Posted on 12/22/2018 5:52:48 AM PST by Kaslin

The U.S. economy is in remarkably good health, and the Federal Reserve risks upsetting the apple cart with its unjustified interest rate hike.

The Fed raised interest rates by .25 percent at its December 18-19 meeting, a move that President Trump rightly called “foolish” in light of his ongoing trade negotiations with China and other major U.S. trade partners.

The President makes a good point. Since a stronger dollar makes U.S. exports less competitive and tends to increase net imports, higher interest rates threaten to undermine the value of the targeted counter-tariffs President Trump is using to get China to negotiate a fair trade deal — a strategy that has already paid off with respect to Mexico and Canada, and South Korea.

The President has also pointed out that hiking interest rates could carry risks for the U.S. economy in the event that developments in Europe or elsewhere — such as the ongoing Brexit negotiations or the anti-government protests in France — cause a negative shock to the world economy. If that were to happen, interest rates could mean the difference between an economic slowdown and a recession.

Economic reports released just one week ahead of the Fed’s next meeting, moreover, presented a strong case for keeping interest rates at the previous target range of between 2 and 2.25 percent.

By law, the Fed is only supposed to change interest rates in order to stabilize prices or maximize employment — rates go up to keep the economy from overheating if unemployment is too low or inflation is too high, and they go down if an economic slowdown causes high unemployment or reduces the inflation rate.

The latest Consumer Price Index (CPI) data show that the cost of living remained flat in November, pushing inflation down to just 2.2 percent over the preceding 12 months. That’s almost perfectly consistent with the 2.1 percent inflation rate recorded in both 2016 and 2017, which is only slightly above the Fed’s target of 2 percent inflation.

Raising interest rates at this point is likely to put too much downward pressure on inflation, which in turn would put a leash on economic growth in the near future.

The unemployment rate has also leveled off recently, after plunging to a 50-year low of 3.7 percent over the course of Donald Trump’s presidency. November marked the third straight month that unemployment remained stable, arguing against fears that the economy is overheating.

Some analysts have speculated that rising wages — average hourly pay has increased 3.1 percent over the last 12 months — might have formed part of the Fed’s rationale for raising interest rates, since higher consumer spending could theoretically push prices up. Yet, while wage growth has certainly been solid, it’s merely been keeping up with the growth of the overall economy, which is on pace to exceed a GDP rate of 3 percent for the year.

Given that both unemployment and inflation have stabilized at levels that are indicative of a strong, healthy economy, it was premature for the Fed to raise interest rates in anticipation of inflation that may never materialize.

If wage gains do end up exerting inflationary pressure, the effects likely won’t be felt for months, at which point the Fed could have simply reconsidered an interest rate hike at its next quarterly meeting. If the inflation predictions turn out to be wrong, though, raising interest rates now might actually be damaging to the economy.

President Trump was right: raising interest rates at this point was foolish. The Fed should have heeded the President’s sound advice.

In the past, a retiree could work for 30 - 40 years and save a pile of money to live on during retirement.

If he got 5% or better interest, he had money to spend to live well, which would help feed the economy.

With today's low interest, those retirees who have saved now have to hope to slowly liquidate their savings to live on, and are being very careful of their spending, as it's scary to spend down your nest egg, rather than live off the interest.

If you spend too much, and live too long, you are broke.

5 to 6% interest isn't an outrageous amount for borrowers to spend for the use of other peoples' money.

You have to have a percent or so in the middle for the "middlemen" to have an incentive to be middlemen between the savers and borrowers.

I’ve been doing 3 or 5 year arms since 2001 on two houses. Has worked like a charm. Currently 3.25 on one and 2.875 on the other.

Yep the feds did that, borrowed 4 Trillion at 0 interest rates hope they had fun, not thinking about the future or were they? Fun fact, at one dollar a second, how long will it take to pay the first Trillion back? A little over 33,000 years!

If they are going to raise an interest rate it should be for savings accounts.

I’ve been doing 3 or 5 year arms since 2001 on two houses. Has worked like a charm. Currently 3.25 on one and 2.875 on the other.

1980’s there was double digit interest rate and my mother and step father livesd off interest on their money.

The Fed keeps rates low and does Quantitative Easements in a democrat regime, and raises rates and tightens the supply when a republican is in office.

