Skip to comments.

"January Effect" an omen for 2015? --Investment & Finance Thread - Jan. 4

Weekly investment & finance thread ^

| Jan. 4, 2015

| Freeper Investors

Posted on 01/04/2015 9:26:15 AM PST by expat_panama

A good January for stocks promises big gains for the year --or so goes the story goes (from Down January for stocks is bad omen for 2014 - USA Today) "How stocks fare in January often sets the tone for the full year". A lot of work's been done on this, and TradingSim reports that

When the S&P500 has a net positive gain in the first five trading days of the year, there is about an 86% chance that the stock market will rise for the year, it has worked in 31 out of the last 36 years (as of 2006). The five exceptions to this rule were in 1966, 1973, 1990, 1994, and 2002. Four out of these five years were war related, while 1994 was a flat market. As history suggests, the markets average nearly 14% gains when the January Effect is triggered.

--but the downside is:

A down January is a bad omen for the stock market. Yale Hirsch of the The Stock Traders Almanac suggests that since 1950, every down January in the S&P500 preceded a new or extended bear market, or in some cases, a flat market. They go on to further suggest that down January’s are followed by substantial declines averaging -13%.

| |

|

|

|

|

|

| |

|

% above avg. months |

% times the following year is above avg. |

% times month predicts following year |

|

| |

|

|

|

|

|

| |

January |

55% |

66% |

59% |

|

| |

February |

48% |

66% |

55% |

|

| |

March |

60% |

66% |

56% |

|

| |

April |

53% |

62% |

55% |

|

| |

May |

47% |

63% |

60% |

|

| |

June |

44% |

62% |

53% |

|

| |

July |

57% |

63% |

55% |

|

| |

August |

59% |

62% |

55% |

|

| |

September |

38% |

62% |

49% |

|

| |

October |

51% |

66% |

51% |

|

| |

November |

56% |

62% |

57% |

|

| |

December |

67% |

64% |

58% |

|

| |

|

|

|

|

|

| |

average |

53% |

64% |

55% |

|

| |

|

|

|

|

|

That's nice, but let's do our own thinking.

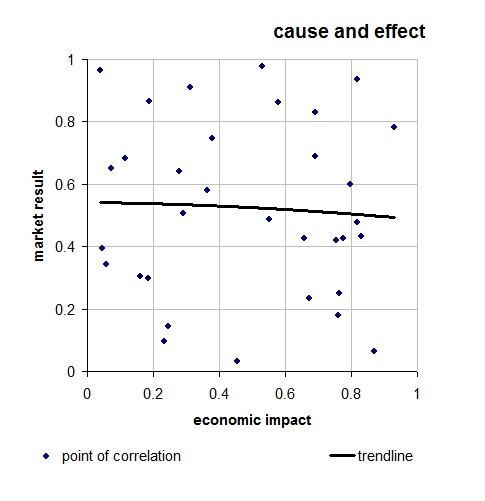

On the left is what we get when we look at the Dow Jones average monthly change for each month since 1896 and compare the month's performance with the total returns for the subsequent 12 months. The idea is to see if January is any better at predicting the up comming year any better than say February or March or...

What we end up with is the fact that most months are up, most years are up so most months predict the following year. Since 1896 January has in fact predicted better than most, but our winner turns out to be May which is right 60% of the time vs. January's 59% score.

predict the following year. Since 1896 January has in fact predicted better than most, but our winner turns out to be May which is right 60% of the time vs. January's 59% score.

* * * * * * *

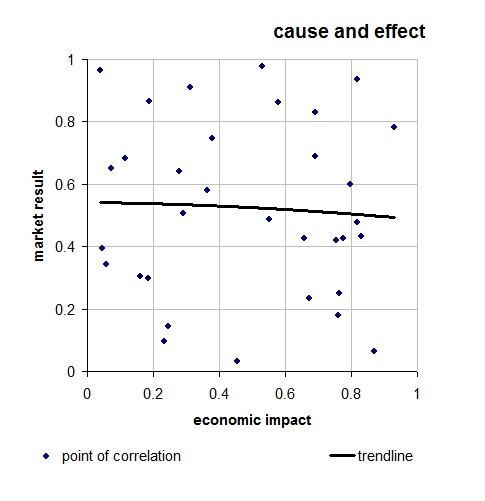

My personal take is that this is random and the problem we face is that it's sooo easy to see trends in purely random numbers. Check out the plot on the right of how an imaginary econ impact can affect my imaginary market. We end up with a trend line that slopes slightly downward. We could even exaggerate the scale and use it to "prove" a correlation.

My point is that all the numbers plotted there are random, and random numbers can always slow some kind of trend line. What's not random though is that people are productive and over the years they create wealth and if we invest in them we get rich. I can live with that.

