Posted on 04/23/2011 5:11:22 PM PDT by blam

Silver Black Swan If Rampant Speculation Is Not Reigned In

Commodities / Gold and Silver 2011

Apr 23, 2011 - 11:49 AM

By: Dian L Chu

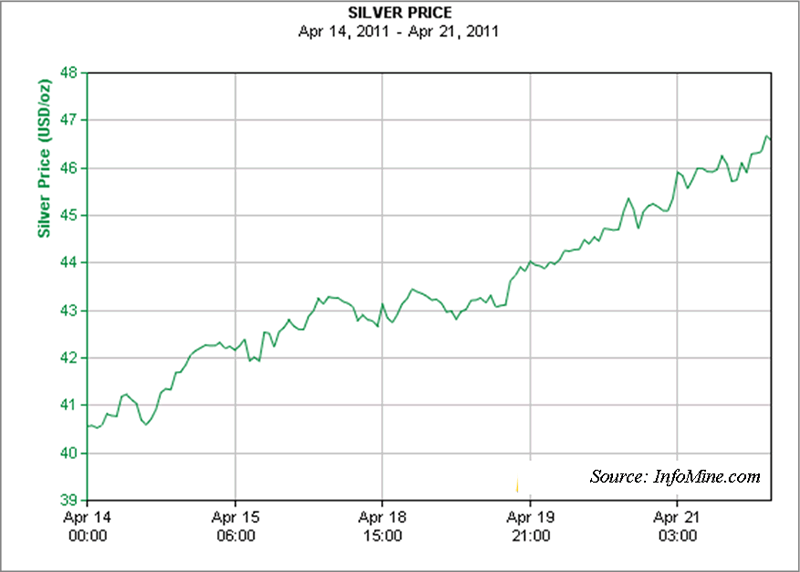

If you think the crude oil market has gone totally out of control in the past month or so, observe the Silver. The Silver market has basically gone parabolic the week of April 17, going from $41.75 on April 15th to $46.69 on April 21st--a 12% move in 5 trading days, topping off the move with a 5% move on Thursday (See Chart).

As Silver is a thinly traded market, one thing the CME could do is to raise margin requirements for Silver speculators; otherwise risk is setting up the silver market for an record-setting crash, which could impact many other markets in the process of correcting, especially other commodities like Gold and Crude Oil.

A Silver Contagion

We are not talking about a 5% correction setting up at these levels for silver, we are talking in terms of a 20% down day that poses a contagion effect to markets in general.

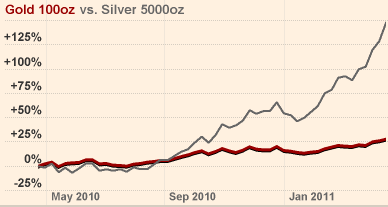

The reason the contagion risk in the Silver market is that while Gold is going up half a percent to one percent, Silver is logging in 3.5% days routinely (See Chart below). Well, what goes up, must come down... eventually. So, when this market breaks, it is going to break hard to the order of 10% easily.

That kind of market selling will not occur in a vacuum, especially since commodities have been trending up as a group, i.e., the same hedge funds and banks are trading all the risk-on commodities as well, like Gold, Copper, Crude Oil, Wheat, etc.

In other words, if Silver gets a 10% down day, which it almost will for sure, and if it isn`t cooled off considerably with proper margin requirements instituted by the CME, then, the rest of the commodities will be forced to overshoot to the downside as well.

ETF Trading & Portfolio Rebalancing

There are a couple of reasons for this. With the advent of commodity funds, silver is part of the basket of commodities in the funds. Also, because traders will not want to fight the tape, shorts will come in and take advantage of the selloff in Silver to push other commodities down through ETF trading vehicles.

Moreover, the same banks and hedge funds trading silver are also involved in the major commodity groups as well, and they will be liquidating other positions to keep their portfolios balanced with regard to risk. So expect a lot of portfolio rebalancing to take place if the Silver market drops 10% in a day across many hedge funds.

Price & Margin Out of Balance

The CME routinely sets margins based upon contract prices. So, if Silver goes up $10 more in price, then the ratio of margin to price goes down. In order to realign margins with the higher price, CME would raise the margins.

The reason this becomes a problem is that if price gets too far out of balance with margin requirements, the risk goes up, because traders will not be properly sized with regard to risk for a potential correction, and many trading accounts could be devastated due to overleverage.

Black Silver Swan

In addition, if Silver speculators are all heavily leaning towards one direction as the action of recent silver price movement suggests, then, there is an increased risk of a major market dislocation, thus creating a ‘black silver swan' day. That’s exactly the kind of event that exchanges try to prevent from occurring, as it is extremely unhealthy for markets, and bad for business.

It is obvious to anyone observing the Silver market that it is overheated to the Nth power. The longer CME ignores the problem, the worse the consequences will be down the line. When all the other risk-on commodity trades are putting in 1% days, and Silver is putting in 5% days, then you know the longer this goes on, the higher probability that this trade and market could end very badly.

Flash Crash 2.0?

As the very real possibility of a 20% two-day correction is moving towards becoming a very real probability, it could bring down a lot of other markets in the process. Remember, we had the flash crash around this time last year? Well, if the Silver market isn`t cooled off, it could potentially be one of the catalysts for another broad flash crash this year.

Raise Margin Requirements by 30%

The easiest way for the CME to lessen the probability of an epic crash in the Silver market, and the subsequent public and regulatory inquisitions, would be to raise margin requirements by at least 30%, as the starting point.

Actually, the CME could be a little late based upon the manner in which silver speculation has gone bizzerk, especially over the last trading week--the market has simply become parabolic. The CME could have raised margin requirements once Silver broke $40 an ounce, and without a doubt they should have raised margin requirements on the 14th of April, before this latest 12% weekly move.

