Skip to comments.

Saudis Trying to Kill U.S. Frackers as Oil could fall to $20 for the first time in 15 years.

PJ Media ^

| 12/09/2015

| Stephen Green

Posted on 12/09/2015 8:12:46 AM PST by SeekAndFind

Saudi Arabia might just bust OPEC by keeping its taps open, but right now the Kingdom's main concern is strangling American shale production.

Read:

Markets had been expecting Opec to announce a new ceiling on production after last Friday's meeting, but analysts at Barclays said the lack of any curbs in its announcement was a sign of discord. "Past communiques have at least included statements to adhere, strictly adhere, or maintain output in line with the production target. This one glaringly did not. "Â they said.

Saudi Arabia needs oil prices of $100 a barrel to balance its budget, but as the world's biggest exporter of crude it is gambling that the low price will knock out the threat posed by so-called unconventional supplies, such as shale.

The chief executive of Saudi Aramco, Amin Nasser, said at a conference in Doha on Monday that he hoped to see oil prices adjust at the beginning of next year as unconventional oil supplies start to decline.

In a sign that US production could dip, Baker Hughes' November data showed US rig count numbers down month-by-month by 31 to 760 rigs.

The story also notes that "Venezuela, in particular, is thought to be suffering badly as a result of the drop in oil prices." But that's what happens when you're a one-industry socialist country which has been neglecting to invest in that industry.

But here in America? The Saudis aren't stupid, so they must understand that our shale oil isn't going anywhere. Sure, a lot of wells will go offline at $40, even more at $30, and the fracking industry might nearly shut down at $20.

And then what? Oil prices will rise, and those shale wells will come back online.

Saudi Arabia has one big advantage. Its crude oil is plentiful, easy to get to, easy to refine, and cheap to transport. That lets Riyadh set a price floor far below anywhere that most anyone else can make a profit.

American shale oil is also plentiful, but it's much harder to get to, harder to refine, and more expensive to transport. But there's so dang much of it that our frackers can set a price ceiling far below OPEC's salad days of $100-plus crude.

Thanks to the cutthroat capitalism practiced in this country, new extraction methods bring that ceiling lower. Fracking once required $100 oil to make a profit. Now some producers can go as low as $50. And that number will continue to shrink.

Until and unless the Saudis can convince Washington to hobble American frackers by law -- and don't think the Democrats haven't tried and won't try again -- then OPEC's salad days aren't coming back for a very long time, or maybe ever.

TOPICS: Business/Economy; Cuba; Foreign Affairs; News/Current Events; Russia

KEYWORDS: antifracking; cuba; energy; epa; fracking; globalwarminghoax; methane; nicaragua; oil; oilprice; opec; petroleum; popefrancis; putinsbuttboys; romancatholicism; russia; saudiarabia; saudis; stephengreen; venezuela; vladtheimploder

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-84 next last

To: SampleMan

If you don’t understand how lowering the cost to produce more oil, helps an industry selling a product in a lower priced market, I don’t think I can help with more discussion.

No more government subsidies.

“The nine most terrifying words in the English language are: I’m from the Government, and I’m here to help.”

- Ronald Reagan

God Bless

61

posted on

12/11/2015 4:28:25 AM PST

by

thackney

(life is fragile, handle with prayer)

To: C210N

It’s at 1.67 where I am this week...Toledo area.

62

posted on

12/11/2015 4:38:59 AM PST

by

DouglasKC

(I'm pro-choice when it comes to lion killing....)

To: thackney

Curious,

Presume that the Soviet Union had offered to sell steel and oil to us at below our production price for 10 years, in order to shut down our domestic steel and oil industries, with the intent of then launching a war we could not quickly respond to.

Is that the free market in action. Would the preservation of that industrial capability qualify as a national interest to all citizens?

63

posted on

12/11/2015 11:51:25 AM PST

by

SampleMan

(Feral Humans are the refuse of socialism.)

To: SampleMan

The solution in your example still is not taking Tax Payer dollars to subsidize private industry.

It is wrong every time. There are always better ways.

64

posted on

12/11/2015 2:52:32 PM PST

by

thackney

(life is fragile, handle with prayer)

To: thackney

Really, pray tell, how would you have suggested dealing with that problem without making steel more expensive for the citizen’s of the U.S. that the free steel being offered?

65

posted on

12/11/2015 6:06:11 PM PST

by

SampleMan

(Feral Humans are the refuse of socialism.)