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 101-118 next last

To: expat_panama

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Whoa-- "market in correction"!! It means stop investing and this being the beginning of Jan. it also means the entire year's in the terlet. Or not.

What we know is (from IBD) "The Dow lost 1.9%, the S&P 500 1.8% and the Nasdaq 1.6%. Volume rose from Friday's levels. All three indexes closed below their 50-day moving averages." Metals are solid now with gold & silver both climbing back up over their psychological pegs of $1,200 and $16 --now at $1,212,55 and $16.36. Later this morning we'll hear from Factory Orders and ISM Services. fwiw right now futures are off for stocks and up for metals.

Ah, almost forgot --good morning all! Related threads:

To: expat_panama

So much for the $60 bottom, er ah $55, er ah $50 bottom of oil. Picking a bottom is purely a guessing game. You would be better off picking your nose.

23

posted on

01/06/2015 3:37:54 AM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

--as in you can pick your friends and you can pick your nose but you can't pick your friend's nose?

Picking a bottom though is easy (stop right there --we're talking oil prices!). It's foretelling the future that's hard. What I like to do is go with the fact that what's happened before is more likely to happen again than something that's never ever happened. We've had $20 (inflation adjusted) oil before --plenty of times. I'm expecting a return visit to that range before this is over.

To: Lurkina.n.Learnin; expat_panama

Time to buy energy companies. I’ll have an order in sometimes today.

25

posted on

01/06/2015 4:07:14 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

http://blogs.wsj.com/canadarealtime/2015/01/05/oils-doomsayer-says-doom-again/

January 5, 2015, 1:57 PM ET

Oil’s Doomsayer Says Doom … Again

By Christian Berthelesen

Citigroup Inc.’s Ed Morse was the analyst who prominently called $75-a-barrel global oil prices last March, back when it was trading above $100 a barrel and prevailing wisdom had prices rising rather than falling. He was right, of course – Brent crude plummeted through that threshold in late November and has continued to fall, to $53 and change Monday.

As such, oil-market watchers tend to listen to what he has to say. And what is his outlook for the foreseeable future? Look out below.

Mr. Morse and his team at Citigroup have cut their estimate for global oil prices to average $63 a barrel in 2015, down from $80, and for the U.S. benchmark to average $55 a barrel this year (just FYI, Nymex prices briefly traded below $50 a barrel earlier Monday). They see a confluence of factors — including continued surging U.S. production, Saudi resistance to cutting output, and a weakening global economy — conspiring to push prices even lower before recovering somewhat in the second half of 2015 and into next year.

In a new research note titled “Oil and Trouble Ahead in 2015” distributed Monday, Mr. Morse said that 2014’s price drop was supply driven, and that the oversupply situation will continue to grow in the first half of the year as the U.S. shale production boom continues and Saudi Arabia prices aggressively to regain U.S. import market share. Meanwhile, hundreds of thousands of barrels of Canadian crude will be making their way down to the U.S. Gulf Coast, the Middle East is ramping up new refining capacity, and Iraqi-Kurdish exports are expected to continue growing.

snip

26

posted on

01/06/2015 4:17:43 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

Time to buy energy companies...It's beginning to make a lot of sense because there's so much structural need there that doesn't change. Just the same you might want to check out the energy sector performance for the past day, week, month --energy stocks are still in a big freefall. Many traders prefer to buy when things aren't so extremely negative.

To: expat_panama

28

posted on

01/06/2015 5:03:14 AM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: expat_panama

Well this cannot be true. It has to be because of Wiemar style hyperinflation. I know because I read it on Free Republic...

http://www.citylab.com/politics/2015/01/why-us-egg-prices-have-nearly-doubled-since-september/384204/

Why U.S. Egg Prices Have Nearly Doubled Since September

It seems that 2015 will be the year the U.S. egg industry gets scrambled.

Image Reuters/Mike Blake

It’s expensive to let these birds out of their cages. (Reuters/Mike Blake)

In 2014, Americans consumed nearly 260 eggs each on average, more than in recent years but fewer than in 1945, when consumption peaked at 402 eggs per person.

The recent uptick in consumption has been attributed to soaring meat prices, which make eggs a comparatively cheaper and more attractive protein source, plus new awareness that eating an egg a day won’t harm your health. A sudden abundance of egg sandwiches and scrambles on fast-food menus has encouraged Americans to eat more eggs at breakfast; and it’s not a stretch to surmise that culinary globalization is introducing Americans to new ways to use eggs in other meals, such as bibimbap. The U.S. loves its eggs once again.

Per capita egg consumption in the US has been higher than 240 every year since 1999. In 2014, Americans had nearly 260 eggs each.

