Posted on 03/09/2013 11:23:01 AM PST by blam

Dow And Silver In Gold Terms

Commodities / Gold and Silver 2013

March 09, 2013 - 05:44 PM GMT

By: Richard Mills

The Dow on Gold's terms:

* During January 2000 gold traded at an average price of $284.32

* January 2000 the Dow was 10,900

* 10,900/$284.32 per ounce = 38.33 gold ounces to buy the Dow

Today gold is trading at $1570.90 while the Dow Jones (DJIA) continues to break records, up another 30 points as I write to 14,284.

14,284/1570.90 = 9.09 ozs of gold to buy the Dow today.

38.33/9.09 = 4.2

The Dow on Silver's terms:

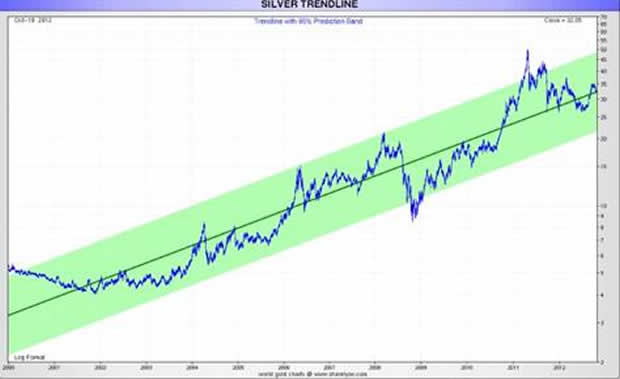

During January 2000 silver averaged $4.95 oz January 2000 the Dow was 10,900 10,900/$4.95 per ounce = 2202 silver ounces to buy the Dow

Today silver is trading at $28.62, the Dow is 14,284.

14,284/28.62 = 499 ozs silver to buy the Dow.

2202/499 = 4.4

The Dow has gone up roughly, and only, 3400 points since January 2000.

Gold, during the same period, has gone from an average of $284 to $1570.90 ($1570.90/$284 = 5.5x) while silver has gone from an average of $4.95 to $28.62 ($28.62/$4.95 = 5.7x) per oz.

In January 2000 the gold/silver ratio was $284.32/$4.95 = 57.43

Today, as I calculate these numbers, gold is $1570.90 oz while silver is $28.62 oz for a gold/silver ratio of 54.88.

Silver, a.k.a. 'poor man's gold' trades in lockstep with gold - from a ratio of 57.4 in 2000 to a ratio of 54.8 today some 13 years later who can argue?

Joe and Suzie on Gold's Terms

We've seen how gold and silver are doing relative to each other and the Dow. How is Joe & Suzie Average making out on gold's terms? Let's take a look at housing and wages...

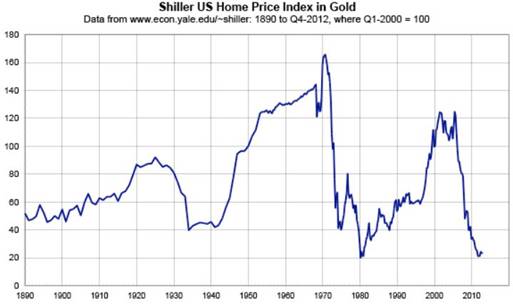

Today's home prices are lower than they were during the Great Depression and are approaching their all-time lows.

"At first, the drop in the dollar simply offset the apparent rise in home prices, and prices in gold worked sideways until 2006. But when home prices began to fall in dollar terms, and dollars were themselves falling in value, the double-whammy pushed true home prices down to levels not seen since the late 1980s. In fact, they set a new record, the lowest level since the index was first published. This means that most homes purchased in the last 20 years are now worth less than the original purchase price, even if they show gains of 100%, 200%, or more, in dollar terms." ~ pricedingold.com

The average U.S. worker earned $13.75 an hour in January of 2000. As we already know the price of an ounce of gold averaged $284.

The average worker would have had to work 20.65 hours ($284/$13.75) to buy an oz of gold in January, 2000.

Today the average U.S. workers wage is $19.77 and gold is $1570.90 oz - the average working Joe/Suzie would have to work 79.45 hours to buy an oz.