To: SampleMan

66

posted on

12/12/2015 5:23:06 AM PST

by

thackney

(life is fragile, handle with prayer)

To: thackney

Not by subsidy. I notice you don't offer any answer to the hypothetical I presented to you. I'm just looking for your method for avoid "subsidy".

There are many methods by which one country can actively attack and diminish another. You are suggesting that a government tasked with defending its citizens should ignore most of those.

67

posted on

12/12/2015 5:33:56 AM PST

by

SampleMan

(Feral Humans are the refuse of socialism.)

To: SampleMan

My response included tariffs as a possible better solution.

I did not avoid the question. But on the topic of the oil, we need to start with taking away the extra taxes, overbearing regulations and open up all areas for exploration and production.

68

posted on

12/12/2015 1:11:25 PM PST

by

thackney

(life is fragile, handle with prayer)

To: AdmSmith; AnonymousConservative; Berosus; bigheadfred; Bockscar; cardinal4; ColdOne; ...

IOW, despite Obama's best efforts, fraccing has led not only to lower oil prices, but has undercut the funding for worldwide terror, including virtually the entire foreign policy of Vlad Putin.

69

posted on

12/12/2015 3:46:08 PM PST

by

SunkenCiv

(Here's to the day the forensics people scrape what's left of Putin off the ceiling of his limo.)

To: thackney

How are tariffs not a subsidy?

70

posted on

12/12/2015 6:07:00 PM PST

by

SampleMan

(Feral Humans are the refuse of socialism.)

To: SampleMan

Taxing an importer is quite different than taking dollars from US tax payers and giving it to private industry.

I still am against it, but better than a subsidy.

71

posted on

12/12/2015 6:15:55 PM PST

by

thackney

(life is fragile, handle with prayer)

To: thackney

A tariff on an import is not different than a tax on the consumer. It is a distinction without difference.

Bob can be forced to pay $100 to the U.S. to hand over to ACME Refrigerators so he can pay $100 for a $200 refrigerator (which really costs him $200 include the tax subsidy), OR Bob can pay $200 for a $100 foreign refrigerator that has a $100 tariff added to its price. Bob is paying more either way.

Now purchasing domestic oil at a price just above the break-even fracking price takes money out of Bob’s pocket for sure, but let’s look what Bob will get out of it.

- First, the the money purchased a nonperishable product that will retain value.

- Second, Bob is protected from the reestablishment of a monopoly that has but one wish, which is to crush the competition, so that they can gouge the hell out of Bob going forward.

- Third, besides holding the price down longer for Bob, the defeat of the bid for monopoly will result in the oil Bob purchased being worth more in the future, thus decreasing Bob’s future taxes.

Mind you, I’d purchase the dirt-cheap, market dumping oil from the Saudis for as long as they’d pump it, while stockpiling our own oil. Bob would be a lot better off at every stage of the endeavor.

Could it be done privately? Theoretically yes, if I had a trillion dollars I could start purchasing fracked oil at $40 a barrel, knowing that doing so would defeat the Saudi bid for reestablishing a monopoly. Then oil would pop back up and I’d make a hell of a profit. Of course, the private industry has already been doing this, which is why most every tank and tanker in the world is chock full.

Look, I am no fan of subsidies and I’m on board with everything you are saying that removing hurdles, regulation expense, and undue taxation should be the first steps. But that said, when a foreign power acts outside of free market principles to pursue the destruction of a U.S. industry as a matter of its own foreign policy, then it is the responsibility of the U.S. Government to act to protect U.S. citizens, even if those citizens own large corporations.

72

posted on

12/12/2015 6:38:09 PM PST

by

SampleMan

(Feral Humans are the refuse of socialism.)

To: SampleMan

A tax on the product is paid by the user of the product.

Requiring the government to buy at above market prices takes tax dollars from all to give to private companies.

Both are bad ideas, but only one is a subsidy.

73

posted on

12/12/2015 7:08:00 PM PST

by

thackney

(life is fragile, handle with prayer)

To: thackney

Sir,

If you tax all of my competitors, but not me, you are subsidizing my business. And who pays for that? The consumer does.

Now if you are digging iron ore out of the ground and a foreign country dumps cheap iron ore on the market with the intent of destroying you and creating a monopoly, that puts everyone that depends on a free and unrestricted access to iron ore at risk.

It is vital to the national interest to retain certain vital capabilities, energy would be one of those.