The state that consumes the most of them is California, where new animal-welfare laws concerning egg production kicked in on January 1. From now on, all eggs sold in California must come from hens that live with enough space to stand up, fully extend their limbs, and turn their bodies around. That translates to at least 116 square inches of floor space per chicken, according to NPR.

The vast majority of egg-laying chickens in the U.S. do not live in conditions like that.

Bye bye, battery cages. (Reuters/Mike Blake)

Most U.S. chickens are kept in notoriously small “battery cages,” which are illegal in Europe because they’re considered cruel and inhumane.

So now, the vast majority of U.S. egg producers cannot sell eggs in California, which imports about one-third of its eggs each year. As a result, consumers in California will see immediate price increases—from 35 percent to 70 percent markups, according to one source quoted by NPR—and prices are expected to rise in the rest of the country, too, as farmers will either be spending on replacing their battery cages with alternative structures or reducing the sizes of their flocks (or both) to comply with the new standards.

The wholesale price of a dozen eggs fluctuated between $1 and $1.77 across the U.S. in 2014, according to government statistics. Egg prices swing up and down regularly, the Wall Street Journal noted in 2013, but before 2005 the average wholesale price of a dozen was always less than one dollar.

The wholesale price of a dozen eggs fluctuated between $1 and $1.77 across the US in 2014, according to government statistics.

If it gets close to $2 per dozen, perhaps consumption will turn down again. In any case, given the impact of California’s new laws on egg farming across the country—not to mention the rise of California-based food company Hampton Creek, which aims to eventually get consumers to entirely replace farmed eggs with its plant-based substitutes—it seems that 2015 is the year the U.S. egg industry gets scrambled.

This post originally appeared on Quartz, an Atlantic partner site.

To: expat_panama

To: Wyatt's Torch

“If it gets close to $2 per dozen, perhaps consumption will turn down again.”

I guess it’s because I live in a small town but it’s over $3 a dozen here. An 18 pack is $5.99.

31

posted on

01/06/2015 5:39:23 AM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: expat_panama

To: Wyatt's Torch; abb

Catch a falling knife?AKA "don't fight the tape" or "the trend is your friend". The idea that it's just not reasonable to expect an ongoing price movement to suddently reverse course just because today we bought in. OK, so it does happen once in a while, but in my experiance it's not often enough to cover losses.

To: Wyatt's Torch

Except that you never know where the bottom is. But if something was a good buy at X dollars, it is a better buy at 3/4 X or 1/2 X, every time.

And nothing, I mean nothing, will take the place of hydrocarbon energy in our lifetimes. So a prediction that energy, and the companies that produce it, will be here for quite a while longer.

34

posted on

01/06/2015 7:09:07 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: Lurkina.n.Learnin

This is my favorite “price of eggs” story.

http://en.wikipedia.org/wiki/Klondike_Gold_Rush

Prices remained high in Dawson and supply fluctuated according to the season. During the winter of 1897 salt became worth its weight in gold, while nails, vital for construction work, rose in price to $28 ($760) per lb (0.45 kg).[224] Cans of butter sold for $5 ($140) each.[225] The only eight horses in Dawson were slaughtered for dog food as they could not be kept alive over the winter.[224][n 34] The first fresh goods arriving in the spring of 1898 sold for record prices, eggs reaching $3 ($81) each and apples $1 ($27).[228]

35

posted on

01/06/2015 7:24:18 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

To: abb

To: expat_panama; Wyatt's Torch

Torch:

pretty certain the US economic expansion is now self-sustainingpanama agrees.

I don't agree. When it is truly self-sustaining, there will be no need for 0% interest rates and the continued printing of billions of Bernake Bucks every month. Also, no need for phony 5.0% growth figures, it will be real.

38

posted on

01/06/2015 9:56:05 AM PST

by

citizen

(Hopefully, the MSM will again be making a big deal of high gas prices come Jan 20, 2017.)

To: citizen

...no need for 0% interest rates and the continued printing of billions of Bernake Bucks every month...At first glance the impulse is to point out that folks are in fact greater than zero paying interest rates, or to mention Bernanke's no longer there, but some how my guess is that it's not what you mean.

To: abb

you never know where the bottom is. --untill years later but then it doesn't matter.

What we're saying it that while we don't know if energy stock prices are at the bottom, what we do know is that right now they're falling. If they stop falling for a few days or a week then what we'd know is that they stopped falling right now.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 101-118 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

predict the following year. Since 1896 January has in fact predicted better than most, but our winner turns out to be May which is right 60% of the time vs. January's 59% score.

predict the following year. Since 1896 January has in fact predicted better than most, but our winner turns out to be May which is right 60% of the time vs. January's 59% score.