Consider: Global conflicts are intensifying and raising already considerable tension levels. Zero interest rates, global quantitative easing and escalating currency wars - an international race to worthless that ends with everyone a loser and leads to a rise in protectionism and future trade wars

After mulling over all that's happening in the world today ask yourself "what chance does Joe and Suzie have of buying gold and silver cheaper in the future than now?"

Conclusion

Buying some gold and silver should be on everyone's radar screens. Is it on your screen?

If not, maybe buying either, or a bit of both, should be.

This article implies relationships that aren’t actually all that predictive. 1980 blows the whole notion out of the water.

During the 1980 Nelson Bunker Hunt silver mania you couldn’t get shtye for your junk silver. The silver content in it was deeply discounted if you brought it to a gold dealer to sell. What the gold/silver buyers wanted was pure silver with 100oz silver bars preferred. There were few if any 100% silver coins back then. Today (of course) there are very good ones from the Canadian and US governments and other places. I would trust an APMEX one ounce silver coin (rounds is what they are called) or same size APMEX silver bar. Or the 10oz APMEX silver bar. They are stamped out hard like a coin so look very nice and acceptable in a SHTF situation or just in trade next week to buy stuff. Not poured like ye old 10oz silver bar by Engelhard or Johnson Mathey you can find on eBay.

POURED

LOAF

INGOT

http://www.ebay.com/sch/i.html?_odkw=johnson+matthey++10&_osacat=0&clk_rvr_id=457466044968&_from=R40&_trksid=p2045573.m570.l1313&_nkw=engelhard+10&_sacat=0

In 1980 your junk 90% silver coins....Lets say the dealers would buy the silver content of them at about 60% of its value. It was in that area

And then there is always the worry this could happen again.

http://en.wikipedia.org/wiki/Executive_Order_6102

What scenario do you see? Why and at what point will the FR start selling its USG Treasury securities? The FR is presently buying (also holding) them at the rate of one trillion a year....I hear the number is this large

News for federal reserve balance sheet

Reuters - 2 days agoNEW YORK (Reuters) - The U.S. Federal Reserve's balance sheet grew to a record large size in the latest week with increased holdings of U.S. ...The U.S. Federal Reserve's balance sheet grew to a record large size in the latest week with increased holdings of U.S. government debt, Fed data released on Thursday showed.

The Fed's balance sheet, a broad gauge of its lending to the financial system, stood at $3.091 trillion on March 6, compared with $3.072 trillion on February 27.

The Fed's holdings of Treasuries totaled $1.762 trillion as of Wednesday versus $1.750 trillion the previous week.

The Fed's ownership of mortgage bonds guaranteed by Fannie Mae (FNMA.OB), Freddie Mac (FMCC.OB) and the Government National Mortgage Association (Ginnie Mae) totaled $1.016 trillion on Wednesday, which was little changed from the previous week.

The Fed's holdings of debt issued by Fannie Mae, Freddie Mac and the Federal Home Loan Bank system was $73.59 billion, unchanged on the week.

The Fed's overnight direct loans to credit-worthy banks via its discount window averaged $21 million a day compared with an average of $3 million per day the prior week.

Treasury Scarcity to Grow as Fed Buys 90% of New Bonds ...

www.bloomberg.com/.../treasury-scarcity-to-grow-as-fed-buys-90-of...Dec 3, 2012 – ... next year as the Federal Reserve soaks up almost all the net new bonds. ... With the Fed buying about $85 billion a month in Treasuries and ...Federal Reserve may buy more bonds - Dec. 9, 2012

money.cnn.com/2012/12/09/.../federal-reserve.../index.html

Dec 9, 2012 – Federal Reserve officials face cloudy economic signals and end of Operation Twist at its last meeting of the year. ... The more likely move, however, is for the Fed to say it will buy more Treasury bonds as a way to keep ... Fed's Transferred $88.9 Billion to Treasury in 2012 - NYTimes.com

www.nytimes.com/2013/01/.../feds-2012-profit-was-88-9-billion.htm...Jan 10, 2013 – The Federal Reserve sent record earnings to the Treasury ... The Fed has transferred at least some profit to the Treasury every year since 1934. ... That has allowed the Fed to buy assets without increasing the amount of ...

