy daughters were removed from Sodom before the Judgement. His wife looked back and turned into a pillar of salt.

So “the daily”, the five wise virgins, the “victors” from the seven churches, all will be taken out of this world before the Judgement really begins.

Romans 10

8 But what does it say?

“The word is near you,

in your mouth and in your heart”

(that is, the word of faith that we preach),

9 for, if you confess with your mouth that Jesus is Lord and believe in your heart that God raised him from the dead, you will be saved.

10 For one believes with the heart and so is justified, and one confesses with the mouth and so is saved.

11 For the scripture says, “No one who believes in him will be put to shame.”

12 For there is no distinction between Jew and Greek; the same Lord is Lord of all, enriching all who call upon him.

13 For “everyone who calls on the name of the Lord will be saved.”

http://www.usccb.org/bible/romans/10

Revelation 2

7 “’”Whoever has ears ought to hear what the Spirit says to the churches.

To the victor I will give the right to eat from the tree of life that is in the garden of God.”’

- - - - -

11 “’”Whoever has ears ought to hear what the Spirit says to the churches.

The victor shall not be harmed by the second death.”’

- - - - -

17 “’”Whoever has ears ought to hear what the Spirit says to the churches.

To the victor I shall give some of the hidden manna; I shall also give a white amulet upon which

is inscribed a new name, which no one knows except the one who receives it.”’

- - - - -

24 But I say to the rest of you in Thyatira, who do not uphold this teaching and

know nothing of the so-called deep secrets of Satan: on you I will place no further burden,

25 except that you must hold fast to what you have until I come.

26 “’”To the victor, who keeps to my ways until the end, I will give authority over the nations.

27 He will rule them with an iron rod. Like clay vessels will they be smashed,

28 just as I received authority from my Father. And to him I will give the morning star.

29 “’”Whoever has ears ought to hear what the Spirit says to the churches.”’

- - - - -

Revelation 3

4 However, you have a few people in Sardis who have not soiled their garments;

they will walk with me dressed in white, because they are worthy.

5 “’”The victor will thus be dressed in white, and I will never erase his name

from the book of life but will acknowledge his name in the presence of my

Father and of his angels.

6 “’”Whoever has ears ought to hear what the Spirit says to the churches.”’

- - - - -

7 “To the angel of the church in Philadelphia, write this:

“‘The holy one, the true,

who holds the key of David,

who opens and no one shall close,

who closes and no one shall open,

says this:

8 “‘“I know your works (behold, I have left an open door before you, which no one can close).

You have limited strength, and yet you have kept my word and have not denied my name.

9 Behold, I will make those of the assembly of Satan who claim to be Jews and are not,

but are lying, behold I will make them come and fall prostrate at your feet,

and they will realize that I love you.

10 Because you have kept my message of endurance, I will keep you safe in the time of trial

that is going to come to the whole world to test the inhabitants of the earth.

11 I am coming quickly. Hold fast to what you have, so that no one may take your crown.

12 “‘“The victor I will make into a pillar in the temple of my God, and he will never leave it again.

On him I will inscribe the name of my God and the name of the city of my God, the new Jerusalem,

which comes down out of heaven from my God, as well as my new name.

13 “‘“Whoever has ears ought to hear what the Spirit says to the churches.”’

- - - - -

20 “’”Behold, I stand at the door and knock. If anyone hears my voice and

opens the door, [then] I will enter his house and dine with him, and he with me.

21 I will give the victor the right to sit with me on my throne, as I myself

first won the victory and sit with my Father on his throne.

22 “’”Whoever has ears ought to hear what the Spirit says to the churches.”’”

- - - - -

* [2:7] Victor: referring to any Christian individual who holds fast to the faith

and does God’s will in the face of persecution. The tree of life that is in the

garden of God: this is a reference to the tree in the primeval paradise (Gn 2:9);

cf. Rev 22:2, 14, 19. The decree excluding humanity from the tree of life has

been revoked by Christ.

http://www.usccb.org/bible/revelation/2

http://www.usccb.org/bible/revelation/3

49

posted on

09/19/2017 10:31:23 PM PDT

by

SubMareener

(Save us from Quarterly Freepathons! Become a MONTHLY DONOR)

To: Jarhead9297; SkyPilot; Roman_War_Criminal

Yeah, I have heard at least that amount. Don’t know what the real number is. I know some claimed upwards of 600T.