Now, my proposal is not to guarantee a profit, but to guarantee a break-even point for a finite amount of time. We know its finite, because the Saudis can’t sustain their tactic for more than a few years. The American citizen would be spending slightly more for oil than now, in order to save a lot more on oil for decades into the future.

A tariff on foreign oil would have the same effect of setting a minimum floor for domestic oil, but it would in all likelihood be far more protective and costly to the consumer.

The only risk to the citizen in my plan would be that oil would stay below $40/barrel forever and they would get stuck paying $40/barrel for oil. That is a punishment that most Americans would be willing to risk if not wholeheartedly welcome. But the far more likely outcome would be oil popping back up above $40/barrel, at which tax payer expenditure would be zero and purchased assets could be sold at a profit to the tax payer.

74

posted on

12/12/2015 8:09:06 PM PST

by

SampleMan

(Feral Humans are the refuse of socialism.)

To: SeekAndFind; txrefugee; thackney; RinaseaofDs; Ancesthntr; TexasRepublic; TexasFreeper2009; ...

Cheap Oil Puts the House of Saud at Risk by David P. Goldman

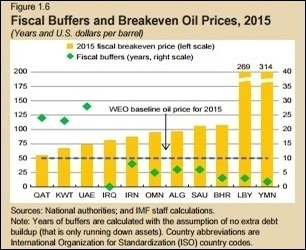

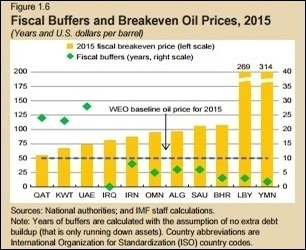

The chart shows the oil price at which all the major Middle Eastern producers can balance their government budgets; in the Saudi case, the break-even oil price (yellow columns) is $105. The green dots show the number of years each country has before it runs out of monetary reserves. Iraq is flat broke now. Saudi and Algeria have five years, and Iran has eight.

It's not clear whether Saudi Arabia can cut spending so deeply and maintain political stability. There is no official data on poverty in Saudi Arabia, but one Saudi newspaper used social service data to estimate that 6 million of the kingdom's 20 million inhabitants are poor, some desperately so.

In order to keep the favor of the Wahhabi clerical establishment, the monarchy has allowed wealthy Saudis to provide free-lance financing for Islamist causes that Riyadh officially rejects.

http://www.meforum.org/5582/saudis-cheap-oil

75

posted on

12/13/2015 2:08:22 AM PST

by

AdmSmith

(GCTGATATGTCTATGATTACTCAT)

To: AdmSmith

Russia is not in that chart, which is interesting.

I don’t believe Iran has 8 years of reserves. They might, but its something worth investigating. The Russians don’t have that long. All the money is going out the door right now, and next to nothing is coming back in.

To: SampleMan

If you tax all of my competitors, but not me, you are subsidizing my business. And who pays for that? The consumer does. subsidy

http://www.merriam-webster.com/dictionary/subsidy

money that is paid usually by a government to keep the price of a product or service low or to help a business or organization to continue to function

Words already have meaning, making up your own is rather pointless.

While a directed import tax is a benefit, and typically unfair, it is not a subsidy.

It does not take money from those not involved in the transaction and purchase of the products, and give it to those who are.

but to guarantee a break-even point for a finite amount of time.

What you may not understand is there is no single breakeven point. The cost to produce oil varies from field to field. The value of the different crude oil varies in qualities and locations, as much as double the price.

The oil industry has been through many booms and bust. I know, they have affected my job more than once. But what you suggest hurts the industry in the long run. And it hurts the refining industry immediately. The industry making the actual fuel is no less important than the one producing the feedstock.

77

posted on

12/13/2015 11:20:27 AM PST

by

thackney

(life is fragile, handle with prayer)

To: RinaseaofDs

78

posted on

12/13/2015 12:41:22 PM PST

by

AdmSmith

(GCTGATATGTCTATGATTACTCAT)

To: AdmSmith

We’ve been here before. Last time Russia’s economy was about to collapse they reasoned that either they had to start a war or they had to fold.

They invaded Afghanistan, with the ultimate goal of invading Saudi Arabia.

Putin already made his decision. He started by invading Georgia, then Ukraine, now Syria (they were invited . . .).

I expect them to reach the southern border of Syria and turn right.

Putin is definitely selling the China to do it.

The SA reasons it can survive #30/BBL oil longer than anybody can.

To: RinaseaofDs

80

posted on

12/14/2015 8:29:23 AM PST

by

AdmSmith

(GCTGATATGTCTATGATTACTCAT)

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-84 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson