Posted on 05/26/2020 8:21:03 AM PDT by SeekAndFind

Once again, a few stocks lead the many. This is a time for pre-retirees to understand what that means.

This is probably a good time to remind you that I am neither a bull nor a bear. I am a realist. So, while some professional investors manage money with an emphasis on “where’s the market going,” I favor a different approach.

I cut the market into many smaller pieces, and make decisions based on more of a “weight of the evidence” approach. That is, I don’t stop my market analysis after checking out the S&P 500, Dow and Nasdaq NDAQ. I dive deeper, and analyze fundamental, price and sentiment patterns of those smaller pieces. History is a key guide here, too.

Focus now, so you can relax later (when you retire) I mention this because I truly believe we are at the most pivotal time in the lives of the generation of investors I belong to: the Baby Boomers (I just made it, born in 1964). You see, markets are cyclical.

And while anything can (and will) happen in the global financial system, that is out of our control. So, we should stop trying to control it. Or even worse, think we can control it.

What IS within our control is how we position our wealth to give us the highest likelihood of retiring the way we want. To do this, it is essential to understand how those stock market “headlines” get created, how they evolve, where the hidden risks are, and how to translate that into investment portfolio decisions. You either do this yourself, offload it to someone else, or do what too many Boomers are doing: leave it to chance.

(Excerpt) Read more at forbes.com ...

"Markets climb a wall of worry".

Trumps fault????

“I am a realist”

Everyone thinks that they’re a realist. If you flaunt it, however, you’re probably deluding yourself, or trying to delude others.

So many people still believe that “fundamentals” have anything to do with larger stock indexes.