Anyway, yes, we're going to go nowhere having a Fed that believes growth equals inflation especially when they think 3% is the danger level. That precludes having red-hot quarters over 4% and maybe over 5% as you have in normal robust recoveries (read that non-Obama recoveries) before settling down because the Fed will pounce quickly to strangle the recovery in the crib as it has done here.

I'm not opposed to rate hikes per se. We don't need and shouldn't want QE-level rate hikes to grow. However, as you can tell from my 20 year plus grudge against Greenspan, we really do not need a Fed that thinks its mission is to regulate economic growth. It's supposed to maintain a steady money supply.

“Slightly higher interest rates will “unlock” a pile of money retirees are sitting on.”

I agree wholeheartedly, but would suggest that the Fed could moderate and time their increases in such a manner that would not cause panic in the markets. This week’s increase was poorly timed and communicated.

I am one of those retirement savers and grow tired of earning 1+% on a $15,000 CD for 5 years. I am happy to see rates increase, gradually and as the economy allows. I’m about 15 years out from retirement and am saving as much as I can!

A drop in the stock market simply means buying in at a lower price, if you’re buying, and I am!

I would agree on raising it for savings accounts. I’m not sure I understand everything about interest rates,but when I was working & occasionally borrowing,it seems I paid a pretty high rate. Now I’m retired & can’t afford to borrow at all, I get very low/almost no interest on my savings. Wish someone could explain all this. It seems(from what I’m hearing) that there is low interest for some & high interest for others. Of course,credit card interest is a whole different ball game.

