Posted on 11/29/2017 11:28:16 AM PST by Kaslin

We'll get to the study mentioned in the headline shortly -- but first, it's already time for another tax reform fact check, necessitated by the Left's relentless machine of anti-reform propaganda and distortions. On MSNBC, anchor Ali Velshi butchered the facts on the Congressional Budget Office's analysis of the projected impact of Senate Republicans' tax reform bill. Here's the segment in which he disseminates, well, fake news, followed by an explanation of exactly how he misrepresented the CBO chart. Via the Free Beacon:

MSNBC's Ali Velshi Messes Up CBO Chart on Tax Reform (Video)

"More bad news from the Congressional Budget Office showing that by 2021, people making less than $30,000 a year are going to pay between $5,000 and $9,000 more in taxes. By 2027, those folks could see an increase of up to $16,000 in their taxes," [he says]. The chart is not, as Velshi claims, a hard dollar estimate of the increase or decrease in an individual's tax payment. Rather, the chart displays estimates of the cumulative revenue the federal government will reap (in millions of dollars) from all individuals in the highlighted income brackets compared to current rates. For instance, in the 2021 column, the chart lists the number 9,000. The number 9,000 is not $9,000; it represents $9,000,000,000. The chart's title clearly states the numbers in the columns are representations of millions of dollars, not single dollars. The accurate interpretation of the chart would be that, in 2021, the federal government will receive a collective increase in revenue of $9 billion from individuals in the $20,000 to $30,000 income bracket. Velshi's claim that "by 2021, people making less than $30,000 a year are going to pay between $5,000 and $9,000 more in taxes," is false.

That's a bad error, but isn't it still troublesome that the data he references estimates that the very lowest income groups would end up contributing more revenue (collectively) to the federal government, whereas that burden gets reduced for all other households making $40,000 or more annually? Well, that might seem like a very serious problem if you were operating without context. In reality, these fictional "tax increases" arise from the bill's repeal of Obamacare's individual mandate tax. Just as people choosing not to purchase Obamacare plans that they don't want or can't afford is not "kicking them off of healthcare," people choosing to forego federal dollars in the form of Obamacare subsidies is not "raising taxes" on them. Those are voluntary decisions. Here are the real numbers:

For political reasons Obamacare called its subsidies "tax credits" and runs them through the IRS, even though it's really spending.

If people CHOOSE not to buy, CBO pretends the foregone subsidies are a tax hike.

Here's the real distribution table.https://t.co/2CiYx4IzkU pic.twitter.com/HMTZzoJ0DZ— Phil Kerpen (@kerpen) November 28, 2017

Reductions across the board, with the exception of a few income groups at the end of the budget window -- due to the on-paper expiration issue (another source of misleading demagoguery) we dealt with at length yesterday. Here's more from National Review:

For more than a week now, some media outlets have been running wild with “distributional tables” from the Joint Committee on Taxation and the Congressional Budget Office claiming that — as a CNN headline last night put it, though the story itself was much better — “Poor Americans would lose billions under Senate GOP tax bill.” This is entirely an artifact of how the agencies approach the individual mandate, which the bill repeals. They think a lot of lower-income Americans won’t buy health insurance absent a requirement that they do so, and that as a result these individuals will get less in government subsidies. As Nicole Kaeding of the Tax Foundation put it, “Less of an advanceable refund from the Treasury results in the appearance of a tax increase.” She pointed out that the JCT itself had released a separate table that excluded the effects of repealing the mandate and showed, unsurprisingly, that all income groups got a tax cut. We now have such a table from the CBO as well. Through 2025, after which point the individual tax cuts expire (though they’ll likely be renewed by a future Congress), all income groups see a tax cut.