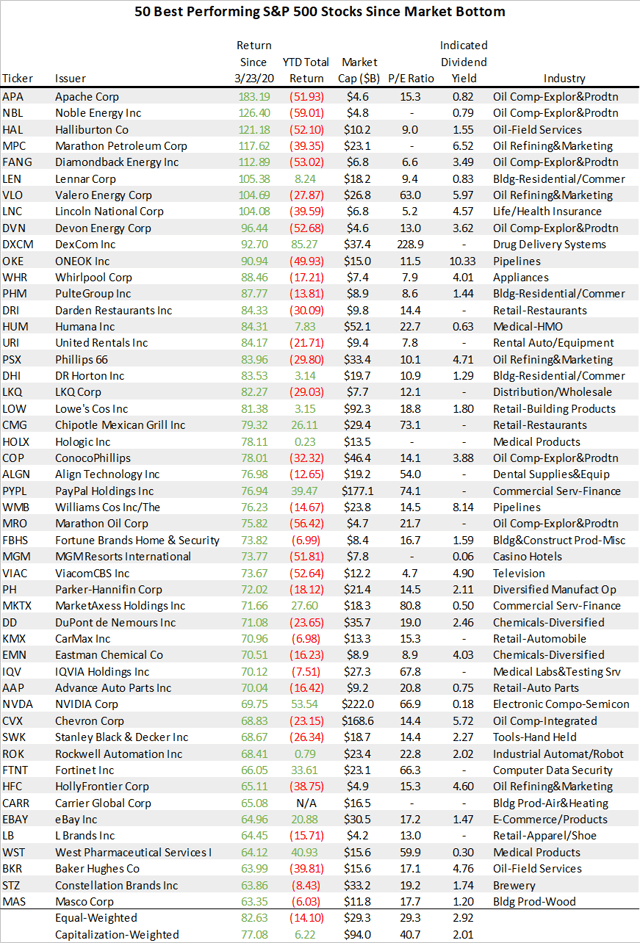

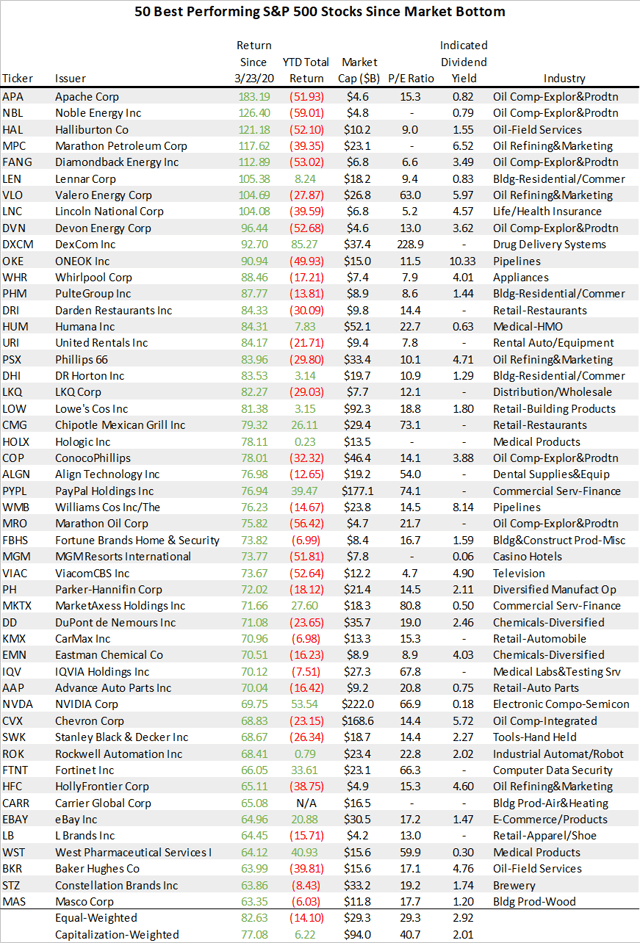

I like how a couple of the best performers are home builders Pulte and DR Horton. Remember that a market can remain irrational longer than you can remain solvent.

Very large short positions have been taken. See my post just now...

I bought some ETFs on 3-12-20 that are doing really well. I wanted to buy something fast that didn’t take a lot of research like individual stocks. I used the screener on etrade set to all star ETFs, Morningstar 5 star, and average annual performance. Then I picked the top ones for 10 years and since inception.

They are up an average of 33%.

Economic fundamentals are what drives the markets. Those tax, regulatory, and trade fundamentals are better than they have been for many decades, the economy will follow them, and the markets will follow the economy.

Rental car biz, like most or all of the travel-related biz, has been hard hit. The travel sector (other than surface travel by wheeled personal transporation) is going to suck for at least a couple years, although I suspect the stock will be worth speculating on by getting it cheap now.

Petroleum-related biz is going to be all over the map, because not all companies (in any type of business) are managed or positioned identically. It'll recover faster than casinos, hotels, cruise lines, etc.

Banks -- the large banks have been beaten down like the rest of the market, and their dividends may be cut, although I doubt it will be deep where it happens. Meanwhile, check out the yield with the current dividends and share prices, and compare those with CD or money market yields.

Cookout supplies are going to be big this summer, IMHO, families will staycation themselves because of finances and inability to get time off when they're working again. Amusement parks will boom late in the summer, IMHO.

Entire industries are being crushed..oil & energy services, restaurants, hotels, travel & tourism, airlines, aircraft manufacturers, auto manufacturers & dealers, car rental, retail, retail & commercial real estate as well as related suppliers and support services....a developing tsunami of personal and corporate bankruptcy and probably bank failures starting soon afterwards...….and people are panic buying stocks in these zombie companies. this will not end well.

lotta money made since march 23rd.... for a guy that was sitting on a pile of cash

Travel, Hospitality Stocks Rise on Hopes for Reopening

12:09 pm ET May 26, 2020 (Dow Jones)

By Dave Sebastian

https://www.morningstar.com/news/dow-jones/202005267045/travel-hospitality-stocks-rise-on-hopes-for-reopening

Timeless wisdom.

Those short positions are going to get wiped out.

Maybe so.

I agree, but a lot of folks here (probably with 401ks underwater) sure take the opposite view. I just don’t see it recovering like some say. There is no way with the economic damage that has been done.

There may be managed funds that have not recovered, but the S&P 500 pretty much has. It’s only down around 10% from it’s all time high.

When I look at all the funds available in my 401k and look at the ten year performance, not a single managed fund performed better than the 500. Couple that with the fact that it has the lowest fees and it’s a no brainier.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.