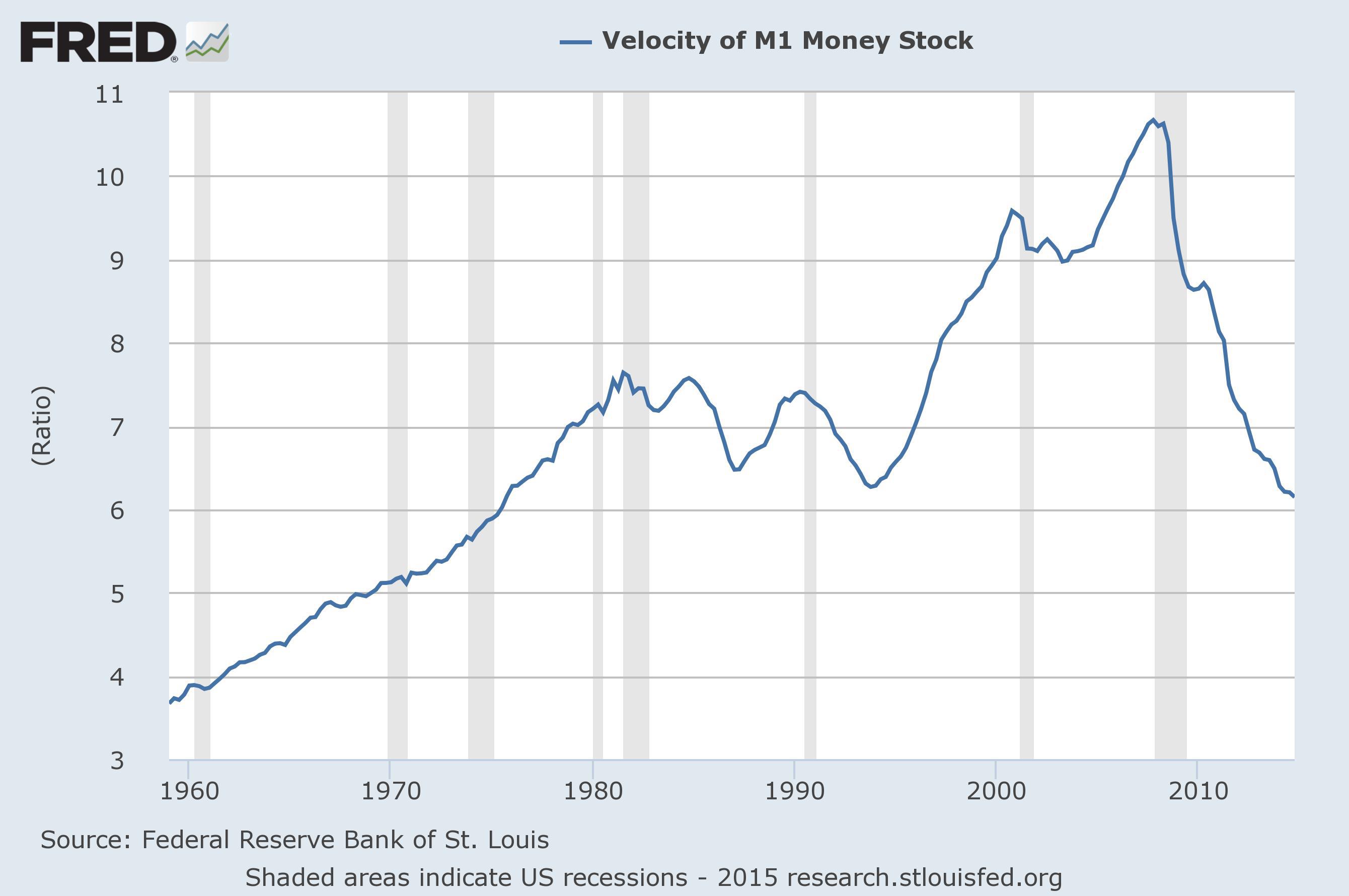

This is the situation the U.S. was facing as the 2016 election approached:

What you're seeing there from 2008 to 2014 was a classic case of a "liquidity trap," where the U.S. economy had slowed down so badly that the injection of new money into the system did not result in expanded economic activity.

It sounds counter-intuitive, but it's true: Operating at historically low interest rates for an extended period of time actually caused individuals and businesses to sit on their cash and earn almost no interest on it at all.

This was almost certainly a function of two things:

1. Lack of confidence in the economy.

2. Lack of urgency in borrowing.

I believe Item #2 is what is driving the Fed's interest rate policy right now. Suppose I'm a business owner and I have a major investment to make in a new factory or upgraded equipment in the next 18-24 months. Under a scenario of perpetual near-zero interest rates, I'm doing this major project two years from now. If I know interest rates are going to be higher in two years, I'm doing this RIGHT NOW.

Which of these is better for the U.S. economy in 2018-19?

The FED is the penultimate Swamp Denizen. ‘Nuff said.

////////////////

“Jekyll island”. World banking system for global governance. Got to destroy this “nationalism” trend in the first world. Got to make sure the orchestrated destruction of western civilization is completed before the productive class slaves revolt. When Bush left and Obama entered, TARP and Stimulus package created 1.5 trillion in newly created paper fiat currency in one year. No inflation, zero interest rate for 8 years. Hmmmmmmmmmmmmm?

Trump comes in, and reduces corporate tax and repatriates trillions. Then he stimulates manufacturing and cuts personal taxes. Economy roars and FED starts raising rates as if we were Zimbabwe. Hmmmmmmmmmmmmmm?

When you borrow your interest rate depends on your credit history, the value of any collateral you put up, and your capacity to make the promised payments.

What percentage of first time home buyers just got shot down out of the market???

I doubt seriously that would get any traction. An audit of the fed by swamp auditors, no doubt.

If not, quit bitching about this because the more we spend and consume from Uncle Sugar, the more the Feds have to intervene. We are in No Man's land because of the amount the Feds had to purchase in the open market. It's easy to buy on credit, working on a plan to pay "it" off is another story.

In case you did not notice, the Feds went on a buying spree late 2008 until around 2016 or so. That, in addition to all the US securities they already held.

Geez, are we allowed to "bitch" at the political time of when the Fed raises interest rates?

Yes, of course we are.

Yup.

Sometimes some of us just need to have a dream...…

I believe time has proven your point correct!

We don’t owe anything to anyone. Paid off house. 40 ft sailboat paid for. Inherited paid for property on Big Island. Pay cash for almost new cars because I deposit a ‘car payment’ into an account every month and we keep our cars about 10 years anyway. 2 Mercedes paid for. The low interest rates on savings, etc does us no good but we both have steady retirement income so the low interest doesn’t really hurt us. We just don’t gain much. We only have one cc that we pay off every month. Life is pretty good for us but other people who rely on interest from money saved are getting screwed. The low interest rates are helping people with mortgages though so.....

With mortgage clock resets, closing costs and the loss of purchase money protections, I seriously doubt you're coming out ahead in that scenario...ymmv

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.