Posted on 04/10/2013 4:13:57 AM PDT by dennisw

Daily investment & finance & thread (4-10-13 edition) Freepers lets make some cash

Trying to focus on the markets for today and each day and the economic news

This is where you can impart some investment wisdom to your fellow freepers. You can vent about the big one that got away. You can

chime in how Obama is out to wreck American capitalism.

If you see another FR economic thread you like and want to link to it here, please do

Post your favorite economic site links. Your favorite economic blogs and precious metals blogs and sites

Apmex.com is a solid place with good reputation to buy precious metals and has great presence on ebay for easy quick impulse buys

such as a gift for a college boy's graduation. College Girls too! Even high scoool.

Kitco is the best site for gold and silver charts and other precious metals information

Ping list -- on or off let me know here or via freep-mail. If I missed you then Freep-mail me

I might ping you to other interesting economic threads a few times a week. One per day maybe

Sites that posters have recommended ------ zerohedge turdferguson

ping

Any numbers on the docket for today?

Equity research at GS, MS, and JP all seem to think the selloff in mid-con refiners was unwarranted and that they’re attractive.

One of the banks put out a piece on the [two-company] US Integrated Oil industry; conclusion was that they favored CVX over XOM.

Gold juniors have been en fuego the last couple of days.

Also, Obama is a SCOAMF.

Discussion/economics/finance/investing/current-events/time-of-life/philosophy/preparedness BUMP!

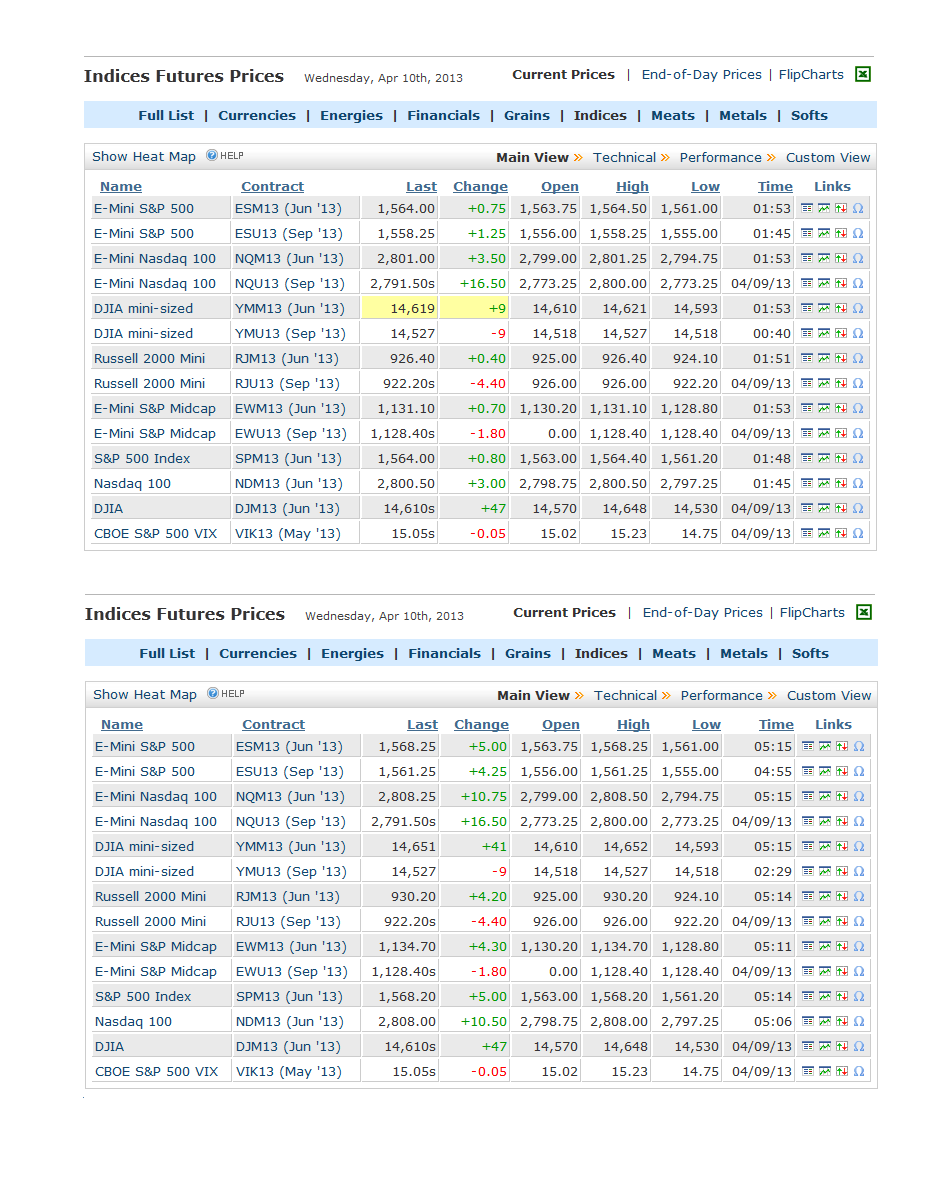

This time of day I like to get the market's pulse by checking the index futures --they're up strong and more bullish by the hour:

In other news, zee Germans sold 2yr paper today for 2 bips. 0.02%. 2 bips for keeping your money for 2 years. Yipes.

http://finance.yahoo.com/blogs/daily-ticker/p-500-may-fall-more-40-fall-chris-120957460.html

Even though the S&P 500 (^GSPC) and Dow Jones Industrial Average (^DJI) are hovering at all-time highs, Chris Martenson, author of PeakProsperity.com and the “Crash Course” Series, is forecasting a major market correction.

Martenson predicts the S&P could fall 40% to 60% to the 600-800 level by this fall. His last major market call was in March 2008, before the financial crisis.

TITN fell off of a cliff today. Might be a good entry point if anybody is interested.

It's almost scary how much the market is up and stays up. I try to pick things that could weather a big correction. Like food. Haven't found a good energy or pharma that could grow fast enough to suit me. Did a nice swing trade on SCTY but didn't get back in to do it again soon enough. Otherwise I would tend to avoid solar, don't know why this one is doing so well so far, another IPO.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.