Posted on 10/29/2018 10:00:07 AM PDT by SeekAndFind

President Donald J. Trump has taken on the Federal Reserve (Fed), saying that Fed chairman Jerome H. Powell is threatening US economic growth by further raising interest rates. Mainstream economists, the financial press and even some politicians react with indignation: the president’s comments undermine the Fed’s political independence, potentially endangering the confidence in the US dollar. Such a public reaction is, at first glance, understandable – as mainstream economists have declared the political independence of the central bank a "golden calf" issue.

Monetary theorists argue that a politically independent central bank is best for the currency and the economy. As a result, most central banks around the world, including the Fed, have been made politically independent. But is this so? Well, if the economy thrives, politicians leave the Fed alone. If the economy stumbles, or if the Fed pursues unpopular measures, it runs the risk that Congress or the president may revise the Federal Reserve At of 1913, stripping it of its power. In fact, the Fed’s monetary policy cannot deviate too much from the Congress’ and the president’s political agenda.

Granted: In good times, the Fed is more or less protected from the demands of political parties. But what about the influence from ‘special interest groups' such as the banking industry on Fed policymaking? There should hardly be any doubt that the Fed caters, first and foremost, to the needs of commercial and investment banks. As the monopoly producer of the US dollar, it creates – in close cooperation with the banking community – new Greenbacks mostly via credit expansion out of thin air. In this sense, the Fed and private banks represents a cartel.

This cartel produces inflation, leading to increases not only of consumer prices but also of the prices of assets such as stocks, housing and real estate. This, in turn, debases the purchasing power of the US dollar and benefits some at the expense of many. The Fed-banker cartel, which keeps issuing ever more quantities of US dollar, also causes economic disturbances, speculative bubbles, and boom-and-bust cycles; and it tempts consumers, firms, and the government to run into ever more debt. Especially so as the Fed sets the interest rate for bank credit, and in doing so basically controls all interest rates in credit markets.

As the Fed-banker cartel expands the money supply via credit extension, the market interest rate gets artificially suppressed: It is pushed to a level that is lower compared to a situation in which the Fed does not expand the credit and money supply out of thin air. As a result of the lowered market interest rate, savings decline, while consumption and investment go up – setting into motion an economic boom. However, this boom will turn into bust if and when the market interest rate rises – which inevitably happens once no more new credit and money is pumped into the system; if the Fed raises interest rates after having lowered them beforehand.

It might be frightening to hear, but the Fed does not know where the "right" interest rate level is. In terms of interest rate policy, it purses a ‘trial and error' approach. As history shows all too well, the Fed lowers interest rates sharply in times of financial and economic crisis. If incoming data suggests that the economy is returning to growth, the Fed starts raising the interest rate and keeps raising it until the interest rate becomes ‘too high', turning the boom into yet another bust. It would not be surprising if the Fed's current interest hiking cycle were going to trigger yet another debacle.

Viewed from this perspective, President Trump certainly has a point in criticizing the Fed's latest series of interest rate increases. However, forcing the Fed to keep interest rates at artificially lowered levels for longer does not solve the real problem. It would only lead to more distortions in the financial and economic system, foreseeably increasing the costs of the inevitable crisis even further. In other words: The truth is that Fed policy is not the solution to the problem, it is the most significant part of the problem. If shutting down the Fed right away is not an option, one path that is open to the president is to end the Fed's money monopoly. This could be done by, first and foremost, ending all taxes and regulatory requirements standing in the way of using means of exchange such as precious metals, gold and silver in particular, and cyber currencies for monetary purposes. In fact, it would open up a free market in money. People would be getting a greater choice and thus could easily diversify away from the US dollar if they wished without incurring undue costs.

The Fed-banker cartel’s scope of maneuvering would be significantly reduced because they could no longer keep inflating the credit and money supply as before. For if they do, the US dollar will depreciate against alternative monies for all eyes to see, making the Greenback less competitive, potentially driving the US dollar out of the market altogether. In the early stage of a free market in money, people would presumably divert part of their US dollar savings and time deposits into gold and silver as a store of value. Later, businesses that provide not only storage and safekeeping services but also offer payment and settlement services would emerge, finally opening up the possibility to make daily payments with ‘digitised' gold and silver money. If the US administration truly wishes to "To Make America Great Again", there is no way around addressing the US dollar fiat currency problem at some point. The president's latest criticism of the Fed's interest rate policy no doubt points in the right direction. To underpin his criticism with the unquestionably right reasons, it should be accompanied by manifest efforts to set up a free market in money. Fortunately, a good number of US states has already been moving in this direction. President Trump would arguably have the best reasons to follow up – and push for a free market in money on a federal level.

Dr. Thorsten Polleit, Chief Economist of Degussa and macro-economic advisor to the P&R REAL VALUE fund. He is Honorary Professor at the University of Bayreuth.

Trump is absolutely right

Powell is a mildly educated bankocrat who doesn’t understand the dynamics of the money system he’s managing

The situation changed with Trump’s tax policies being implemented AND the trade rules being re-negotiated.

You can’t apply the old simplistic relationship of rates to GDP because the fundamentals changed. Powell and Volcker never understood either point and screwed up the economy for a generation.