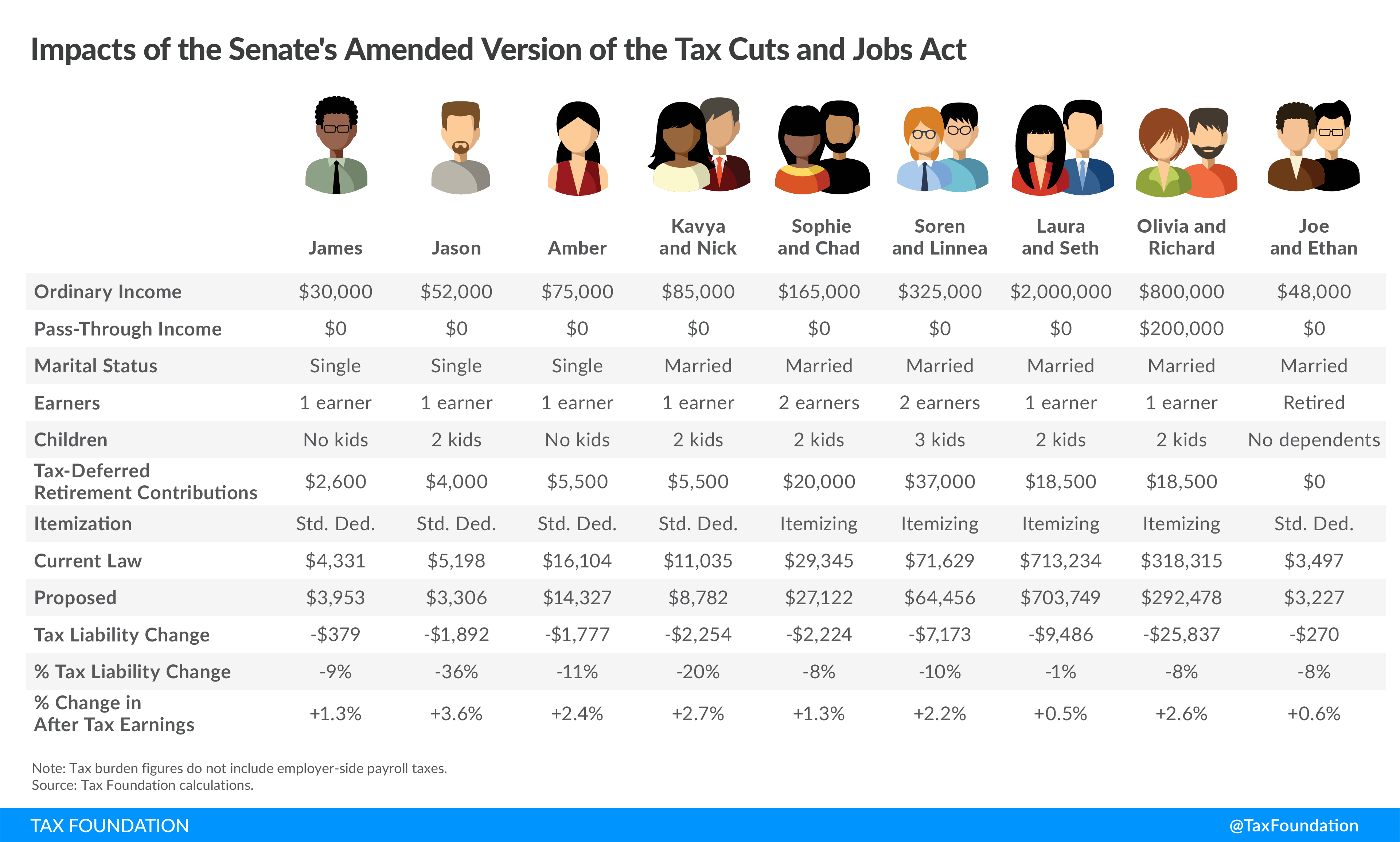

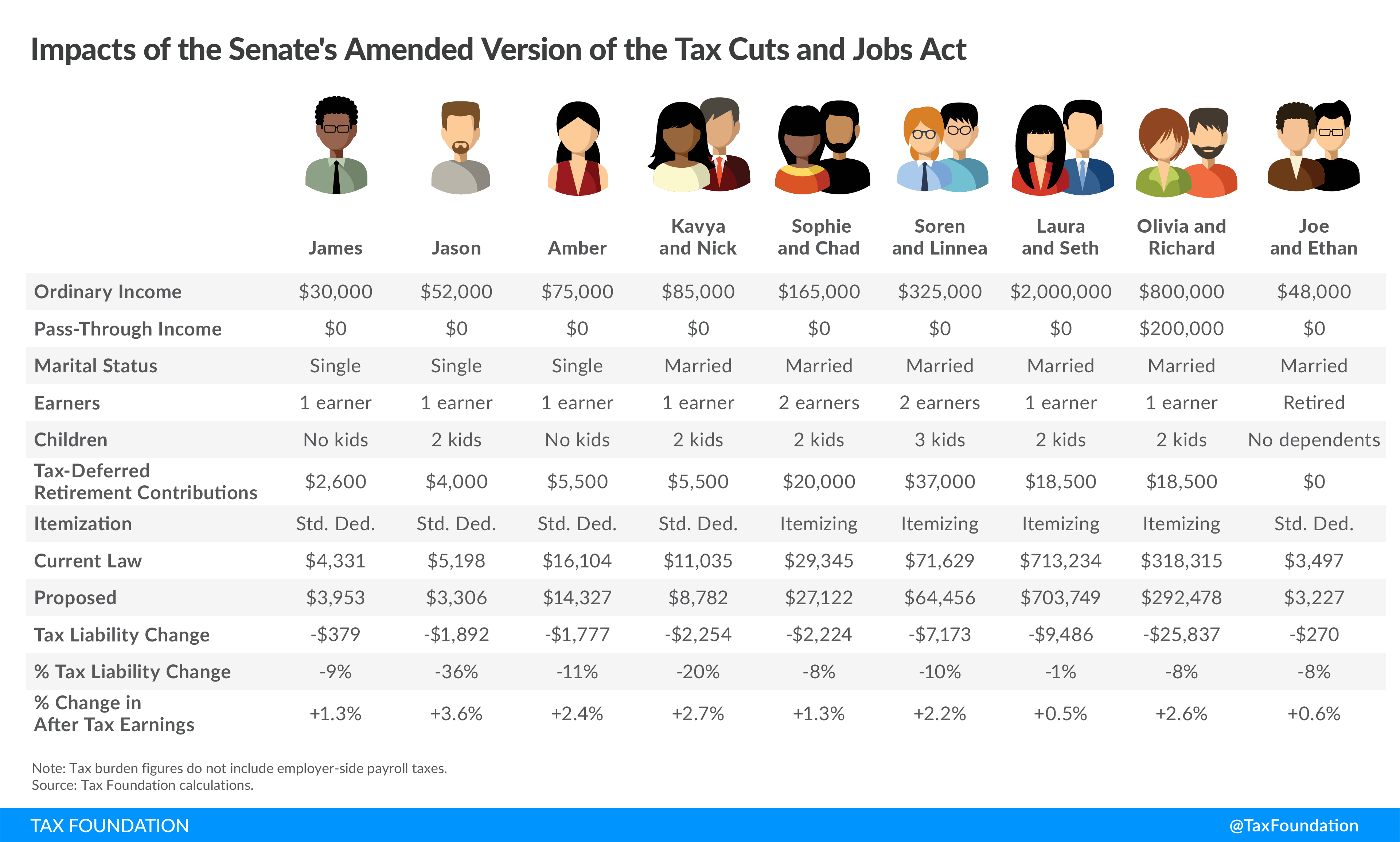

It's also worth recalling that CBO has routinely and vastly overestimated the power of the individual mandate tax, leading to scary-looking, inflated numbers that hurt Republicans during their failed 'repeal and replace' push. For example, great number of those who'd supposedly "lose coverage" with the mandate axed are...Medicaid recipients. Medicaid is free to beneficiaries (but not taxpayers, obviously). They're trying to tell us that people will give up free (if deeply substandard) coverage just because they're no longer required to hold it? It's totally illogical. Meanwhile, feast your eyes on this infographic from the nonpartisan Tax Foundation, illustrating how various households would be be impacted by the Senate GOP tax reform package. As you peruse these numbers, recall that the Left is screaming that these proposals are anti-middle class monstrosities:

Quote: "Our results indicate a reduction in tax liability for every scenario we modeled, with some of the largest cuts accruing to moderate-income families with children." The majority are automatic winners, as they're among the vast majority of all filers who take the (roughly doubled) standard deduction. Every household profiled in the analysis gets a tax cut and an increase in after-tax earnings. The smallest percentage cut and income boost goes to the richest couple. Another busted narrative.