50

posted on

09/19/2017 10:37:36 PM PDT

by

SaveFerris

(Luke 17:28 ... as it was in the days of Lot; they did eat, they drank, they bought, they sold ......)

To: central_va

Add the 17th to that as well.

We would be more like the United States again and not the United State.

To: SubMareener

The nation that has killed 60 million babies is under judgement from YHWH. He is done with the United States of America. Our crimes are our punishment! Amen.

52

posted on

09/20/2017 12:19:07 AM PDT

by

Theophilus

(Repent)

To: Garth Tater

"This cycle [the money multilier effect] continues as more people deposit money and more banks continue lending it until finally the $100 initially deposited creates a total of $500 ($100/0.2) in deposits. This creation of deposits is the multiplier effect."This is absolutely how the multiplier effect works. You'll notice, but ignore, the fact that each bank needs a deposit to fund the smaller loan that they make.

The loans are always smaller, not larger, than the deposit, because they are not creating money out of thin air, as you, and others, mistakenly claim.

Banks can, and do, create money out of deposits.

To: Garth Tater

To: Garth Tater

I read that entire exchange and I must say that you are a better man than I.

I would have stopped talking to him after one or two replies.

Cognitive dissonance...

55

posted on

09/20/2017 6:00:21 AM PDT

by

DBG8489

To: Garth Tater

It’s about time you gave up, he just refuses to believe the truth.

The part he refuses to understand is that the Fed gives Member Banks, Instant Credit at Face Value for the Promissary Note you signed for your loan, that is when the Money is actually created out of thin air. Now the member bank attaches their interest and fees to earn a profit by selling you something they never actually owned in the first place.

We used to call this Usury.

56

posted on

09/20/2017 6:41:40 AM PDT

by

eyeamok

(Idle hands are the Devil's workshop)

To: Toddsterpatriot; Garth Tater

I would like someone to explain to me how central banks get money for “quantitative easing.”