The longer the CME fails to address the problems in the Silver market to rein in excessive speculation, the more risk there is of an extreme market crash. Just as I said before--"The white metal appears overbought and could be heading towards a bubble stage," and without QE2, that bubble would have formed and burst by now.

Silver A Screaming Short

With gold/silver ration setting new 28-year low record almost everyday in April, it looks like the necessary elements are already set in motion for another horrid crash and burn contagion scenario--but this time originating from Silver--due to the interconnected nature and electronic evolution of modern day markets. Any intervention effort by that time would most likely be futile in the face of a multi-market algo contagion.

I predicted this a long time ago: Government intends to inflate the debt away

Dang it all!! It’s too late for me. I bought silver and it indeed has gone straight up!! Save yourselves and don’t buy silver or the same thing could happen to you.

I don’t understand, if the govt inflates the debt away won’t dollars be worth less? Seems to me silver would be even more valuable, why would it be worth less too? I really don’t understand.

No one doubts that the government intends to inflate the debt away at this point. It gets rid of the debt while pummeling the dollar and increasing the size of the government dependency class. It’s a win win for democrat and republican progressives who control Washington.

However, keep in mind that a significant amount of the demand for silver is as an industrial metal. Not as much as say, titanium or lithium, but on the order of 30%-40%. In a worldwide depression, this demand will dry up.

There’s a reason everyone knows what the term “the gold standard” means, and “the silver standard” isn’t even a term.

I believe speculation is playing a major role in the commodities run-up. But that speculation is in turn fueled by bad currency policies.

The author might be short silver and is hoping silver will go down so his clock does not get cleaned.

We need to be cautious.

The left redefines common terms to demonize their opponents and to excuse themselves.

What is “speculation?”

The left (headed by none other than Obammie the Commie at this time) is trying to demonize “speculators.” By using that term, what they are trying to demonize is those who invest in the futures market.

There are two types of “speculators” as being discussed. But there is only one true type of speculating regarding the markets. The other type is not speculating at all.

Speculators do nothing more than invest in the current price of a commodity. This no more controls the price of that commodity than a gambler who bets on the final score of a game contributes to the score of that game. Sometimes the gambler wins. Sometimes they lose. But speculating on the futures market is good for the people. It helps to ensure the flow of commodities to those who need them.

Now, what is being conflated with “speculating” is what the mega-firms like JP Morgan, Chase, and Goldman-Sachs are doing. They are buying up actual crude, storing it in massive tankers, and refusing to deliver. In short, they are withholding supply in order to drive up the market price. They bought when it was cheaper, held it off the market, manipulated the cost in part by devaluing the currency, and will sell at a massive profit when they finally deliver the commodity.

This is NOT speculating. This is none other than the old “trust” style of manipulating the market. We have anti-trust laws on the books that should be applied to this activity...the same laws that the left love to tout as saving the little guy from the evil rich mega-investors. Of course, these are the people who backed Obammie and his Commies, so they are being given a free ride.

Meanwhile, Obammie the Commie is going to investigate the legitimate type of speculator, the lower-level investor who is just trying see an ROI on a risky investment.

Again, the leftists are trying to demonize the free-market side of the equation while protecting the “Corporate Socialists” (those enterprises that collude with the government for monopolistic control over a market sector and to eliminate competition).

Yes...silver would be worth more.

You are 100% correct. Up is down and down is up.

I won’t be at all surprised is Silver sees 30 this year, but I will be surprised if it doesn’t see 50 after that.

A good drop of 20% (to $37) is a terrific buying opportunity.

Even $40 is a nice chance for those feeling left out to start accumulating, hoping for more of a drop before the bull continues his charge.

” Government intends to inflate the debt away “

Which is great for Government and the favored Bankers and Investors —

Not so much for us down here ‘in the weeds’ having to try to buy food and fuel and heat and light with increasingly worthless dollars....

(And you lucky few who still have a job, get a clue — your paycheck will NOT keep pace...)

Industrial demand may lessen, but individuals, groups, companies, banks, and countries are loading their vaults as the impending fiat collapse draws nearer.

I believe this “bubble” is just getting legs, and won’t break until $150-$200/oz. silver is upon us. A 10-20% correction will not burst the bubble.

This guy posted all the black swans listded in the cartoon bear video. Over 30 reasons silver would pop were in the funny video. The actual reasons are posted here:

http://www.oilbull.com/1464/silver-revisiting-the-silver-bear-black-swans/

Here is the video (prior link is an itemized list of the black swans):

http://www.oilbull.com/1429/black-swans-silver-the-xtranormal-bears/

They have been raising the margin on silver since November. Each time it is less effective at bring the price down for any length of time. There is no evidence another margin hike will be effective now.

otherwise risk is setting up the silver market for an record-setting crash, which could impact many other markets in the process of correcting, especially other commodities like Gold and Crude Oil.

Yes heaven forbid that oil get cheaper. The reason commodities have exploded, including silver, is due to the dollar, the debt, and endless QE. Fix those, and silver will come down. Yes, silver can correct next week, or at any time. But until those reasons are fixed, it will recover and continue up.

The “value” of an ounce of silver won’t change much, however the “price” will change dramatically with the fall of the dollar.

Just like Hugo Chavez. Haven't heard from him since Egypt exploded, what is he up to these days?

I disagree. Perhaps there is a technical distinction that is being lost. Speculators who hold the physical assets are great.

There is nothing wrong with that, and they can lose as well. The old fashion land speculators, actually owned the land and went bust.

Today's problem are the speculators who 'buy' something, ie ETF's, Oil, without the physical delivery.

Finally, it is the fault of both dems and repubs, not simple rats. Dunno why your pushing the idea that Rats are only responsible.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.