Parting thought: Many lefties are dismissing the Tax Foundation analysis, complaining that the group is "nonpartisan in name only." By that standard, the same could be said of the left-leaning Tax Policy Center, which...also found that Americans across all income groups, on average, would get a tax cut under the House-passed Republican bill.

Sorry for the large graphic

For later....

Parting thought: Many lefties are dismissing the Tax Foundation analysis, complaining that the group is "nonpartisan in name only." By that standard, the same could be said of the left-leaning Tax Policy Center, which...also found that Americans across all income groups, on average, would get a tax cut under the House-passed Republican bill.

I don’t know about this graphic. I know for my wife and myself, $250k range, we will pay a little more. But I am all for the elimination of SALT deductions. In fact I am in favor of eliminating all deductions including the standard and child tax credits. Every individual should be paying the same percentage of gross income in federal taxes. That way everyone has skin in the game. And if you pay no taxes, you have no business voting. It is a direct conflict of interests.

Thanks for resizing

why are there no brown faces in the upper brackets?...RACIST!

We should encourage married tax payers to have children, we should reward it, especially people that stay married. Healthy families are much less of a drain on fiscal budgets.

bfl

no gay couples either...lol..

oops i missed one

oops i missed one

>

But I am all for the elimination of SALT deductions. In fact I am in favor of eliminating all deductions including the standard and child tax credits.

>

Concur. I understand the idea of ‘promoting family, but govt doesn’t, not while picking their pockets, supporting a welfare state\single-mothers (more kids = more $$).

Course, I’d rather see a return to non-fiat currency, where total elimination can occur. As it stands, it’s all one big shell game and We the People the ultimate shills.

>

Every individual should be paying the same percentage of gross income in federal taxes. That way everyone has skin in the game.

>

Sorry, but unless there’s *only* a NRST (Fair Tax’ish), you’re still talking not having 100% w/ ‘skin in the game’.

Flat-tax would still require an IRS, still involuntary, still anti-Rights.

No, every individual should be paying the same %...on a *voluntary* basis. Fedzilla has NO inherit right to the fruits of any one’s property. 5th explicitly indicates as much.

Buyer > seller > State > Fed. All new/initial purchases only; we got enough 2x+ taxation.

>

And if you pay no taxes, you have no business voting. It is a direct conflict of interests.

>

Believe that’s a given around here ;)

“In fact I am in favor of eliminating all deductions including the standard and child tax credits. Every individual should be paying the same percent.”

If you are taxing income (as opposed to consumption) there have to be deductions to account for the minimum cost of living expenses which are not really income.

To illustrate the point, are you suggesting the small business owner should pay taxes on gross revenue? Of course not, because a low margin, high turnover business like a grocery store would get killed that way, whereas a high margin low turnover business like an architect would get off relatively easy.

The same principle applies to employees. For example, an employee earning a salary just barely covering the cost of living would get killed with no deductions vs a highly paid salaried earner for whom living expenses is but a small fraction of his salary.

The point is, income tax should be on profit not gross revenue - and while that concept is covered for small business owners by the schedule C deductibility of expenses, the salaried earners mechanism for deducting expenses is the standard or itemized deductions. Take that away and you are taxing revenue, which is not a fair representative of one’s earnings.

If you have to spend it in order to keep working and getting your paycheck - i e, transportation, work clothes, (and you do need a minimum of food and shelter just to make it to work another day), those should be treated as deductible expenses just like business expenses.

A person earning a $25k salary is arguably earning zero after paying even the most minimal expenses - why shouldn’t that person be able to deduct basic living expenses? That’s what the itemized and standard deduction is for, and I think it’s fair.

Having said that, the tax code is full of innappropriate deductions, credits and incentives which were put there as manipulative tools to redistribute wealth, encourage PC behavior, buy votes for crooked politicians and foist all sorts of social engineering experiments on the public. I don’t think the government should be subsidizing the housing industry, procreation, or certain approved energy alternatives, etc.

The purpose of deductions should simply be to account for basic living expenses which should not be considered part of taxable income.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.