Anyone have some secret maps they want to sell me?

Yeah, whenever I see articles like this, you can usually figure on it being someone promoting gold or silver or related things...

Sure enough...

“an opportunity for a small percentage of Americans to become wealthy by investing into companies that we believe will prosper in an inflationary environment, such as Gold and Silver miners. “

... stated in their “about us” section...

[ can you say “paid by these ‘investment opportunities’ ...” LOL... ]

This is some interesting stuff. I was wondering about buying a bag of silver coins — cheapest I’ve found is that monex operation — $1k per bag. I’m not so sure about buying into these companies listed on this article — looks too much like a setup.

Don’t worry, the money supply will be reduced through massive, confiscatory taxation.

The USD will crash at some point. However, that isn’t what’s currently happening. It’s never a good idea to assume facts about the market that are not yet in evidence. Wait until the trend has clearly changed, but don’t wait so long that the new trend is mostly over!

Trading rule #1: Cut your losses short, let your winners run!

How many people are going to see their home values increase speedily and think the world is alright again, not realizing when it zips on by and the salary doesn’t equal the rent increases or property tax increases or cost of living increases?

The Dollar is way too big to fail.

bull.... inflation ain’t coming back anytime soon and when it does it will not be as hyper inflation. Hyper inflations are very rare

I might be wrong though, my inflation hedge is au, which did well in 1930s deflation too

Utterly contradicts the headline. If dollars are confetti, houses which have some real value must be worth wheelbarrows full of said confetti.

Doom mongers never worry about the intellectual coherence of their allegations.

The housing crisis is demonstrative proof that nominal debts in dollars can be worth more than the real assets they are written against, which cannot happen if dollars are so oversupplied they have no value.

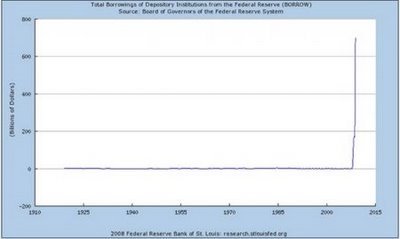

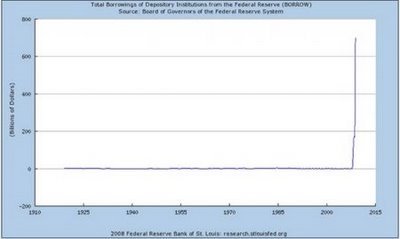

In fact, demand for dollars is nearly infinite at the present time, but only for safe investment purposes. Monetary velocity is non-existent, and therefore so is any pricing pressure. Large increases in free reserves in the banking system due to Fed actions have not been accompanied by large increases in total dollars outstanding (just the usual moderate ones), and money turnover has remained basically flat.

What the quantity theorist types never admit is that the value of anything depends on demand for it as well as supply, and the demand for money is not a constant.

There is a reason rates for riskless debts are very low and the dollar is strong against all currencies, and it isn't because hyperinflation is occurring.

It is a deflation. But men ideologically committed to slandering the Fed and the financial system cannot accept the existence of deflation in a fiat money system.

ping

If this is true, now is the time to borrow to the hilt and buy durable assets, such as land, houses etc.

Personally, I am just planning on hunkering down.

Awashed?

As the government continues to bailout bail out every bank in existence and pass larger stimulus's stimuluses (or stimuli?), all of the Dollars being squirreled away around the world will soon come out all at once.

Gold looks set to move substantially higher as governments all around the world embark on a programme of "quantitative easing"

By Ian Williams

Last Updated: 2:18PM GMT 10 Mar 2009

Last July I wrote an article for telegraph.co.uk suggesting that gold had lagged other commodities in general and oil in particular and that gold would hit $2,000 an ounce over the next two or three years.

At the time oil was trading at $140 a barrel and using the gold/oil ratio I suggested that either oil was far too high or gold at around $900 was too low.

Since then all other commodities have collapsed in value, with oil showing the most spectacular collapse of all, falling to $35 a barrel, while gold is now higher with the price having moved up to about £1,000 an ounce.

[snip]

Good thing the world is awash with dollars. During the coming depression, I’ll be able to put those dollars to good use if we run out of toilet paper.

Posting at 2AM (Central Time) and I haven’t read through all the responses, so this may be redundant.

Whenever I hear of someone who wants to sell me gold and/or silver because of upcoming doom and gloom it always begs the question:

Why do you want my worthless dollars for this valuable gold and silver? Do you have so much of it that you can’t pay the storage fees? Or maybe you heard of me from a mutual friend, and out of the goodness of your heart you want to bear the brunt of the imminent and certain financial loss that I would incur by holding on to my dollars?

Or maybe, just for the heck of it, you want to make a losing sale, just to see how it feels?