Trump’s economic policies have produced the growth rates seen in the 19th century when the U.S. last had similar rules and the Federal “reserve” bank didn’t exist. Happily. If Powell understood that he would get out of the way of the train.

But his dim incomprehension of what is going on around him only guarantees that he will decrement growth. By how much, don’t know - could be simulated though. Regardless, it’s too much, no matter how little.

Monetary theorists argue that a politically independent central bank is best for the currency and the economy.

~~~

The implication is that if it’s not run by the government then it is politically independent.

This is like saying that the media is politically objective and we all know that’s a laugh. George Orwell portrayed a oppressive government run system of propaganda but it’s far more sinister when it appears to independent but isn’t.

How does that mess get unraveled without massive inflation, the total destruction of middle class ability to get ahead financially, or economic collapse, or maybe all three? Can't see how it's possible.

It was quite a while before I learned that the Fed was a private bank that dictated the monetary policy in this country. Hate it, because it’s there to make money at our expense, but then I look at the people that make up the United States Congress and, unfortunately, some thieves at the Fed are probably better than Waters, Pelosi, Harris, Warren, Schumer, basically each and everyone of them, save a very small handful.

Believe it or not, if you pull up some video of the nasty prick Alan Grayson, when talking to some people from the Fed, he absolutely destroys them. Probably wouldn’t pee in his mouth if his teeth were on fire, but if the Fed is ever audited, I’d be willing to let him take part. Don’t know if it’s a show, but he really seems to have a very strong dislike for all things related to the Federal Reserve and Wall St execs.

https://www.youtube.com/watch?v=BORjkIcIcwQ https://www.youtube.com/watch?v=7FanwghzrKU

Just makes me wonder why the banks and other financial institutions seem incapable of deciding, on their own, who is credit worthy or not. It’s like the whole system is set up for everyone to be able to point the finger at someone else, in a circular motion.

The continued strength of the dollar is strong indication that the interest rate is not too low. The lack of inflation is another indication.

The Fed turns over its profit to the US Treasury, last year it was about 35 billion.

It might be frightening to hear, but the Fed does not know where the “right” interest rate level is.

—

Bingo. A true free-market economy does not need a global overseer of bank rates. It is an attempt at centralized control of the economy and centralized control requires metrics, which are often wrong to begin with or late or politically biased.

The Fed, ostensibly created to mitigate boom bust cycles has instead exacerbated the frequency and severity of boom bust cycles.

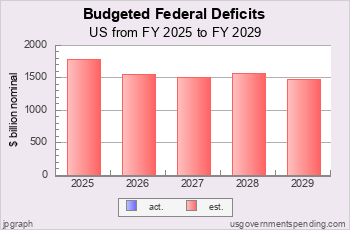

Just wondering. If the deficit going down yet? I understand the economy is great...but ...what about the deficit?

Our banks are part of the global banking infrastructure. For the most part, The Fed has zero interest in our nation under PDJT.

Mostly a good article.

There are some on the committee that sets interest rates who agree with Trump. They don’t want to invert the yield curve.

Yes, it should be independent. And yes, it should be regularly audited to insure its independence. As well as to insure that it is not injecting “Unconscionability” or corruption into the system.

This means either doing blatantly unfair actions, or engaging in insider trading, rewarding friends and punishing enemies.

Don’t fret. The Fed saw the “Goldilocks” numbers on inflation, GDP, income and Consumer Confidence. Before we did. Expect a pause in the needed increases in short term interest.

What this article does is show the mechanism by which control of wealth gets concentrated into a few hands. This has happened now on a global scale and the only obstacle is an individualistic voting bloc in the US who want secure boarders and a life where they decide what they will do, not some cabal of international bureaucrats and their crony private banking allies pulling the strings of the central banks.

Decentralization and "nationalism" [e.g. let me worry about me and you worry about you] appear to be the trend as the pendulum is swinging back. There will likely be some creative destruction in its path.

I always wondered if Trump could issue US Notes (or the electronic equivalent) to replace Federal Reserve Notes.... IOW bypass the Fed. I realize this would still be fiat money and would inflate, but it would bypass the Fed & the US could reduce these notes as was convenient.

https://www.nosue.org/banking/united-states-note-vs-federal-reserve-note/

Yep - they did historic things to help Obama and are now trying to hurt Trump...because he understands that they are really superfluous and not needed....

“In terms of interest rate policy, it purses a ‘trial and error’ approach.”

I don’t believe this for a New York minute. They know what increasing and/or decreasing interest rates will do. Not specifically, but strategically.

IMHO, Their actions during Obama allowed for a bifurcated economy with inflation on basic goods and attempts to maintain/prevent deflation of capital.

Now they have taken repeated steps to do whatever they can to limit economic improvements outside their control by raising rates multiple times in the past year...with more to come.

Since we don’t have politicians in either Party in Congress willing to tackle Spending, we will see a little increase in Deficits.

However, over time, the growth in the economy will partially shrink the deficits. Don’t pay too much attention to the out year Projected Deficits as those will be CBO numbers and they use simpleton static accounting which assumes super low growth rates.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.