Posted on 05/01/2021 9:13:56 PM PDT by SeekAndFind

This week, President Biden proposed taxing capital gains at death at a tax rate of 39.6 percent plus the 3.8 percent investment tax. He proposed a $1 million exemption. For an individual with less than $11.8 million in net worth, this would create a new death tax from whole cloth.

President Biden’s new death tax would result in estates that currently are not remotely close to having sufficient net worth to pay a death tax paying a death tax. It can be named a ‘capital gains tax at death’; it is a new death tax.

For a long-term real estate investor, President Biden’s plan could confiscate an entire estate. For many others, estates that would have been passed tax-free to children would see very, very large percentages of their estates reduced by Biden’s new death tax.

The proposal falls into the kind of ‘question’ one might have asked young children when something went woefully wrong: “Don’t tell me what you were thinking, please tell me if you were thinking.”

If an individual’s only asset were an apartment that he purchased thirty years ago and that apartment was currently encumbered by debt, a capital gains tax of 43.4% could easily exceed the net cash that would be received on the sale of the building by the individual’s family upon the individual’s death. The Biden capital gains tax at death would eliminate the taxpayer’s entire estate.

If the decedent purchased the apartment building for $2,000,000 in 1981, the entire building would be depreciated resulting in a tax basis (cost) for the building of zero, so only the initial value of the land would offset the gain at sale. Assume $500,000 was the cost basis of the land when the building was purchased.

Should the building have a fair market value of $10,000,000 and current debt of $7,000,000, the taxable capital gain at death would be $8,500,000 after the $1,000,000 exemption. The Biden death tax would be 43.4 percent of the gain: $3,689,000. The calculation would be very straight forward: the building would be sold for $10,000,000, the debt of $7,000,000 would be paid and the net proceeds would not be sufficient to pay Biden’s death tax.

The result, an individual who thought he was going to leave $3,000,000 to his children would see 100% of that amount taken by the government. (The numbers only get worse if the decedent’s state of residence also imposes a capital gains tax at death.)

How common a problem would this be? Very, very common is the answer. Real estate developers borrow on old properties to build or buy new properties. Real estate developers borrow on old properties to make charitable contributions. The Biden proposal would confiscate 100 percent of the assets for some real estate owners and take very large percentages of the estates of many other real estate investors.

Until this week, an individual owning assets with a fair market value of $20,000,000 and debts of $11,000,000 had a net worth of $9,000,000. Under current law, the $9,000,000 would be passed along tax-free to his children. In some cases, Biden proposes to take it all. In other cases, Biden proposes to take most and in all cases, Biden proposes a new death tax out of whole cloth.

This new death tax does not stop at real estate. Oil drillers essentially have little or no cost basis in their wells. As a result, after the million dollar exclusion, Biden is proposing a new 43.4% death tax on existing royalty interests.

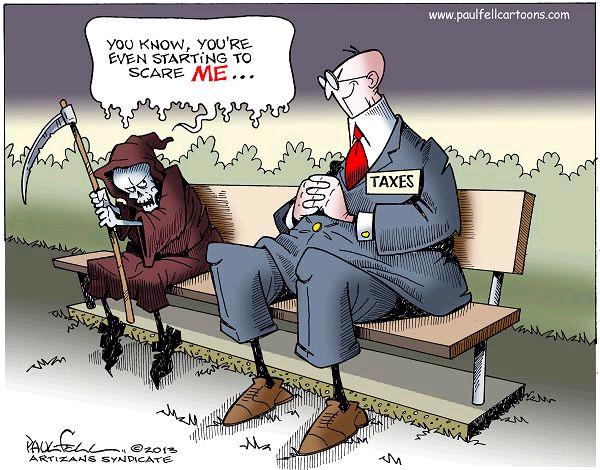

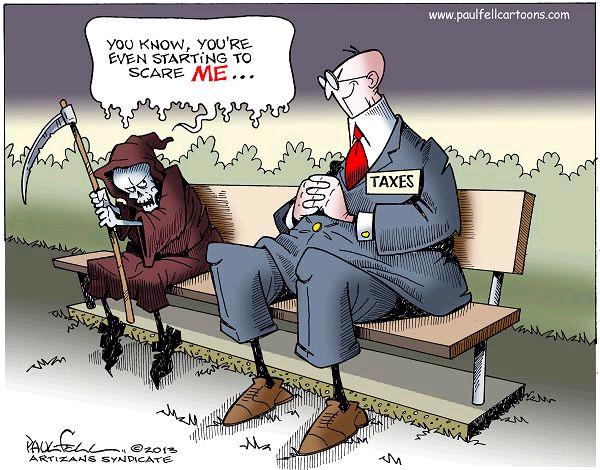

The United States does not need the government appearing with its hand out standing next to that guy with the sickle.

Who cares if an asset is encumbered by a mortgage when its owner dies? A proposed tax policy should stand or fall on its own, regardless of other issues that come into play in specific situations.

I’d also point out that having $7M in mortgage debt on an asset that was purchased for $2M and has been fully depreciated indicates a level of sophistication on the part of the owner that should make ANY death tax rate nothing more than a minor consideration in estate planning.

I did not see that mentioned.

Also, would this apply to capital gains in Trusts?

EVERY person who works for a Trust company has a law degree (LOL - that is only a slight exaggeration).

Biden's tax people have no idea what kind of legal mine field they are walking into if they start messing around with Trust Funds!

wipe out all inter-generational transfer of wealth but exclude those rat bastards that created it

What's the death tax on a building bought for 40k in 1980 and worth now 5M?

Well, if it falls under “reconciliation” - it likely will pass.

If they dump the filibuster - it will pass.

Not enough of them.

This senile old reprobate has stocked the administration with America hating socialists and doesn’t even know what’s going on. He’s as bad as O’Bummer, viz. haplessly and fecklessly looking over the bills signed while he slept.

One thing I’ve observed about liberal pukes is that they’re all for the liberal rhetoric until they’re the ones dealing with the mess. It’ll be interesting to see how it plays out.

Only very foolish individuals own $10M buildings in their own names. Our system favors corporations for a reason - smart people use them.

Sales of Mason jars to ensue.

Agreed:

That’s a great image.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.