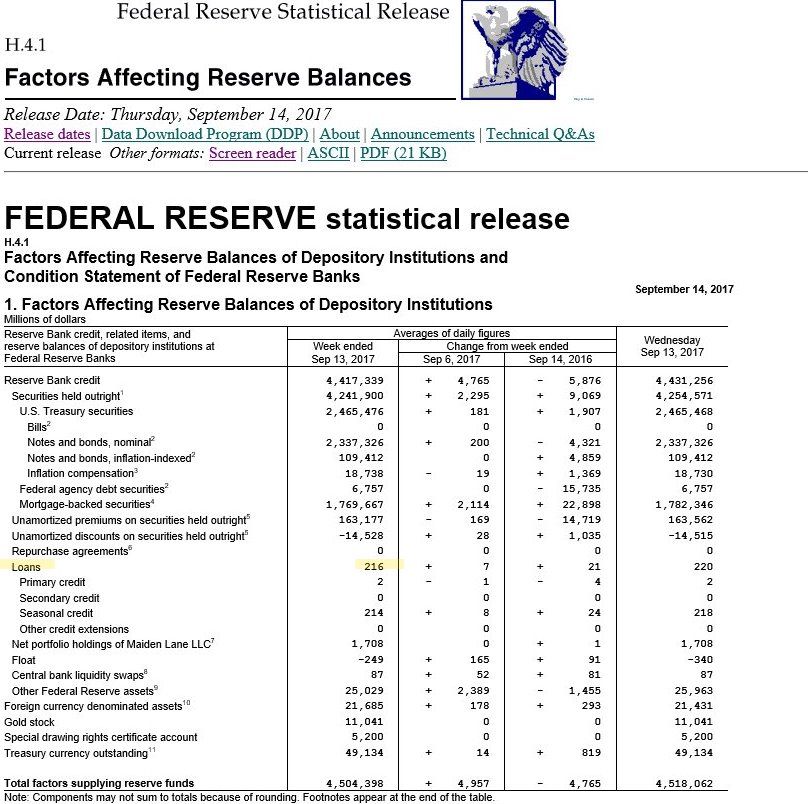

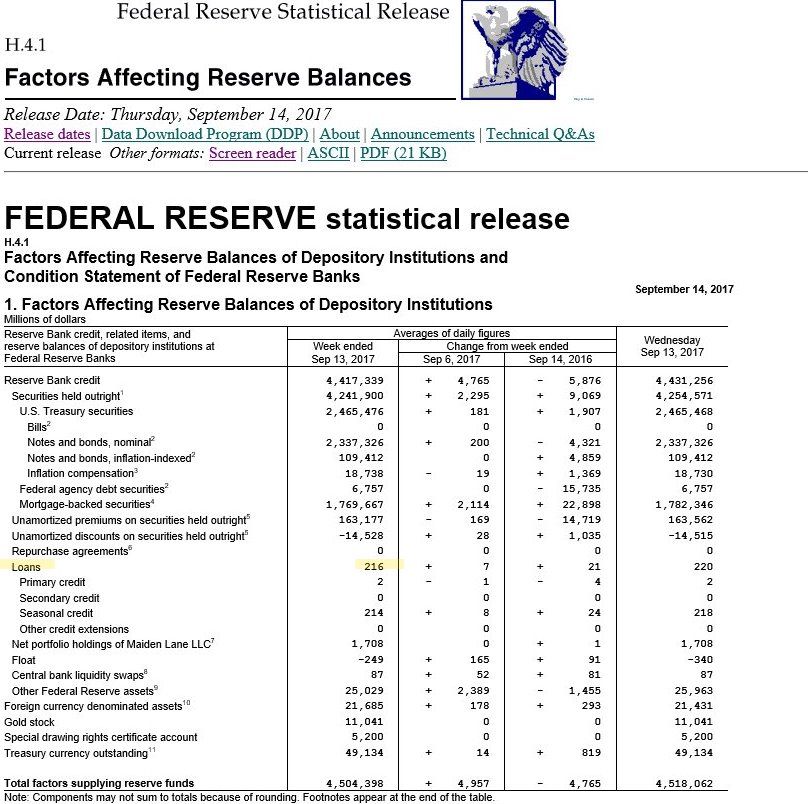

The Federal Reserve now sits on $4.5 trillion of purchased Government and agency bonds. World-wide, central bank “balance sheets” are north of $15 Trillion. The Japanese Central Bank is the largest shareholder in 90% of the Nikkei index companies. The ECB buys so many bonds, many German government bonds pay NEGATIVE interest rates. The list of central bank perversity is endless.

Is this not sheer money-printing, designed to manipulate markets and interest rates, support governments, with the consequence of simply making member banks and the rich even richer?

57

posted on

09/20/2017 8:29:41 AM PDT

by

PGR88

To: eyeamok

"It’s about time you gave up, he just refuses to believe the truth."

Do you think it might be his job not to understand? There are paid govt workers out there whose job it is to disrupt or lead discussions away from areas they would prefer we didn't discuss.

58

posted on

09/20/2017 10:51:34 AM PDT

by

Garth Tater

(Gone Galt and I ain't coming back.)

To: eyeamok

The part he refuses to understand is that the Fed gives Member Banks, Instant Credit at Face Value for the Promissary Note you signed for your loan, that is when the Money is actually created out of thin air. Now the member bank attaches their interest and fees to earn a profit by selling you something they never actually owned in the first placeNice! The argument seems to have shifted.

It's gone from, banks don't need money to make loans, they create it from thin air, and that's not fair........

To.....

Banks DO need money to make loans, but they get it all from the Fed, and that's not fair.......

Unfortunately, reality........

https://www.fdic.gov/bank/statistical/stats/2017jun/industry.pdf

The above link shows that banks currently have $10.8 trillion in domestic deposits and $8.7 trillion in loans

This screen shot shows that banks are currently borrowing a whopping $216 million from the Fed.

That's MILLION with an "M".

Kind of tough to make over $8.7 trillion in loans with only $216 million.

To: PGR88

I would like someone to explain to me how central banks get money for “quantitative easing.”Central Banks create money out of thin air. They can then use this money to be the lender of last resort in a financial panic.

That's why central banks were created.

Is this not sheer money-printing, designed to manipulate markets and interest rates, support governments,

Yes. Absolutely.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-76 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson