Skip to comments.

The Size of the Bank Bailout: $29 Trillion (Throwback Thursday)

CNBC ^

| 2/11/2014

| John Carney

Posted on 08/21/2014 6:58:15 AM PDT by mgist

So this guy from (let's say) Morgan Stanley walks into a bar.

He orders drink after drink. Downs a dozen or so high-quality glasses of Scotch. Does a few shots of tequila. Maybe grabs a beer at the end of the night.

The bar manager sees the condition the guy is in, takes a look at his tab. Sees the total amount of drinks he’s been served. Grabs the bartender aside and asks him a question.

“Bartender Ben, how many drinks did you serve that guy?”

“Just one,” Bartender Ben says.

“Ben! Be straight with me. I’m looking at his tab. Scotches. Shots of Jurado Tequila. A pint of Six Point. You served him a lot more than one drink,” the manager says.

“You’re looking at it wrong, my friend. You are adding up all the drinks I served him over the whole night. But at any one time, I only served him one drink,” Bartender Ben explains.

Just then the guy from Morgan Stanley looks up. His glass is empty again. “Bartender,” he says. “I’ll have a another.”

“See,” says bartender Ben. “Just one at a time.”

Quite obviously Bartender Ben’s position is absurd.

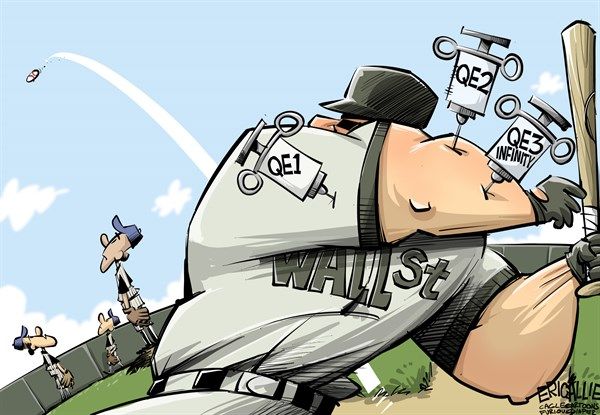

But something like this position was on display last week when the Federal Reserve criticized reports claiming that the total size of its emergency facilities was $7.77 trillion. The Fed argued that these reports overstated the size of the facilities because they added up all the loans extended despite the fact that many were short term loans that we simply rolled over. According to the Fed, the best thing to do is look at the total amount outstanding at one one time, which was just $1.7 trillion.

Just like the guy who only had one drink…at a time.

The counter to this is that the need to keep borrowing under what are supposed to be short term facilities shows just how badly financial institutions were faring during the financial crisis.

“The amount of overnight lending reflects how broken our financial system really is. A well capitalized, moderately leveraged system does not require this massive liquidity from a central bank — interbank lending should be sufficient. What the data reveals is that the financial sector remains dangerously under-capitalized and overleveraged,” Barry Ritholz writes at the Big Picture.

Recently, a pair of PhD students at the University of Missouri-Kansas City tried to assess the total size of the Fed’s commitments—not just loans made, but asset purchases as well. The bottom line: a Federal Reserve bailout commitment in excess of $29 trillion.

That figure has, in turn, been criticized by economist James Hamilton who argued, incredibly, that the Fed’s bailout commitment under one facility was zero because all the money was paid back.

From an email sent to monetary theorist and Fed critic Randall Wray:

“Felkerson [one of the UM-KC students] takes the gross new lending under the Term Auction Facility each week from 2007 to 2010 and adds these numbers together to arrive at a cumulative total that comes to $3.8 trillion. To make the number sound big, of course you want to count only the money going out and pay no attention to the rate at which it is coming back in. If instead you were to take the net new lending under the TAF each week over this period-- that is, subtract each week's loan repayment from that week's new loan issue-- and add those net loan amounts together across all weeks, you would arrive at a cumulative total that equals exactly zero. The number is zero because every loan was repaid, and there are no loans currently outstanding under this program. But zero isn't quite as fun a number with which to try to rouse the rabble.” Just like our drunk guy from Morgan Stanley. He never drank a drop. Because at the end of the night his glass was empty.

Wray on why this is nonsense.

But in fact, the Fed lent “overnight” on a chronic basis to our liquidity chugging banks because they could not fund themselves in markets at the interest rate they desired. So the Fed “accommodated” by pouring the cheap whiskey over and over and over—for weeks, months, even years on end. To get a measure of this chronic abuse of overnight lender-of-last-resort facilities it does make sense to add up across the loans. That is a far better measure of the extent of the Fed’s efforts to bail out troubled banks—who should be expected to fund themselves in markets, not at the lender-of-last-resort!

In other words, these big numbers are real and they really matter.

It’s not just rabble rousing populism to point out that the Fed went far beyond its role as a lender of last resort or a provider of short term liquidity. And the only way to really show this is to show the cumulative totals.

In other words, to show the bar tab.

Even if the hypothetical drunk guy pays his bill in total, he still got served all those drinks.

TOPICS: Government

KEYWORDS: bailoutobama; cnbc

Navigation: use the links below to view more comments.

first previous 1-20, 21-29 last

21

posted on

08/21/2014 1:58:33 PM PDT

by

RckyRaCoCo

(Shall Not Be Infringed)

To: mgist

Sorry but where I come from this is called CleptocracyWhat was stolen? Who was it stolen from? Where?

Thanks for the link.