That was gold only. Silver was not touched. This time around I don’t think the Obama-trons and their ilk will issue any gold confiscation orders a la FDR. They will just tax the transactions to death (say 30-50%) with heavy penalties for neighbor Joe selling gold coins to neighbor Tom without notifying the IRS. Kinda like a Federale gun registry, the Federales might get very interested in those anti-fiat money guys who live in the USA. Might what to know who they are and to tax the shyte out of their gold and silver transaction

In our zero sum economy the Obama plan is to take from us (defund us) via taxes what have you and to fund the left, fund the Obama voters-moochers, fund an ever growing Federale Gov’t bureaucracy crammed full of affirmative action hires.

Based on the article, it would seem that the price of gold and silver is inflated. Since they are trading on demand, the price can go up dramatically, but it can also go down dramatically.

To determine if gold is inflated, one really needs something to compare it with that tends to resist dramatic swings but nonetheless has a real, lasting value.

Some have suggested that an acre of tillable farmland fits the bill. Decent farmland in our largely agricultural states sells from about 2-3 thousand an acre. That is roughly 1.5 to 2 ounces of gold.

The difficulty is finding the past value of farmland and comparing it to the then value of gold to see what the price of an acre was in gold. (During times when gold didn’t have an arbitrary value assigned by an interventionist government.)

Bought in in 2000 - have been holding for 13 years now. Have quintupled my investment. It’s worked for me. When G & S go up again, I’m cashing in and paying off my farm. If it crashes, I’m not out a penny of my original investment and will still have almost enough to pay off my farm...which means instead of quitting my job, I’ll have to work about 5 more years to completely pay it off - and this will be before I hit 60, God willing!

Now, remember - I’m the one, who as a teen, used her allowance money to buy cocoa, wheat, corn and coffee futures instead of Tiger Beat magazine and nail polish, LOL! My Daddy & Grandpa taught me well. :)

I wish you the very best.

Thanks! Plan the work, then work the plan. And if that doesn’t work, move on to Plan B! :)

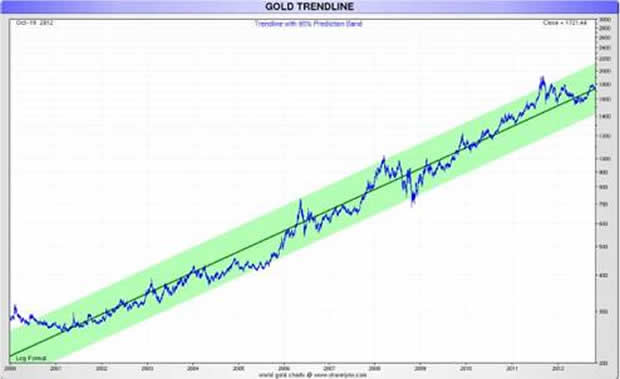

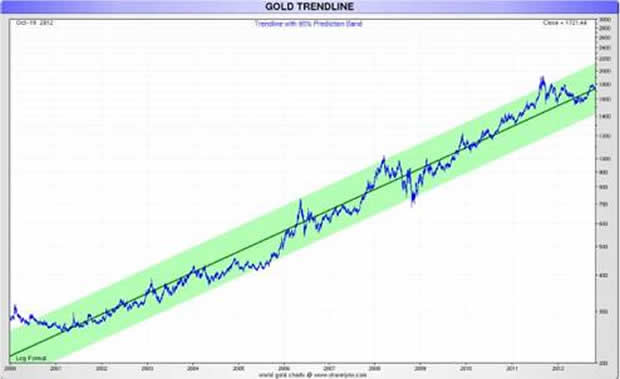

IMHO the trend line for gold is presently below reality. Were it not for the downward slope from the unsustainable peak the trend line would be higher than the present.

I think it should be at $1900 or $2000, that is greater then the present $1600.

Then there is the gold/silver ratio. The ratio was stated at ~54. Historically, for a very longtime the reatio was closer to 15. If the price of gold is correct, Silver has a ways to go before topping out. The author cites correlation at 54 but historic correlation is much lower.

Wages are lagging because of the unemployment. The disparity will decrease with the coming wage inflation.

Unstated was that as the price of gold in vaults rises, so does the price of the gold in the ground. A basket of mining stocks in a mutual fund is buying gold in the ground.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.