My internal projection, ~2015

GDP multiplier is dangerously close to 1

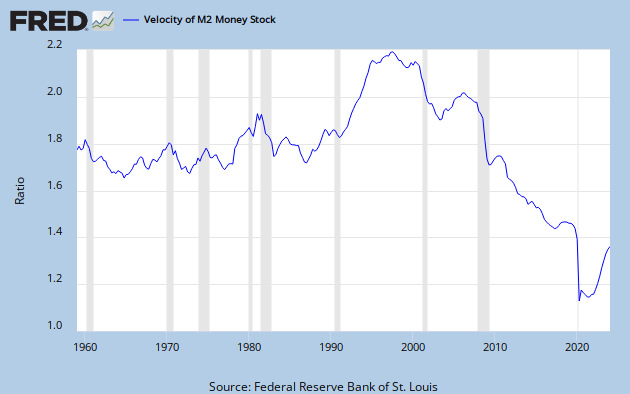

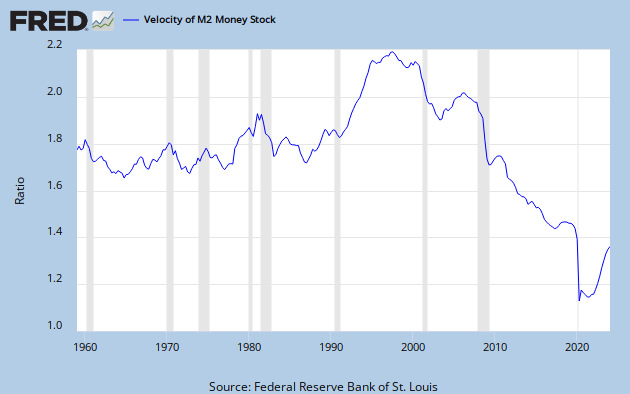

And M2 velocity,

The best single indicator of economic activity,

is still dropping

Anyone who thinks this is healthy is

I think US Treasury bonds are definitely a bubble in the classic sense. But the thing is that EVERYONE is in the same boat: the Japanese, the Europeans, and US. All the central banks that matter are printing like crazy and buying their own bonds with the $$. And the rest of the World depends on the Japanese, the Europeans, and US for their livelihood. So, the game will probably go on for some time. In fact, the US is likely to be the “last man standing” when the others collapse.

It will eventually end in disaster, but probably not in 2013.

No not everyone.

China is making virtually everything now.

China is doing just fine. Owning 50% of all the factories we use, to use Chinese employees to manufacture everything anymore.

How about we start paying attention to that.

My internal projection, ~2015

GDP multiplier is dangerously close to 1

And M2 velocity,

The best single indicator of economic activity,

is still dropping

Anyone who thinks this is healthy is

You got it. That's why some previous posters are not buying into the article as much as they should. There is no question that the government bond bubble (along with mortgage bonds) is going to collapse. The problem with zero rates is that they hollow out the economy and push money into speculative carry trade or commodities. The carry trade and commodity bubbles expand and contract with psychological factors and reaction from the Fed. When the final contraction comes, the Fed will be boxed in.

We have yet to see any real deflation or corresponding "money printing" for stimulating demand. All contraction so far has been in assets and money printing up to now is to buy bonds. The money printing buys government bonds and the politicians spend money to stimulate demand indirectly. But the politicians can also transfer money directly to people to buy votes. We have probably passed the point where we can fundamentally cut back the payments by greatly expanding the economy. But there will be minor expansions while politicians kick the can on reform.