I'm a freelance writer reporting on travel, tourism policy and business ethics. I highlight the balance of life, exploring leisure and wanderlust, while also reporting on the verity of the human spirit. I have a BA in Philosophy with a concentration in Values and Social Policy and an interdisciplinary accreditation in Peace and Conflict Studies. Email tips to tracey@emeraldtraveler.com and follow me on Twitter (@EmeraldTraveler) and Google+.

The author sounds like a really groovy chick!

22

posted on

08/21/2014 2:09:05 PM PDT

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: mgist

“”The Fed argued that these reports overstated the size of the facilities “”

“facilities” - Lost me right there. I’m too old to understand the meaning of words aren’t what they’ve always been.

To: All

24

posted on

08/21/2014 3:54:53 PM PDT

by

musicman

(Until I see the REAL Long Form Vault BC, he's just "PRES__ENT" Obama = Without "ID")

To: Toddsterpatriot

Stolen from tax payers. This is tax payers money going to a labyrinth of offshore banks accounts that all of these banks have.

The taxpayers have nevr been given a straight story on any of this, I don’t know what makes you think all the money was given back, while they are still throwing it around. Even the original TARP funds haven’t been fully collected.

http://wallstreetonparade.com/2012/08/the-untold-story-of-the-bailout-of-citigroup/

“On December 16, 2009, Citigroup announced it was selling more common stock to raise funds to repay $20 billion of its TARP funds. Selling more common stock meant it was diluting the taxpayer’s stake in the 7.7 billion shares still owned by the government.

The government put the taxpayer at risk for another full year before it dumped its 7.7 billion shares of common stock, selling it off from April 26, 2010 through December 10, 2010.

Both the Treasury and the Fed were hoping that the public would never hear the details of the trillions that were flowing to Wall Street behind the scenes, in addition to the publicly acknowledged programs. Once that information was released, we learned that Citigroup borrowed $2.513 trillion from the Fed between December 1, 2007 through July 21, 2010, according to the Government Accountability Office.

Those funds were loaned at an interest rate dramatically below the market rates that a subprime borrower like Citigroup would have paid in an honest market system. While Citigroup was charging struggling consumers rates as high as 17 percent, it was borrowing from the taxpayer at a fraction of one percent.

Isn’t it time for our government to speak honestly about the Citigroup bailout?”

25

posted on

08/21/2014 3:59:50 PM PDT

by

mgist

(.)

To: mgist

Stolen from tax payers.The Fed neither spends nor lends taxpayer funds.

This is tax payers money going to a labyrinth of offshore banks accounts that all of these banks have

Wrong. Those banks that have an American division could take out fully collateralized loans. Loans that were, long ago, fully repaid. At a profit to the Fed.

I don’t know what makes you think all the money was given back,

You can see that by looking at the Fed's balance sheet.

Even the original TARP funds haven’t been fully collected.

Some money is still outstanding. The bank repayments more than covered all the bank loans. Even if not another bank TARP dollar is repaid, it was still profitable for the Treasury. Not to mention saving the banking system.

“On December 16, 2009, Citigroup announced it was selling more common stock to raise funds to repay $20 billion of its TARP funds. Selling more common stock meant it was diluting the taxpayer’s stake in the 7.7 billion shares still owned by the government.

OMG! That's funny. Selling shares meant it could repay a loan. And that's what the Treasury and Fed wanted, banks to raise more bank capital (like selling shares). And the government still made a huge profit when it sold all the shares of Citi.

Both the Treasury and the Fed were hoping that the public would never hear the details of the trillions that were flowing to Wall Street behind the scenes

Loans from the Fed were on every weekly Fed balance sheet release.

Once that information was released, we learned that Citigroup borrowed $2.513 trillion from the Fed between December 1, 2007 through July 21, 2010, according to the Government Accountability Office.

Yup. A bit at a time, repaid and borrowed again.

Those funds were loaned at an interest rate dramatically below the market rates that a subprime borrower like Citigroup would have paid in an honest market system.

Subprime? LOL!

What was the market rate for fully collateralized, overnight loans?

While Citigroup was charging struggling consumers rates as high as 17 percent, it was borrowing from the taxpayer at a fraction of one percent.

Nope. Tarp loans were a lot more expensive. And Fed loans did not involve taxpayer funds.

Thanks for the link.

Maybe look for one with fewer huge errors next time?

26

posted on

08/21/2014 4:28:43 PM PDT

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: Toddsterpatriot

http://townhall.com/tipsheet/katehicks/2011/10/12/by_the_numbers_who_did_wall_street_buy_in_2008

The banksters bought and paid for Obama. The fact that you believe anything this Manchurian administration claims, says more about you, than anything else.

Americans are naive, but not stupid. Chavez had thousands of paid gargoyles all over the internet to influence public opinion. There is a war between good and evil. We have choices to make.

Actions have consequences, and we will pay consequences for our choices. God will take care of His enemies and their enablers. They have children, how they dare betray God is beyond my understanding?

While man may rationalize, Karma won’t. Good luck to you and yours.

27

posted on

08/21/2014 6:34:17 PM PDT

by

mgist

(.)

To: mgist

The fact that you believe anything this Manchurian administration claims That's hilarious! Where did I do that?

Americans are naive, but not stupid.

Except when it comes to banking. Then they'll believe all sorts of stupid crap.

Good luck to you and yours.

Don't ever change.

28

posted on

08/21/2014 9:09:21 PM PDT

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: mgist

29

posted on

08/21/2014 9:27:24 PM PDT

by

Liberty Valance

(Keep a simple manner for a happy life :o)

Navigation: use the links below to view more comments.

first previous 1-20, 21-29 last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson